This document provides an update on the transition of NHS property assets to new organizational structures following reforms in the UK healthcare system. It discusses the transfer of assets from Primary Care Trusts to NHS Property Services Ltd. and some challenges in carrying out transfers, funding arrangements, and strategic planning. It also introduces the concept of "patient hotels" as a way to provide accommodation for patients awaiting discharge or treatment.

![Update Nov 2012

Letter from Simon Holden (CEO)

„Core‟ landlord and advisory services that Primary Care Trust estates

teams currently provide or manage:

• Strategic estates management

• ƒ Property management advice

• The operational delivery of

[property] services:

• Refurbishment and maintenance

• Emergency/on-call repairs

• Quality assurance

• Compliance with statutory

regulations (such as fire, asbestos)

• Non-urgent breakdowns (electrical,

mechanical, building)

• Planned preventative maintenance

• Health and safety, fire safety and

risk assessment (landlord only)

• Mechanical and engineering services

4](https://image.slidesharecdn.com/nhspropcov23ahei-130930074658-phpapp02/75/NHSPS-Update-Strategic-Estate-Partnerships-4-2048.jpg)

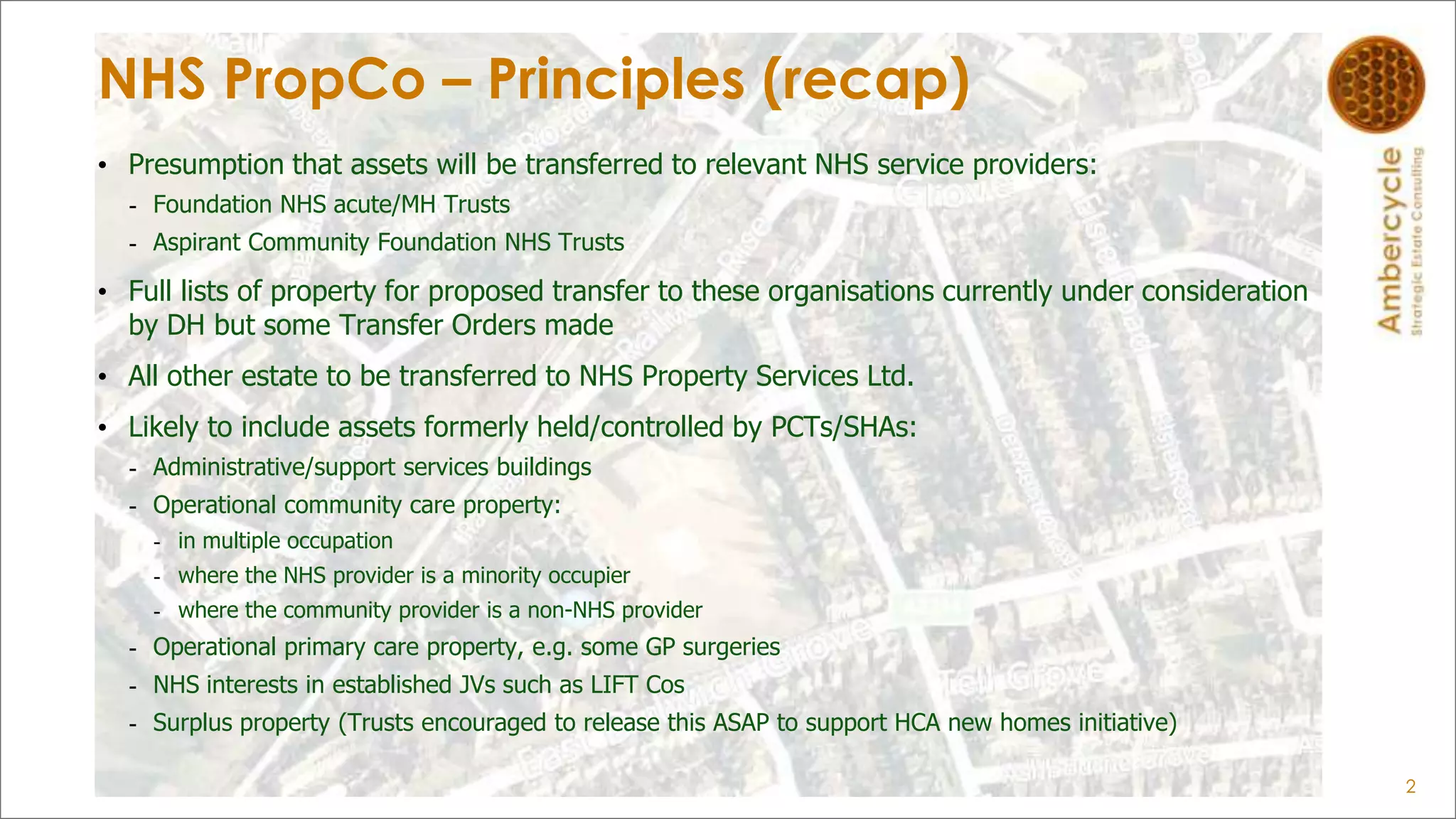

![Update 2 April 2013

Letter from Peter Coates (on behalf of Secretary of State)

To: landlords, sponsors and/or funders

Setting the Scene

• On 31st March 2013, Primary Care

Trusts ceased to exist

• A significant number of properties

previously owned or leased by

Primary Care Trusts (together

with all resulting liabilities) will

transfer to NHSPS

• The Secretary of State for Health

holds all of the shares in NHSPS

Statement of Principle

• SoS acknowledges fundamental

importance of…good quality

premises [for primary health]

• enshrined in NHS Constitution

pledge :

• “services provided in clean and

safe environment that is fit for

purpose, based on national best

practice”.

6](https://image.slidesharecdn.com/nhspropcov23ahei-130930074658-phpapp02/75/NHSPS-Update-Strategic-Estate-Partnerships-6-2048.jpg)

![From an outsider’s perspective

• Capacity Struggle

• 30-40 Local Area Team Co-ordinators appointed by NHSPS

• Interaction with NCB & CCGs still unclear

• GPs rushing to get leases in place [or not in some cases]

• DH focus on making sure Transfer orders in place

• Traffic light triage of transfer risk issues: 1st 100 days, 2nd

100 days etc.

• CHP has similar issues with LIFT estate

• NHSPS likely to be looking for „quick wins‟ but

• Nothing controversial expected pre-election!

12](https://image.slidesharecdn.com/nhspropcov23ahei-130930074658-phpapp02/75/NHSPS-Update-Strategic-Estate-Partnerships-12-2048.jpg)

![What is a Strategic Estate Partnership?

• No single definition

• Often whole estate PPP principle

• Can be specific assets with option to widen scope

• Assets taken off balance sheet but can be just contractual

• Often includes asset management and [some] FM

• Can also include healthcare & support services

• Private sector partner brings development skills & finance

• With agreement can be extended to include other public sector assets

14](https://image.slidesharecdn.com/nhspropcov23ahei-130930074658-phpapp02/75/NHSPS-Update-Strategic-Estate-Partnerships-14-2048.jpg)