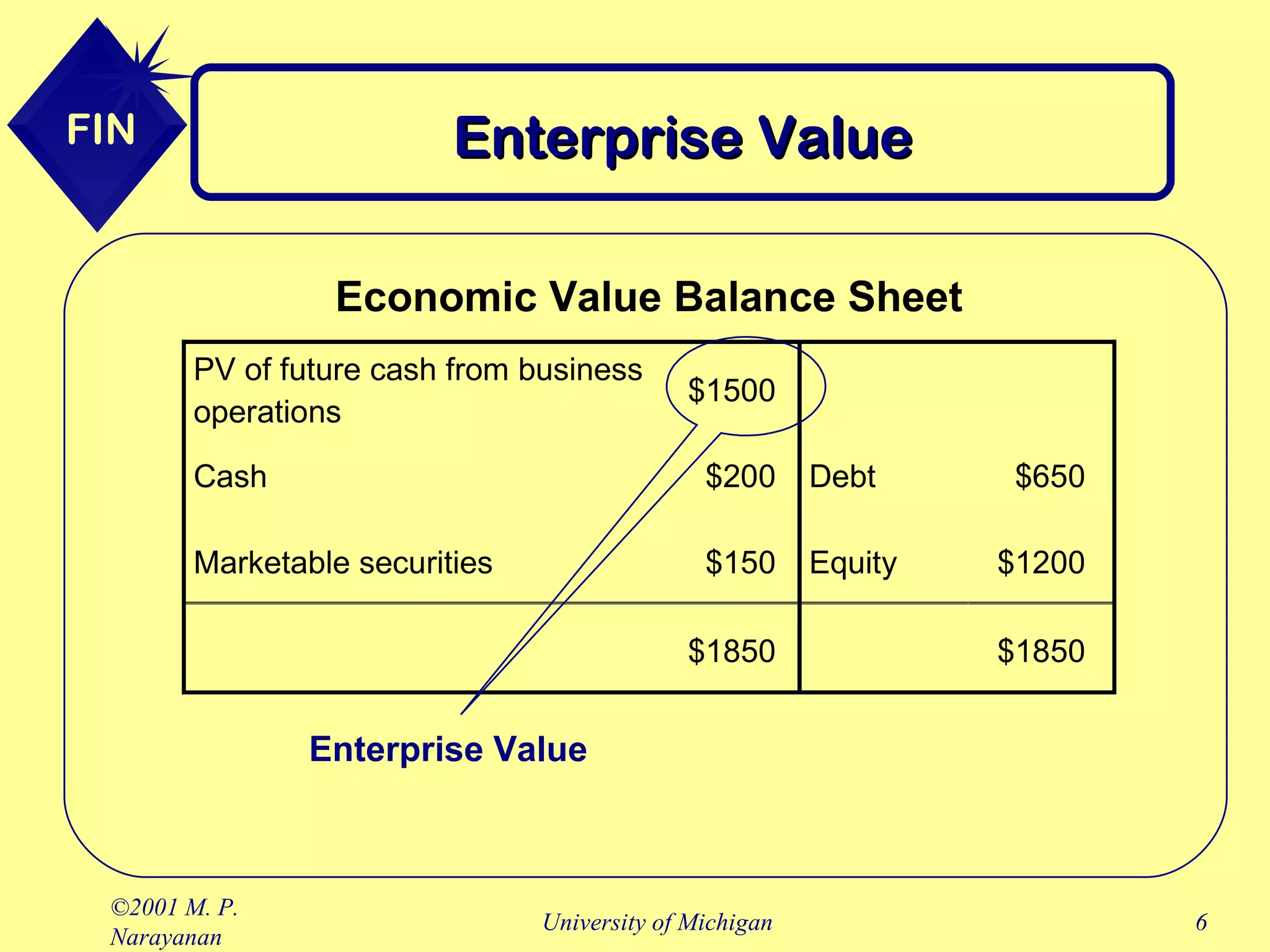

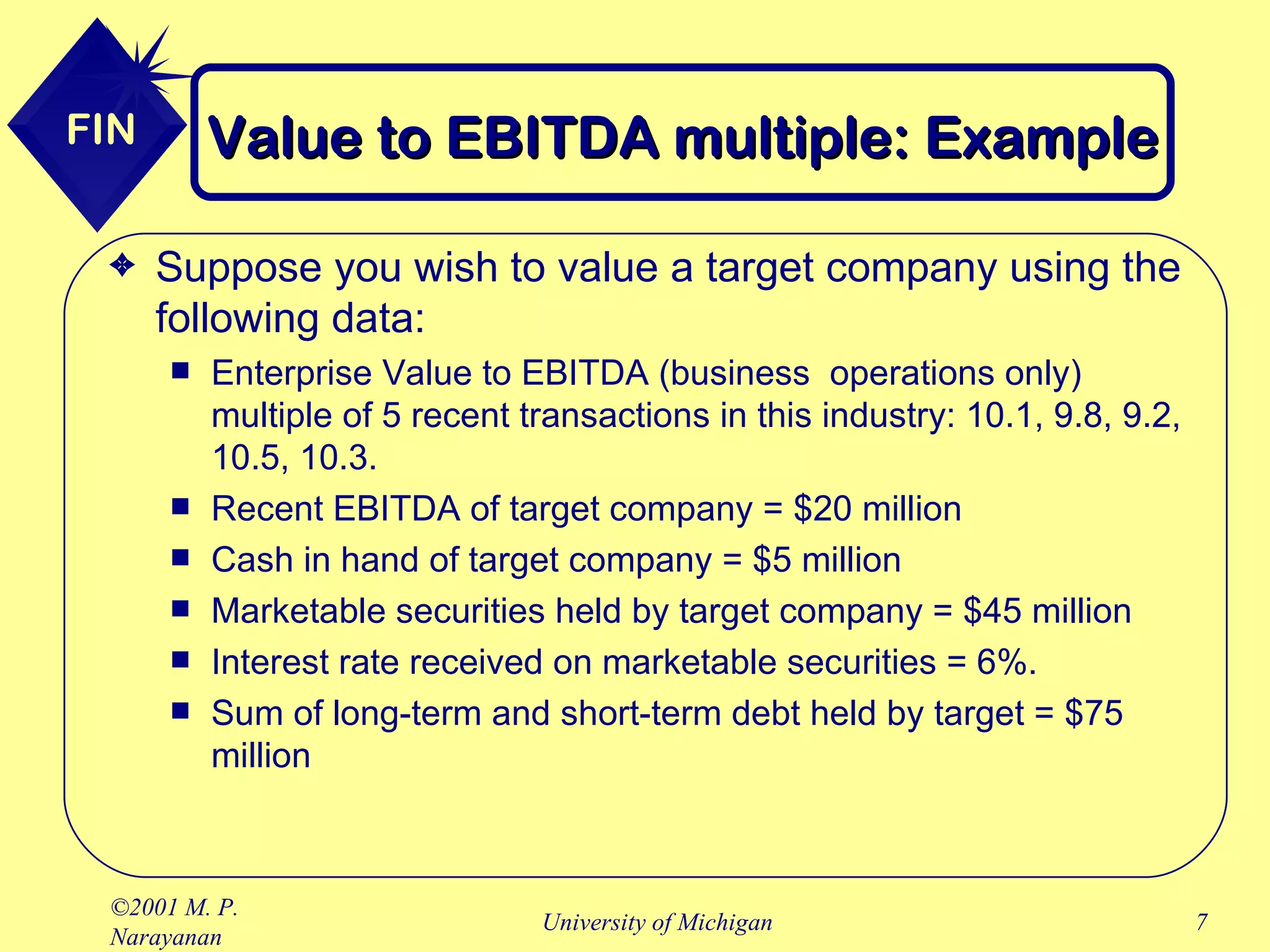

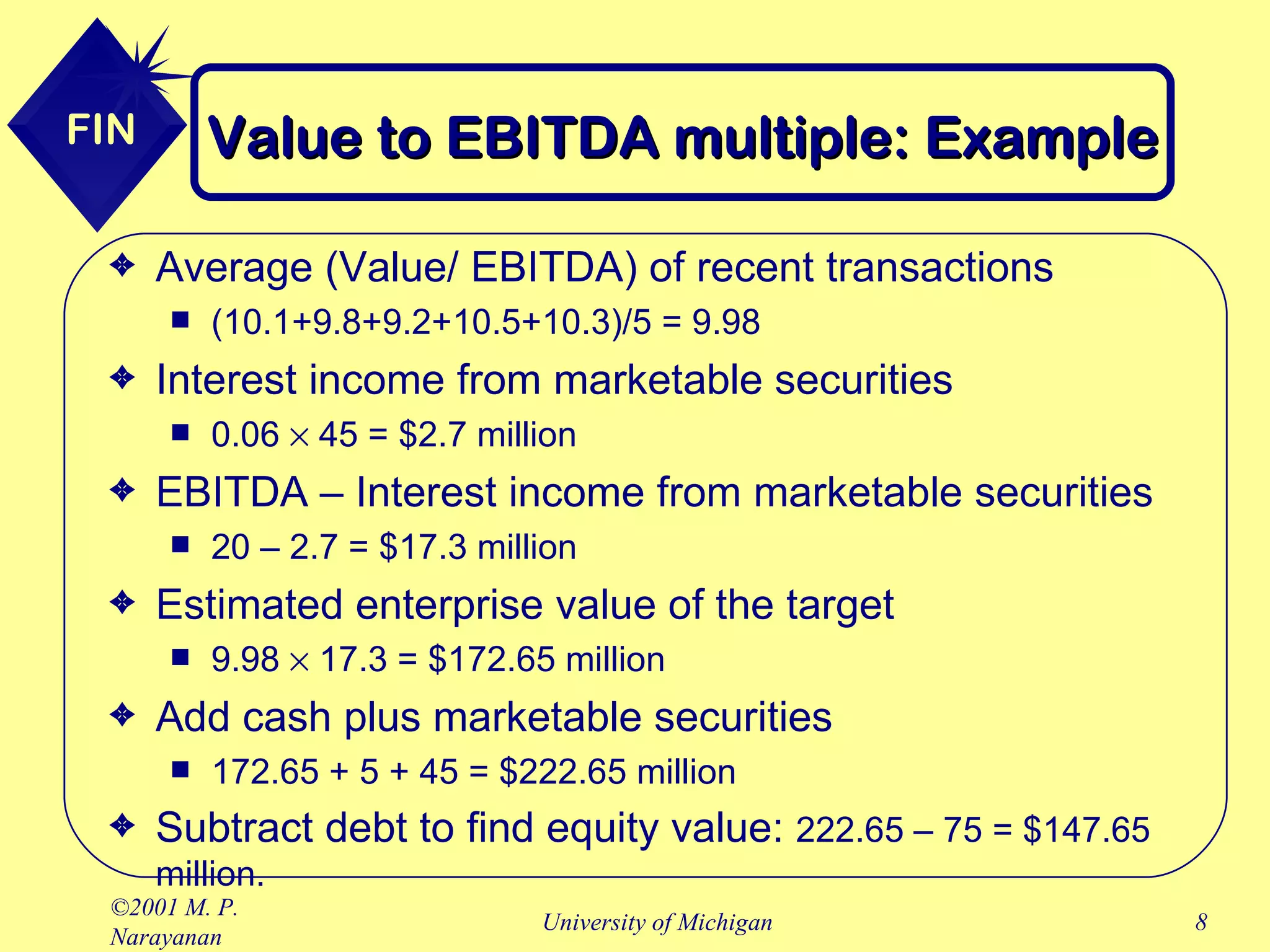

