worksheet fo financial report analysis for past five years

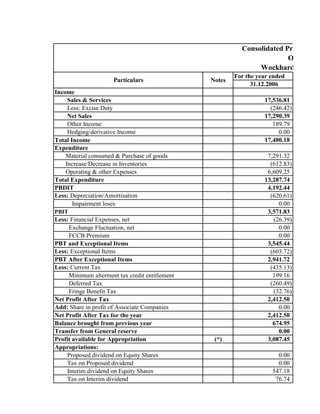

- 1. Consolidated Profit & Lo Of Wockhardt Limited For the year ended Particulars Notes 31.12.2006 Income Sales & Services 17,536.81 Less: Excise Duty (246.42) Net Sales 17,290.39 Other Income 189.79 Hedging/derivative Income 0.00 Total Income 17,480.18 Expenditure Material consumed & Purchase of goods 7,291.32 Increase/Decrease in Inventories (612.83) Operating & other Expenses 6,609.25 Total Expenditure 13,287.74 PBDIT 4,192.44 Less: Depreciation/Amortisation (620.61) Impairment loses 0.00 PBIT 3,571.83 Less: Financial Expenses, net (26.39) Exchange Fluctuation, net 0.00 FCCB Premium 0.00 PBT and Exceptional Items 3,545.44 Less: Exceptional Items (603.72) PBT After Exceptional Items 2,941.72 Less: Current Tax (435.13) Minimum alterment tax credit entitlement 199.16 Deferred Tax (260.49) Fringe Benefit Tax (32.76) Net Profit After Tax 2,412.50 Add: Share in profit of Associate Companies 0.00 Net Profit After Tax for the year 2,412.50 Balance brought from previous year 674.95 Transfer from General reserve 0.00 Profit available for Appropriation (*) 3,087.45 Appropriations: Proposed dividend on Equity Shares 0.00 Tax on Proposed dividend 0.00 Interim dividend on Equity Shares 547.18 Tax on Interim dividend 76.74

- 2. Transfer to General Reserve 1,500.00 Surplus Carried to Balancesheet 963.53 (*) 3,087.45 Earnings Per Share:(in Rs) Basic 22.05 Dilluted 22.04 Nominal value of shares Rs 5 (Previous year Rs 5) 5.00

- 3. dated Profit & Loss A/C Of Wockhardt Limited (Rs in Millions) For the year ended For the year ended For the year ended For the year ended 31.12.2007 31.12.2008 31.03.2010 31.03.2011 25,060.46 35,983.62 45,059.00 37,552.22 (152.31) (85.83) (44.78) (39.83) 24,908.15 35,897.79 45,014.22 37,512.39 460.01 355.85 295.24 159.03 1,623.39 0.00 0.00 0.00 26,991.55 36,253.64 45,309.46 37,671.42 11,359.34 13,900.91 19,409.79 14,544.72 (1,431.82) (297.36) 315.58 617.50 10,213.85 14,438.99 17,057.42 13,262.91 20,141.37 28,042.54 36,782.79 28,425.13 6,850.18 8,211.10 8,526.67 9,246.29 (784.84) (1,078.33) (1,481.39) (1,166.18) 0.00 (52.14) 0.00 0.00 6,065.34 7,080.63 7,045.28 8,080.11 (1,638.13) (2,590.70) (3,424.83) (2,671.05) 314.27 105.29 (259.30) 1,366.57 0.00 (1,294.91) (268.30) 0.00 4,741.48 3,300.31 3,092.85 6,775.63 0.00 (5,809.91) (12,949.21) (5,732.14) 4,741.48 (2,509.60) (9,856.36) 1,043.49 (526.50) (237.30) (277.81) (338.38) 0.00 0.00 0.00 0.00 (354.01) 1,192.08 119.88 251.91 (36.07) (38.56) (8.74) 0.00 3,824.90 (1,593.38) (10,023.03) 957.02 33.24 204.80 16.40 (51.83) 3,858.14 (1,388.58) (10,006.63) 905.19 963.53 2,881.28 1,492.70 (57.40) 0.00 0.00 0.00 83.69 4,821.67 1,492.70 (8,513.93) 931.48 273.59 0.00 0.00 0.00 46.50 0.00 0.00 0.00 957.56 0.00 0.00 0.00 162.74 0.00 0.00 0.00

- 4. 500.00 0.00 (8,456.53) 0.00 2,881.28 1,492.70 (57.40) 931.48 4,821.67 1,492.70 (8,513.93) 931.48 35.25 (12.69) (91.44) 8.27 35.25 (12.69) (91.44) 8.27 5.00 5.00 5.00 5.00

- 5. Common Size Analysis of P/L A/C of Wockhardt Ltd for past five years For the year ended For the year ended For the year ended 31.12.2006 31.12.2007 31.12.2008 % in terms of Net Sales % in terms of Net Sales % in terms of Net Sales 100.00% 100.00% 100.00% 1.10% 1.85% 0.99% 0.00% 6.52% 0.00% 101.10% 108.36% 100.99% 42.17% 45.60% 38.72% -3.54% -5.75% -0.83% 38.22% 41.01% 40.22% 76.85% 80.86% 78.12% 24.25% 27.50% 22.87% -3.59% -3.15% -3.00% 0.00% 0.00% -0.15% 20.66% 24.35% 19.72% -0.15% -6.58% -7.22% 0.00% 1.26% 0.29% 0.00% 0.00% -3.61% 20.51% 19.04% 9.19% -3.49% 0.00% -16.18% 17.01% 19.04% -6.99% -2.52% -2.11% -0.66% 1.15% 0.00% 0.00% -1.51% -1.42% 3.32% -0.19% -0.14% -0.11% 13.95% 15.36% -4.44% 0.00% 0.13% 0.57% 13.95% 15.49% -3.87% 3.90% 3.87% 8.03% 0.00% 0.00% 0.00% 17.86% 19.36% 4.16% 0.00% 1.10% 0.00% 0.00% 0.19% 0.00% 3.16% 3.84% 0.00% 0.44% 0.65% 0.00%

