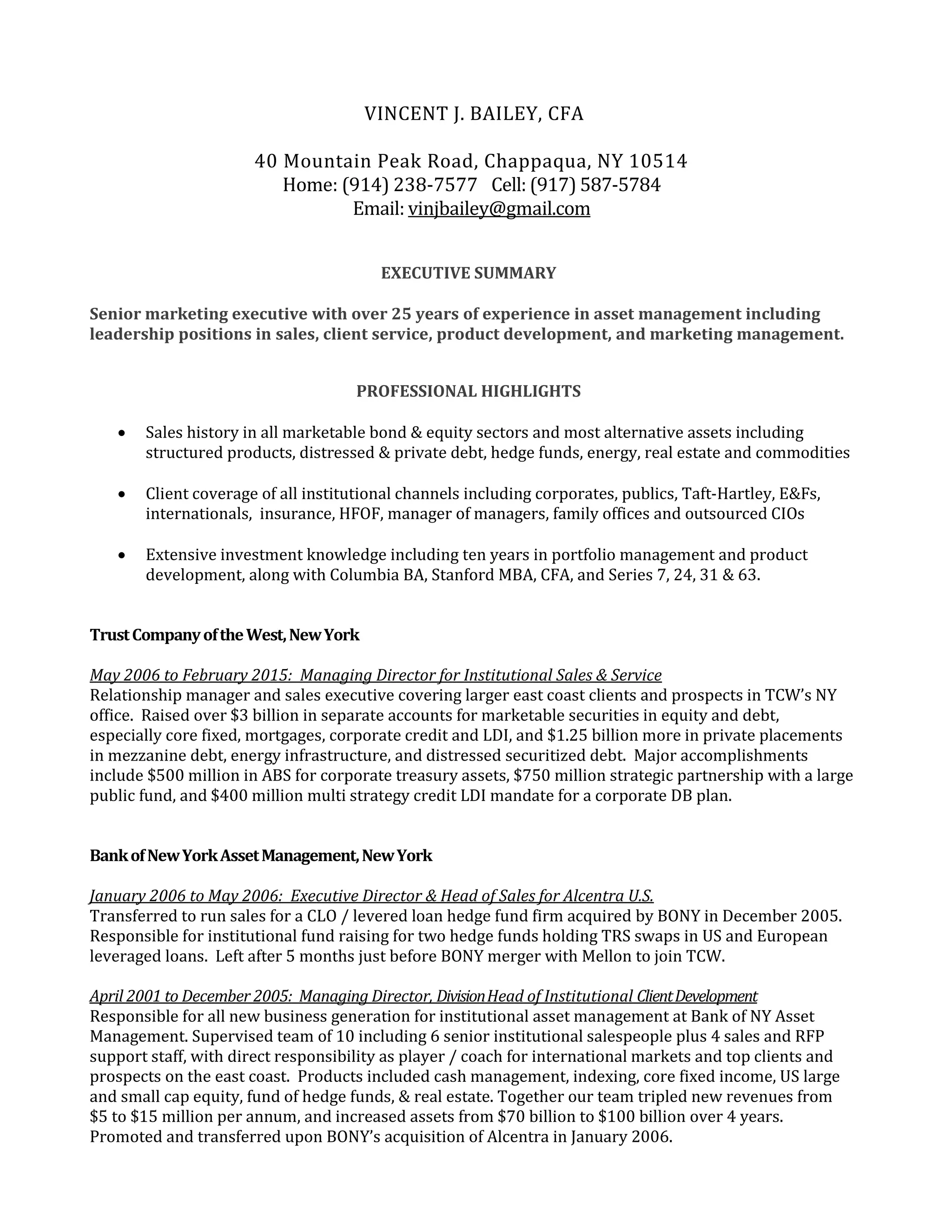

Vincent Bailey is a senior marketing executive with over 25 years of experience in institutional asset management. He has held leadership positions in sales, client service, product development, and marketing management at firms including TrustCompanyoftheWest, BankofNewYorkAssetManagement, and Credit Suisse Asset Management. He has expertise in all asset classes including equities, fixed income, alternatives, and structured products.