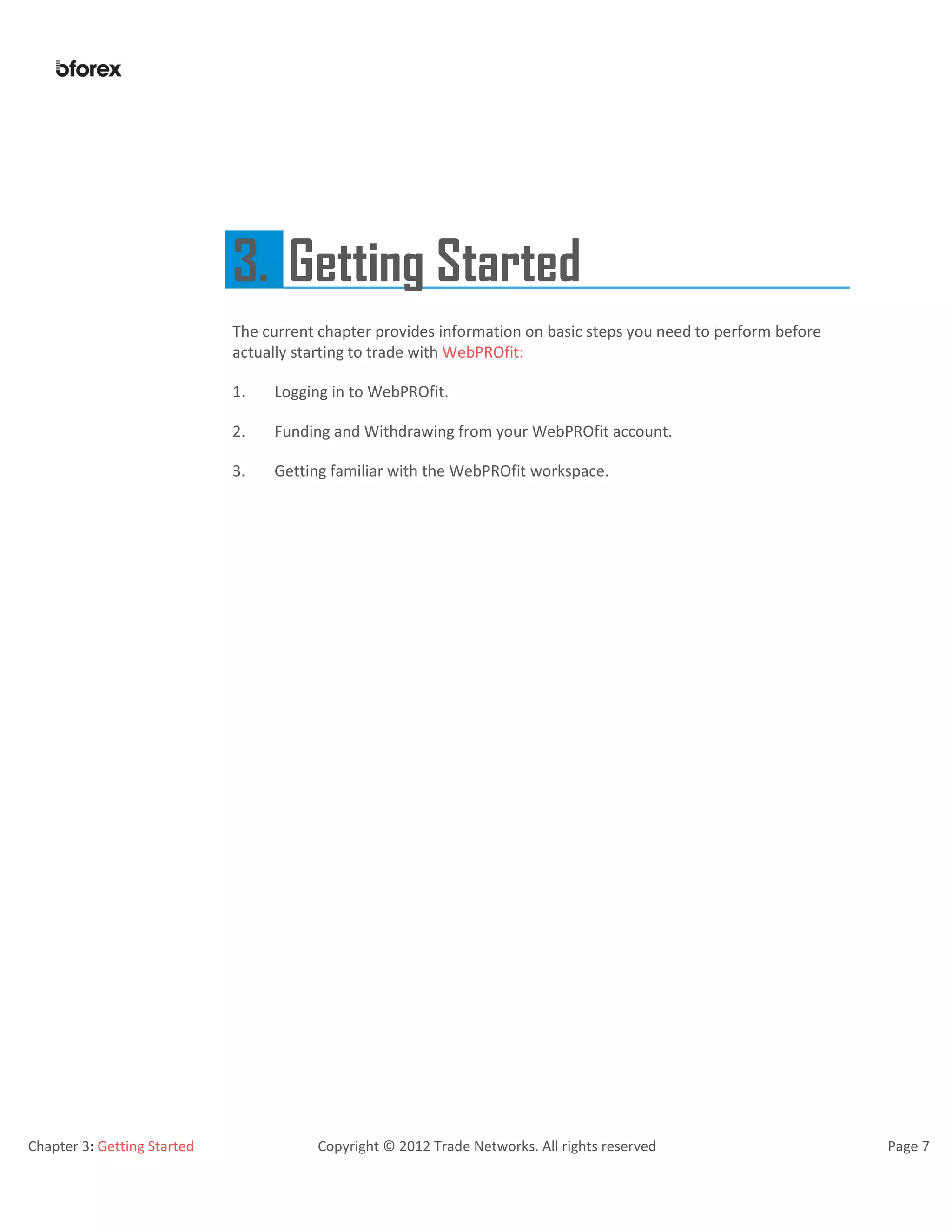

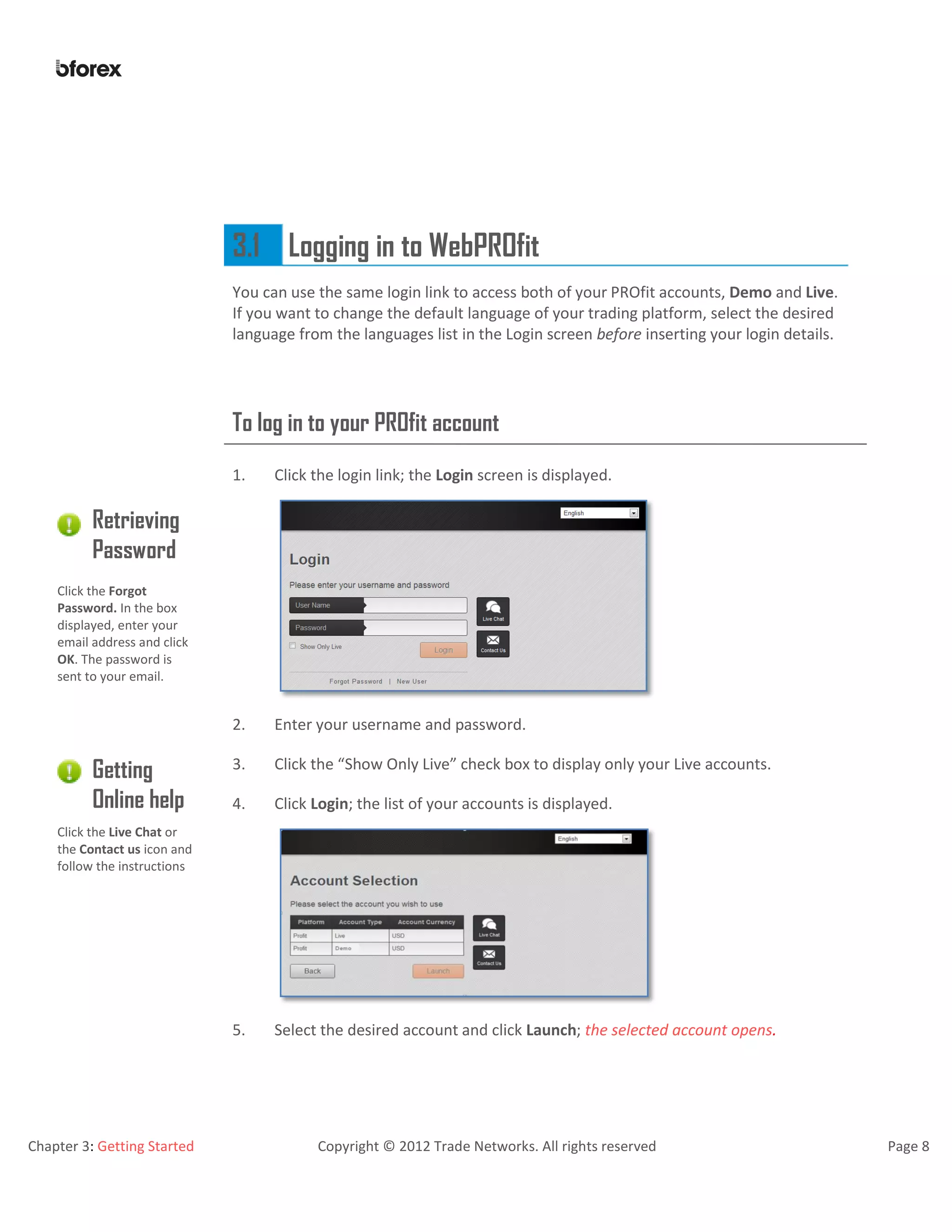

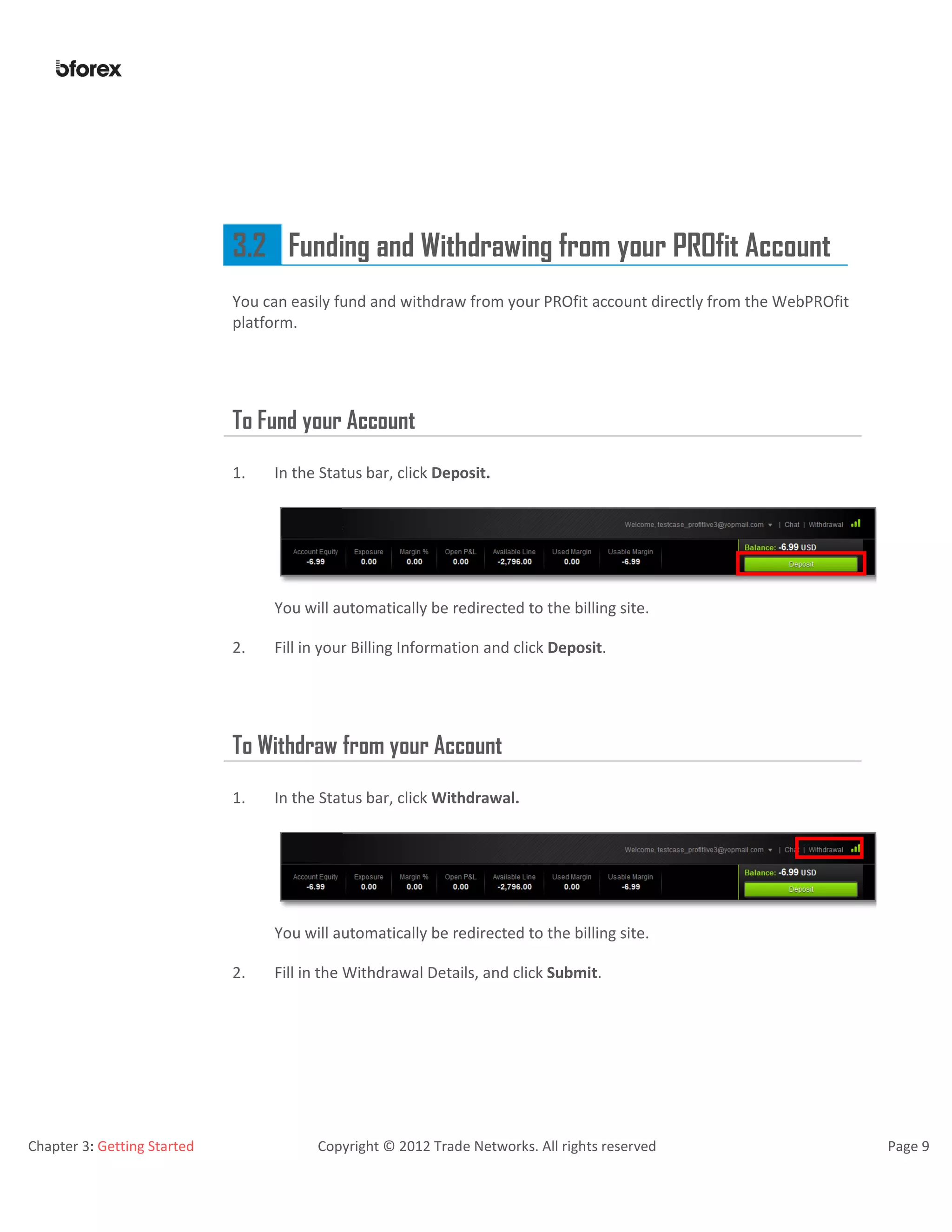

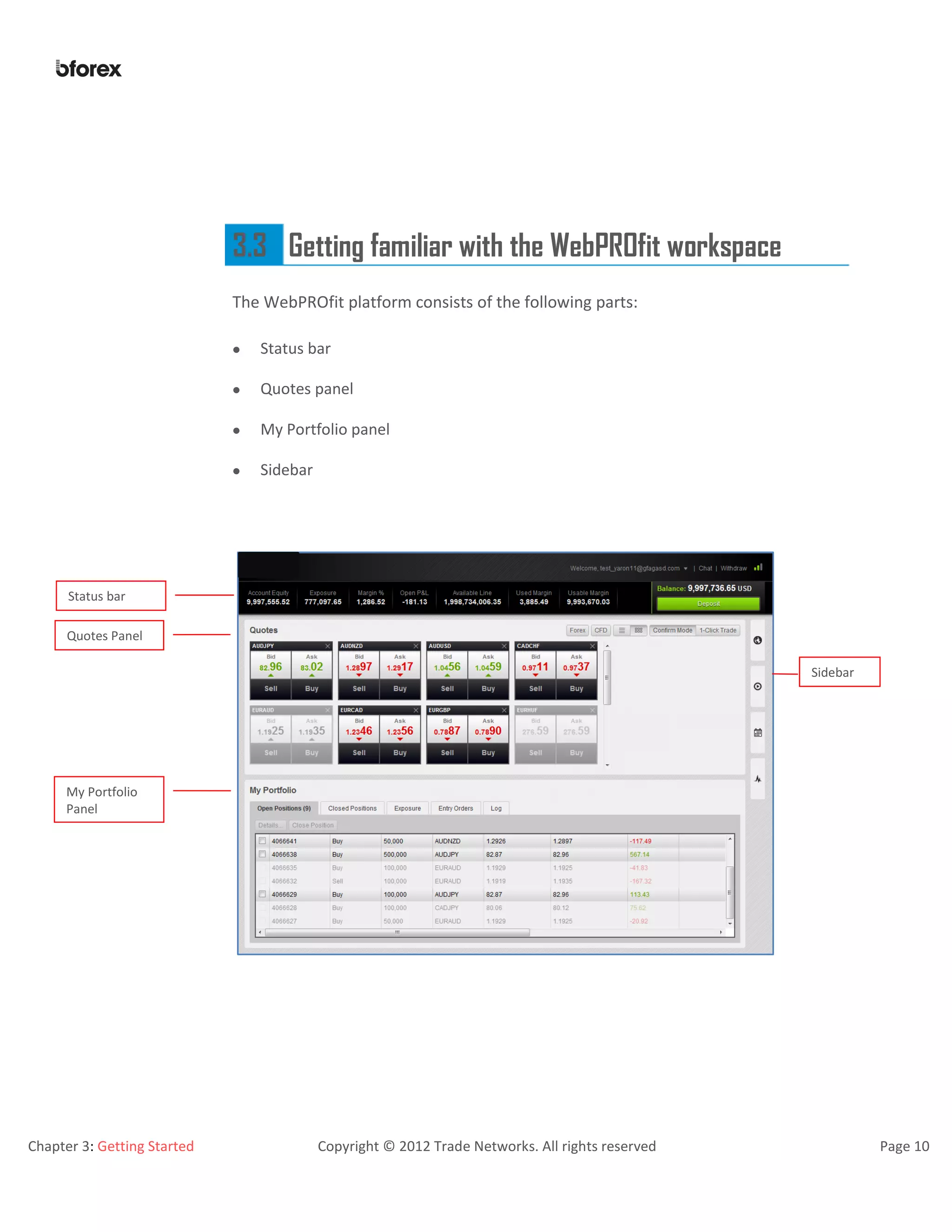

