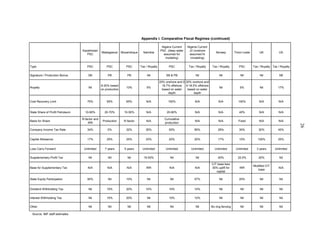

This working paper evaluates Russia's oil fiscal regime and proposes reforms to improve investment support while ensuring government profit share. Oil revenue significantly contributes to Russia’s economy, and the paper highlights the challenges of declining production and rising extraction costs. It presents simulation results and compares international fiscal practices, aiming to strengthen the management of Russia's oil wealth for sustainable development and financial stability.