This document defines key financial terms including:

- Credit as the ability to obtain goods/services before payment based on future payment trust.

- Debit as an amount owed listed on the left of an account.

- Interest as money paid regularly for borrowing or delaying debt repayment.

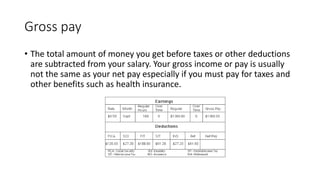

- Gross pay as total pay before taxes/deductions, while net pay is wages after withholdings.

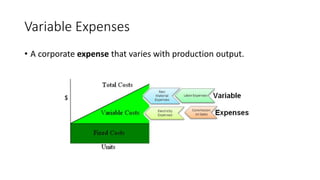

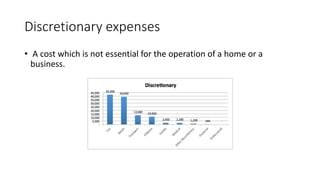

- Fixed expenses as constant costs regardless of sales, versus variable expenses varying with production.