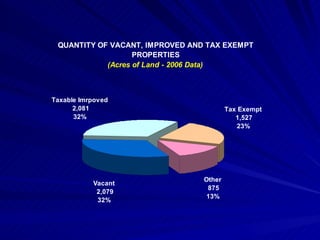

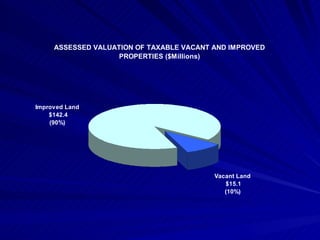

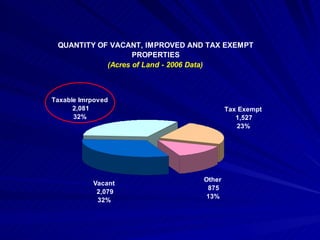

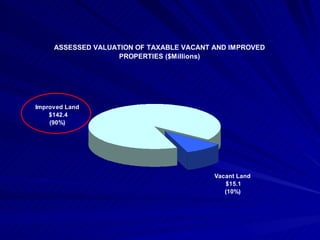

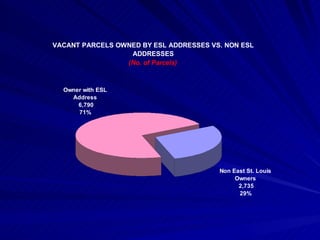

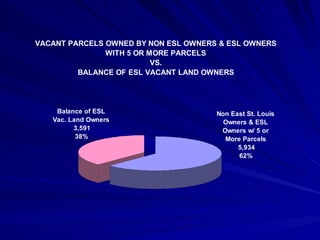

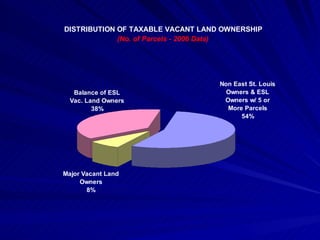

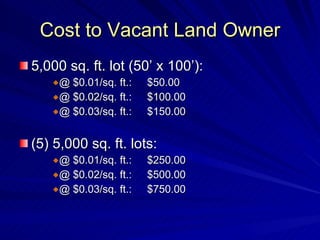

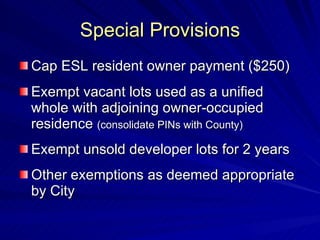

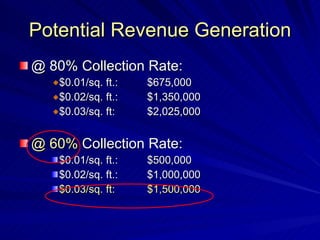

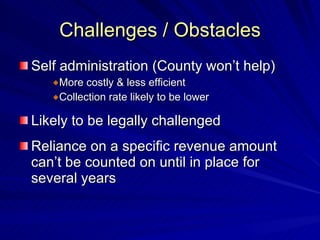

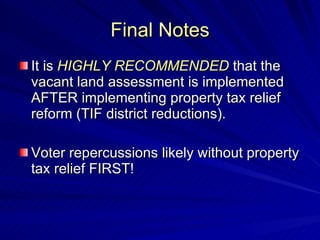

The document proposes a vacant land assessment for the City of East St. Louis to generate revenue for essential public services. It suggests charging an annual fee per square foot of vacant land, with rates of $0.01, $0.02, or $0.03. This could generate between $500,000 to $2 million annually at collection rates of 60-80%, helping to maintain services while discouraging land speculation. However, challenges include difficulty administering the program and potential legal challenges.