The World Development Report 2024 focuses on the 'middle-income trap,' analyzing the challenges faced by middle-income countries in achieving sustained growth and transitioning to high-income status. Key issues include slowing growth, structural stasis, and the dynamics of creative destruction, highlighting the importance of innovation and institutional reform. The report emphasizes the need for policies that foster economic mobility and encourage competition to overcome these challenges.

![66 | WORLD DEVELOPMENT REPORT 2024

a. World Bank 2024.

Box 2.3 The magic of investment accelerations (continued)

And they should not bet the farm—or even a

field—on leapfrogging. Infusion is imperative. A

review of the literature on middle-income traps

highlights that countries often try to make pre-

mature leaps from investment to innovation.

According to Gill and Kharas (2015, 28–29),

[Some countries tried] to leapfrog

prematurely into “knowledge economies,”

with none of the institutional

infrastructure in place to accomplish this.

Poor quality universities, low levels of

human capital, limited venture capital,

regulatory

barriers and incomplete rule

of law present significant barriers to

becoming an innovation-driven economy.

Middle-income countries that invest

heavily and prematurely in trying to

become “knowledge economies” can find

low returns to such investments. The

combination of wasted fiscal spending

and a faulty growth diagnostic can lead

to substandard performance—another

example of the middle-income trap.

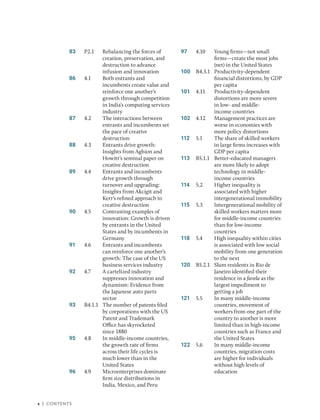

Figure B2.3.1 Investment growth accelerations: Colombia, Republic of

Korea, and Türkiye

Sources: Dieppe 2021; Feenstra, Inklaar, and Timmer 2015; World Bank 2024; Database Profiles

(dashboard), Our Data, Haver Analytics, New York, https://www.haver.com/our-data; WDI (World

Development Indicators) (Data Catalog), World Bank, Washington, DC, https://datacatalog

.worldbank.org/search/dataset/0037712.

Note: Investment refers to gross fixed capital formation. The sample period is 1980–2022.

Bars are simple averages of growth in investment and total factor productivity (TFP).

Acceleration years cover the full duration of the episodes. Nonacceleration years exclude

acceleration years that are not included in this box (see World Bank 2024, box 3.1).

–1

0

1

2

3

4

–4

0

4

8

12

16

Investment TFP

(right axis)

Investment TFP

(right axis)

Investment TFP

(right axis)

Colombia Korea, Rep. Türkiye

Acceleration years Nonacceleration years

Investment

growth

(%)

TFP

growth

(%)](https://image.slidesharecdn.com/worlddevelopmentreport2024-240805082550-605477af/85/World-Bank-World-Development-Report-2024-98-320.jpg)

![Structural Stasis | 67

Notes

1. Nassif, Feijó, and Araújo (2015).

2. Branstetter and Kwon (2018).

3. Gill and Kharas (2007).

4. Mokyr (2018).

5. Solow (1957). Technical change is an economic term

meaning a change in the amount of output produced

from the same amount of inputs.

6. Lucas (1988); Romer (1990).

7. Toniolo (1998).

8. Fernández-Villaverde and Ohanian (2018). In the 1950s,

for example, Italian firms benefited from sponsored

training trips for their managers, enabling them to

acquire modern management practices from firms in

the United States. Some firms also received loans to

procure modern machinery from the United States

(technology transfer). Specifically, firms that engaged

in both management and technology transfers wit-

nessed the most substantial long-term productivity

growth, highlighting the important role of infusion

(Giorcelli 2019).

9. Chuah, Loayza, and Nguyen (2018).

10. Acemoglu, Aghion, and Zilibotti (2006); Gerschenkron

(1962); König et al. (2022); Zilibotti (2017).

11. Mokyr (2023).

12. Choi and Shim (2023).

13. World Bank (1978).

14. Zilibotti (2017).

15. Mokyr (2023).

References

Acemoglu, Daron, Philippe Aghion, and Fabrizio Zilibotti.

2006. “Distance to Frontier, Selection, and Economic

Growth.” Journal of the European Economic Association

4 (1): 37–74.

Beasley, William G. 1972. The Meiji Restoration. Stanford,

CA: Stanford University Press.