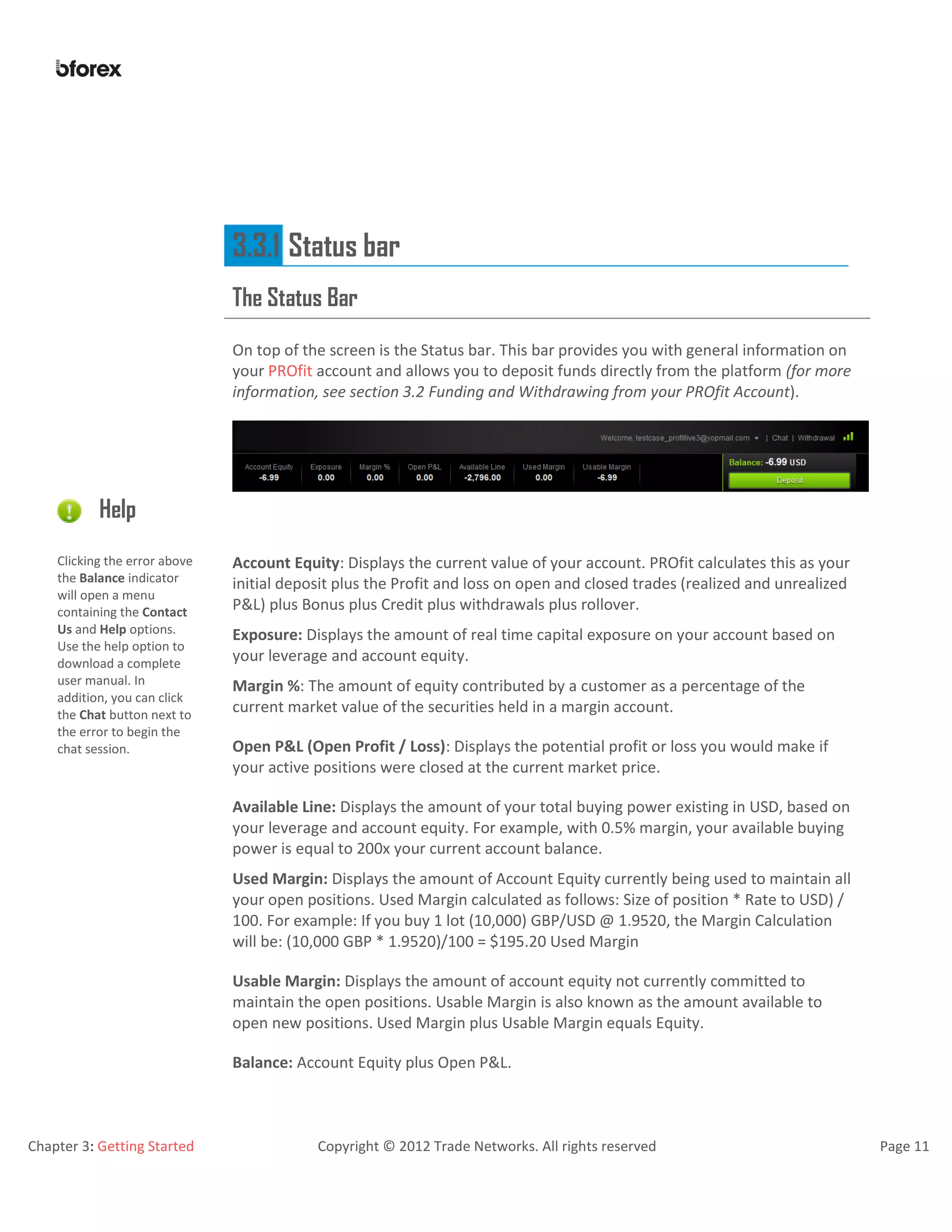

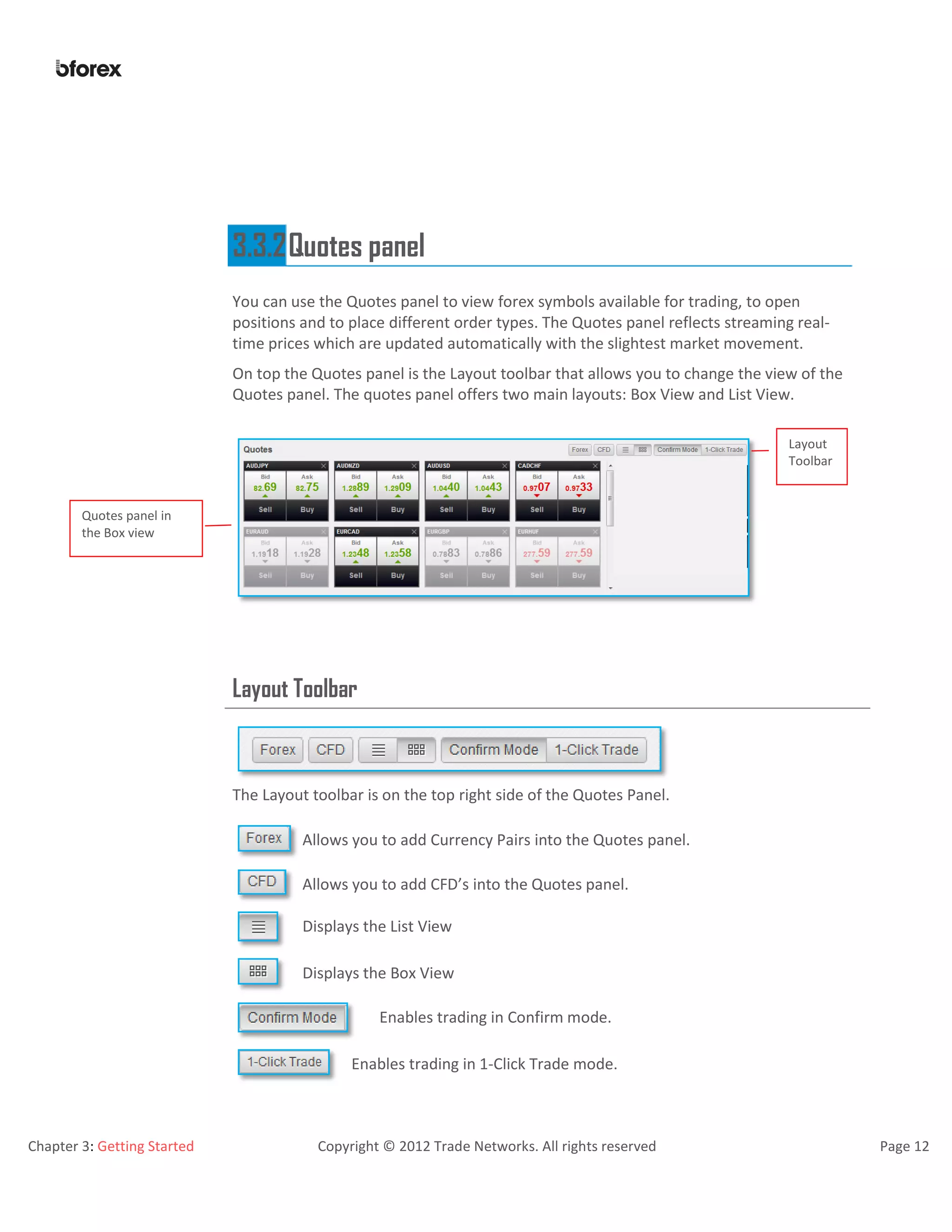

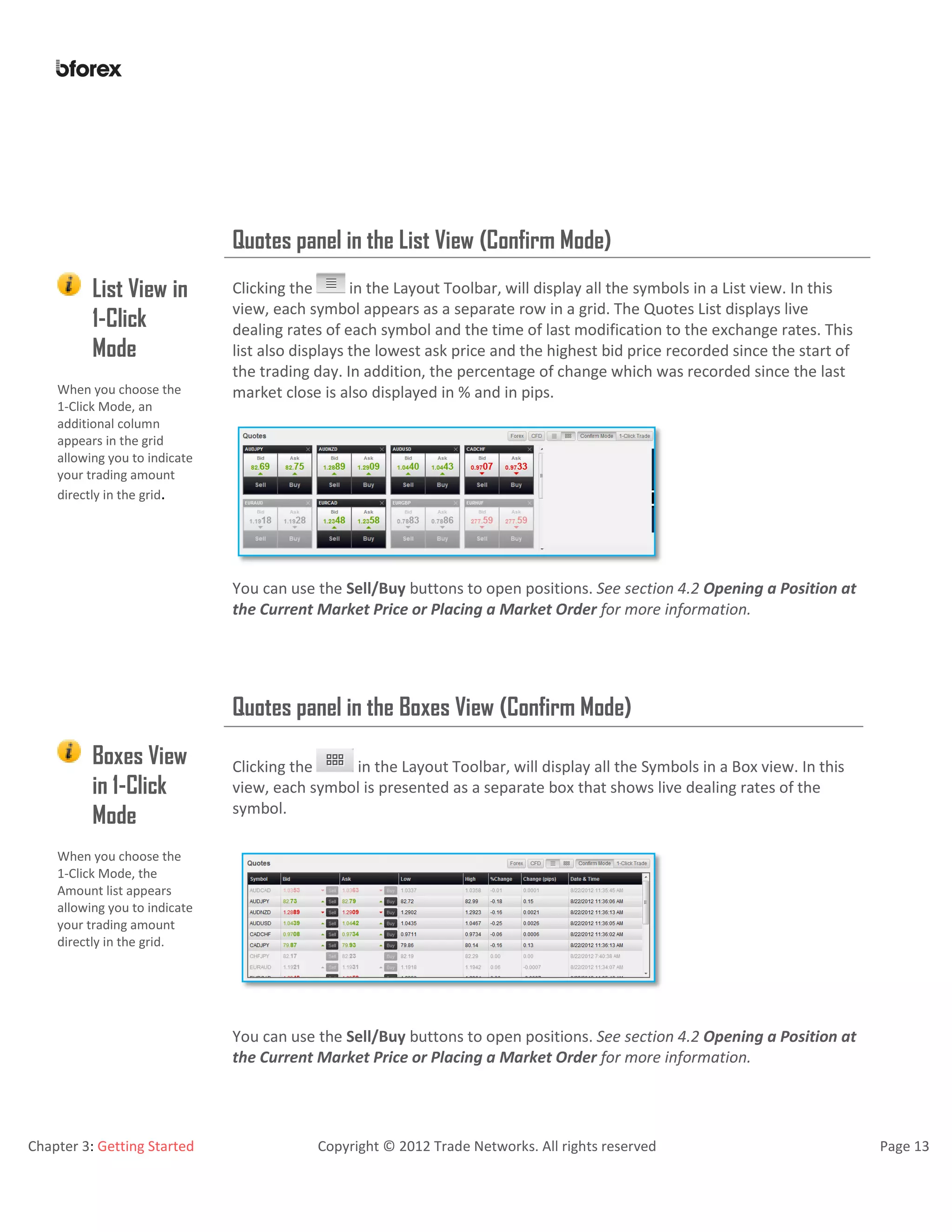

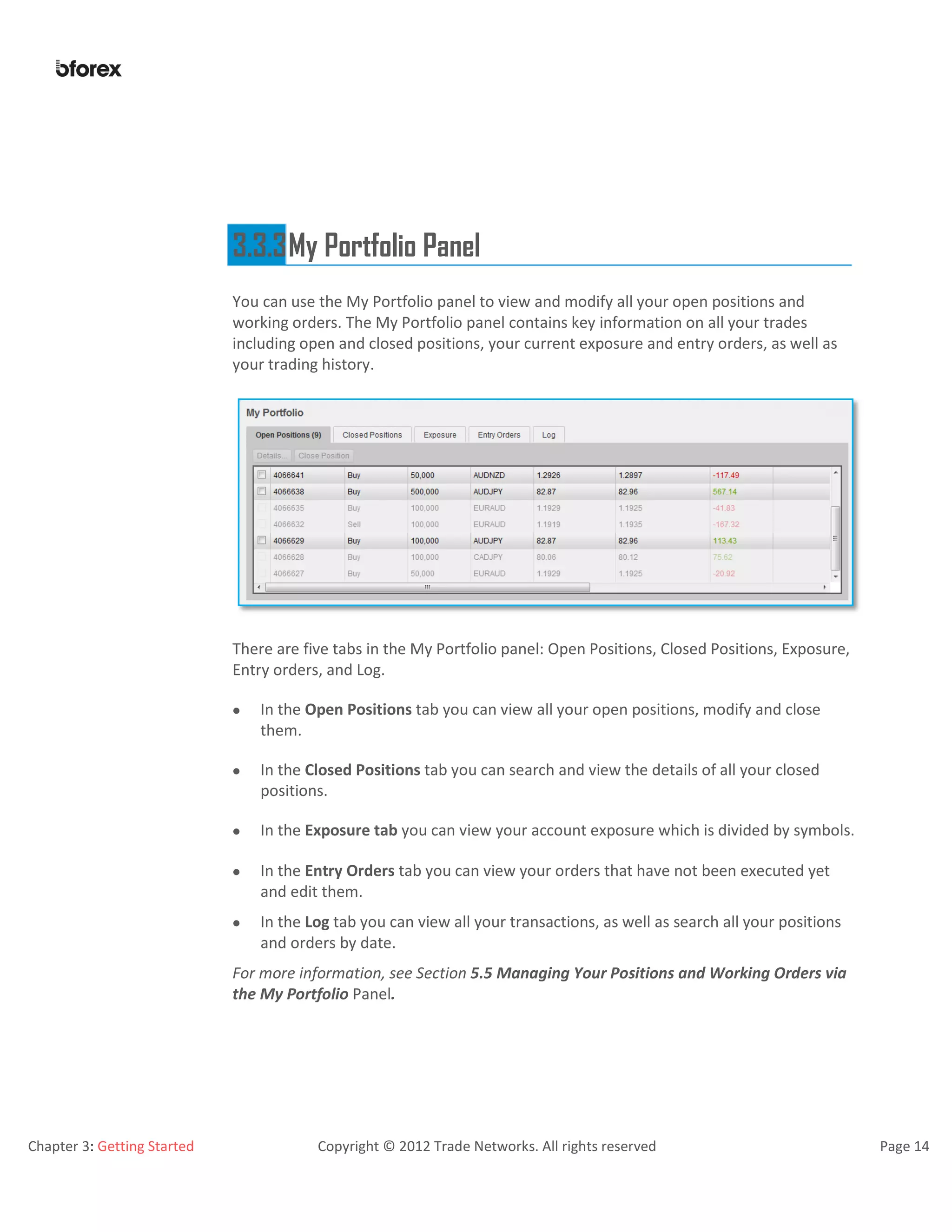