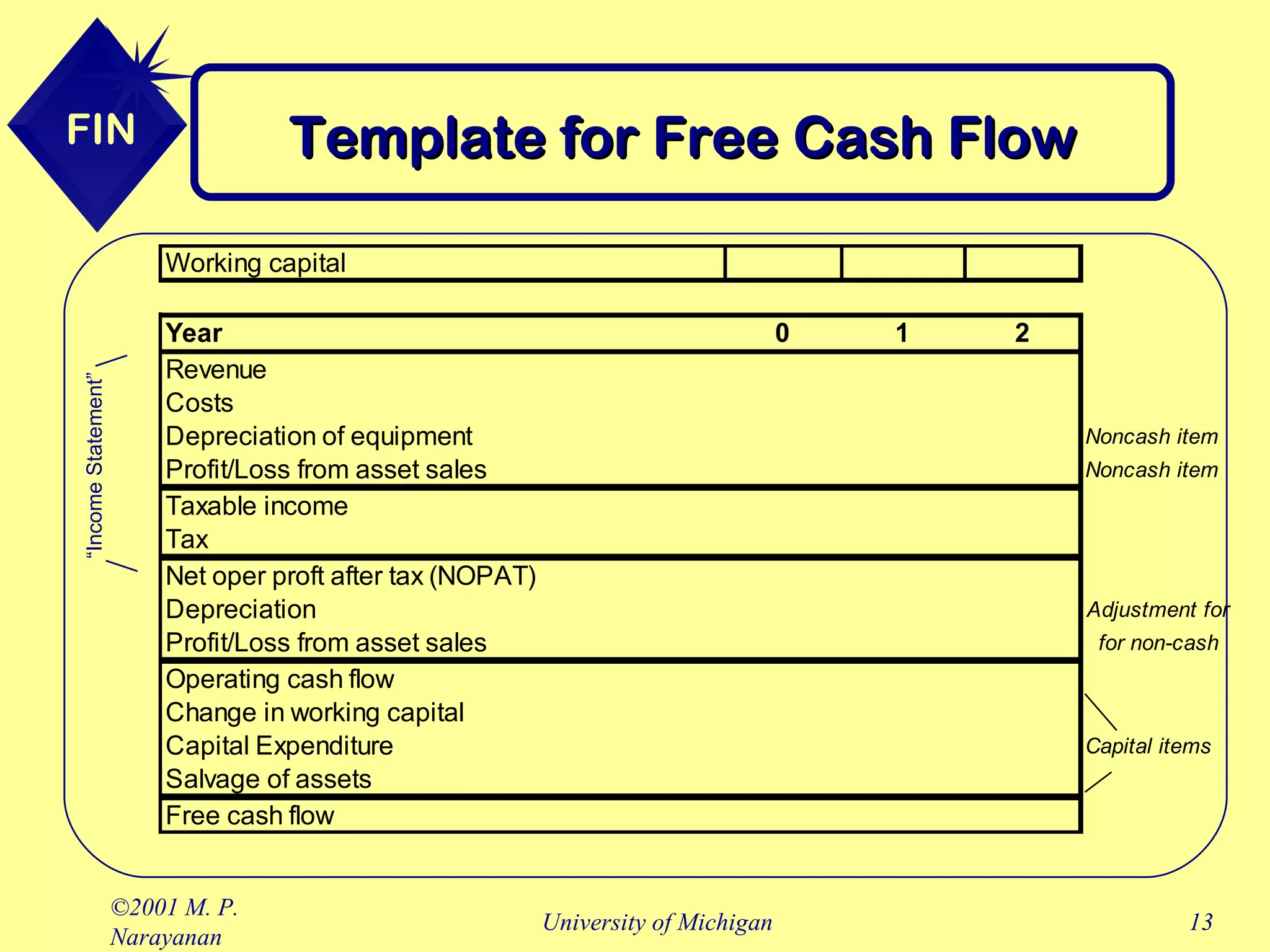

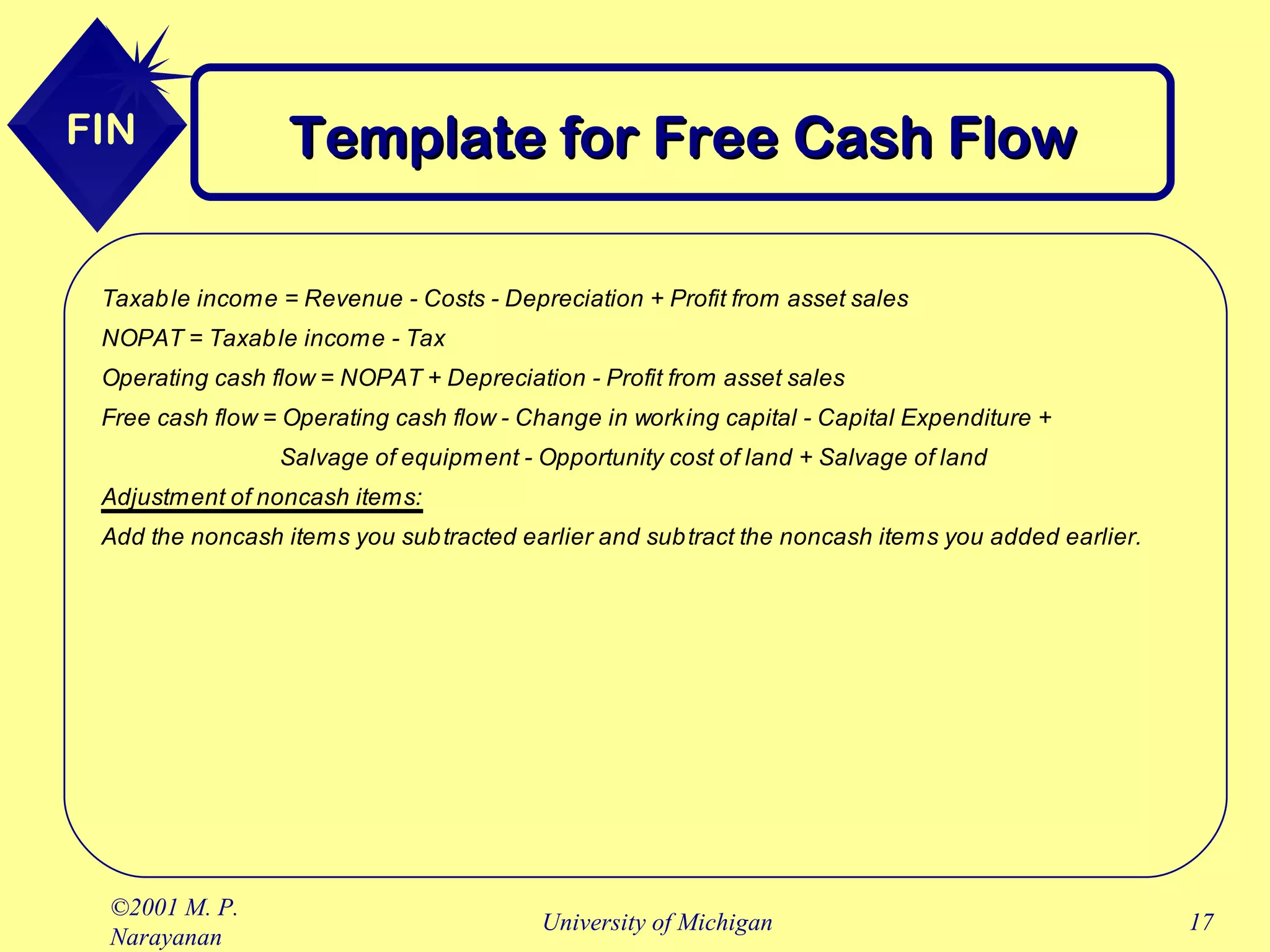

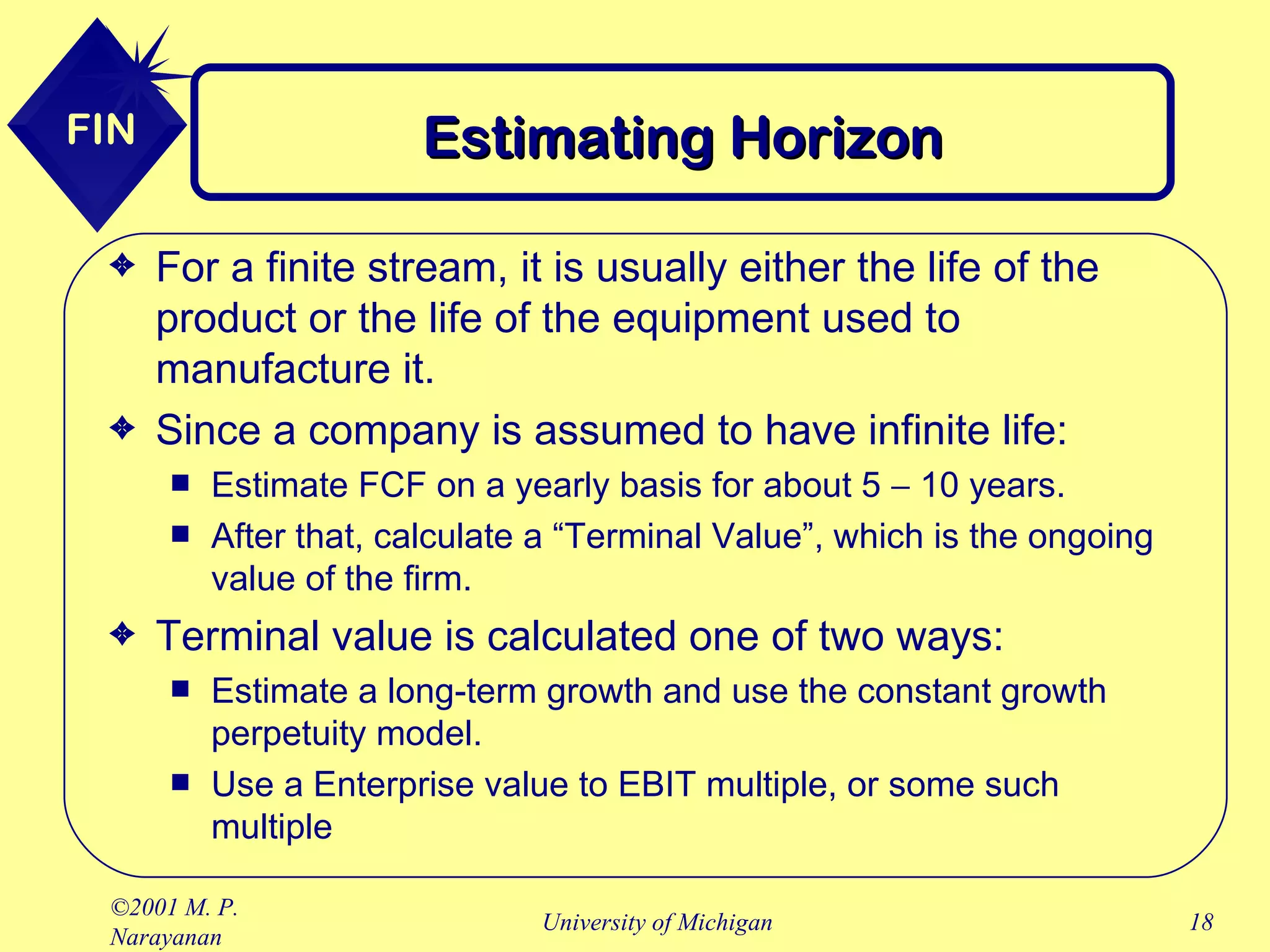

