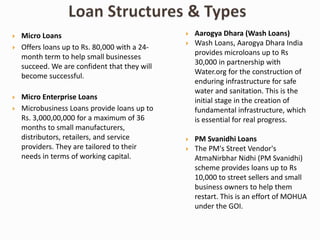

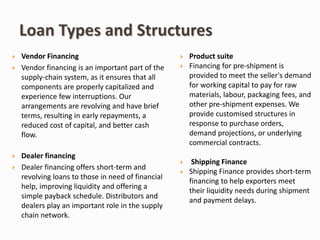

Unity Small Finance Bank aims to enhance financial inclusion in India by providing innovative banking solutions tailored for unbanked and underserved customers. The bank offers a variety of loan products, including microloans for small businesses and specialized loans for women entrepreneurs, with initiatives supporting street vendors and large corporations alike. Additionally, the bank focuses on supply chain finance to address working capital needs, ensuring liquidity and efficiency throughout the supply chain.