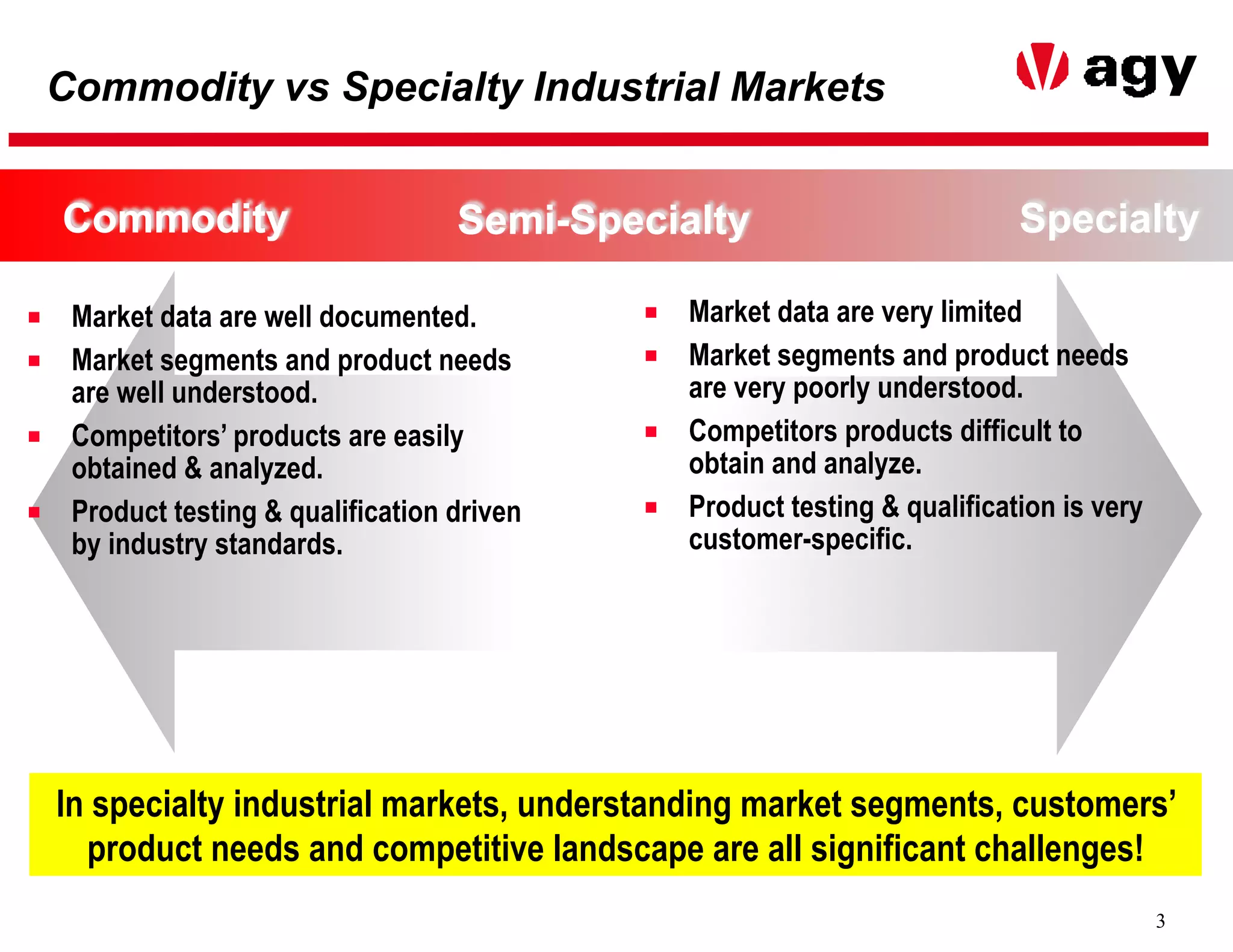

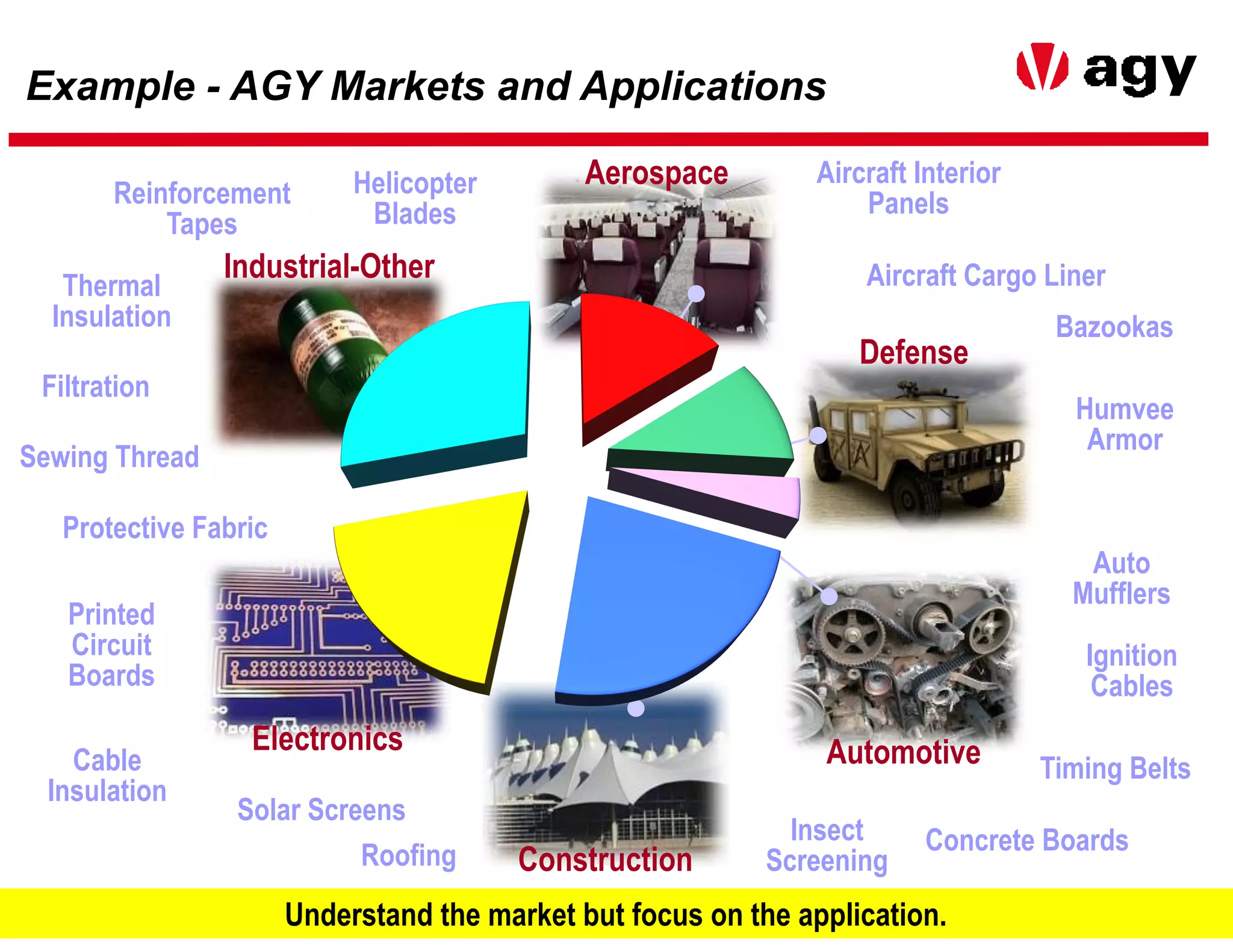

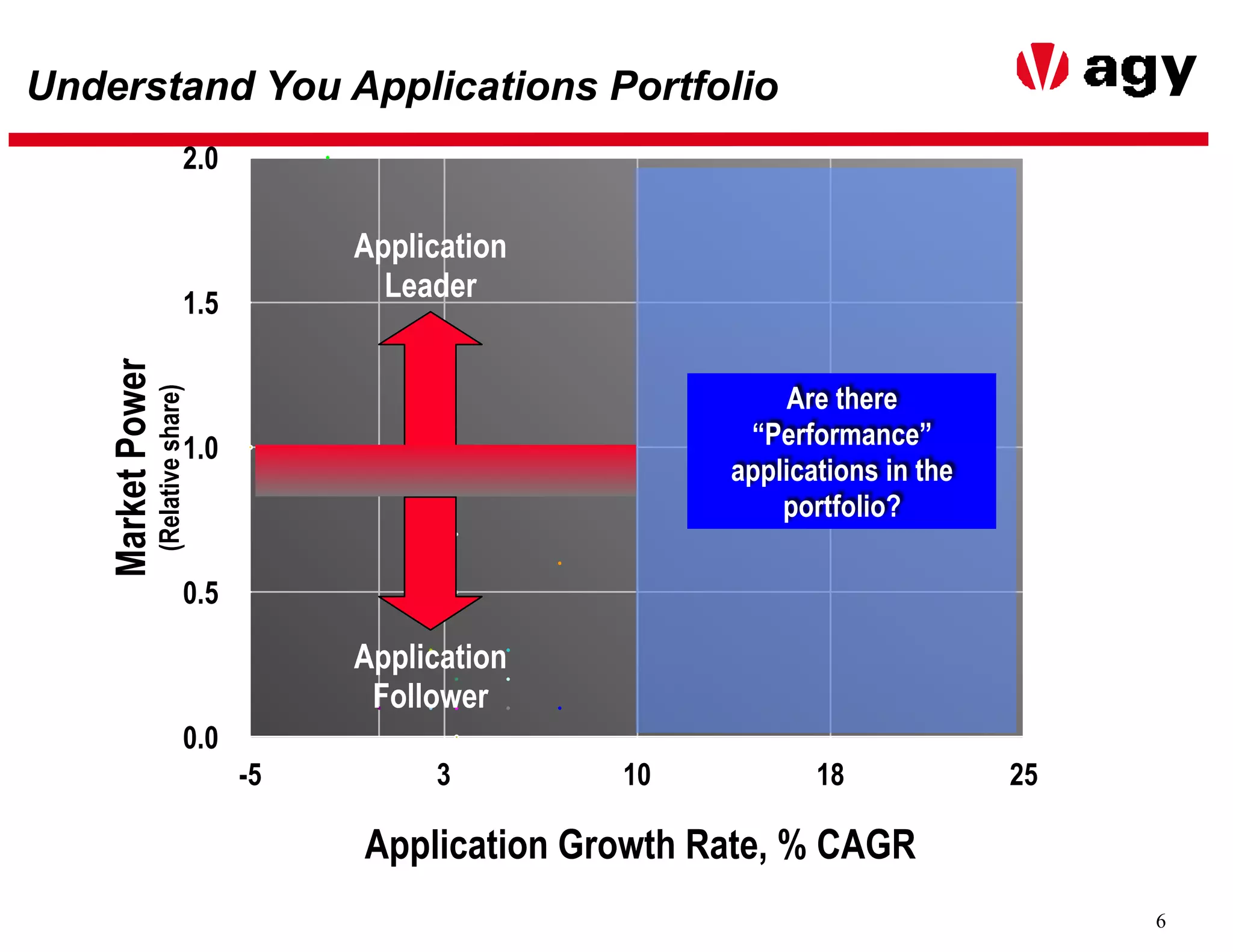