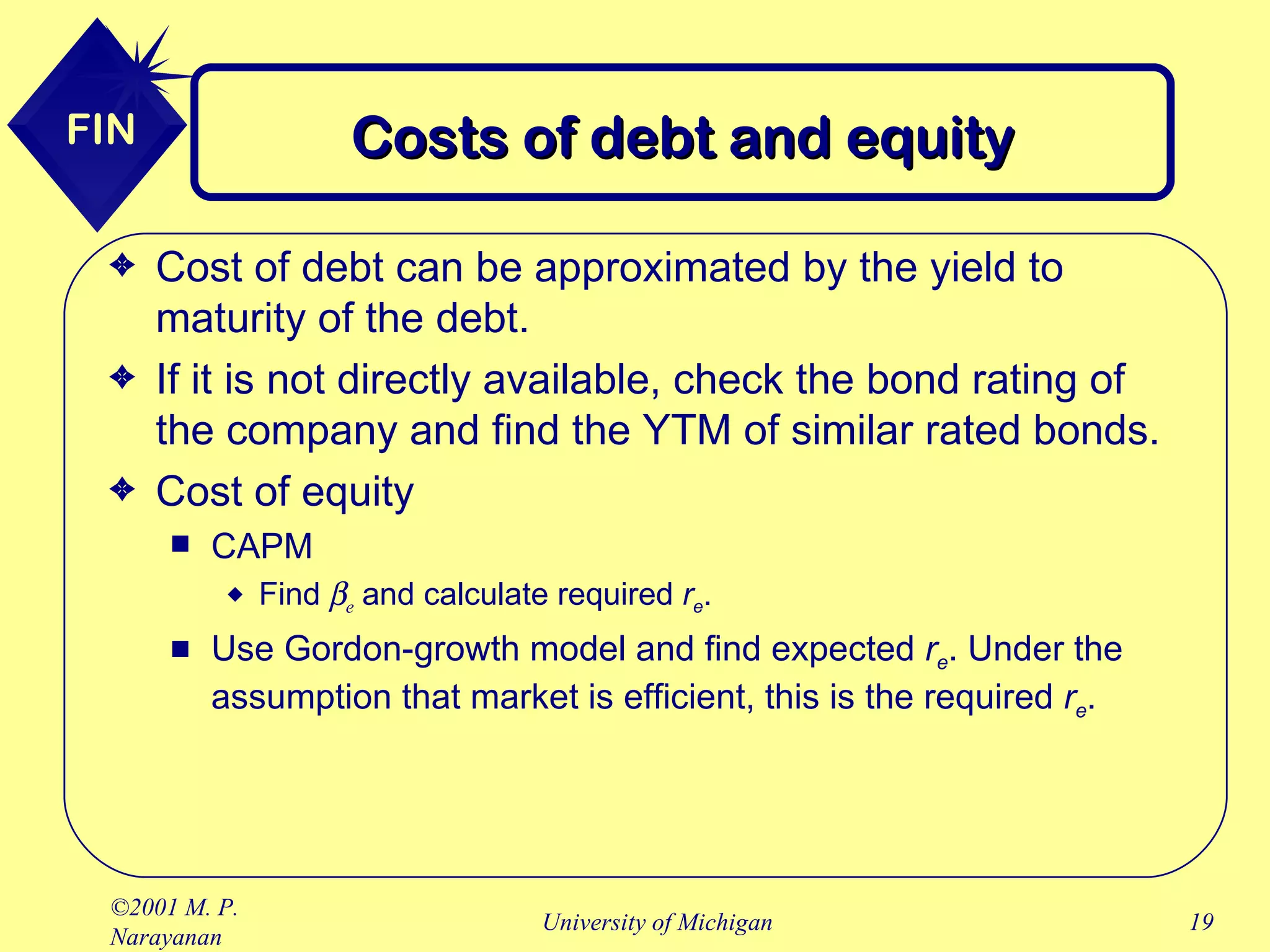

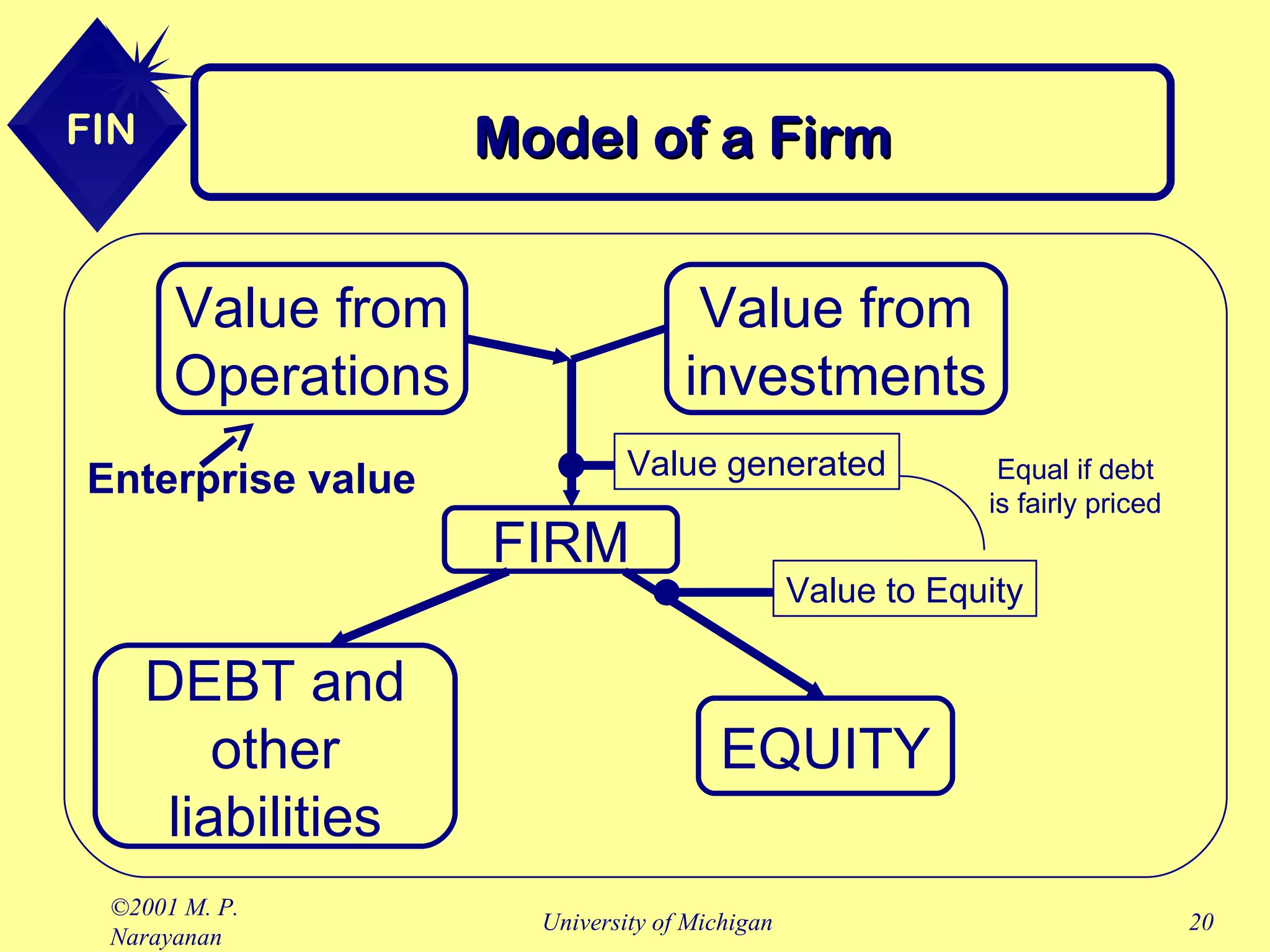

This document discusses several valuation methods including comparable multiples, discounted cash flow analysis, and heuristic methods. It provides an overview of comparable multiples like P/E, price to book, and enterprise value to EBITDA. It then describes using a discounted cash flow approach including estimating free cash flows, determining an appropriate time horizon, and calculating the cost of debt and equity. The document emphasizes that discounted cash flow analysis accounts for synergies and specific company characteristics better than heuristic multiples which have limitations.