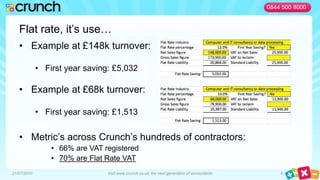

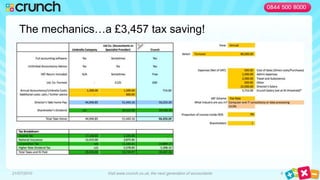

The document discusses key tax points from the recent UK budget, including an increase in employers' national insurance contributions to 13.8% and a reduction in the annual investment allowance from £100k to £25k. It also discusses the advantages of using flat rate VAT for contractors with turnovers under £150k, and how contractors can save thousands in taxes by structuring their pay efficiently, such as paying up to the national insurance threshold of £5,715 and taking the rest as dividends. The document encourages visiting the Crunch.co.uk website for more information and tax calculation tools.