- 6. 8.68% 2.01% 0.00% 5.57% 11.57% 4.16% 17.86% 19.36% 4.16% 0.13% 0.14% -0.04% 0.13% 0.14% -0.04% 0.03% 0.02% 0.01%

- 7. Wockhardt Ltd for past five years For the year ended For the year ended 31.03.2010 31.03.2011 % in terms of Net Sales % in terms of Net Sales 100.00% 100.00% 0.66% 0.42% 0.00% 0.00% 100.66% 100.42% 43.12% 38.77% 0.70% 1.65% 37.89% 35.36% 81.71% 75.78% 18.94% 24.65% -3.29% -3.11% 0.00% 0.00% 15.65% 21.54% -7.61% -7.12% -0.58% 3.64% -0.60% 0.00% 6.87% 18.06% -28.77% -15.28% -21.90% 2.78% -0.62% -0.90% 0.00% 0.00% 0.27% 0.67% -0.02% 0.00% -22.27% 2.55% 0.04% -0.14% -22.23% 2.41% 3.32% -0.15% 0.00% 0.22% -18.91% 2.48% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

- 8. -18.79% 0.00% -0.13% 2.48% -18.91% 2.48% -0.20% 0.02% -0.20% 0.02% 0.01% 0.01%

- 9. Consolidated Balancesheet Of Wockhardt Limited For the year ended Particulars 31.12.2006 SOURCE OF FUND Shareholder's Funds : Share Capital 547.18 Reserves & Surplus 10,115.70 Net Worth 10,662.88 Loan Funds: Secured Loans 14,750.74 Unsecured Loans 4,952.00 Total Debt 19,702.74 Deferred Tax Liability, net 921.06 Total Liabilities 31,286.68 APPLICATION OF FUND Fixed Assets: Gross Block 18,531.30 Less: Acc. Depreciation (4,549.49) Impairment provision 0.00 Net Block 13,981.81 Capital Work-in-Progress, including capital advances 3,085.91 Investments 3.14 Deferred Tax Assets , net 0.00 Inventories 4,299.96 Sundry Debtors 4,615.65 Cash And Bank 9,731.78 Loans And Advances to subsidiaries 0.00 Other Loans and Advances 1,376.73 Total Current Assets [A] 20,024.12 Less: Current Liabilities & Provision Current Liabilities 4,975.44 Provisions 832.86 Total Current Liabilities [B] 5,808.30 Net Current Assets [A-B] 14,215.82 Misc. Expenses 0.00 Profit & Loss A/C, net 0.00 Foreign Currency Translation Reserve 0.00 Total Assets 31,286.68

- 10. onsolidated Balancesheet Of Wockhardt Limited (Rs. In Million) For the year ended For the year ended For the year ended For the year ended 31.12.2007 31.12.2008 31.03.2010 31.03.2011 547.18 547.18 7,232.97 7,999.35 12,188.43 11,068.97 399.48 399.48 12,735.61 11,616.15 7,632.45 8,398.83 23,440.18 31,608.59 15,343.29 14,285.69 5,559.56 10,742.62 4,638.07 4,685.44 28,999.74 42,351.21 19,981.36 18,971.13 920.95 0.00 0.00 0.00 42,656.30 53,967.36 27,613.81 27,369.96 34,095.85 39,895.62 10,318.22 11,381.65 (8,602.75) (9,881.75) (3,166.01) (3,757.22) 0.00 (52.14) 0.00 0.00 25,493.10 29,961.73 7,152.21 7,624.43 5,219.59 6,335.02 4,628.83 7,805.59 709.44 931.94 3,156.44 3,079.54 0.00 415.15 0.00 0.00 7,687.42 8,297.53 3,059.72 3,050.75 6,700.65 8,534.23 4,635.91 3,117.40 3,801.78 6,499.14 989.52 1,616.75 0.00 0.00 2,155.41 1,292.55 1,918.91 6,306.00 4,260.58 2,409.02 20,108.76 29,636.90 15,101.14 11,486.47 8,264.61 8,564.09 3,912.34 3,936.52 609.98 6,188.16 628.61 373.55 8,874.59 14,752.25 4,540.95 4,310.07 11,234.17 14,884.65 10,560.19 7,176.40 0.00 0.00 0.00 0.00 0.00 0.00 2,116.14 1,684.00 0.00 1,438.87 0.00 0.00 42,656.30 53,967.36 27,613.81 27,369.96

