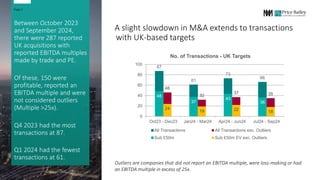

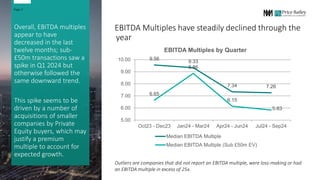

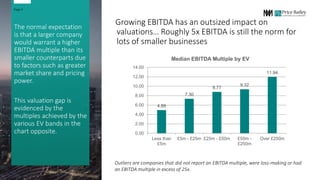

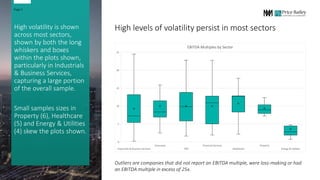

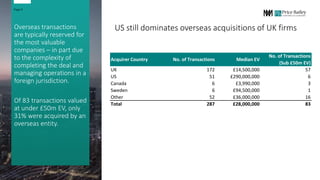

The valuation webinar highlights a slight slowdown in mergers and acquisitions (M&A) involving UK-based targets, with 287 reported acquisitions from October 2023 to September 2024. EBITDA multiples have generally declined over the year, particularly for sub-£50m transactions, despite a spike in Q1 2024 due to private equity activity. Overall volatility remains high across most sectors, and there is a dominance of UK acquirers in overseas transactions, particularly for higher-value deals.