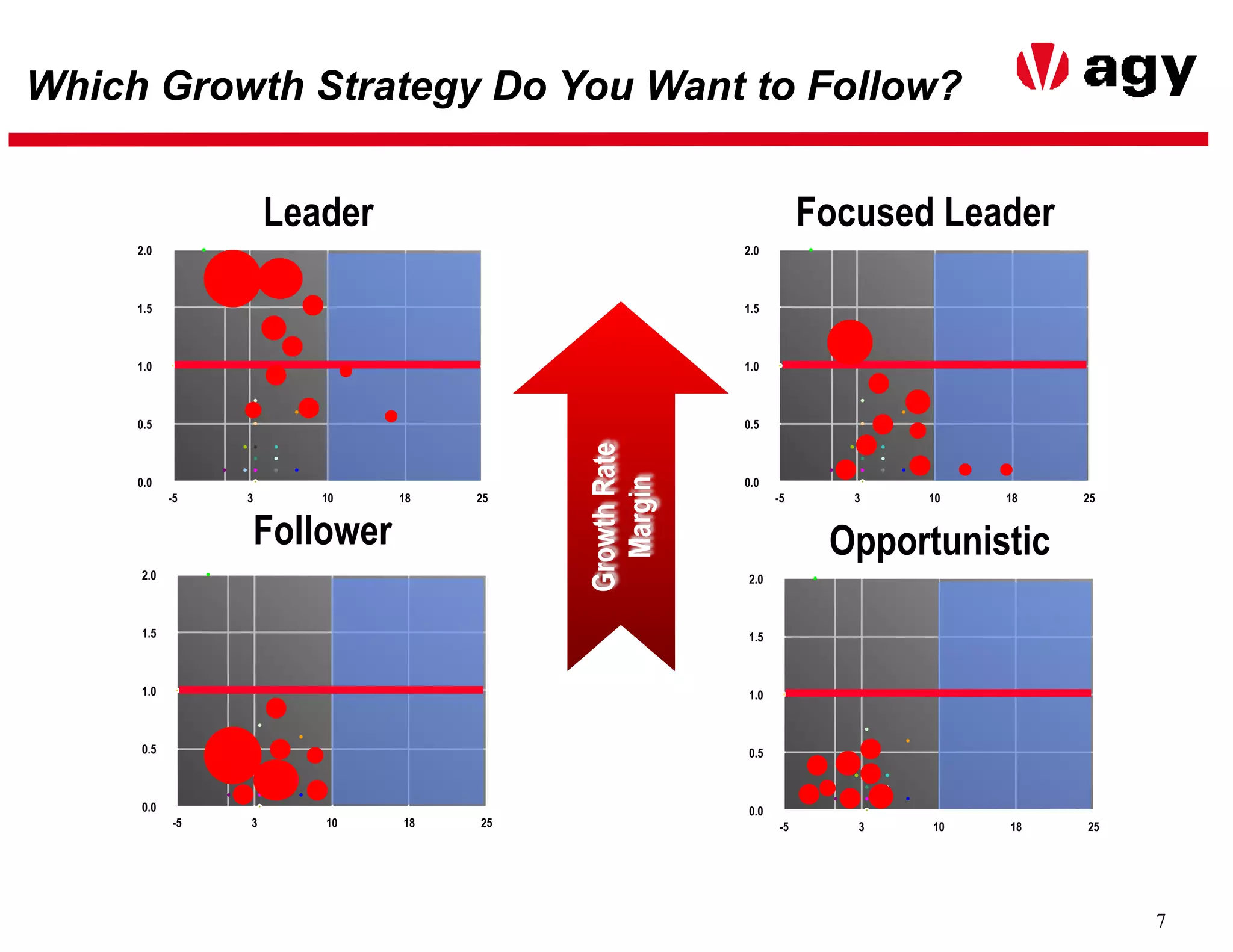

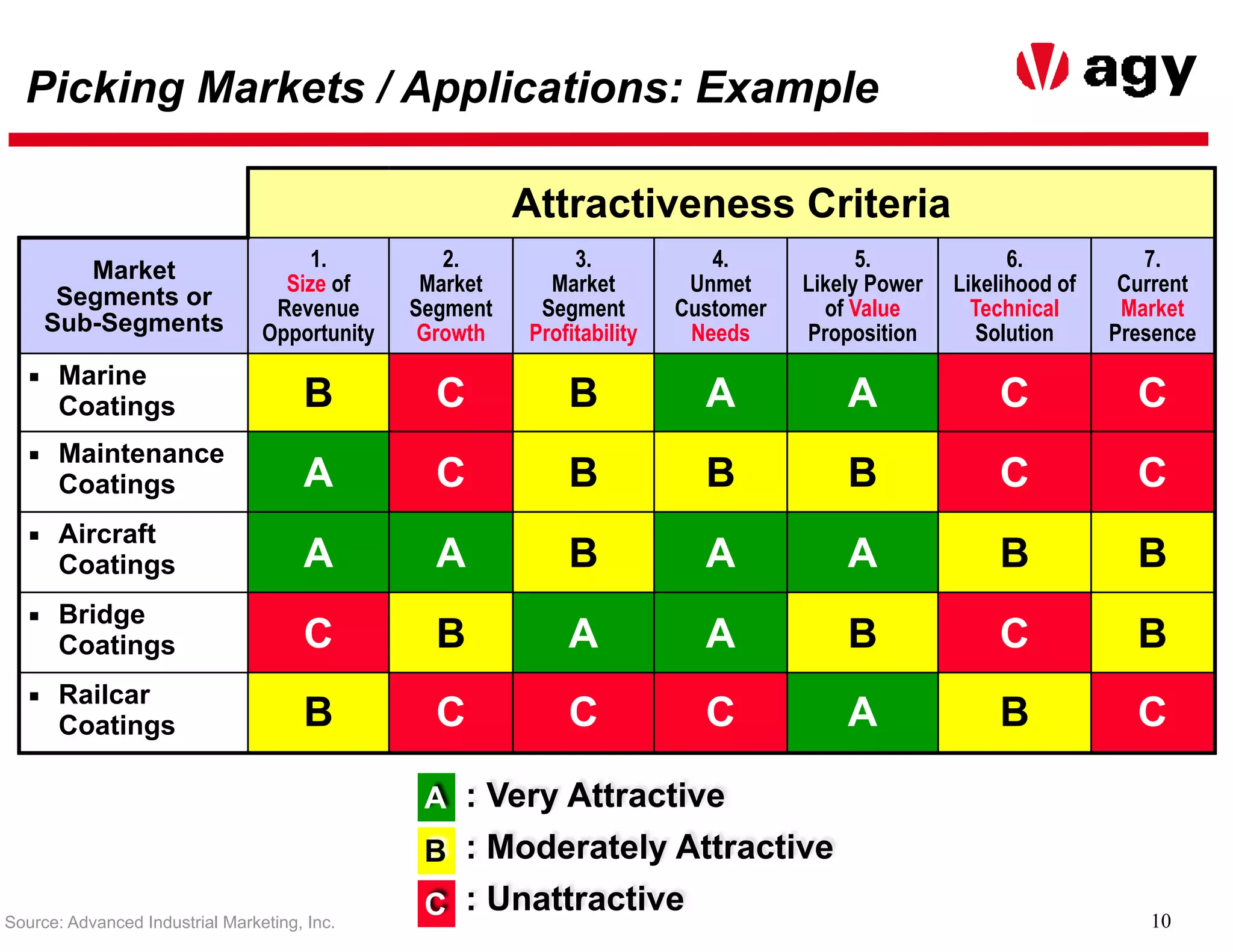

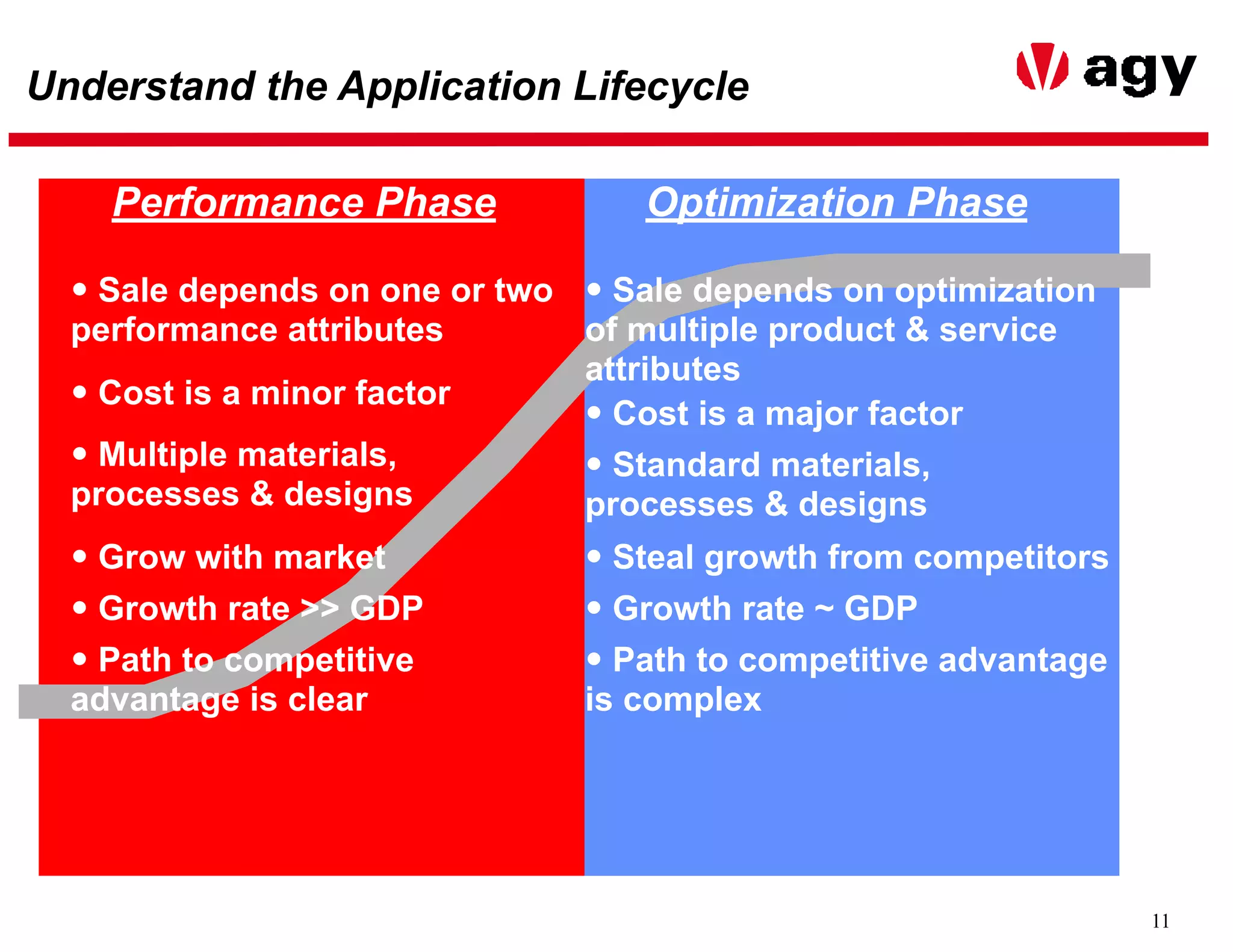