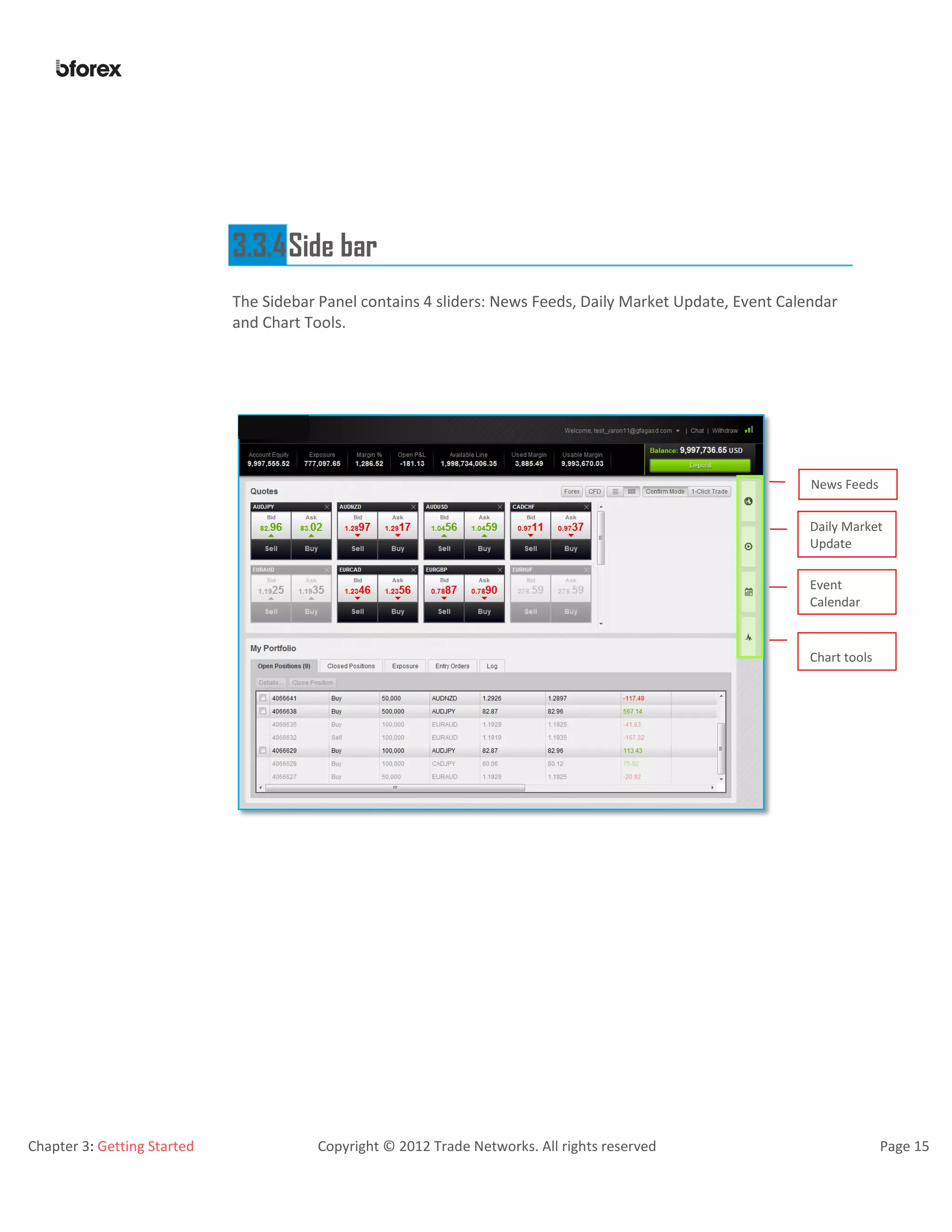

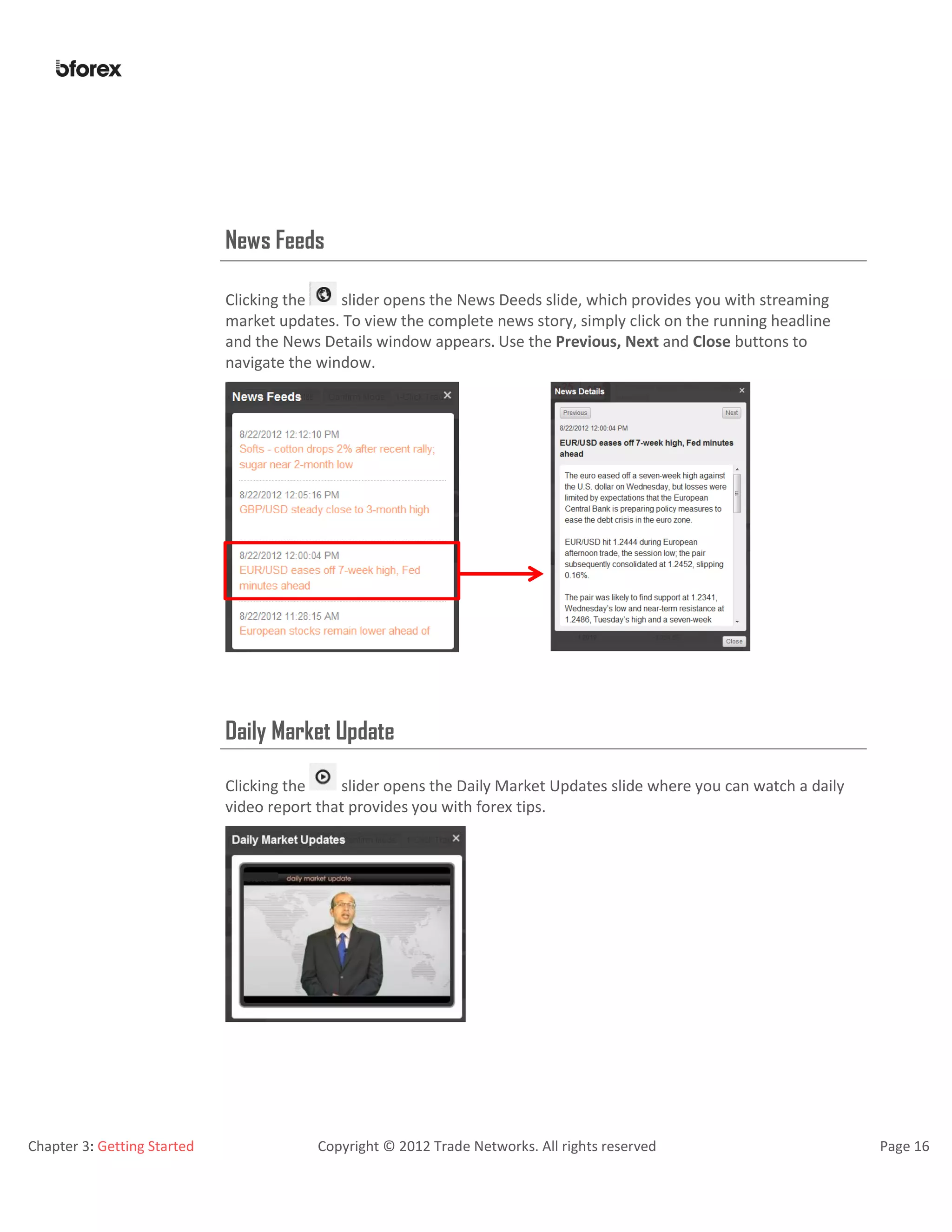

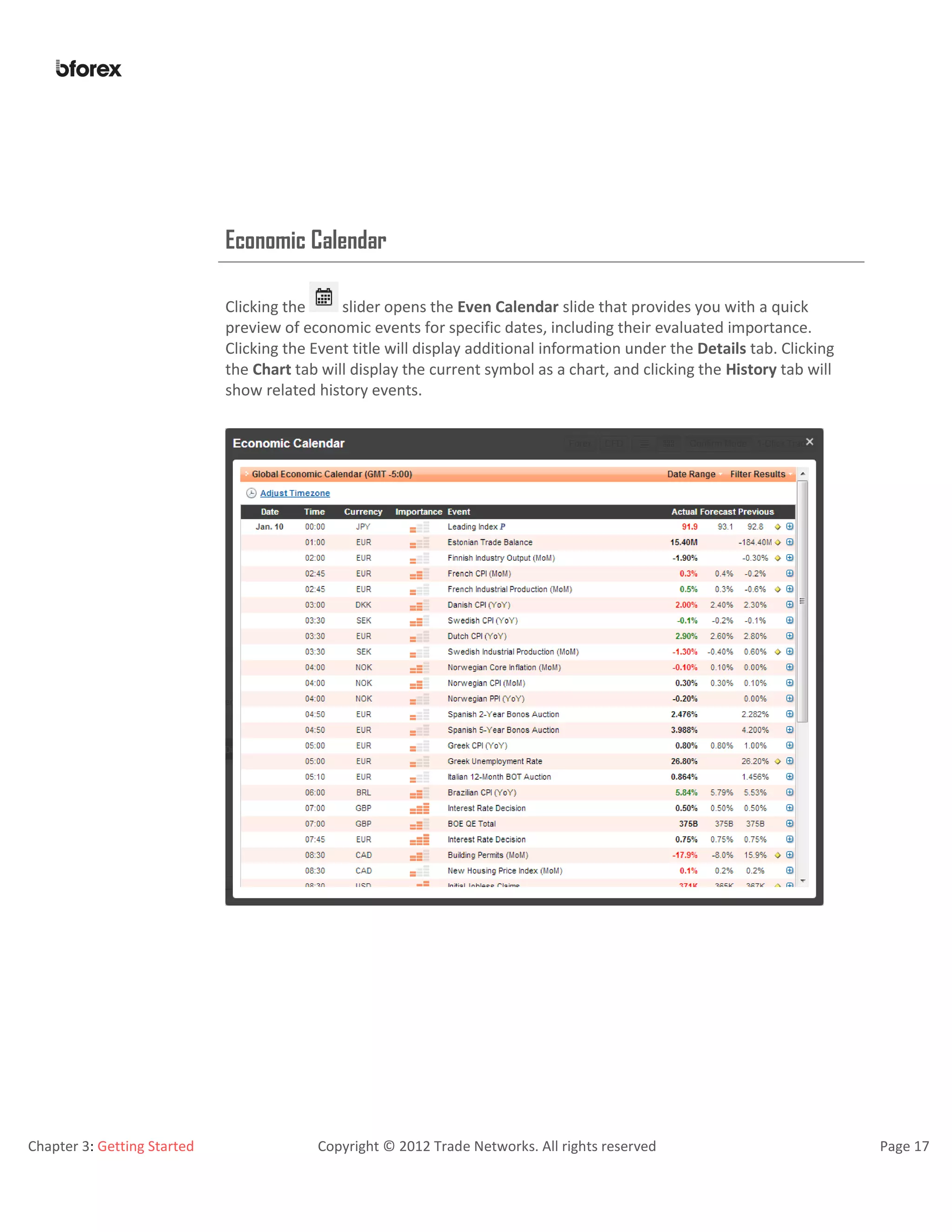

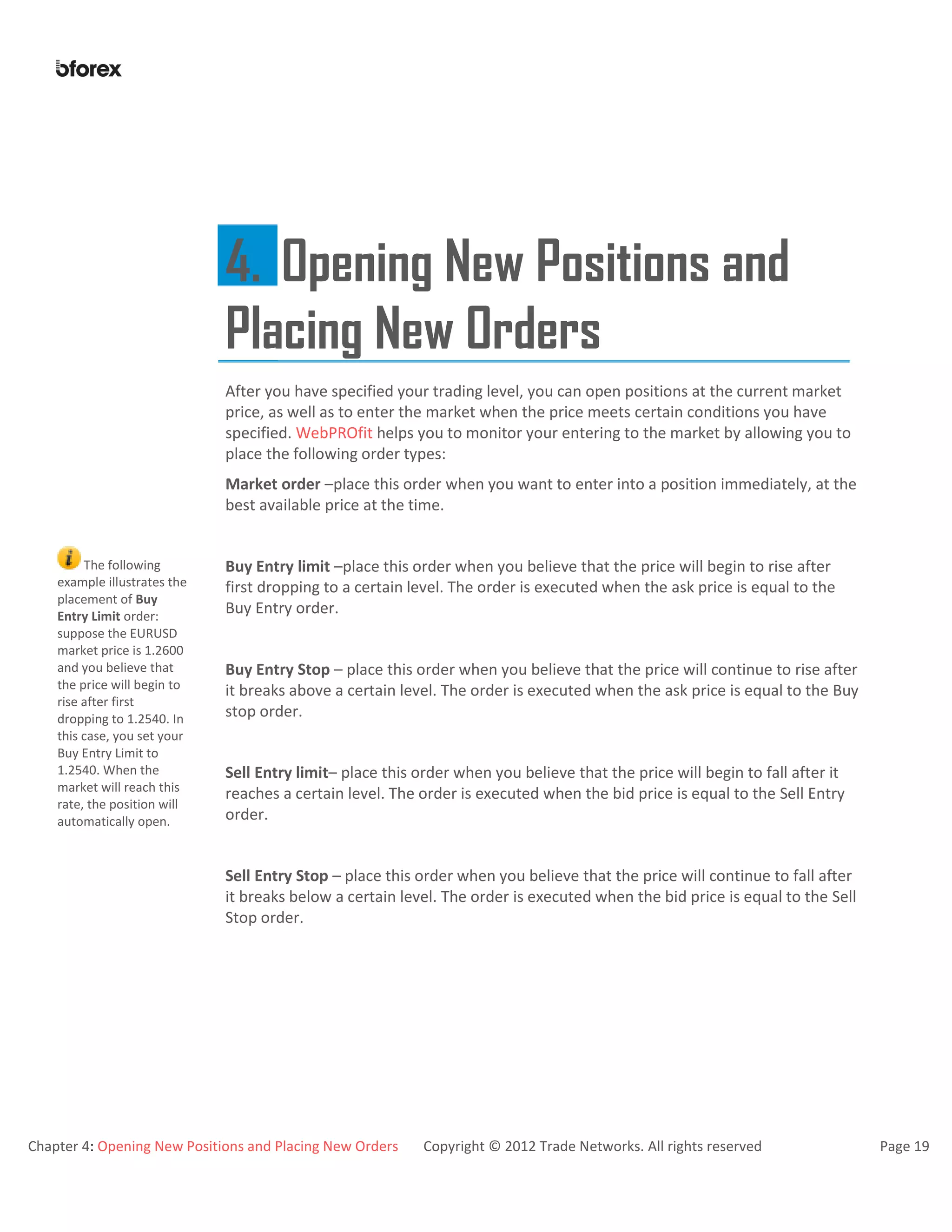

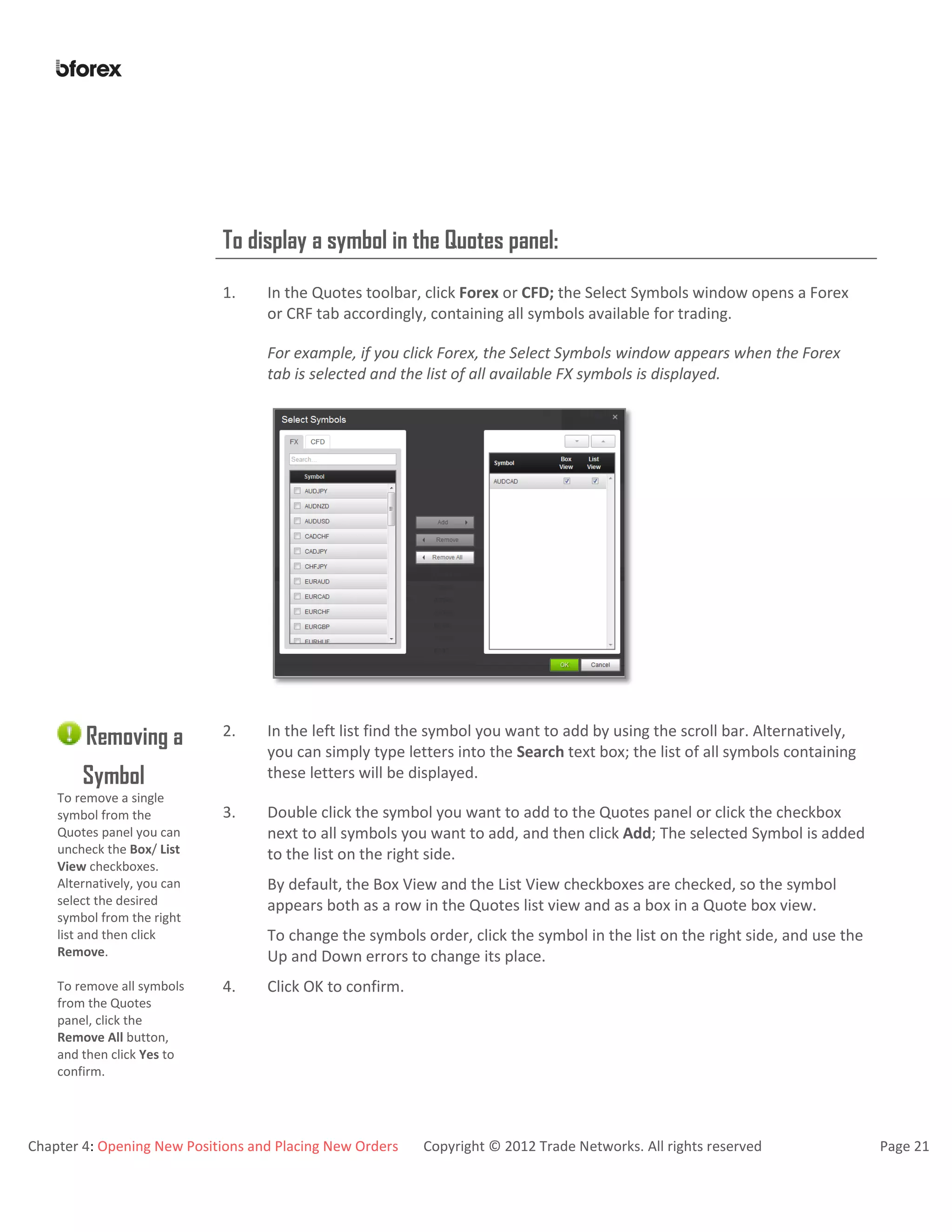