Branstetter, Lee G., and Namho Kwon. 2018. “South Korea’s

Transition from Imitator to Innovator: The Role of

External Demand Shocks.” Journal of the Japanese and

International Economies 49 (September): 28–42.

Bukowski, Maciej, Iga Magda, Łukasz Marć, and Julian

Zawistowski. 2006. “Źródła i perspektyw wzrostu pro-

duktywności pracy w Polsce” [Sources and prospects

of productivity growth in Poland]. December, Instytut

Badań Strukturalnych, Warsaw.

Choi, Jaedo, and Younghun Shim. 2023. “Technology

Adoption and Late Industrialization.” STEG

Working Paper WP033 rev. (September), Structural

Transformation and Economic Growth, Centre for

Economic Policy Research, London.

Choi, Jaedo, and Younghun Shim. 2024. “From Adoption

to Innovation: State-Dependent Technology Policy in

Developing Countries.” STEG Working Paper WP091

(March), Structural Transformation and Economic

Growth, Centre for Economic Policy Research,

London.

Chuah, Lay Lian, Norman V. Loayza, and Ha Nguyen.

2018. “Resource Misallocation and Productivity Gaps

in Malaysia.” Policy Research Working Paper 8368,

World Bank, Washington, DC.

Dieppe, Alistair, ed. 2021. Global Productivity: Trends,

Drivers, and Policies. Washington, DC: World Bank.

Feenstra, Robert C., Robert Inklaar, and Marcel Peter

Timmer. 2015. “The Next Generation of the Penn

World Table.” American Economic Review 105 (10):

3150–82.

Fernández-Villaverde,Jesús,andLeeEdwardOhanian.2018.

“The Lack of European Productivity Growth: Causes

and Lessons for the U.S.” PIER Working Paper 18-024,

Penn Institute for Economic Research, Department of

Economics, University of Pennsylvania, Philadelphia.

Genther, Phyllis A. 2020. A History of Japan’s Government-

Business Relationship: The Passenger Car Industry.

Michigan Papers in Japanese Studies Series. Ann

Arbor: University of Michigan Press.

Gerschenkron, Alexander. 1962. Economic Backwardness in

Historical Perspective. Cambridge, MA: Belknap Press.

Gill, Indermit Singh, and Homi Kharas. 2007. An East

Asian Renaissance: Ideas for Economic Growth. With

Deepak Bhattasali, Milan Brahmbhatt, Gaurav Datt,

Mona Haddad, Edward Mountfield, Radu Tatucu,

and Ekaterina Vostroknutova. Washington, DC:

World Bank.

Gill, Indermit Singh, and Homi Kharas. 2015. “The Middle-

Income Trap Turns Ten.” Policy Research Working

Paper 7403, World Bank, Washington, DC.

Giorcelli, Michela. 2019. “The Long-Term Effects of

Management and Technology Transfers.” American

Economic Review 109 (1): 121–52.

Gradzewicz, Michał, Jakub Growiec, Marcin Kolasa,

Łukasz Postek, and Paweł Strzelecki. 2018. “Poland’s

Uninterrupted Growth Performance: New Growth

Accounting Evidence.” Post-Communist Economies

30 (2): 238–72.

Kolasa, Marcin. 2008. “How Does FDI Inflow Affect

Productivity of Domestic Firms? The Role of Horizontal

and Vertical Spillovers, Absorptive Capacity and

Competition.” Journal of International Trade and

Economic Development 17 (1): 155–73.

König, Michael, Kjetil Storesletten, Zheng Song, and

Fabrizio Zilibotti. 2022. “From Imitation to Innovation:

Where Is All That Chinese RD Going?” Econometrica

90 (4): 1615–54.

Lange, Glenn-Marie, QuentinT. Wodon, andKevinCarey, eds.

2018. The Changing Wealth of Nations 2018: Building a

Sustainable Future. Washington, DC: World Bank.

Lucas, Robert E., Jr. 1988. “On the Mechanics of Economic

Development.” Journal of Monetary Economics 22 (1):

3–42.

Mason, Mark. 1992. American Multinationals and Japan:

The Political Economy of Japanese Capital Controls,

1899–1980. Harvard East Asian Monographs Series,](https://image.slidesharecdn.com/worlddevelopmentreport2024-240805082550-605477af/85/World-Bank-World-Development-Report-2024-99-320.jpg)

![164 | WORLD DEVELOPMENT REPORT 2024

standards provide.5

For example, the standard

connector (SC), a fiber-optic connector devel-

oped by Tyco Electronics (now known as TE

Connectivity Ltd) used in data networking and

telecommunications, has become the dominant

international standard. How? By joining national

standardization organizations in many countries,

the company influenced the standard-making

process, with the result that European and inter-

national standards refer to the SC connector.

