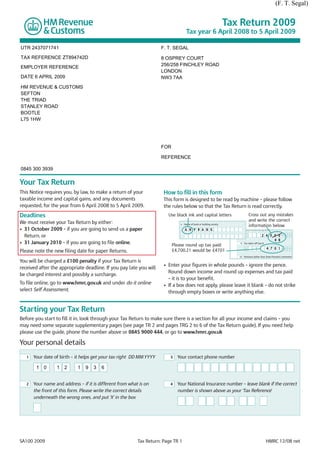

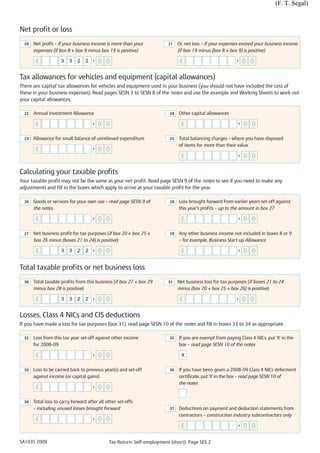

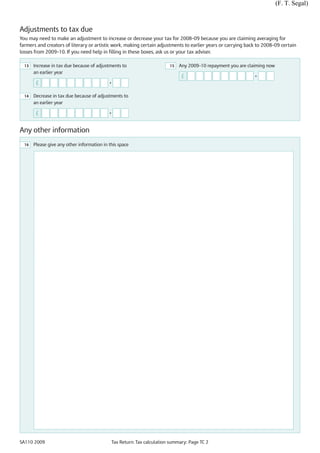

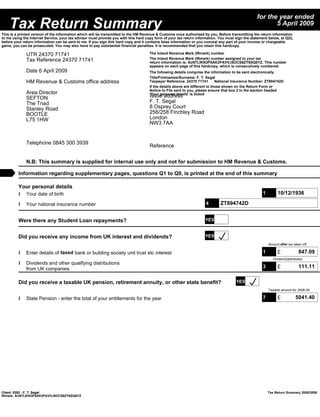

This document is F.T. Segal's Tax Return for the 2009 tax year from April 6, 2008 to April 5, 2009. It provides instructions on how to properly fill out the return, including using black ink, capital letters, rounding figures, and leaving blank any sections that do not apply. It also asks whether supplementary pages need to be completed for various sources of income and gains, such as employment, self-employment, foreign income, and capital gains.