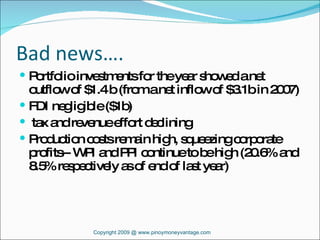

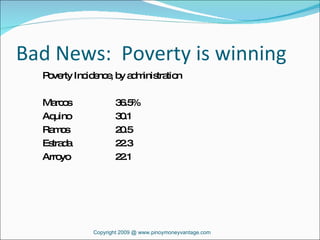

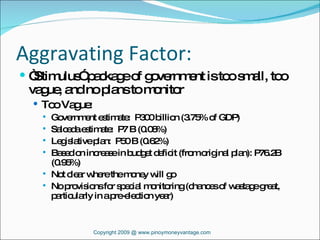

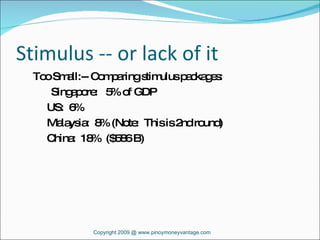

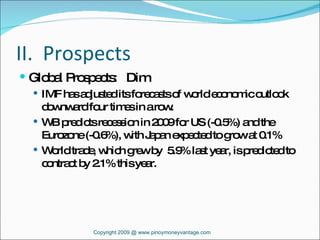

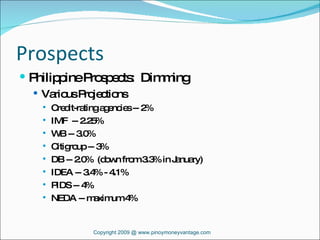

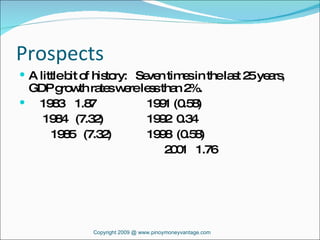

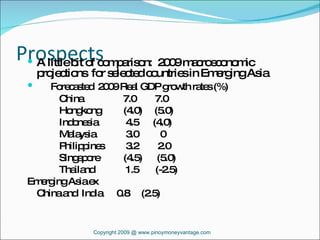

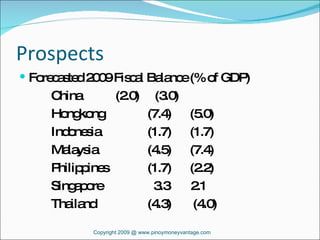

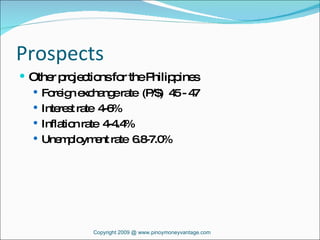

The Philippines faces economic slowdown due to declining global demand and lackluster domestic investment and government intervention. Growth is projected to slow considerably, with forecasts ranging from 2-4% compared to past growth rates over 5%. While the country was in a better position than previous crises, 10 of 11 leading indicators are now negative, portending further economic weakness. The outlook could improve if stimulus packages abroad and at home are sizable and effective.