- 11. Common Size Analysis of Balance Sheet of Wockhardt Ltd for past five years For the year ended For the year ended For the year ended For the year ended 31.12.2006 31.12.2007 31.12.2008 31.03.2010 % in terms of % in terms of % in terms of % in terms of Assets(or liability) Assets(or liability) Assets(or liability) Assets(or liability) 1.75% 1.28% 1.01% 26.19% 32.33% 28.57% 20.51% 1.45% 34.08% 29.86% 21.52% 27.64% 0.00% 0.00% 0.00% 0.00% 47.15% 54.95% 58.57% 55.56% 15.83% 13.03% 19.91% 16.80% 62.97% 67.98% 78.48% 72.36% 2.94% 2.16% 0.00% 0.00% 100.00% 100.00% 100.00% 100.00% 59.23% 79.93% 73.93% 37.37% -14.54% -20.17% -18.31% -11.47% 0.00% 0.00% -0.10% 0.00% 44.69% 59.76% 55.52% 25.90% 9.86% 12.24% 11.74% 16.76% 0.01% 1.66% 1.73% 11.43% 0.00% 0.00% 0.77% 0.00% 13.74% 18.02% 15.38% 11.08% 14.75% 15.71% 15.81% 16.79% 31.11% 8.91% 12.04% 3.58% 0.00% 0.00% 0.00% 7.81% 4.40% 4.50% 11.68% 15.43% 64.00% 47.14% 54.92% 54.69% 15.90% 19.37% 15.87% 14.17% 2.66% 1.43% 11.47% 2.28% 18.56% 20.80% 27.34% 16.44% 45.44% 26.34% 27.58% 38.24% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 7.66% 0.00% 0.00% 2.67% 0.00% 100.00% 100.00% 100.00% 100.00%

- 12. d for past five years For the year ended 31.03.2011 % in terms of Assets(or liability) 29.23% 1.46% 30.69% 0.00% 52.19% 17.12% 69.31% 0.00% 100.00% 41.58% -13.73% 0.00% 27.86% 28.52% 11.25% 0.00% 11.15% 11.39% 5.91% 4.72% 8.80% 41.97% 14.38% 1.36% 15.75% 26.22% 0.00% 6.15% 0.00% 100.00%

- 13. Consolidated Profit & Loss Of Wockhardt Limited For the year ended Particulars Notes 31.12.2006 Income Sales & Services 17,536.81 Less: Excise Duty (246.42) Net Sales 17,290.39 Other Income 189.79 Hedging/derivative Income 0.00 Total Income 17,480.18 Expenditure Material consumed & Purchase of goods 7,291.32 Increase/Decrease in Inventories (612.83) Operating & other Expenses 6,609.25 Total Expenditure 13,287.74 PBDIT 4,192.44 Less: Depreciation/Amortisation (620.61) Impairment loses 0.00 PBIT 3,571.83 Less: Financial Expenses, net (26.39) Exchange Fluctuation, net 0.00 FCCB Premium 0.00 PBT and Exceptional Items 3,545.44 Less: Exceptional Items (603.72) PBT After Exceptional Items 2,941.72 Less: Current Tax (435.13) Minimum alterment tax credit entitlement 199.16 Deferred Tax (260.49) Fringe Benefit Tax (32.76) Net Profit After Tax 2,412.50 Add: Share in profit of Associate Companies 0.00 Net Profit After Tax for the year 2,412.50 Balance brought from previous year 674.95 Transfer from General reserve 0.00 Profit available for Appropriation (*) 3,087.45 Appropriations: Proposed dividend on Equity Shares 0.00 Tax on Proposed dividend 0.00 Interim dividend on Equity Shares 547.18 Tax on Interim dividend 76.74

- 14. Transfer to General Reserve 1,500.00 Surplus Carried to Balancesheet 963.53 (*) 3,087.45 Earnings Per Share:(in Rs) Basic 22.05 Dilluted 22.04 Nominal value of shares Rs 5 (Previous year Rs 5) 5.00

- 15. dated Profit & Loss A/C Of Wockhardt Limited (Rs in Millions) For the year ended For the year ended For the year ended For the year ended 31.12.2007 31.12.2008 31.03.2010 31.03.2011 25,060.46 35,983.62 45,059.00 37,552.22 (152.31) (85.83) (44.78) (39.83) 24,908.15 35,897.79 45,014.22 37,512.39 460.01 355.85 295.24 159.03 1,623.39 0.00 0.00 0.00 26,991.55 36,253.64 45,309.46 37,671.42 11,359.34 13,900.91 19,409.79 14,544.72 (1,431.82) (297.36) 315.58 617.50 10,213.85 14,438.99 17,057.42 13,262.91 20,141.37 28,042.54 36,782.79 28,425.13 6,850.18 8,211.10 8,526.67 9,246.29 (784.84) (1,078.33) (1,481.39) (1,166.18) 0.00 (52.14) 0.00 0.00 6,065.34 7,080.63 7,045.28 8,080.11 (1,638.13) (2,590.70) (3,424.83) (2,671.05) 314.27 105.29 (259.30) 1,366.57 0.00 (1,294.91) (268.30) 0.00 4,741.48 3,300.31 3,092.85 6,775.63 0.00 (5,809.91) (12,949.21) (5,732.14) 4,741.48 (2,509.60) (9,856.36) 1,043.49 (526.50) (237.30) (277.81) (338.38) 0.00 0.00 0.00 0.00 (354.01) 1,192.08 119.88 251.91 (36.07) (38.56) (8.74) 0.00 3,824.90 (1,593.38) (10,023.03) 957.02 33.24 204.80 16.40 (51.83) 3,858.14 (1,388.58) (10,006.63) 905.19 963.53 2,881.28 1,492.70 (57.40) 0.00 0.00 0.00 83.69 4,821.67 1,492.70 (8,513.93) 931.48 273.59 0.00 0.00 0.00 46.50 0.00 0.00 0.00 957.56 0.00 0.00 0.00 162.74 0.00 0.00 0.00

