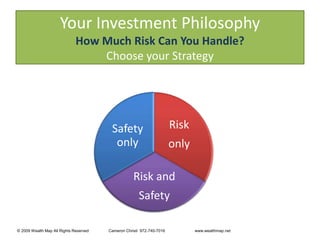

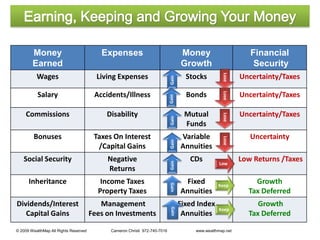

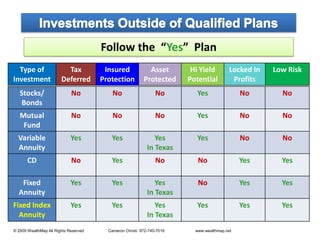

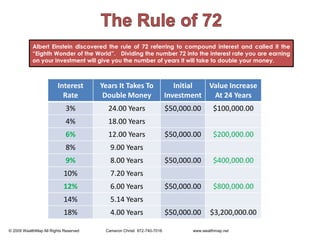

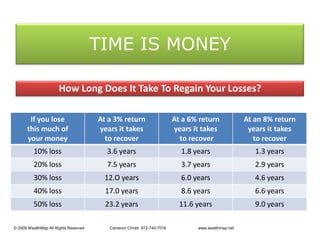

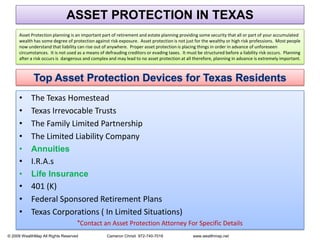

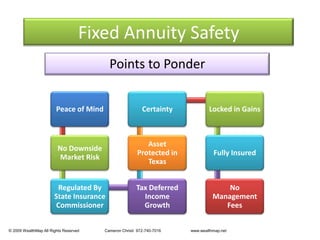

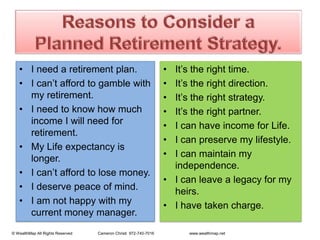

This document provides information about wealth management and financial planning services offered by Cameron Christi and WealthMap. It discusses investment strategies and products including fixed index annuities, fixed annuities, bond funds, mutual funds, life insurance, college funding, long term care, and health insurance. It also covers topics like asset protection, the rule of 72, managing investment risk, and choosing a retirement strategy. The document aims to guide readers toward financial security.