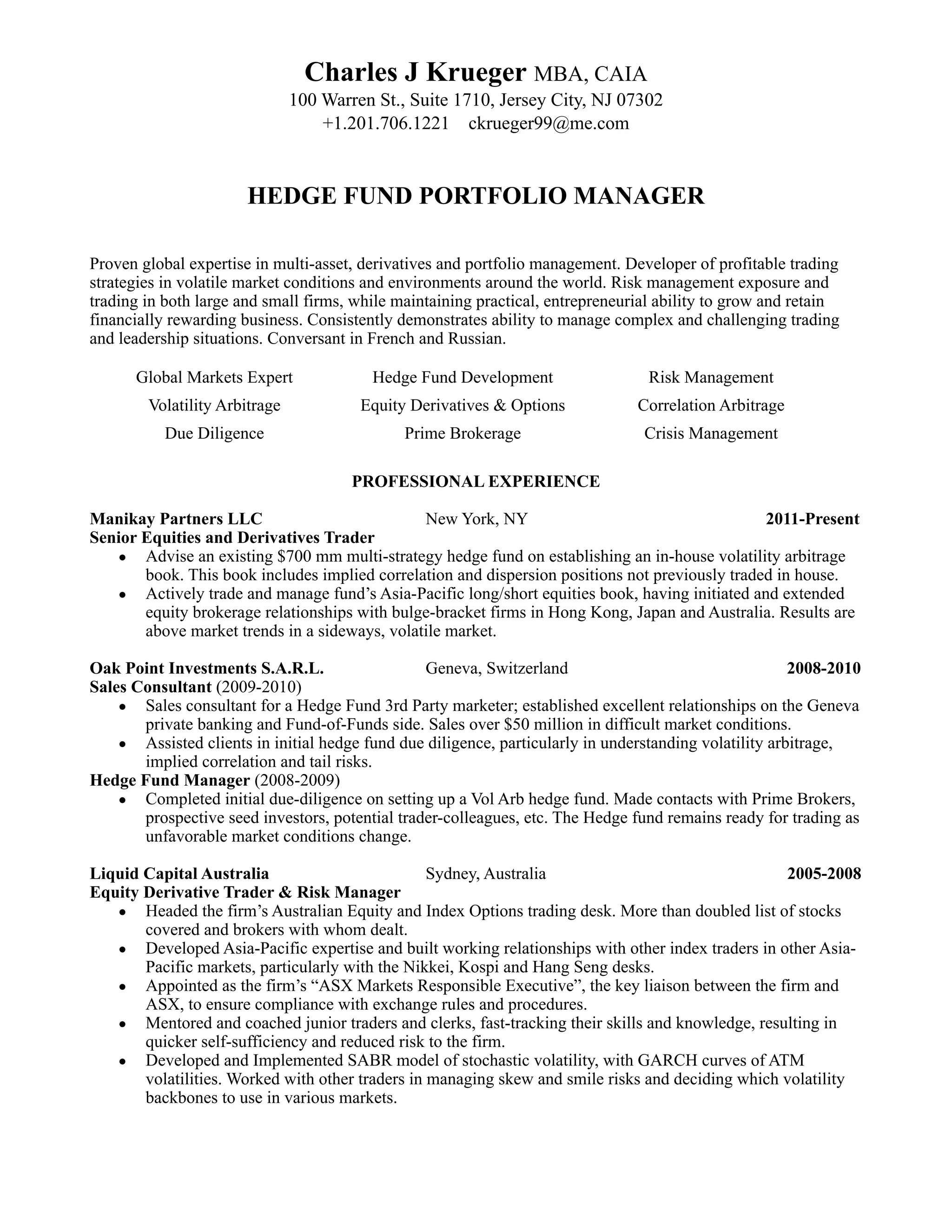

Charles Krueger is a hedge fund portfolio manager with over 25 years of experience in global markets, volatility arbitrage, risk management, and hedge fund development. He currently manages the equities and derivatives trading for a $700 million multi-strategy hedge fund. Previously he was a sales consultant and hedge fund manager focused on volatility arbitrage. Krueger has also held senior trading and risk management roles for several investment firms in Australia, Switzerland, and New York. He has an MBA from UCLA and is fluent in English, French and Russian.