Tyco thus gained a significant global market

share, earning an additional US$50–$100 million

in profits between 1995 and 2004.6

India’s License Raj—a system of central con-

trols introduced in 1951 regulating entry and pro-

duction activity in the registered manufacturing

sector—is another example. The system favored

incumbents and stifled Indian entrepreneurs

for more than four decades. Its dismantlement

during the 1980s and 1990s amplified entry and

business dynamism, and the effects were most

prominent in states with labor market institu-

tions that favored employers.7

Often, dominant incumbents in local markets

lobby local authorities to erect ad hoc entry bar-

riers. In Italy, such local entry regulations in the

retail market increased price margins by 8 per-

cent and reduced the productivity of incumbent

firms by 3 percent in the early 2000s.8

In Peru,

when the national competition agency (Indecopi)

strengthened its powers to dismantle local and

sector-specific regulatory and administrative

entry barriers in 2013, productivity increased sig-

nificantly, including for firms operating in down-

stream sectors or in the same municipality.9

Product market regulations (PMRs), inten-

tionally or inadvertently, protect incumbents and

constrain competition (figure 7.4). These regula-

tions include regulatory barriers to firm entry and

competition in a broad range of key policy areas,

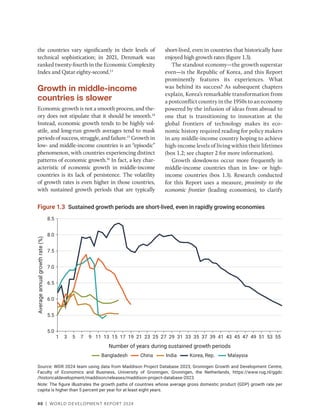

Figure 7.3 In many middle-income countries, markets are dominated by a few business

groups, as a survey suggests

Source: WDR 2024 team based on Schwab (2019).

Note: The survey question: “In your country, how do you characterize corporate activity?” [1 = dominated by a few business

groups; 7 = spread among many firms]. OECD = Organisation for Economic Co-operation and Development.

0

1

2

3

4

5

6

7

J

a

p

a

n

T

o

p

5

a

v

e

r

a

g

e

U

n

i

t

e

d

S

t

a

t

e

s

G

e

r

m

a

n

y

M

a

l

a

y

s

i

a

U

n

i

t

e

d

K

i

n

g

d

o

m

P

o

l

a

n

d

I

n

d

i

a

C

h

i

n

a

O

E

C

D

a

v

e

r

a

g

e

C

z

e

c

h

i

a

S

l

o

v

e

n

i

a

P

o

r

t

u

g

a

l

I

n

d

o

n

e

s

i

a

C

o

s

t

a

R

i

c

a

S

o

u

t

h

A

f

r

i

c

a

B

r

a

z

i

l

R

u

s

s

i

a

n

F

e

d

e

r

a

t

i

o

n

B

u

l

g

a

r

i

a

V

i

e

t

N

a

m

S

l

o

v

a

k

R

e

p

u

b

l

i

c

K

a

z

a

k

h

s

t

a

n

T

ü

r

k

i

y

e

C

h

i

l

e

C

o

l

o

m

b

i

a

M

e

x

i

c

o

K

o

r

e

a

,

R

e

p

.

R

o

m

a

n

i

a

A

r

g

e

n

t

i

n

a

Extent

of

market

dominance

(0–7)

(survey

responses)

High-income

Middle-income](https://image.slidesharecdn.com/worlddevelopmentreport2024-240805082550-605477af/85/World-Bank-World-Development-Report-2024-196-320.jpg)

![208 | WORLD DEVELOPMENT REPORT 2024

a. Hanusch (2023).

b. World Bank (2023a).

c. Lenton et al. (2023).

d. Ferreira Filho, De Souza, and Hanusch (2022); Hanusch (2023).

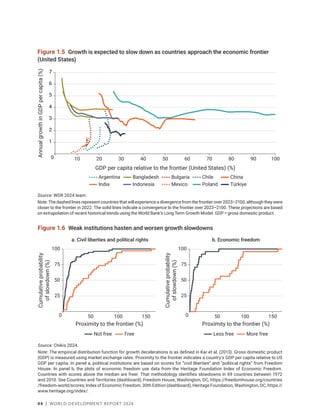

Box 8.5 Productivity growth can slow deforestation in Brazil (continued)

Source: WDR 2024 team extending Ferreira Filho, De Souza, and Hanusch (2022).

