Embed presentation

Downloaded 12 times

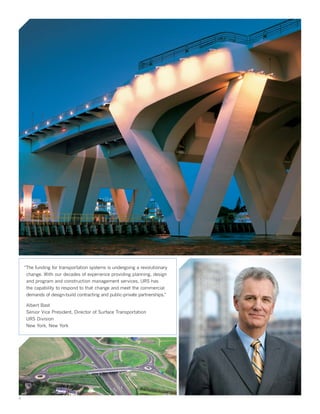

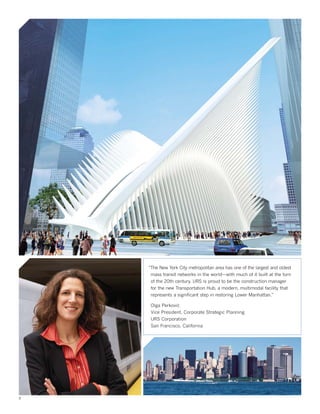

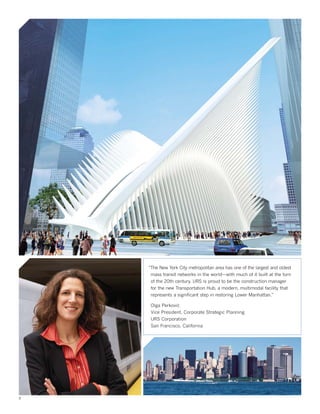

URS is one of the largest engineering design firms worldwide and provides services for infrastructure projects globally. Infrastructure such as transportation networks, water and wastewater systems, and public facilities are deteriorating and in need of modernization. Governments are increasing investment in infrastructure improvements to promote economic growth. URS is at the forefront of modernizing infrastructure, providing planning, engineering, architecture and construction management services for projects in the U.S., U.K., Australia and New Zealand. A 2005 study estimated $1.6 trillion is needed over five years for infrastructure upgrades in the U.S. alone.