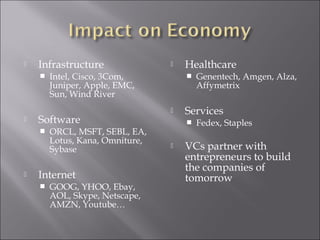

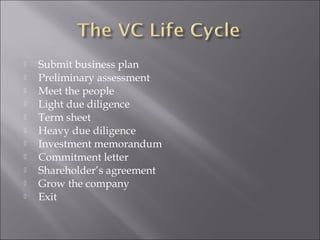

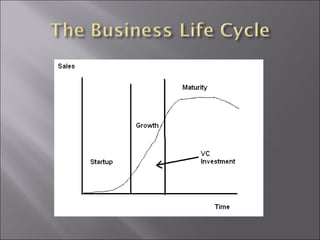

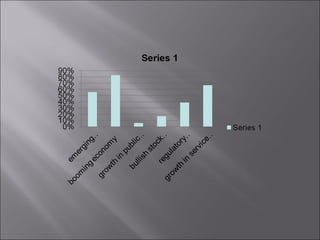

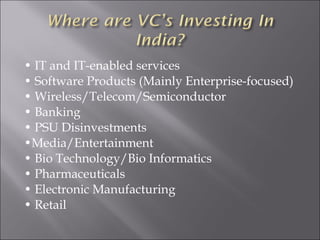

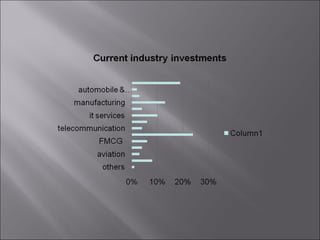

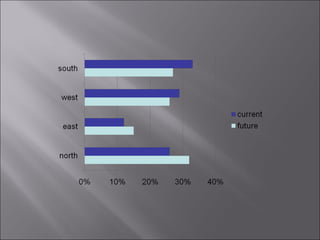

Venture capital provides long-term funding to help private companies grow. Venture capitalists invest capital from institutional and high-net-worth investors and provide managerial expertise. They typically invest in high-technology industries like biotechnology and IT. Qualified companies are technology-focused, have potential for market leadership, low production costs, distribution channels, and potential for IPO or acquisition. Companies seek venture capital because it is difficult to get loans or public funding as new firms. The venture process involves submitting a business plan, meetings, due diligence, term sheets, and growing the company to exit. Venture capital has grown in India due to competitive technology sectors, skilled labor, research institutions, government policies, and capital market