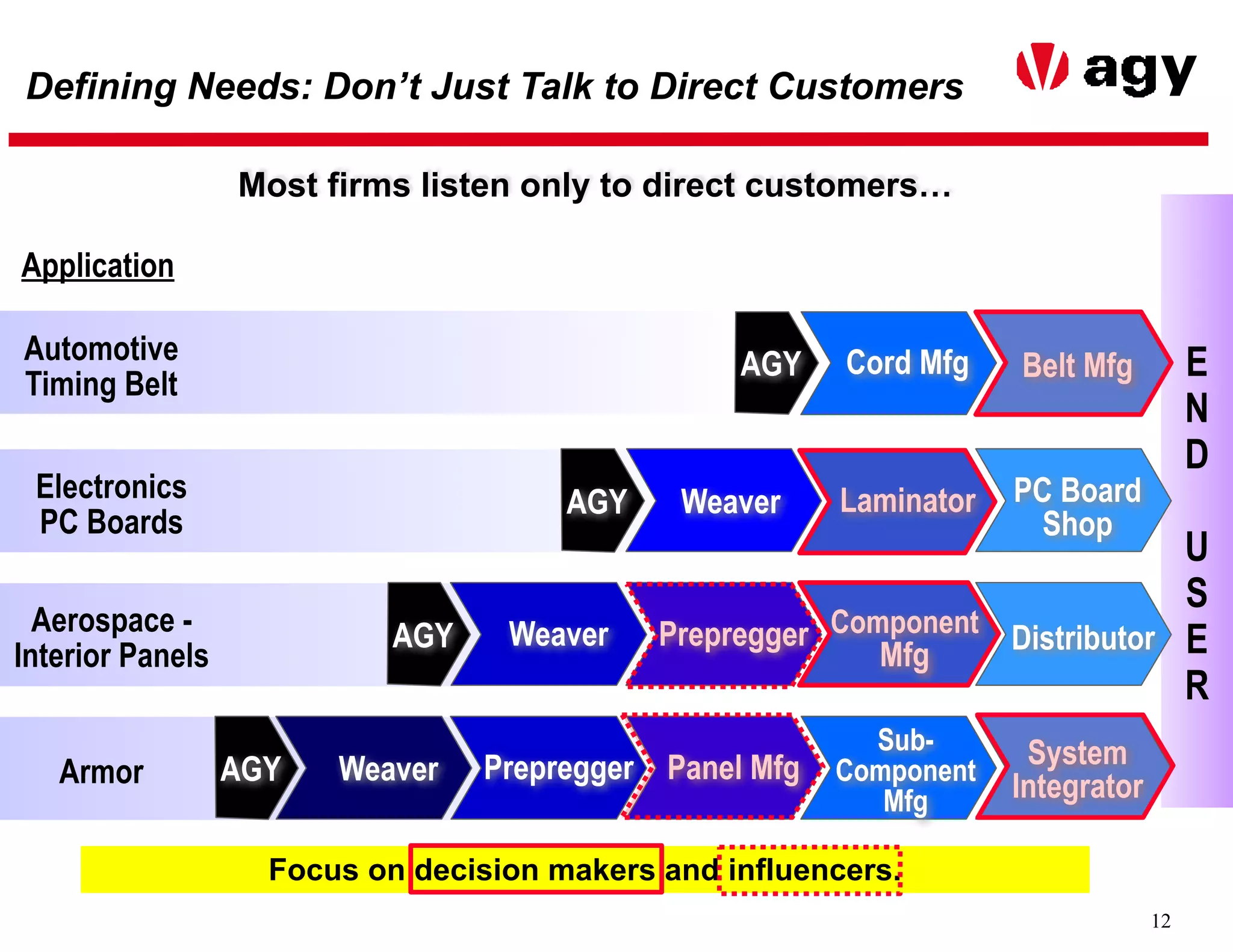

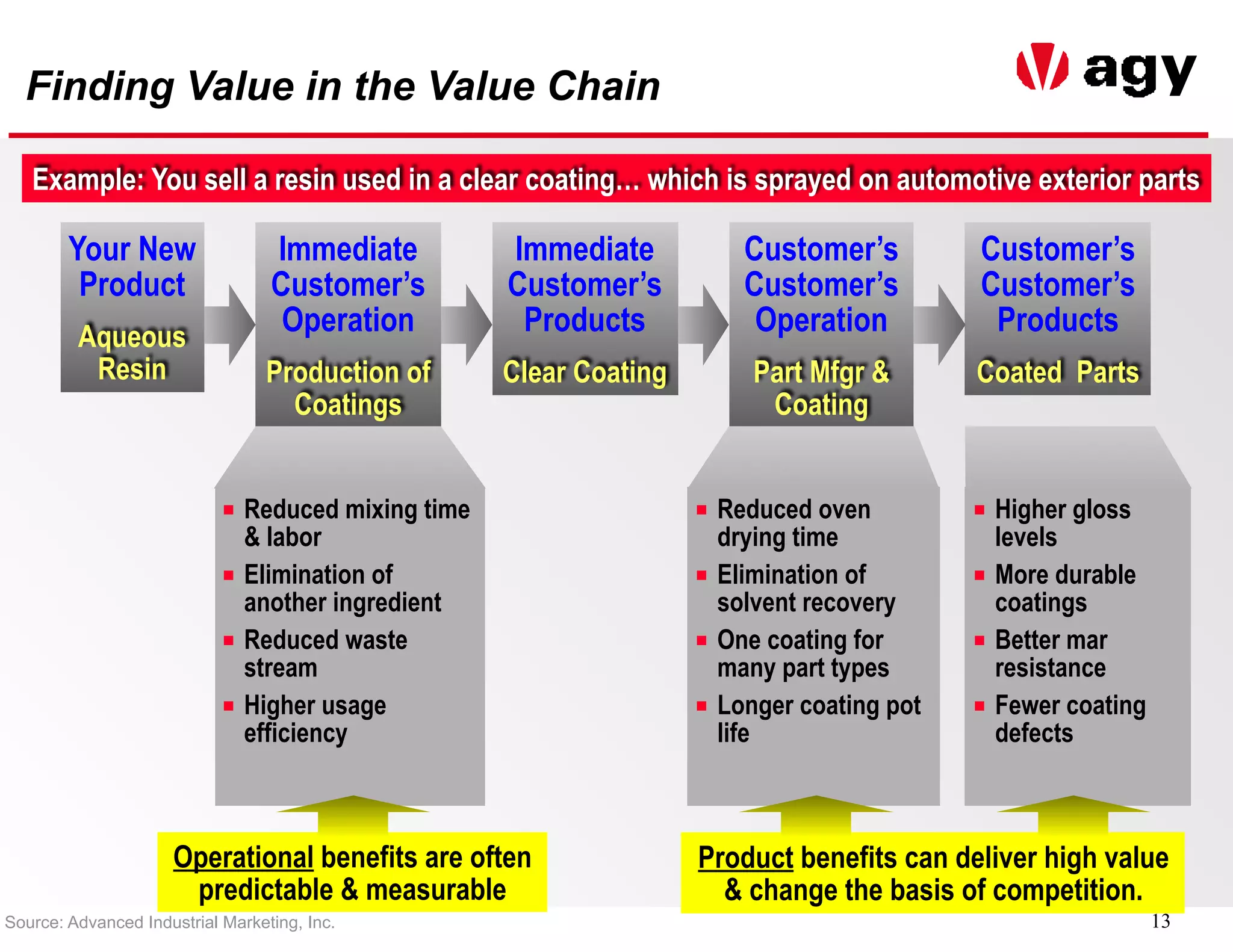

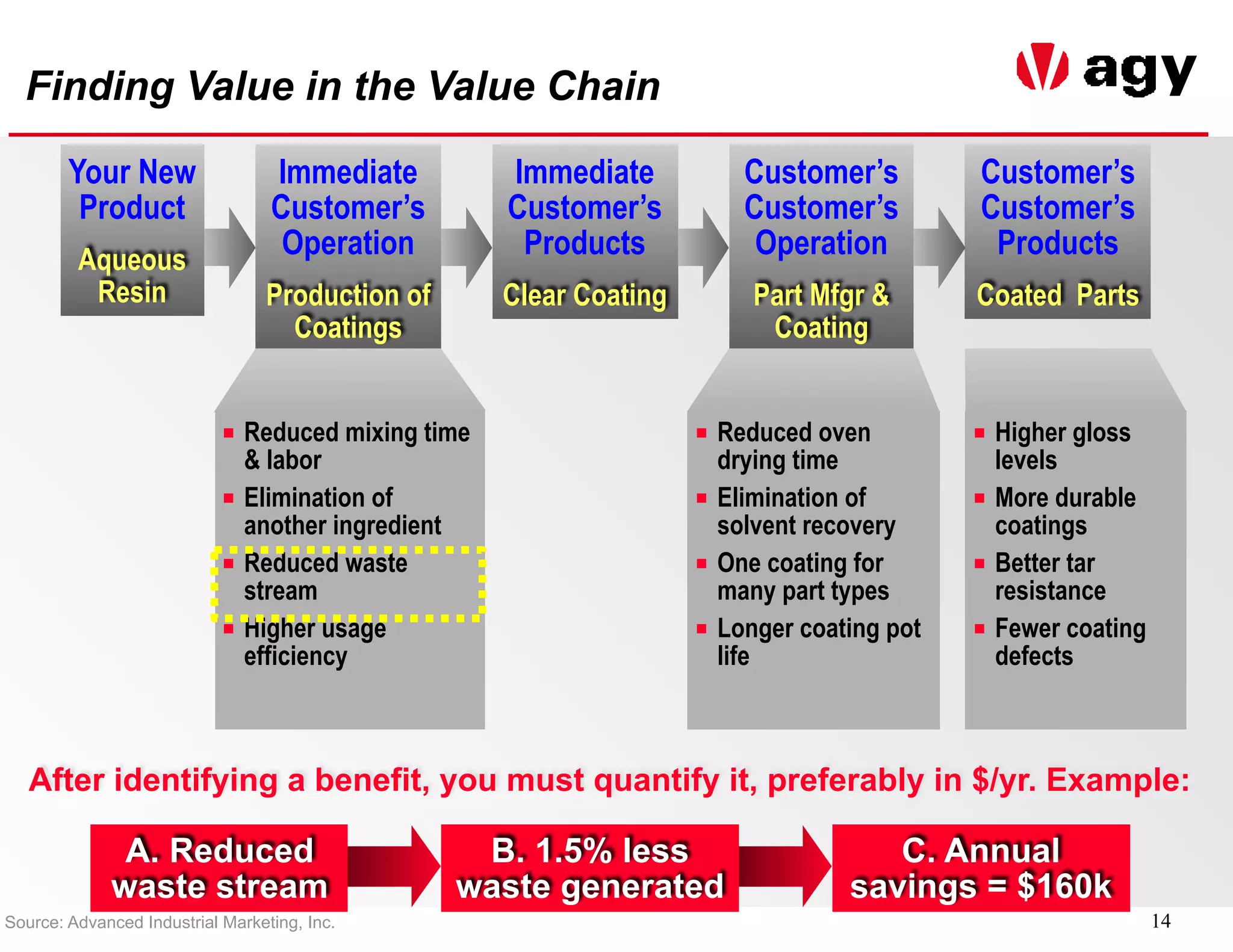

