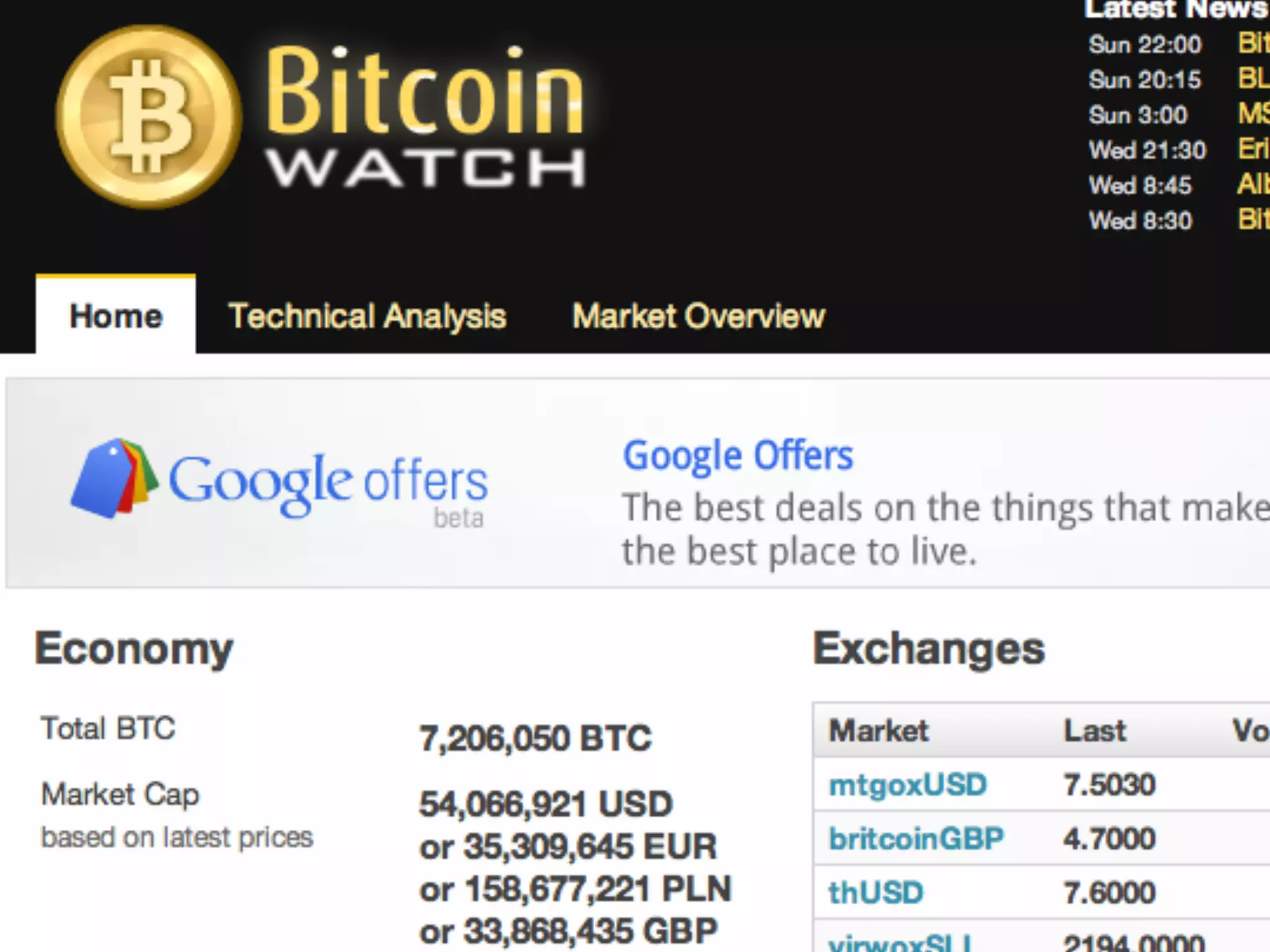

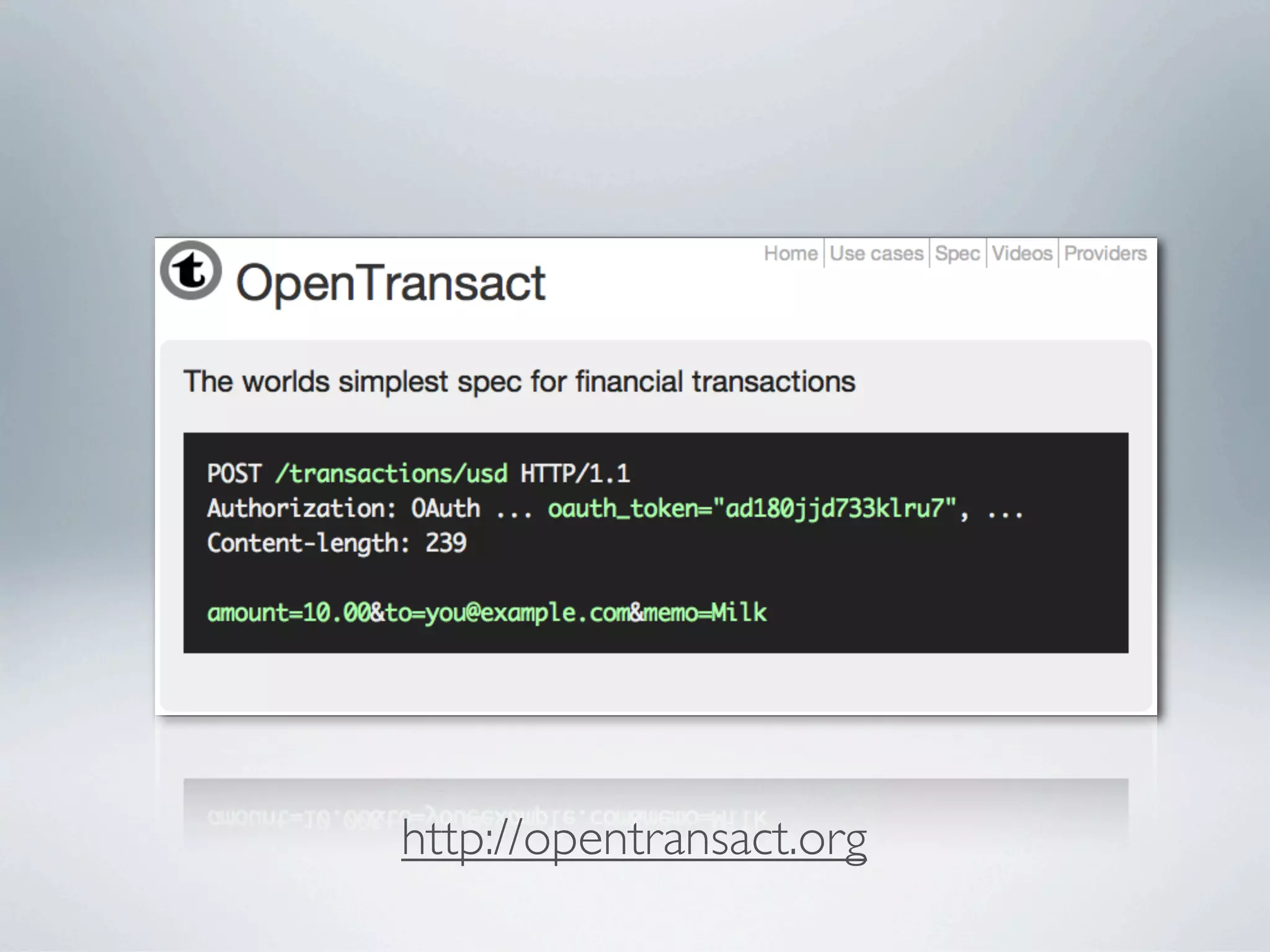

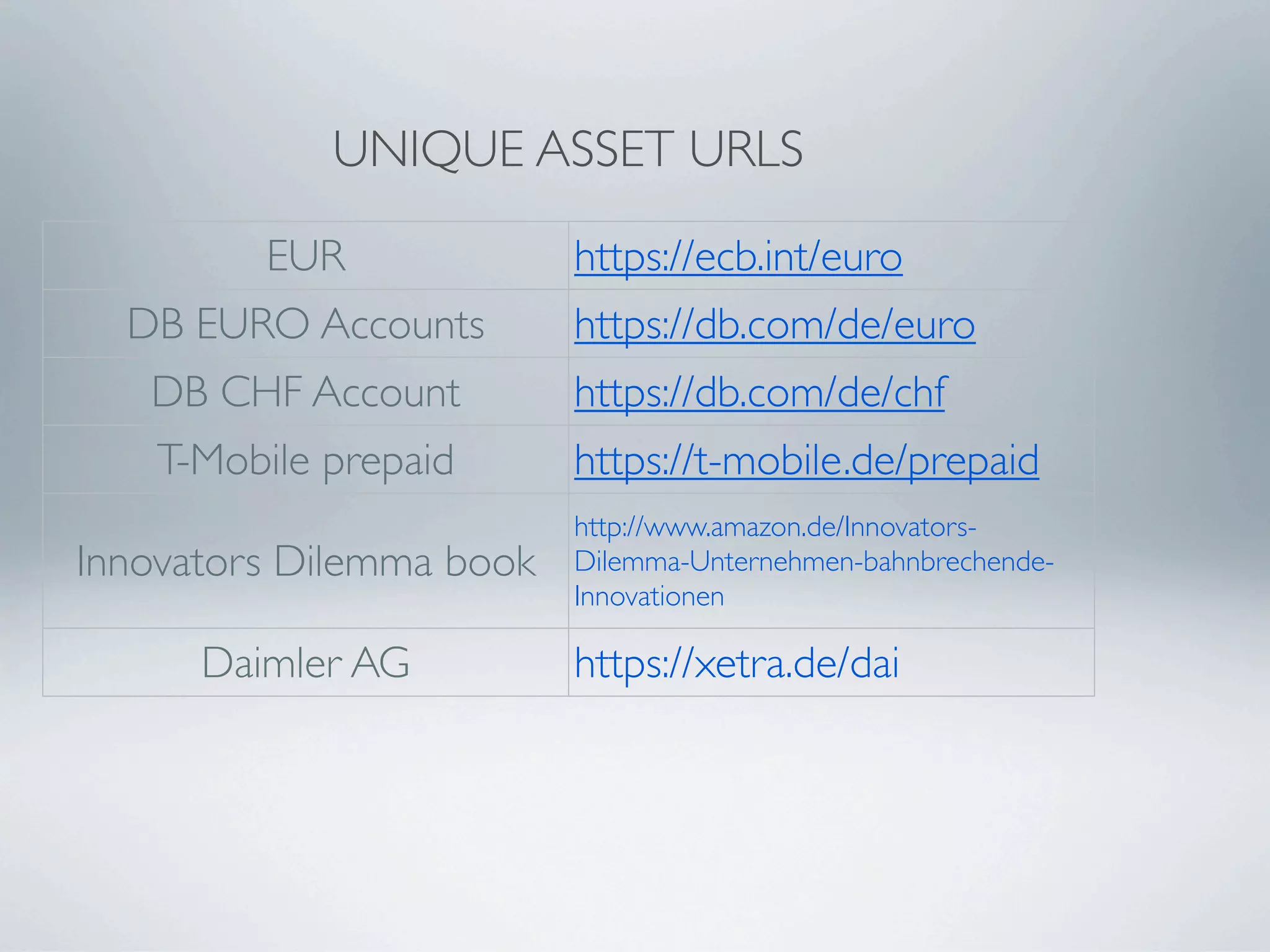

This document discusses the challenges banks pose for financial technology startups and how banks can stay relevant in a changing landscape. It notes that banks often charge high fees and make it difficult for startups to access basic services. New types of digital assets now exist outside the traditional banking system. The document proposes that banks create experimental web-based banks with open APIs, minimal KYC requirements, and no cards to better serve customers and startups. It suggests banks learn from large internet companies and acquire innovative startups to help drive innovation.