- 16. 500.00 0.00 (8,456.53) 0.00 2,881.28 1,492.70 (57.40) 931.48 4,821.67 1,492.70 (8,513.93) 931.48 35.25 (12.69) (91.44) 8.27 35.25 (12.69) (91.44) 8.27 5.00 5.00 5.00 5.00

- 17. Comparative Analysis of P/L A/c of Wockhardt Ltd for the past fiv For the year 2006 & 2007 For the year 2007 & 2008 For the year 2008 & 2010 Absolute change % change Absolute change % change Absolute change (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) (Rs. In Million) 7,523.65 42.90% 10,923.16 43.59% 9,075.38 94.11 -38.19% 66.48 -43.65% 41.05 7,617.76 44.06% 10,989.64 44.12% 9,116.43 270.22 142.38% (104.16) -22.64% (60.61) 1,623.39 #DIV/0! (1,623.39) -100.00% 0.00 9,511.37 54.41% 9,262.09 34.31% 9,055.82 4,068.02 55.79% 2,541.57 22.37% 5,508.88 (818.99) 133.64% 1,134.46 -79.23% 612.94 3,604.60 54.54% 4,225.14 41.37% 2,618.43 6,853.63 51.58% 7,901.17 39.23% 8,740.25 2,657.74 63.39% 1,360.92 19.87% 315.57 (164.23) 26.46% (293.49) 37.39% (403.06) 0.00 0.00% (52.14) #DIV/0! 52.14 2,493.51 69.81% 1,015.29 16.74% (35.35) (1,611.74) 6107.39% (952.57) 58.15% (834.13) 314.27 #DIV/0! (208.98) -66.50% (364.59) 0.00 #DIV/0! (1,294.91) #DIV/0! 1,026.61 1,196.04 33.73% (1,441.17) -30.39% (207.46) 603.72 -100.00% (5,809.91) #DIV/0! (7,139.30) 1,799.76 61.18% (7,251.08) -152.93% (7,346.76) (91.37) 21.00% 289.20 -54.93% (40.51) (199.16) -100.00% 0.00 0.00% 0.00 (93.52) 35.90% 1,546.09 -436.74% (1,072.20) (3.31) 10.10% (2.49) 6.90% 29.82 1,412.40 58.55% (5,418.28) -141.66% (8,429.65) 33.24 #DIV/0! 171.56 516.13% (188.40) 1,445.64 59.92% (5,246.72) -135.99% (8,618.05) 288.58 42.76% 1,917.75 199.03% (1,388.58) 0.00 0.00% 0.00 0.00% 0.00 1,734.22 56.17% (3,328.97) -69.04% (10,006.63) 273.59 #DIV/0! (273.59) -100.00% 0.00 46.50 #DIV/0! (46.50) -100.00% 0.00 410.38 75.00% (957.56) -100.00% 0.00 86.00 112.07% (162.74) -100.00% 0.00

- 18. (1,000.00) -66.67% (500.00) -100.00% (8,456.53) 1,917.75 199.03% (1,388.58) -48.19% (1,550.10) 1,734.22 56.17% (3,328.97) -69.04% (10,006.63) 13.20 59.86% (47.94) -136.00% (78.75) 13.21 59.94% (47.94) -136.00% (78.75) 0.00 0.00% 0.00 0.00% 0.00

- 19. Ltd for the past five years e year 2008 & 2010 For the year 2010 & 2011 % change Absolute change % change (+)/(-) (Rs. In Million) (+)/(-) 25.22% (7,506.78) -16.66% -47.83% 4.95 -11.05% 25.40% (7,501.83) -16.67% -17.03% (136.21) -46.14% 0.00% 0.00 0.00% 24.98% (7,638.04) -16.86% 39.63% (4,865.07) -25.07% -206.13% 301.92 95.67% 18.13% (3,794.51) -22.25% 31.17% (8,357.66) -22.72% 3.84% 719.62 8.44% 37.38% 315.21 -21.28% -100.00% 0.00 0.00% -0.50% 1,034.83 14.69% 32.20% 753.78 -22.01% -346.27% 1,625.87 -627.02% -79.28% 268.30 -100.00% -6.29% 3,682.78 119.07% 122.88% 7,217.07 -55.73% 292.75% 10,899.85 -110.59% 17.07% (60.57) 21.80% 0.00% 0.00 0.00% -89.94% 132.03 110.14% -77.33% 8.74 -100.00% 529.04% 10,980.05 -109.55% -91.99% (68.23) -416.04% 620.64% 10,911.82 -109.05% -48.19% (1,550.10) -103.85% 0.00% 83.69 #DIV/0! -670.37% 9,445.41 -110.94% 0.00% 0.00% 0.00 0.00% 0.00% 0.00 0.00% 0.00% 0.00 0.00% 0.00% 0.00 0.00%

- 20. #DIV/0! 8,456.53 -100.00% -103.85% 988.88 -1722.79% -670.37% 9,445.41 -110.94% 620.57% 99.71 -109.04% 620.57% 99.71 -109.04% 0.00% 0.00 0.00%

