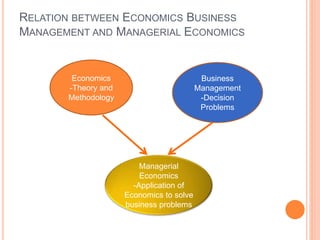

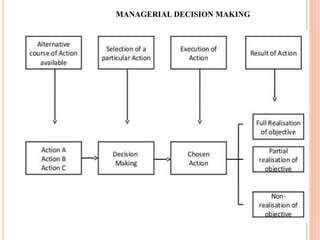

This document provides an overview of managerial economics. It defines managerial economics as the application of microeconomic analysis and quantitative methods to business decision making. The key aspects covered include the meaning and definitions of managerial economics, its relationship to economics and business management, its characteristics as a pragmatic and normative discipline, and its scope in areas like demand analysis, cost analysis, production, pricing, profit, and capital management. Decision making in managerial economics involves applying economic principles to solve problems related to a business's internal and external environments under conditions of uncertainty.