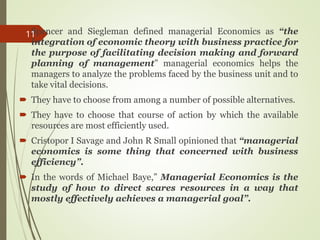

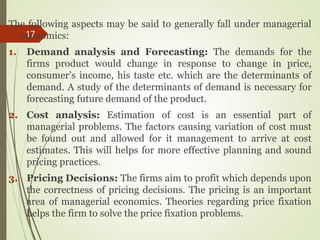

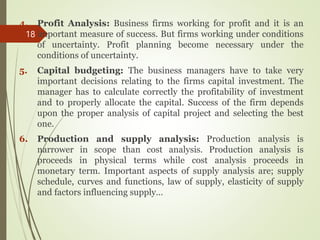

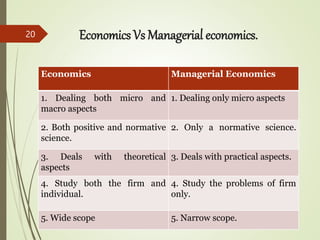

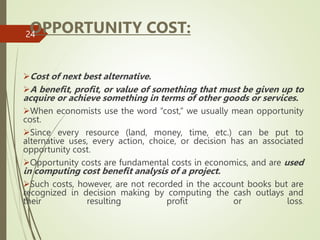

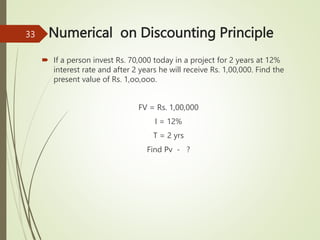

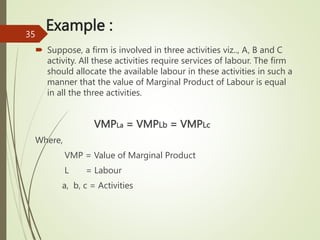

The document provides an overview of economics, defining it as the study of the production, distribution, and consumption of goods and services, focusing on how resources are allocated to satisfy wants. It explains the difference between macroeconomics, which examines economies as a whole, and microeconomics, which looks at individual economic factors, while also introducing managerial economics as a practical application of economic principles to business decision-making. Key concepts discussed include opportunity cost, incremental costs, and the principles guiding effective resource allocation within firms.