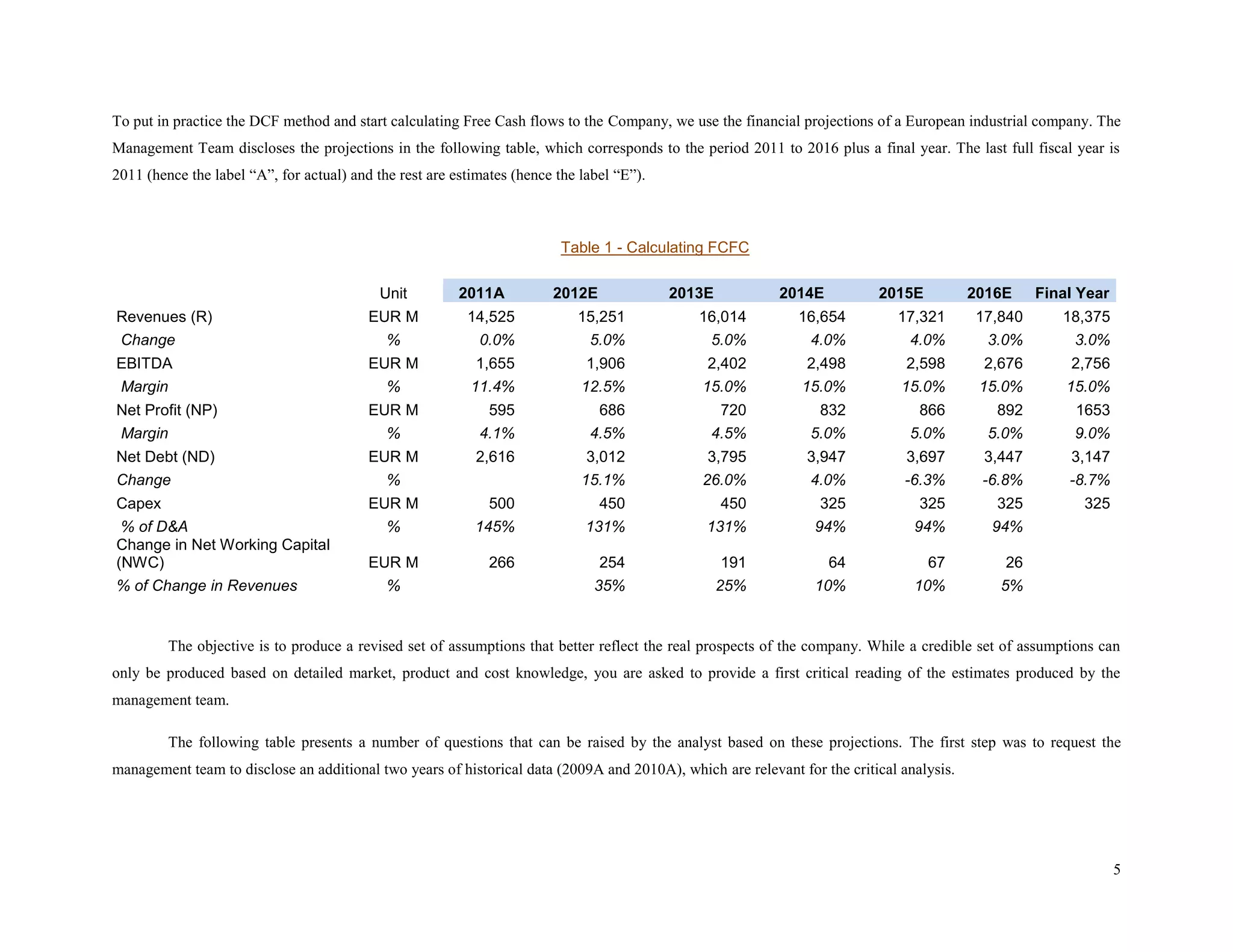

The document discusses free cash flow (FCF) estimation and valuation techniques. It provides equations and considerations for calculating key line items in the FCF statement, including EBITDA, taxes, capital expenditures, and changes in net working capital. The document also discusses estimating the final value and terminal growth rate, and analyzing key performance indicators to inform projections. An example FCF statement is provided for a European industrial company from 2011-2016 and the final valuation year to demonstrate the calculations.