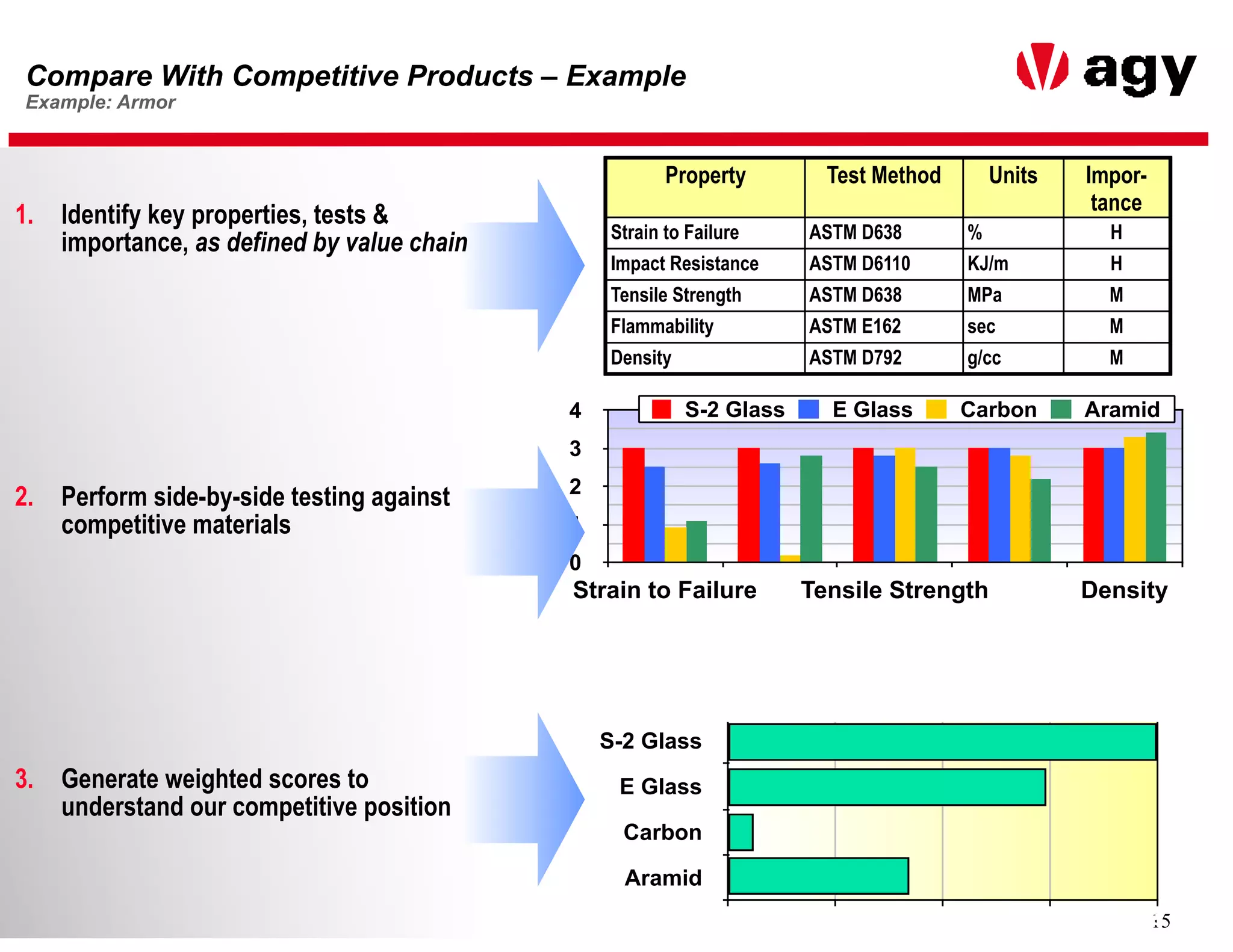

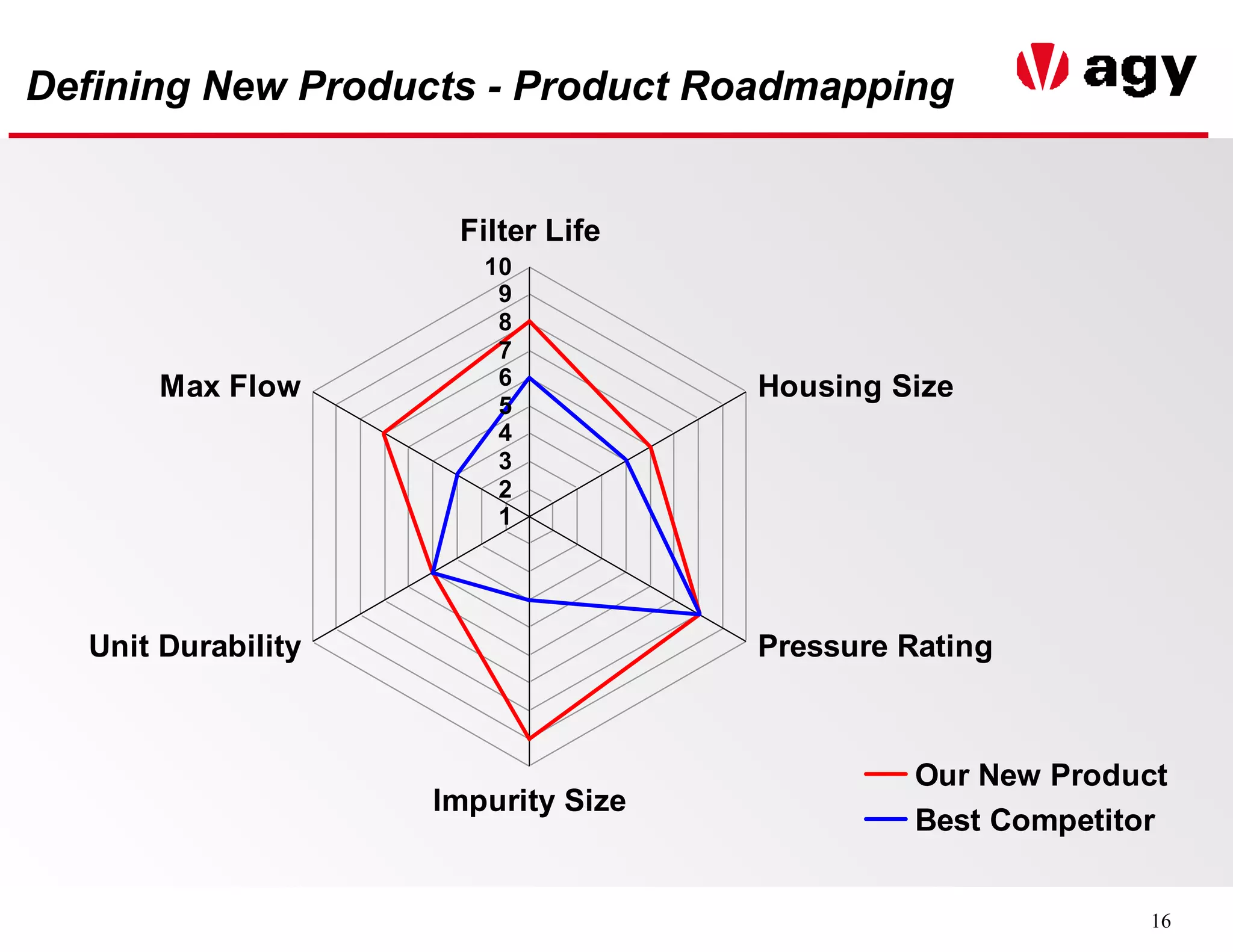