Note: Legal Amazon is the largest sociogeographic division in Brazil, containing all nine states in

the Amazon basin. km2

= square kilometer; TFP = total factor productivity.

Figure B8.5.1 Amazon deforestation falls when Brazilian productivity rises

–30

–25

–20

–15

–10

–5

0

80

85

90

95

100

105

110

115

120

125

130

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

2

0

1

6

2

0

1

7

2

0

1

8

2

0

1

9

2

0

2

0

2

0

2

1

2

0

2

2

Total factor productivity Net change in forest cover, Legal Amazon (right axis)

TFP

index

(1996

=

100)

Net

change

in

forest

cover

(thousands

of

km

2

)

United States “offers the most cost-effective

lever to reduce carbon emissions at the scale and

speed that [are] necessary.” Others have proposed

a strategic combination of temporary research

subsidies and carbon taxes that could steer tech-

nological advancements toward more environ-

mentally sustainable solutions.96

Direct carbon pricing instruments include car-

bon pricing signals sent through carbon taxes and

emissions trading systems (ETSs). According to

the World Bank’s State and Trends of Carbon Pricing

2023 report, these schemes currently cover a rela-

tively limited portion of global carbon emissions,

butthegreateraprogram’sscope,themoreeffective

it can be.97

The report points out that the number

of countries that have adopted direct carbon pric-

ing schemes through ETSs or carbon taxes is lim-

ited.98

Perhaps more important, so is the coverage

of such programs. With the introduction of the ETS

in China in 2021, the share of global carbon dioxide

(CO2

) emissions from fossil fuels covered by direct

carbon pricing schemes rose to about 31 percent

(amounting to about one-quarter of global GHG

emissions). Along with their coverage, average car-

bon prices have been rising over the last few years.

The carbon price in the European Union (EU)](https://image.slidesharecdn.com/worlddevelopmentreport2024-240805082550-605477af/85/World-Bank-World-Development-Report-2024-240-320.jpg)

![218 | WORLD DEVELOPMENT REPORT 2024

sistema educativo” [There’s a disconnect between what

enterprises need and what the education system pro-

vides]. País, November 29, 2022. https://www.lahora

.com.ec/pais/hay-una-desconexion-entre-lo-que-las

-empresas-necesitan-y-lo-que-se-esta-formando-en

-el-sistema-educativo/.

Lall, Saurabh A., Li-Wei Chen, and Peter W. Roberts. 2020.

“Are We Accelerating Equity Investment into Impact-

Oriented Ventures?” World Development 131 (July):

104952.

LaPorta,Rafael,FlorencioLópez‐de‐Silanes,AndreiShleifer,

and Robert W. Vishny. 1997. “Legal Determinants of

External Finance.” Journal of Finance 52 (3): 1131–50.

La Porta, Rafael, Florencio López‐de‐Silanes, Andrei

Shleifer, and Robert W. Vishny. 1998. “Law and Finance.”

Journal of Political Economy 106 (6): 1113–55.

La Porta, Rafael, Florencio López-de-Silanes, Andrei

Shleifer, and Robert W. Vishny. 1999. “Investor

Protection: Origins, Consequences, and Reform.” NBER

Working Paper 7428 (December), National Bureau of

Economic Research, Cambridge, MA.

Lee, Ju-Ho, Hyeok Jeong, and Song-Chang Hong. 2014. “Is

Korea Number One in Human Capital Accumulation?

Education Bubble Formation and Its Labor Market

Evidence.” KDI School Working Paper 14-03 (August),

KDI School of Public Policy and Management, Seoul,

Republic of Korea.

Lenton, Timothy M., David I. Armstrong McKay, Sina

Loriani, Jesse F. Abrams, Steven J. Lade, Jonathan

F. Donges, Manjana Milkoreit, et al. 2023. The Global

Tipping Points Report 2023. Exeter, UK: University of

Exeter.

Lin, Boqiang, and Aijun Li. 2012. “Impacts of Removing

Fossil Fuel Subsidies on China: How Large and How to

Mitigate?” Energy 44 (1): 741–49.

López, José Joaquín, and Jesica Torres. 2020.

“Size-Dependent Policies, Talent Misallocation, and

the Return to Skill.” Review of Economic Dynamics 38

(October): 59–93.