- 21. Consolidated Balancesheet Of Wockhardt Limited For the year ended Particulars 31.12.2006 SOURCE OF FUND Shareholder's Funds : Share Capital 547.18 Reserves & Surplus 10,115.70 Net Worth 10,662.88 Loan Funds: Secured Loans 14,750.74 Unsecured Loans 4,952.00 Total Debt 19,702.74 Deferred Tax Liability, net 921.06 Total Liabilities 31,286.68 APPLICATION OF FUND Fixed Assets: Gross Block 18,531.30 Less: Acc. Depreciation (4,549.49) Impairment provision 0.00 Net Block 13,981.81 Capital Work-in-Progress, including capital advances 3,085.91 Investments 3.14 Deferred Tax Assets , net 0.00 Inventories 4,299.96 Sundry Debtors 4,615.65 Cash And Bank 9,731.78 Loans And Advances to subsidiaries 0.00 Other Loans and Advances 1,376.73 Total Current Assets [A] 20,024.12 Less: Current Liabilities & Provision Current Liabilities 4,975.44 Provisions 832.86 Total Current Liabilities [B] 5,808.30 Net Current Assets [A-B] 14,215.82 Misc. Expenses 0.00 Profit & Loss A/C, net 0.00 Foreign Currency Translation Reserve 0.00 Total Assets 31,286.68

- 22. onsolidated Balancesheet Of Wockhardt Limited (Rs. In Million) For the year ended For the year ended For the year ended For the year ended 31.12.2007 31.12.2008 31.03.2010 31.03.2011 547.18 547.18 7,232.97 7,999.35 12,188.43 11,068.97 399.48 399.48 12,735.61 11,616.15 7,632.45 8,398.83 23,440.18 31,608.59 15,343.29 14,285.69 5,559.56 10,742.62 4,638.07 4,685.44 28,999.74 42,351.21 19,981.36 18,971.13 920.95 0.00 0.00 0.00 42,656.30 53,967.36 27,613.81 27,369.96 34,095.85 39,895.62 10,318.22 11,381.65 (8,602.75) (9,881.75) (3,166.01) (3,757.22) 0.00 (52.14) 0.00 0.00 25,493.10 29,961.73 7,152.21 7,624.43 5,219.59 6,335.02 4,628.83 7,805.59 709.44 931.94 3,156.44 3,079.54 0.00 415.15 0.00 0.00 7,687.42 8,297.53 3,059.72 3,050.75 6,700.65 8,534.23 4,635.91 3,117.40 3,801.78 6,499.14 989.52 1,616.75 0.00 0.00 2,155.41 1,292.55 1,918.91 6,306.00 4,260.58 2,409.02 20,108.76 29,636.90 15,101.14 11,486.47 8,264.61 8,564.09 3,912.34 3,936.52 609.98 6,188.16 628.61 373.55 8,874.59 14,752.25 4,540.95 4,310.07 11,234.17 14,884.65 10,560.19 7,176.40 0.00 0.00 0.00 0.00 0.00 0.00 2,116.14 1,684.00 0.00 1,438.87 0.00 0.00 42,656.30 53,967.36 27,613.81 27,369.96

- 23. Comparative Analysis of Balance Sheet of Wockhardt Ltd for the past five yea For the year 2006 & 2007 For the year 2007 & 2008 For the year 2008 & 2010 Absolute change % change Absolute change % change Absolute change % change (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) 0.00 0.00% 0.00 0.00% 6,685.79 1221.86% 2,072.73 20.49% (1,119.46) -9.18% (10,669.49) -96.39% 2,072.73 19.44% (1,119.46) -8.79% (3,983.70) -34.29% 8,689.44 58.91% 8,168.41 34.85% (16,265.30) -51.46% 607.56 12.27% 5,183.06 93.23% (6,104.55) -56.83% 9,297.00 47.19% 13,351.47 46.04% (22,369.85) -52.82% (0.11) -0.01% (920.95) -100.00% 0.00 0.00% 11,369.62 36.34% 11,311.06 26.52% (26,353.55) -48.83% 15,564.55 83.99% 5,799.77 17.01% (29,577.40) -74.14% (4,053.26) 89.09% (1,279.00) 14.87% 6,715.74 -67.96% 0.00 0.00% (52.14) #DIV/0! 52.14 -100.00% 11,511.29 82.33% 4,468.63 17.53% (22,809.52) -76.13% 2,133.68 69.14% 1,115.43 21.37% (1,706.19) -26.93% 706.30 22493.63% 222.50 31.36% 2,224.50 238.70% 0.00 0.00% 415.15 #DIV/0! (415.15) -100.00% 3,387.46 78.78% 610.11 7.94% (5,237.81) -63.12% 2,085.00 45.17% 1,833.58 27.36% (3,898.32) -45.68% (5,930.00) -60.93% 2,697.36 70.95% (5,509.62) -84.77% 0.00 0.00% 0.00 0.00% 2,155.41 #DIV/0! 542.18 39.38% 4,387.09 228.62% (2,045.42) -32.44% 84.64 0.42% 9,528.14 47.38% (14,535.76) -49.05% 3,289.17 66.11% 299.48 3.62% (4,651.75) -54.32% (222.88) -26.76% 5,578.18 914.49% (5,559.55) -89.84% 3,066.29 52.79% 5,877.66 66.23% (10,211.30) -69.22% (2,981.65) -20.97% 3,650.48 32.49% (4,324.46) -29.05% 0.00 0.00% 0.00 0.00% 0.00 0.00% 0.00 0.00% 0.00 0.00% 2,116.14 #DIV/0! 0.00 0.00% 1,438.87 #DIV/0! (1,438.87) -100.00% 11,369.62 36.34% 11,311.06 26.52% (26,353.55) -48.83%

