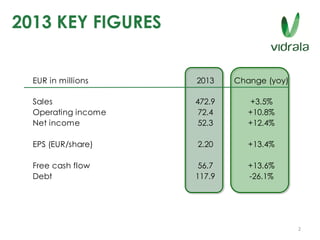

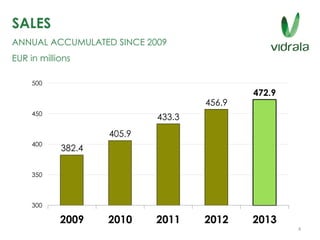

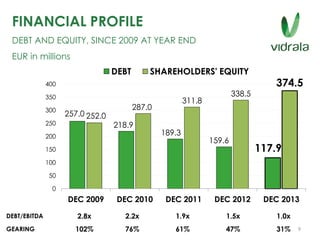

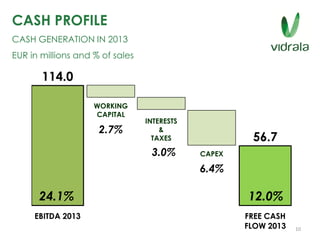

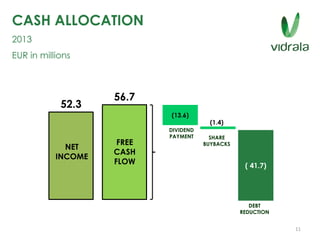

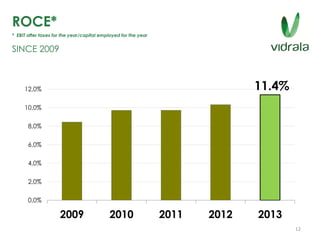

The company reported strong financial results for 2013 with sales increasing 3.5% to EUR 472.9 million and net income growing 12.4% to EUR 52.3 million. Earnings per share increased 13.4% to EUR 2.20. Operating income was up 10.8% to EUR 72.4 million. Free cash flow for the year increased 13.6% to EUR 56.7 million. The company reduced its debt by 26.1% to EUR 117.9 million while increasing shareholders' equity to EUR 374.5 million.