Mateina, Eleonora, and Anastasiya Grunova. 2020. “The

Bulgarian National Electricity Company Sanctioned for

Abuse of Dominance on the Market of Balancing Energy

of Renewables.” Kluwer Competition Law Blog (blog),

January 7, 2020. https://competitionlawblog.kluwer

competitionlaw.com/2020/01/07/.

McGowan,MügeAdalet,andDanAndrews.2016.“Insolvency

Regimes and Productivity Growth: A Framework for

Analysis.” OECD Economics Department Working Paper

1309, Organisation for Economic Co-operation and

Development, Paris.

McKenzie, David J., and Dario Sansone. 2019.

“Predicting Entrepreneurial Success Is Hard:

Evidence from a Business Plan Competition in Nigeria.”

Journal of Development Economics 141 (November):

102369.

McKenzie, David J., and Christopher M. Woodruff. 2017.

“Business Practices in Small Firms in Developing

Countries.” Management Science 63 (9): 2967–81.

McKenzie, David J., Christopher M. Woodruff, Kjetil Bjorvatn,

Miriam Bruhn, Jing Cai, Juanita Gonzalez Uribe, Simon

Quinn, Tetsushi Sonobe, and Martin Valdivia, eds. 2023.

“Training Entrepreneurs.” VoxDevLit 1 (3). https://

voxdev.org/sites/default/files/2023-11/Training

_Entrepreneurs_Issue_3.pdf.

Melitz, Marc J. 2003. “The Impact of Trade on Intra-Industry

Reallocations and Aggregate Industry Productivity.”

Econometrica 71 (6): 1695–725.

Mendes, Philip. 2015. “Integrating Intellectual Property

into Innovation Policy Formulation in Sri Lanka.”

January, World Intellectual Property Organization,

Geneva.

Miller, Amisha, Saurabh A. Lall, Markus P. Goldstein, and

Joao H. C. Montalvao. 2023. “Asking Better Questions:

The Effect of Changing Investment Organizations’

Evaluation Practices on Gender Disparities in

Funding Innovation.” Policy Research Working Paper

10625, World Bank, Washington, DC.

Muñoz-Boudet, Ana María, Lourdes Rodríguez-Chamussy,

Cristina Chiarella, and Isil Oral Savonitto. 2017. “Women

and STEM in Europe and Central Asia.” World Bank,

Washington, DC.

Murnane, Richard J., Marcus R. Waldman, John

B. Willett, Maria Soledad Bos, and Emiliana

Vegas. 2017. “The Consequences of Educational

Voucher Reform in Chile.” NBER Working Paper

23550 (June), National Bureau of Economic Research,

Cambridge, MA.

Naudé, Wim. 2011. “Entrepreneurship Is Not a Binding

Constraint on Growth and Development in the Poorest

Countries.” World Development 39 (1): 33–44.

Neilson, Christopher A. 2024. “The Rise of Coordinated

Choice and Assignment Systems in Education

Markets around the World.” Background paper pre-

pared for World Development Report 2024, World Bank,

Washington, DC.

Nieminen, Mika, and Erkki Kaukonen. 2001. Universities

and RD Networking in a Knowledge-Based Economy:

A Glance at Finnish Developments. Sitra Report 11.

Helsinki: Sitra.

NIHF (National Inventors Hall of Fame). 2022. “Behind the

NIHF Scenes: Camp Invention Is for Every Kind of Kid!”

NIHF, North Canton, OH. https://www.invent.org/blog

/behind-nihf-scenes/camp-invention-2022-all-kids.

OECD (Organisation for Economic Co-operation and

Development). 2021. “Man Enough? Measuring

Masculine Norms to Promote Women’s Empowerment.”

Social Institutions and Gender Index Series, OECD

Development Centre, Paris.

Pagano, Marco, and Paolo F. Volpin. 2005. “Managers,

Workers, and Corporate Control.” Journal of Finance

60 (2): 841–68.

Paredes, Ricardo. 2024. “Duoc and the Higher Vocational

Technical Education in Chile.” Background paper pre-

pared for World Development Report 2024, World Bank,

Washington, DC.

Pekkarinen, Tuomas, Roope Uusitalo, and Sari Pekkala Kerr.

2009. “School Tracking and Intergenerational Income

Mobility: Evidence from the Finnish Comprehensive

School Reform.” Journal of Public Economics 93 (7–8):

965–73.

Peters, Marjolein, Kees Meijer, Etienne van Nuland,

Thijs Viertelhauzen, and Ekim Sincer. 2010.](https://image.slidesharecdn.com/worlddevelopmentreport2024-240805082550-605477af/85/World-Bank-World-Development-Report-2024-250-320.jpg)