- 24. d for the past five years For the year 2010 & 2011 Absolute change % change (Rs. In Million) (+)/(-) 766.38 10.60% 0.00 0.00% 766.38 10.04% (1,057.60) -6.89% 47.37 1.02% (1,010.23) -5.06% 0.00 0.00% (243.85) -0.88% 1,063.43 10.31% (591.21) 18.67% 0.00 0.00% 472.22 6.60% 3,176.76 68.63% (76.90) -2.44% 0.00 0.00% (8.97) -0.29% (1,518.51) -32.76% 627.23 63.39% (862.86) -40.03% (1,851.56) -43.46% (3,614.67) -23.94% 24.18 0.62% (255.06) -40.58% (230.88) -5.08% (3,383.79) -32.04% 0.00 0.00% (432.14) -20.42% 0.00 0.00% (243.85) -0.88%

- 25. Consolidated Profit & Loss Of Wockhardt Limited For the year ended Particulars Notes 31.12.2006 Income Sales & Services 17,536.81 Less: Excise Duty (246.42) Net Sales 17,290.39 Other Income 189.79 Hedging/derivative Income 0.00 Total Income 17,480.18 Expenditure Material consumed & Purchase of goods 7,291.32 Increase/Decrease in Inventories (612.83) Operating & other Expenses 6,609.25 Total Expenditure 13,287.74 PBDIT 4,192.44 Less: Depreciation/Amortisation (620.61) Impairment loses 0.00 PBIT 3,571.83 Less: Financial Expenses, net (26.39) Exchange Fluctuation, net 0.00 FCCB Premium 0.00 PBT and Exceptional Items 3,545.44 Less: Exceptional Items (603.72) PBT After Exceptional Items 2,941.72 Less: Current Tax (435.13) Minimum alterment tax credit entitlement 199.16 Deferred Tax (260.49) Fringe Benefit Tax (32.76) Net Profit After Tax 2,412.50 Add: Share in profit of Associate Companies 0.00 Net Profit After Tax for the year 2,412.50 Balance brought from previous year 674.95 Transfer from General reserve 0.00 Profit available for Appropriation (*) 3,087.45 Appropriations: Proposed dividend on Equity Shares 0.00 Tax on Proposed dividend 0.00 Interim dividend on Equity Shares 547.18 Tax on Interim dividend 76.74

- 26. Transfer to General Reserve 1,500.00 Surplus Carried to Balancesheet 963.53 (*) 3,087.45 Earnings Per Share:(in Rs) Basic 22.05 Dilluted 22.04 Nominal value of shares Rs 5 (Previous year Rs 5) 5.00

- 27. dated Profit & Loss A/C Of Wockhardt Limited (Rs in Millions) For the year ended For the year ended For the year ended For the year ended 31.12.2007 31.12.2008 31.03.2010 31.03.2011 25,060.46 35,983.62 45,059.00 37,552.22 (152.31) (85.83) (44.78) (39.83) 24,908.15 35,897.79 45,014.22 37,512.39 460.01 355.85 295.24 159.03 1,623.39 0.00 0.00 0.00 26,991.55 36,253.64 45,309.46 37,671.42 11,359.34 13,900.91 19,409.79 14,544.72 (1,431.82) (297.36) 315.58 617.50 10,213.85 14,438.99 17,057.42 13,262.91 20,141.37 28,042.54 36,782.79 28,425.13 6,850.18 8,211.10 8,526.67 9,246.29 (784.84) (1,078.33) (1,481.39) (1,166.18) 0.00 (52.14) 0.00 0.00 6,065.34 7,080.63 7,045.28 8,080.11 (1,638.13) (2,590.70) (3,424.83) (2,671.05) 314.27 105.29 (259.30) 1,366.57 0.00 (1,294.91) (268.30) 0.00 4,741.48 3,300.31 3,092.85 6,775.63 0.00 (5,809.91) (12,949.21) (5,732.14) 4,741.48 (2,509.60) (9,856.36) 1,043.49 (526.50) (237.30) (277.81) (338.38) 0.00 0.00 0.00 0.00 (354.01) 1,192.08 119.88 251.91 (36.07) (38.56) (8.74) 0.00 3,824.90 (1,593.38) (10,023.03) 957.02 33.24 204.80 16.40 (51.83) 3,858.14 (1,388.58) (10,006.63) 905.19 963.53 2,881.28 1,492.70 (57.40) 0.00 0.00 0.00 83.69 4,821.67 1,492.70 (8,513.93) 931.48 273.59 0.00 0.00 0.00 46.50 0.00 0.00 0.00 957.56 0.00 0.00 0.00 162.74 0.00 0.00 0.00

- 28. 500.00 0.00 (8,456.53) 0.00 2,881.28 1,492.70 (57.40) 931.48 4,821.67 1,492.70 (8,513.93) 931.48 35.25 (12.69) (91.44) 8.27 35.25 (12.69) (91.44) 8.27 5.00 5.00 5.00 5.00