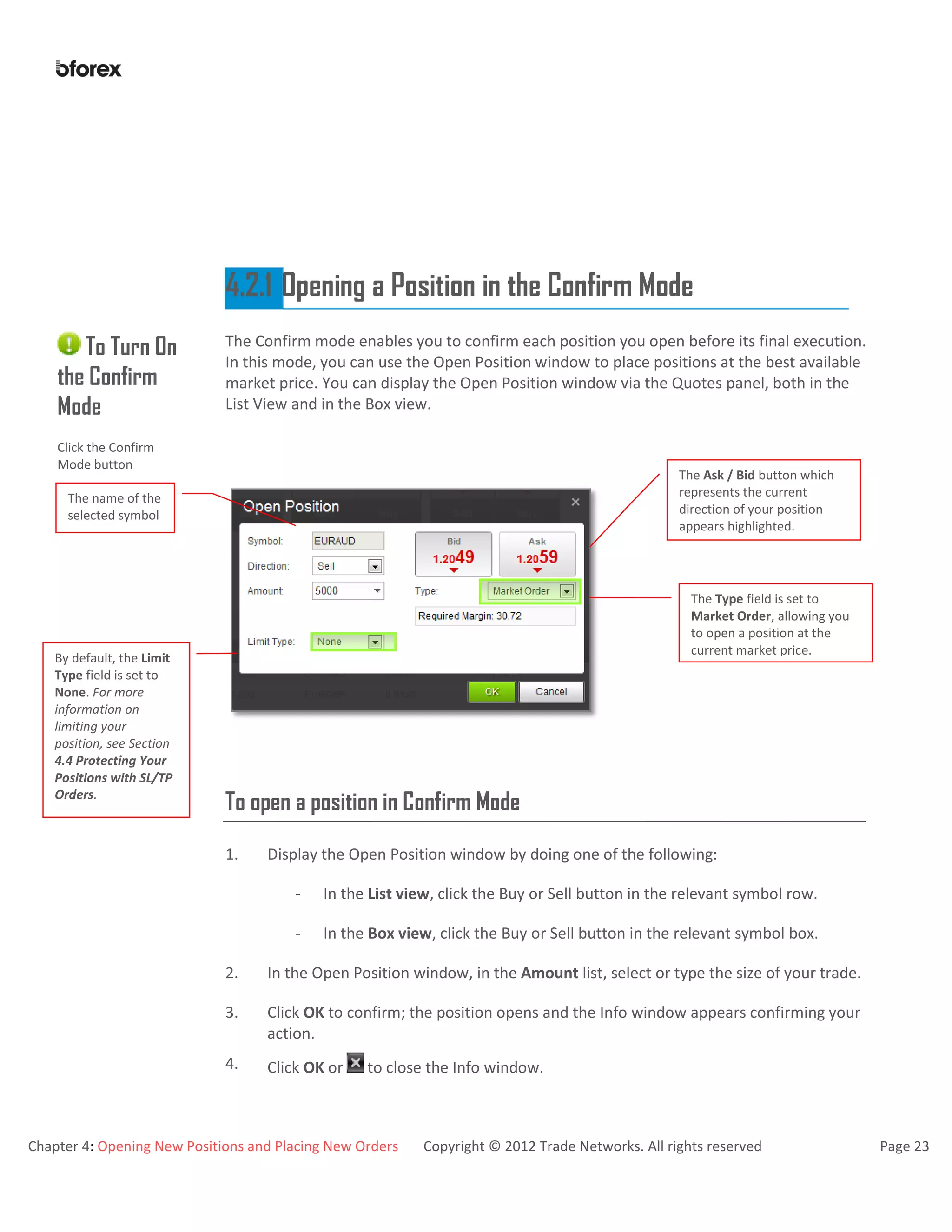

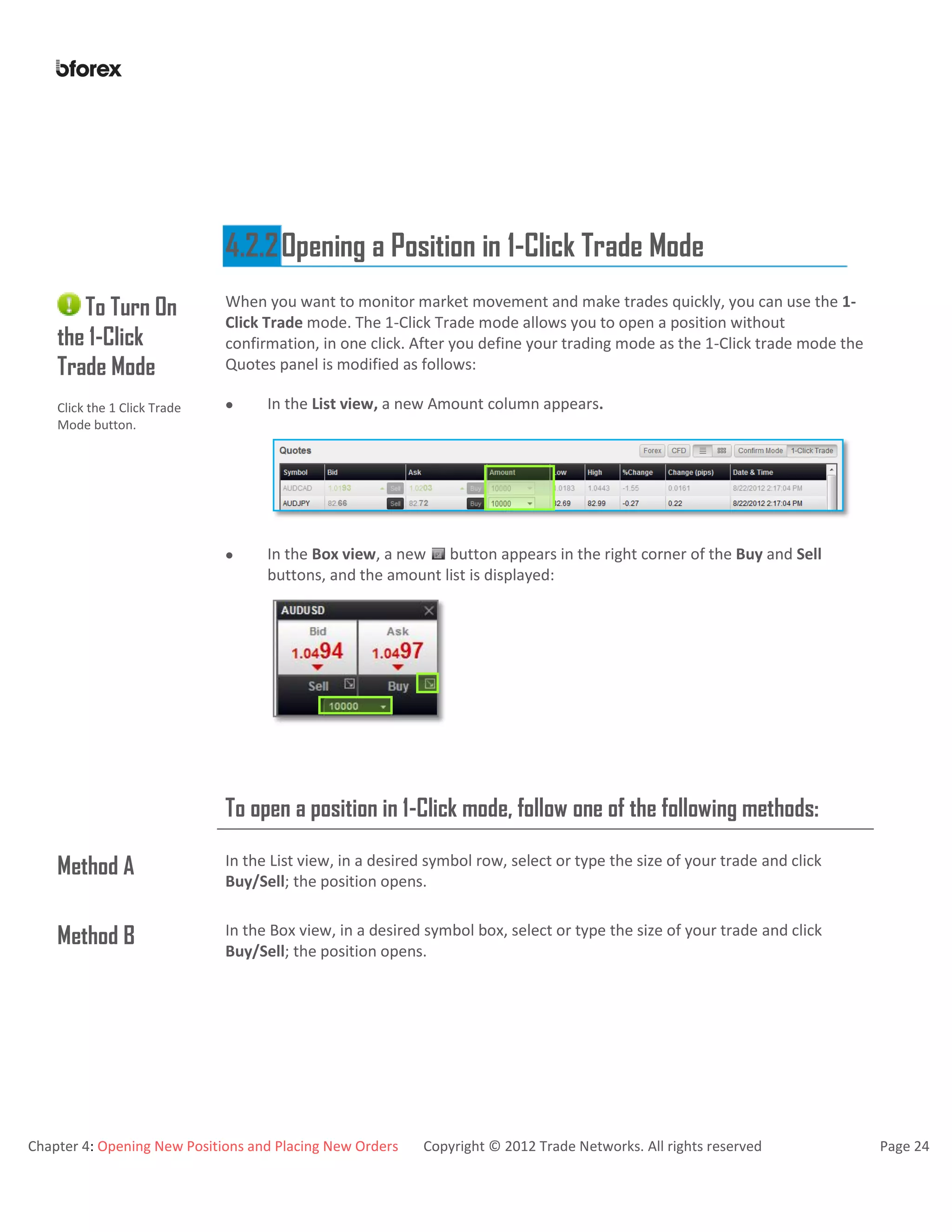

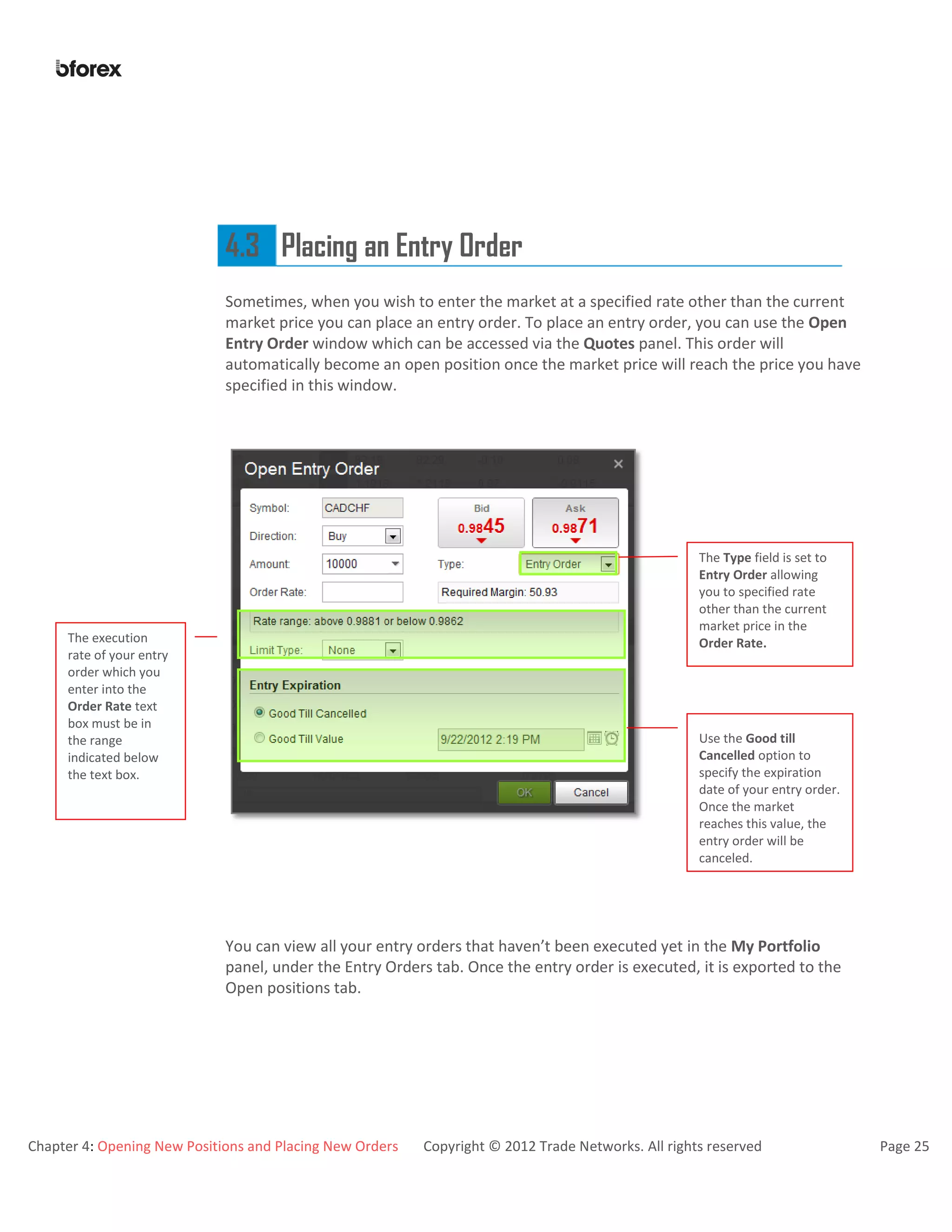

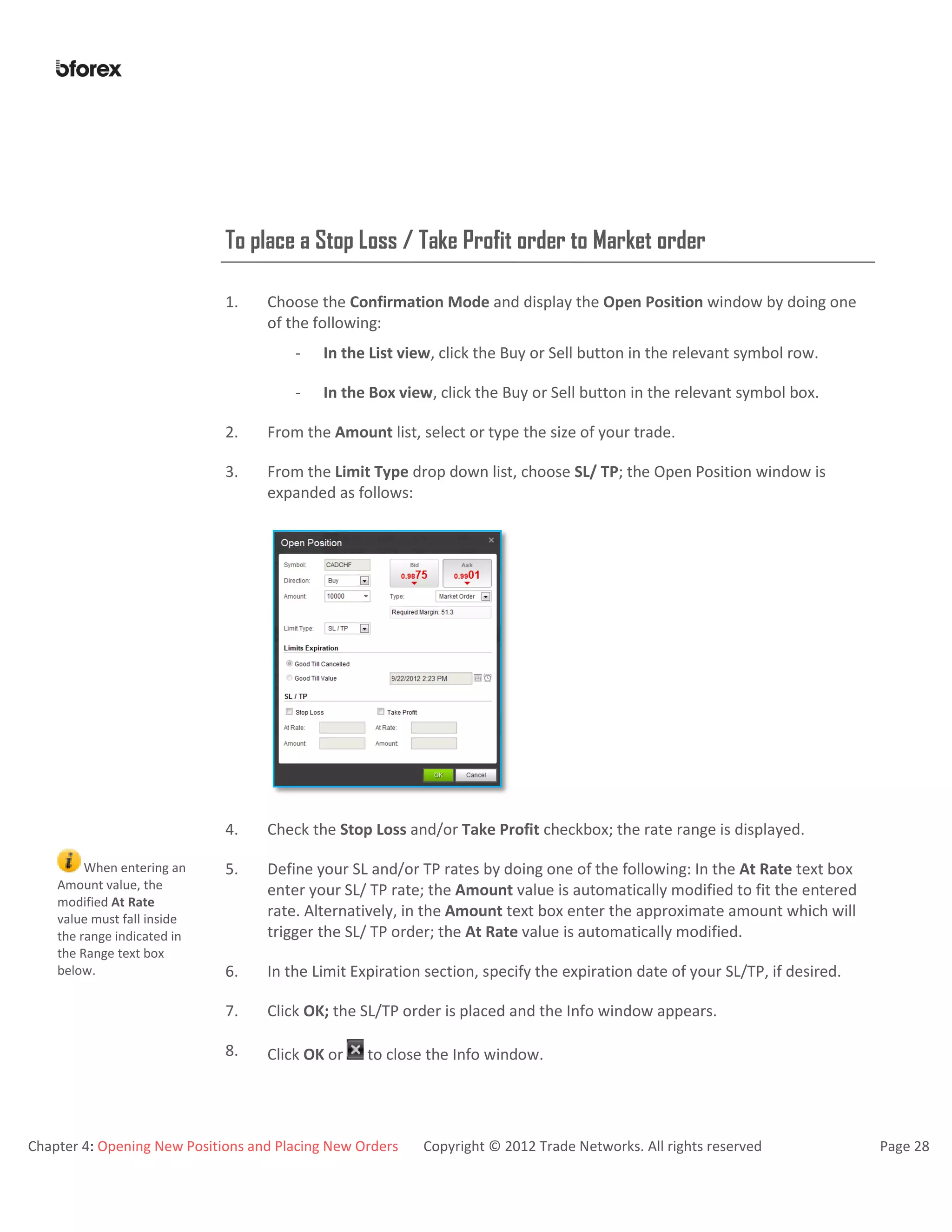

