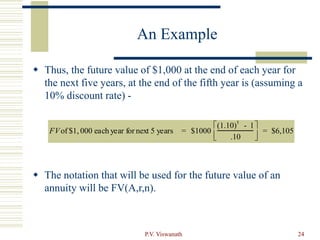

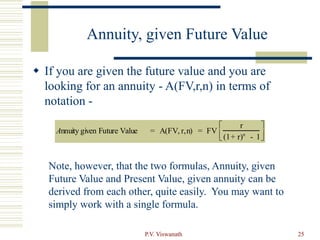

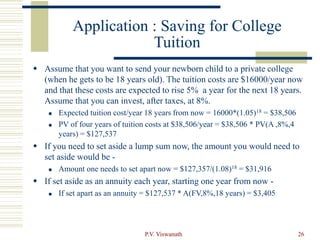

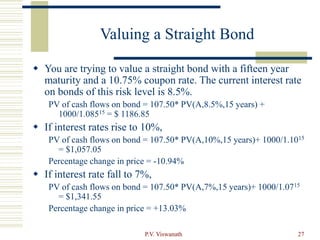

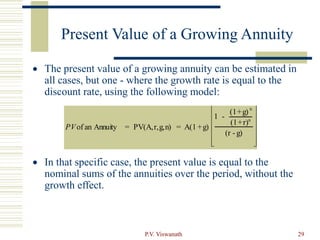

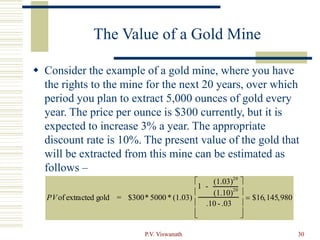

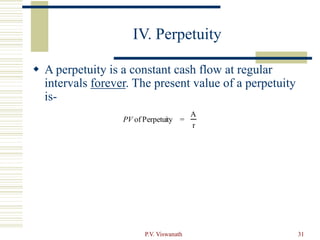

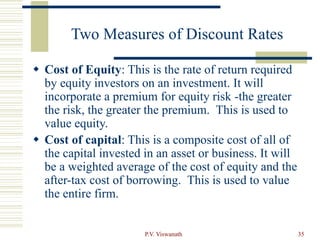

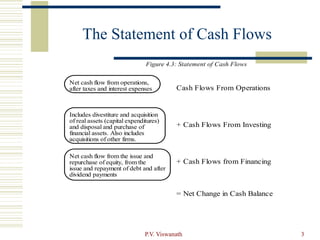

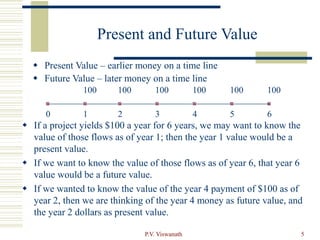

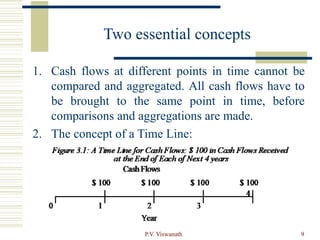

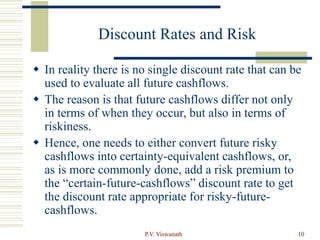

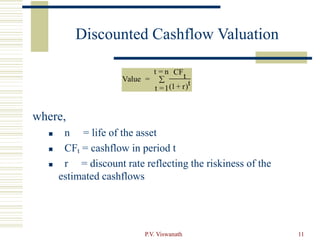

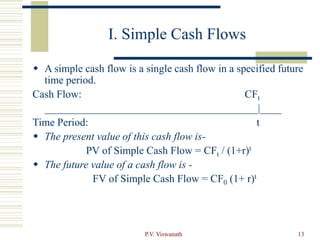

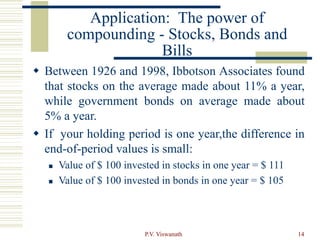

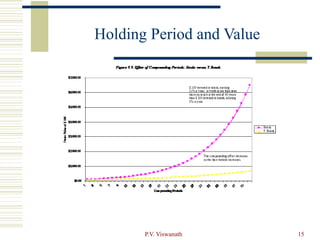

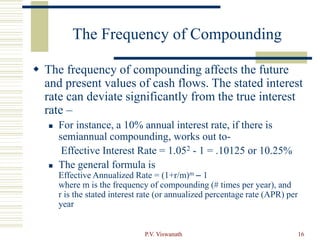

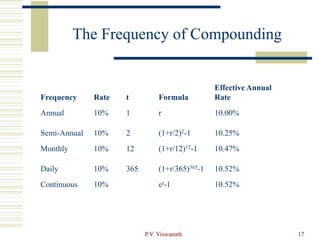

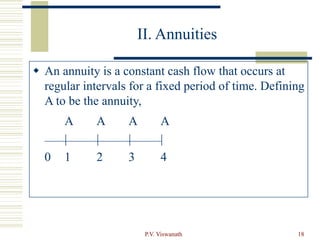

This document provides an overview of key concepts related to cash flows and valuation. It discusses the accountant's approach to the statement of cash flows, which explains changes in cash balance rather than measuring firm value. The financial analyst's approach is more concerned with cash flows to equity and the firm. Present and future value concepts are introduced, along with discount rates and how they relate to risk. Annuities, including growing annuities, are defined and the formulas for present and future value are provided. Applications to valuing bonds and saving for college are discussed. The document aims to explain fundamental valuation concepts.

![P.V. Viswanath 19

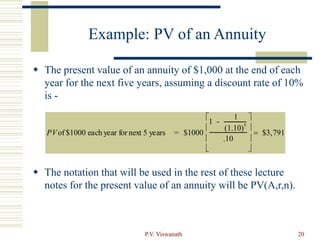

Present Value of an Annuity

The present value of an annuity can be calculated

by taking each cash flow and discounting it back to

the present, and adding up the present values.

Alternatively, there is a short cut that can be used in

the calculation [A = Annuity; r = Discount Rate; n =

Number of years]

n

r

r

A

n

r

A

PV

Annuity

an

of

PV

)

1

(

1

1

)

,

,

(](https://image.slidesharecdn.com/valuation-240208094322-4b698d97/85/valuation-ppt-19-320.jpg)