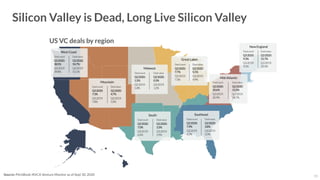

The document discusses the U.S. market entry strategies for fast-growing startups, highlighting the importance of venture capital and cross-border opportunities. It reviews 2020 VC market dynamics, including deal activity, IPOs, and investment trends, while outlining the formation processes for startups in the U.S. and the types of corporate structures recommended for non-U.S. investors seeking access to American markets.