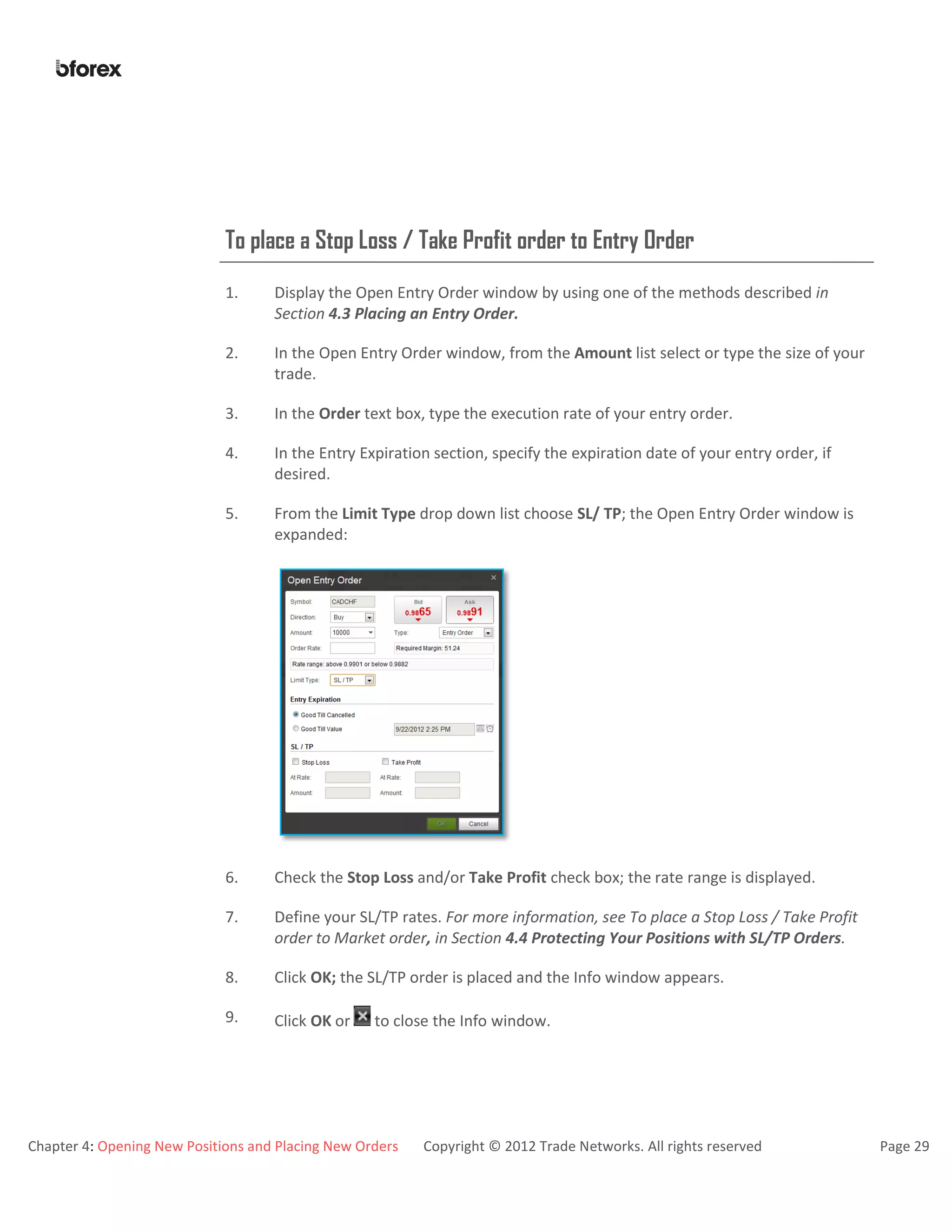

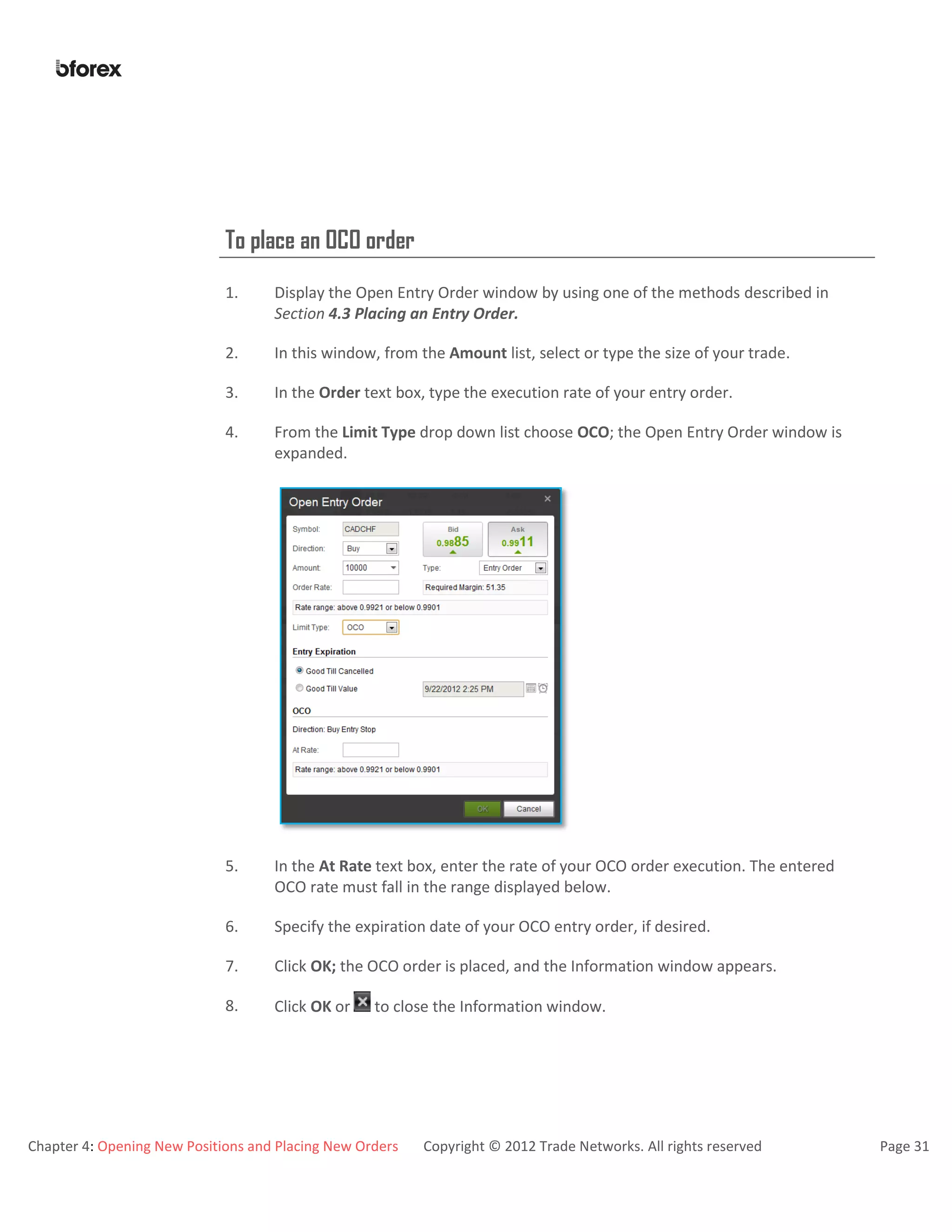

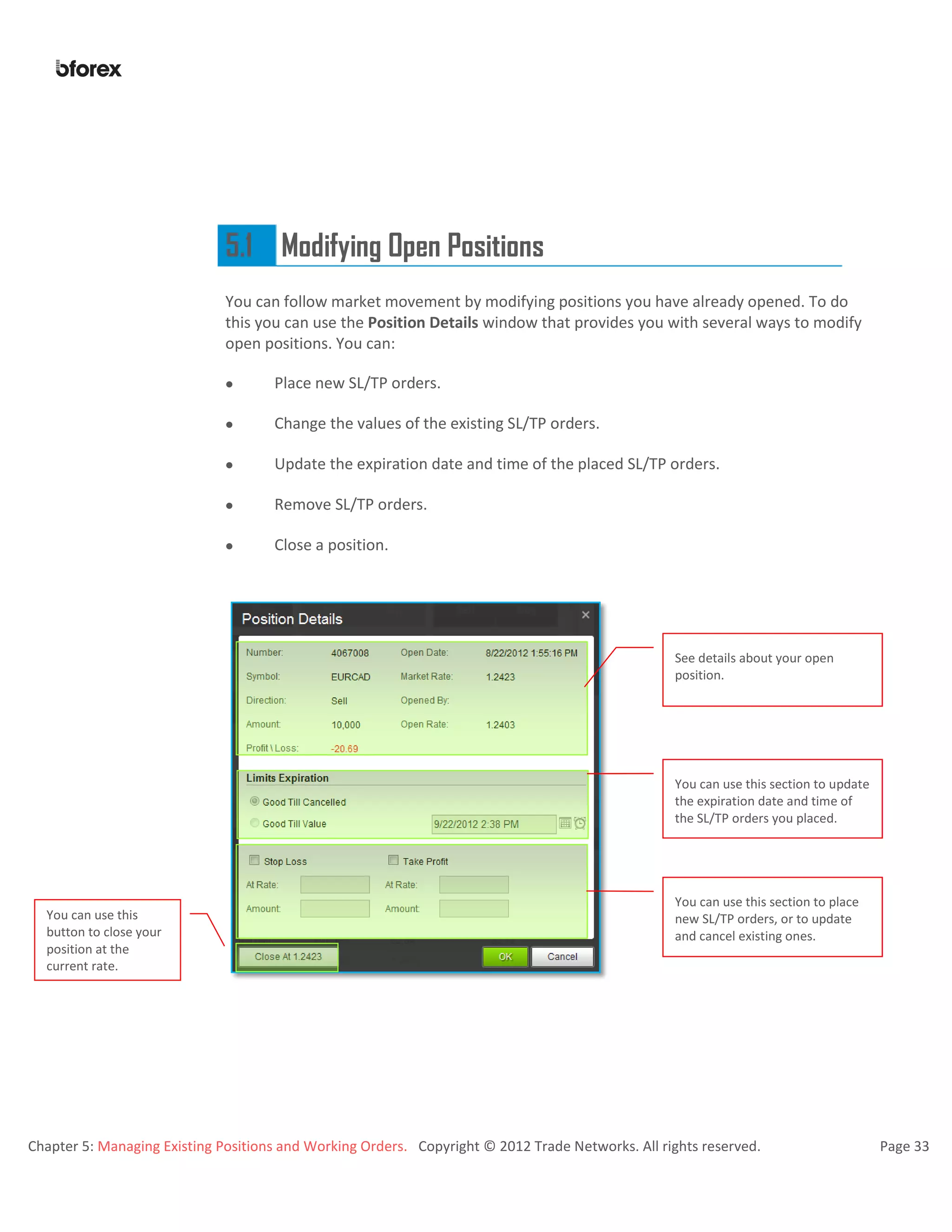

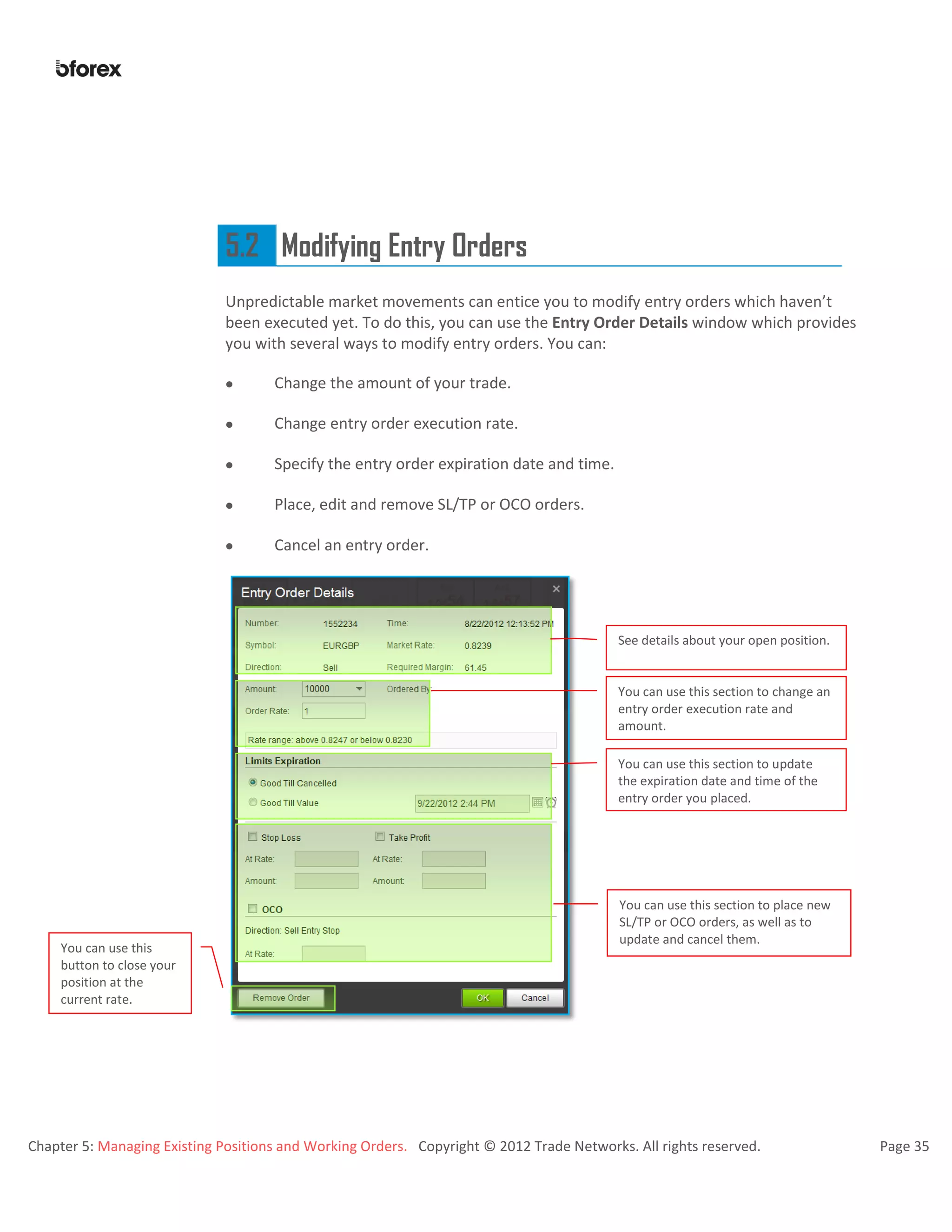