- 29. Trend Analysis of P/L A/c of Wockhardt Ltd for the past five years For the year 2006 & 2007 For the year 2006 & 2008 For the year 2006 & 2010 Absolute change % change Absolute change % change Absolute change % change (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) 7,523.65 42.90% 18,446.81 105.19% 27,522.19 156.94% 94.11 -38.19% 160.59 -65.17% 201.64 -81.83% 7,617.76 44.06% 18,607.40 107.62% 27,723.83 160.34% 270.22 142.38% 166.06 87.50% 105.45 55.56% 1,623.39 #DIV/0! 0.00 0.00% 0.00 0.00% 9,511.37 54.41% 18,773.46 107.40% 27,829.28 159.20% 4,068.02 55.79% 6,609.59 90.65% 12,118.47 166.20% (818.99) 133.64% 315.47 -51.48% 928.41 -151.50% 3,604.60 54.54% 7,829.74 118.47% 10,448.17 158.08% 6,853.63 51.58% 14,754.80 111.04% 23,495.05 176.82% 2,657.74 63.39% 4,018.66 95.85% 4,334.23 103.38% (164.23) 26.46% (457.72) 73.75% (860.78) 138.70% 0.00 0.00% (52.14) #DIV/0! 0.00 0.00% 2,493.51 69.81% 3,508.80 98.24% 3,473.45 97.25% (1,611.74) 6107.39% (2,564.31) 9716.98% (3,398.44) 12877.76% 314.27 #DIV/0! 105.29 #DIV/0! (259.30) #DIV/0! 0.00 0.00% (1,294.91) #DIV/0! (268.30) #DIV/0! 1,196.04 33.73% (245.13) -6.91% (452.59) -12.77% 603.72 -100.00% (5,206.19) 862.35% (12,345.49) 2044.90% 1,799.76 61.18% (5,451.32) -185.31% (12,798.08) -435.05% (91.37) 21.00% 197.83 -45.46% 157.32 -36.15% (199.16) -100.00% (199.16) -100.00% (199.16) -100.00% (93.52) 35.90% 1,452.57 -557.63% 380.37 -146.02% (3.31) 10.10% (5.80) 17.70% 24.02 -73.32% 1,412.40 58.55% (4,005.88) -166.05% (12,435.53) -515.46% 33.24 #DIV/0! 204.80 #DIV/0! 16.40 #DIV/0! 1,445.64 59.92% (3,801.08) -157.56% (12,419.13) -514.78% 288.58 42.76% 2,206.33 326.89% 817.75 121.16% 0.00 0.00% 0.00 0.00% 0.00 0.00% 1,734.22 56.17% (1,594.75) -51.65% (11,601.38) -375.76% 273.59 #DIV/0! 0.00 0.00% 0.00 0.00% 46.50 #DIV/0! 0.00 0.00% 0.00 0.00% 410.38 75.00% (547.18) -100.00% (547.18) -100.00% 86.00 112.07% (76.74) -100.00% (76.74) -100.00%

- 30. (1,000.00) -66.67% (1,500.00) -100.00% (9,956.53) -663.77% 1,917.75 199.03% 529.17 54.92% (1,020.93) -105.96% 1,734.22 56.17% (1,594.75) -51.65% (11,601.38) -375.76% 13.20 59.86% (34.74) -157.55% (113.49) -514.69% 13.21 59.94% (34.73) -157.58% (113.48) -514.88% 0.00 0.00% 0.00 0.00% 0.00 0.00%

- 31. e past five years For the year 2006 & 2011 Absolute change % change (Rs. In Million) (+)/(-) 20,015.41 114.13% 206.59 -83.84% 20,222.00 116.96% (30.76) -16.21% 0.00 0.00% 20,191.24 115.51% 7,253.40 99.48% 1,230.33 -200.76% 6,653.66 100.67% 15,137.39 113.92% 5,053.85 120.55% (545.57) 87.91% 0.00 0.00% 4,508.28 126.22% (2,644.66) 10021.45% 1,366.57 #DIV/0! 0.00 0.00% 3,230.19 91.11% (5,128.42) 849.47% (1,898.23) -64.53% 96.75 -22.23% (199.16) -100.00% 512.40 -196.71% 32.76 -100.00% (1,455.48) -60.33% (51.83) #DIV/0! (1,507.31) -62.48% (732.35) -108.50% 83.69 #DIV/0! (2,155.97) -69.83% 0.00 0.00% 0.00 0.00% (547.18) -100.00% (76.74) -100.00%

- 32. (1,500.00) -100.00% (32.05) -3.33% (2,155.97) -69.83% (13.78) -62.49% (13.77) -62.48% 0.00 0.00%

- 33. Consolidated Balancesheet Of Wockhardt Limited For the year ended Particulars 31.12.2006 SOURCE OF FUND Shareholder's Funds : Share Capital 547.18 Reserves & Surplus 10,115.70 Net Worth 10,662.88 Loan Funds: Secured Loans 14,750.74 Unsecured Loans 4,952.00 Total Debt 19,702.74 Deferred Tax Liability, net 921.06 Total Liabilities 31,286.68 APPLICATION OF FUND Fixed Assets: Gross Block 18,531.30 Less: Acc. Depreciation (4,549.49) Impairment provision 0.00 Net Block 13,981.81 Capital Work-in-Progress, including capital advances 3,085.91 Investments 3.14 Deferred Tax Assets , net 0.00 Inventories 4,299.96 Sundry Debtors 4,615.65 Cash And Bank 9,731.78 Loans And Advances to subsidiaries 0.00 Other Loans and Advances 1,376.73 Total Current Assets [A] 20,024.12 Less: Current Liabilities & Provision Current Liabilities 4,975.44 Provisions 832.86 Total Current Liabilities [B] 5,808.30 Net Current Assets [A-B] 14,215.82 Misc. Expenses 0.00 Profit & Loss A/C, net 0.00 Foreign Currency Translation Reserve 0.00 Total Assets 31,286.68

