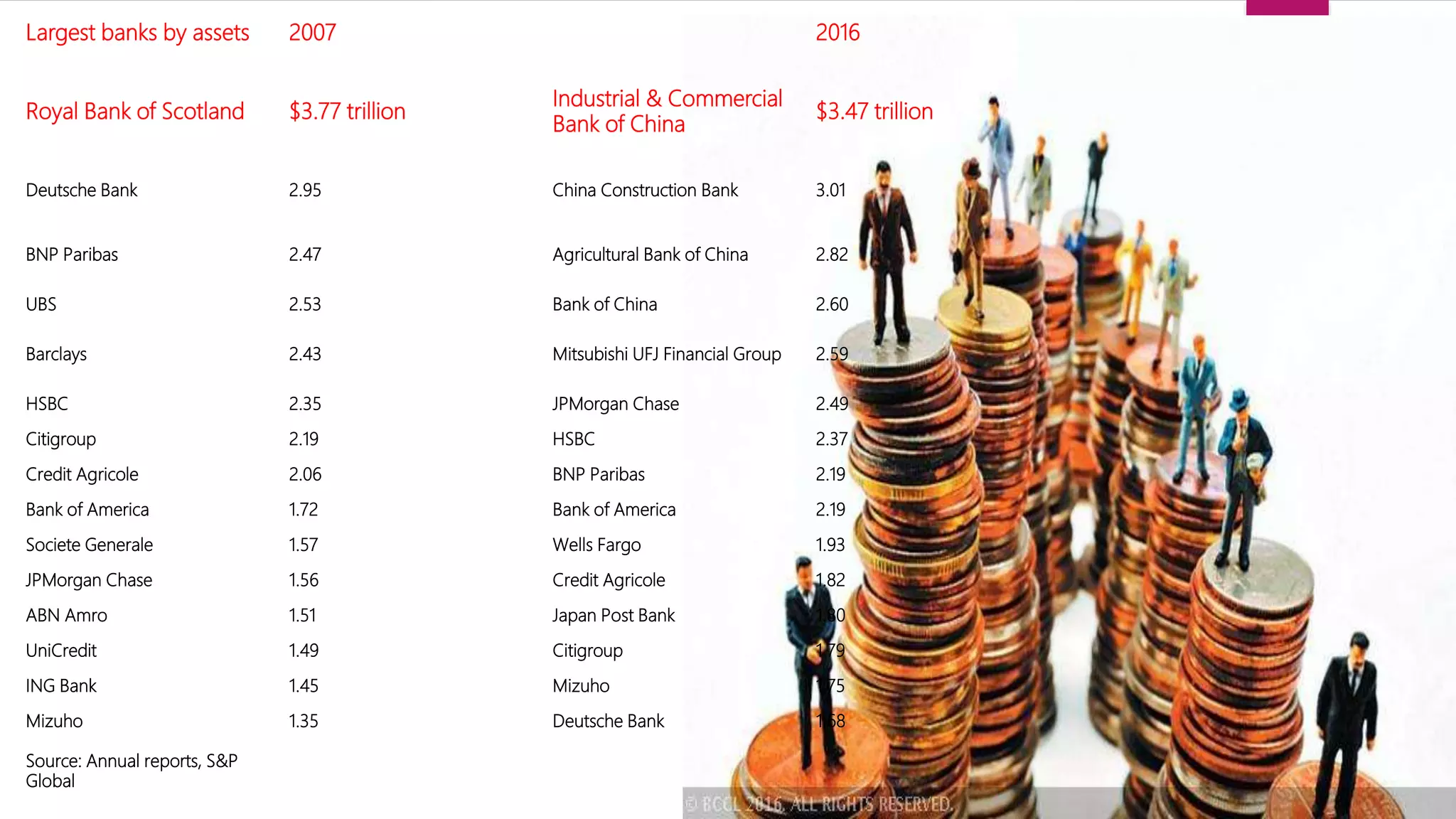

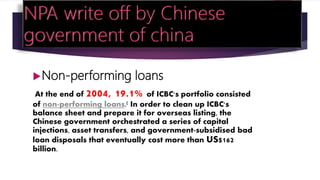

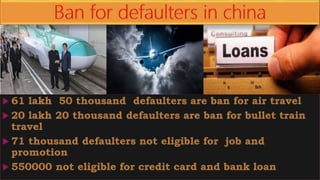

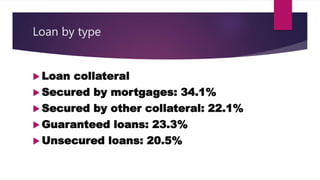

The document provides a summary of the largest banks by assets from 2007 to 2016, highlighting the Royal Bank of Scotland, ICBC, and Deutsche Bank among the top institutions. It also discusses non-performing loans in China's banking sector, particularly ICBC's significant historical issues and the government's interventions to address them. Additionally, it examines loan types and collateral within the banking system, alongside the impact of unsold housing stock on various stakeholders.