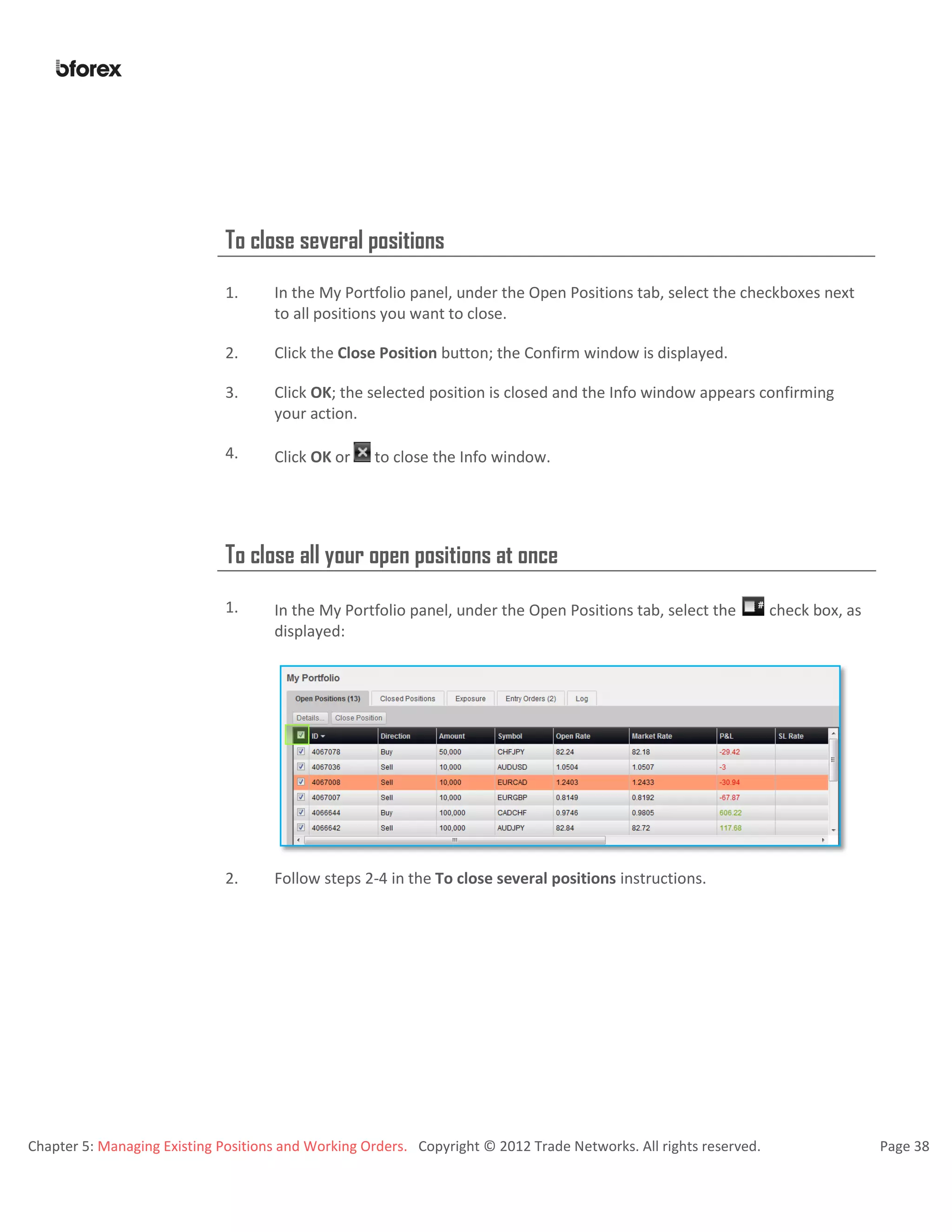

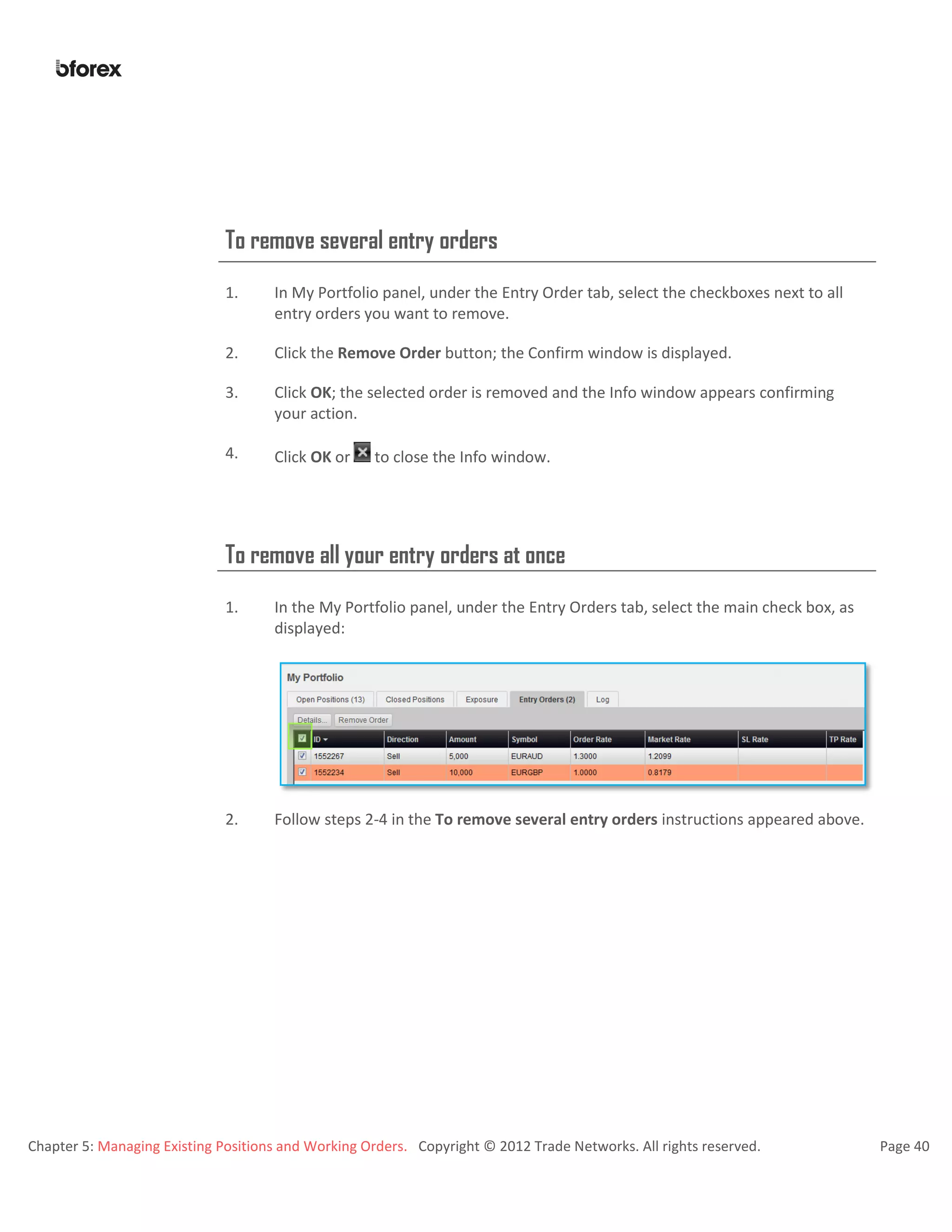

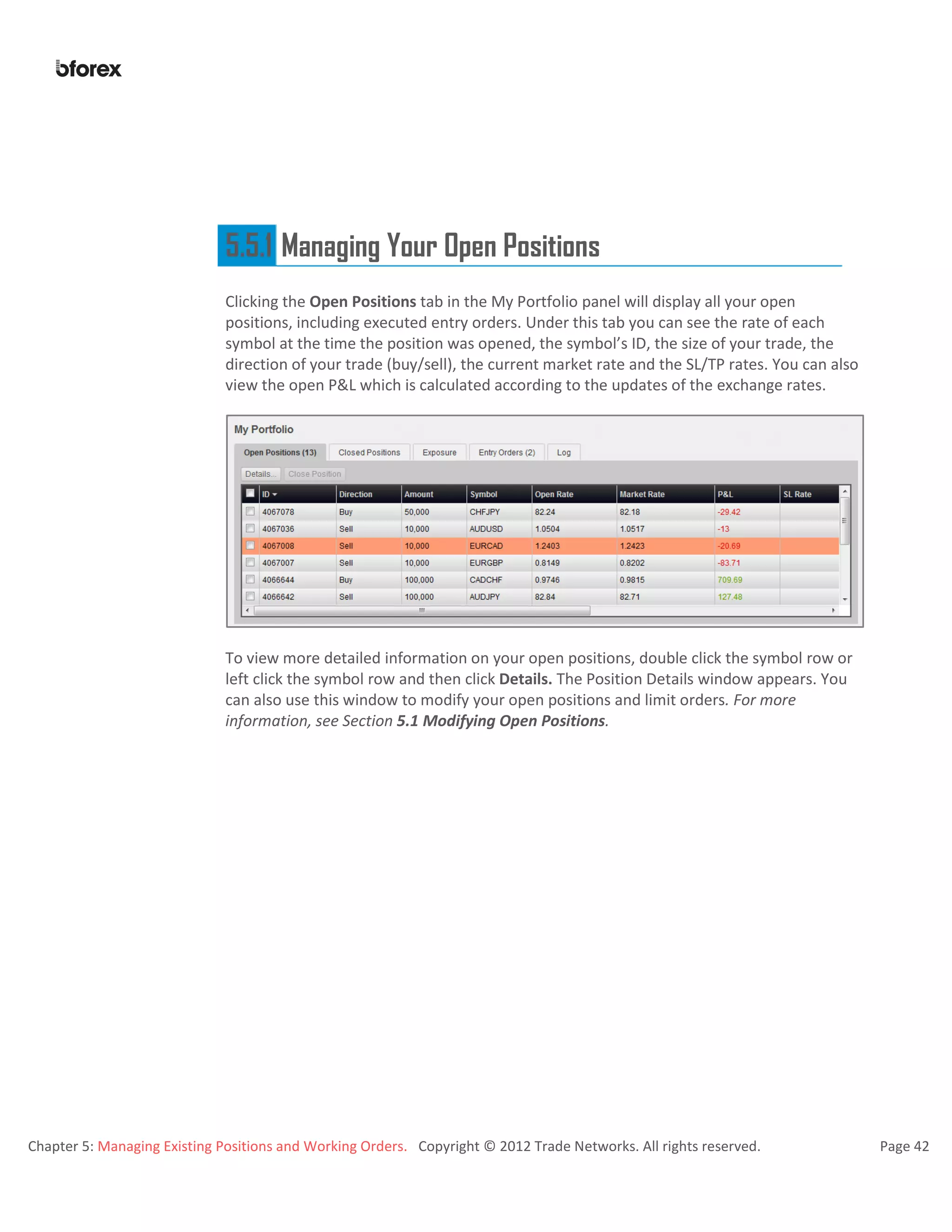

This document provides an overview of the WebPROfit online trading platform. It describes how to log in to the platform, fund an account, and get familiar with the main workspace areas, including the status bar, quotes panel, my portfolio panel, and sidebar. The document also outlines how to open new positions, place orders, and manage existing trades using the tools available on the platform.