- 34. onsolidated Balancesheet Of Wockhardt Limited (Rs. In Million) For the year ended For the year ended For the year ended For the year ended 31.12.2007 31.12.2008 31.03.2010 31.03.2011 547.18 547.18 7,232.97 7,999.35 12,188.43 11,068.97 399.48 399.48 12,735.61 11,616.15 7,632.45 8,398.83 23,440.18 31,608.59 15,343.29 14,285.69 5,559.56 10,742.62 4,638.07 4,685.44 28,999.74 42,351.21 19,981.36 18,971.13 920.95 0.00 0.00 0.00 42,656.30 53,967.36 27,613.81 27,369.96 34,095.85 39,895.62 10,318.22 11,381.65 (8,602.75) (9,881.75) (3,166.01) (3,757.22) 0.00 (52.14) 0.00 0.00 25,493.10 29,961.73 7,152.21 7,624.43 5,219.59 6,335.02 4,628.83 7,805.59 709.44 931.94 3,156.44 3,079.54 0.00 415.15 0.00 0.00 7,687.42 8,297.53 3,059.72 3,050.75 6,700.65 8,534.23 4,635.91 3,117.40 3,801.78 6,499.14 989.52 1,616.75 0.00 0.00 2,155.41 1,292.55 1,918.91 6,306.00 4,260.58 2,409.02 20,108.76 29,636.90 15,101.14 11,486.47 8,264.61 8,564.09 3,912.34 3,936.52 609.98 6,188.16 628.61 373.55 8,874.59 14,752.25 4,540.95 4,310.07 11,234.17 14,884.65 10,560.19 7,176.40 0.00 0.00 0.00 0.00 0.00 0.00 2,116.14 1,684.00 0.00 1,438.87 0.00 0.00 42,656.30 53,967.36 27,613.81 27,369.96

- 35. Trend Analysis of Balance Sheet of Wockhardt Ltd for the past five years For the year 2006 & 2007 For the year 2006 & 2008 For the year 2006 & 2010 Absolute change % change Absolute change % change Absolute change % change (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) (Rs. In Million) (+)/(-) 0.00 0.00% 0.00 0.00% 6,685.79 1221.86% 2,072.73 20.49% 953.27 9.42% (9,716.22) -96.05% 2,072.73 19.44% 953.27 8.94% (3,030.43) -28.42% 8,689.44 58.91% 16,857.85 114.28% 592.55 4.02% 607.56 12.27% 5,790.62 116.93% (313.93) -6.34% 9,297.00 47.19% 22,648.47 114.95% 278.62 1.41% (0.11) -0.01% (921.06) -100.00% (921.06) -100.00% 11,369.62 36.34% 22,680.68 72.49% (3,672.87) -11.74% 15,564.55 83.99% 21,364.32 115.29% (8,213.08) -44.32% (4,053.26) 89.09% (5,332.26) 117.21% 1,383.48 -30.41% 0.00 0.00% (52.14) #DIV/0! 0.00 0.00% 11,511.29 82.33% 15,979.92 114.29% (6,829.60) -48.85% 2,133.68 69.14% 3,249.11 105.29% 1,542.92 50.00% 706.30 22493.63% 928.80 29579.62% 3,153.30 100423.57% 0.00 0.00% 415.15 #DIV/0! 0.00 0.00% 3,387.46 78.78% 3,997.57 92.97% (1,240.24) -28.84% 2,085.00 45.17% 3,918.58 84.90% 20.26 0.44% (5,930.00) -60.93% (3,232.64) -33.22% (8,742.26) -89.83% 0.00 0.00% 0.00 0.00% 2,155.41 #DIV/0! 542.18 39.38% 4,929.27 358.04% 2,883.85 209.47% 84.64 0.42% 9,612.78 48.01% (4,922.98) -24.59% 3,289.17 66.11% 3,588.65 72.13% (1,063.10) -21.37% (222.88) -26.76% 5,355.30 643.00% (204.25) -24.52% 3,066.29 52.79% 8,943.95 153.99% (1,267.35) -21.82% (2,981.65) -20.97% 668.83 4.70% (3,655.63) -25.72% 0.00 0.00% 0.00 0.00% 0.00 0.00% 0.00 0.00% 0.00 0.00% 2,116.14 #DIV/0! 0.00 0.00% 1,438.87 #DIV/0! 0.00 0.00% 11,369.62 36.34% 22,680.68 72.49% (3,672.87) -11.74%

- 36. the past five years For the year 2006 & 2011 Absolute change % change (Rs. In Million) (+)/(-) 7,452.17 1361.92% (9,716.22) -96.05% (2,264.05) -21.23% (465.05) -3.15% (266.56) -5.38% (731.61) -3.71% (921.06) -100.00% (3,916.72) -12.52% (7,149.65) -38.58% 792.27 -17.41% 0.00 0.00% (6,357.38) -45.47% 4,719.68 152.94% 3,076.40 97974.52% 0.00 0.00% (1,249.21) -29.05% (1,498.25) -32.46% (8,115.03) -83.39% 1,292.55 #DIV/0! 1,032.29 74.98% (8,537.65) -42.64% (1,038.92) -20.88% (459.31) -55.15% (1,498.23) -25.79% (7,039.42) -49.52% 0.00 0.00% 1,684.00 #DIV/0! 0.00 0.00% (3,916.72) -12.52%