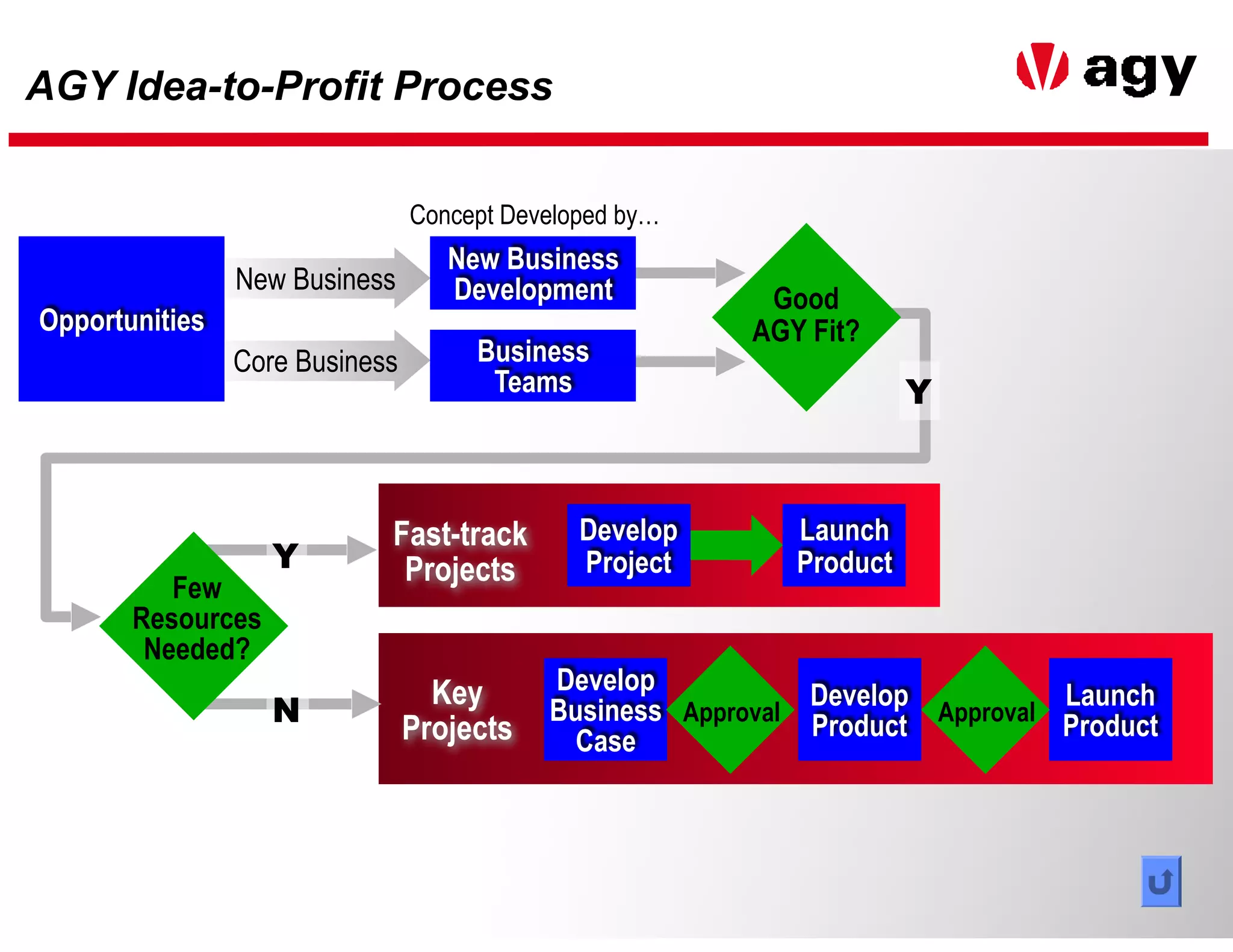

This document discusses developing value propositions in business-to-business (B2B) markets. It emphasizes the importance of understanding applications within specialty industrial markets, defining value from the customer's perspective, and benchmarking products against competitors. The presentation also provides a checklist for capturing value and discusses organizational processes like using cross-functional teams and focusing resources on key projects.