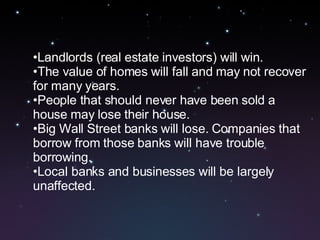

The 2008 financial crisis was caused by risky lending practices encouraged by HUD Secretary Andrew Cuomo in 2000. He ordered Fannie Mae and Freddie Mac to buy mortgages from marginal homeowners, encouraging lenders to issue risky loans. These loans were bundled and sold to Wall Street as secure investments, fueling a housing bubble. When demand dried up as everyone who could buy a house had, home prices fell and many borrowers owed more than their homes were worth. This caused the value of bundled mortgages to drop, bankrupting investment banks and insurance companies who had invested heavily in them. The crisis will only end when real estate prices stabilize as landlords buy up homes and rent them out.