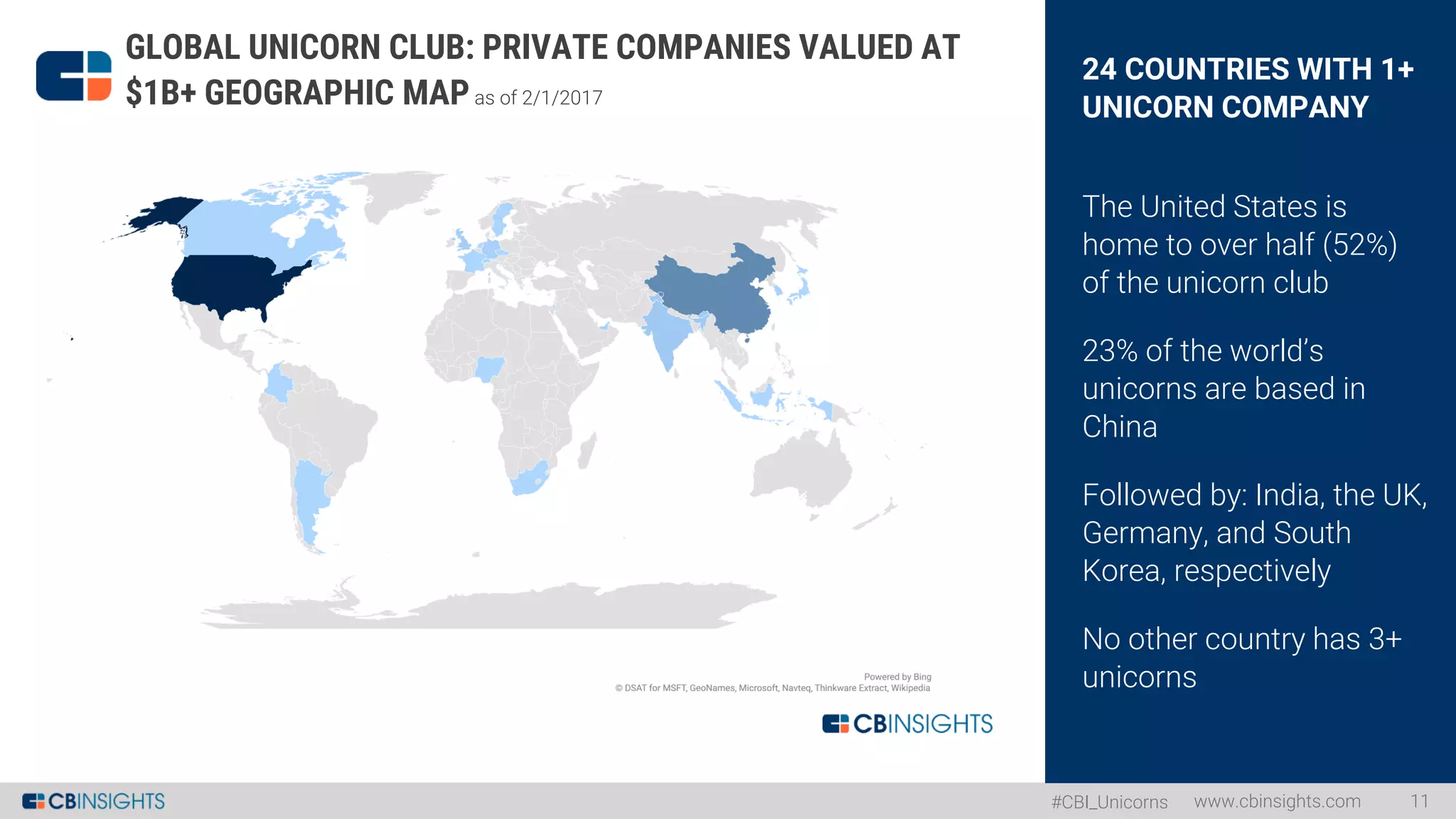

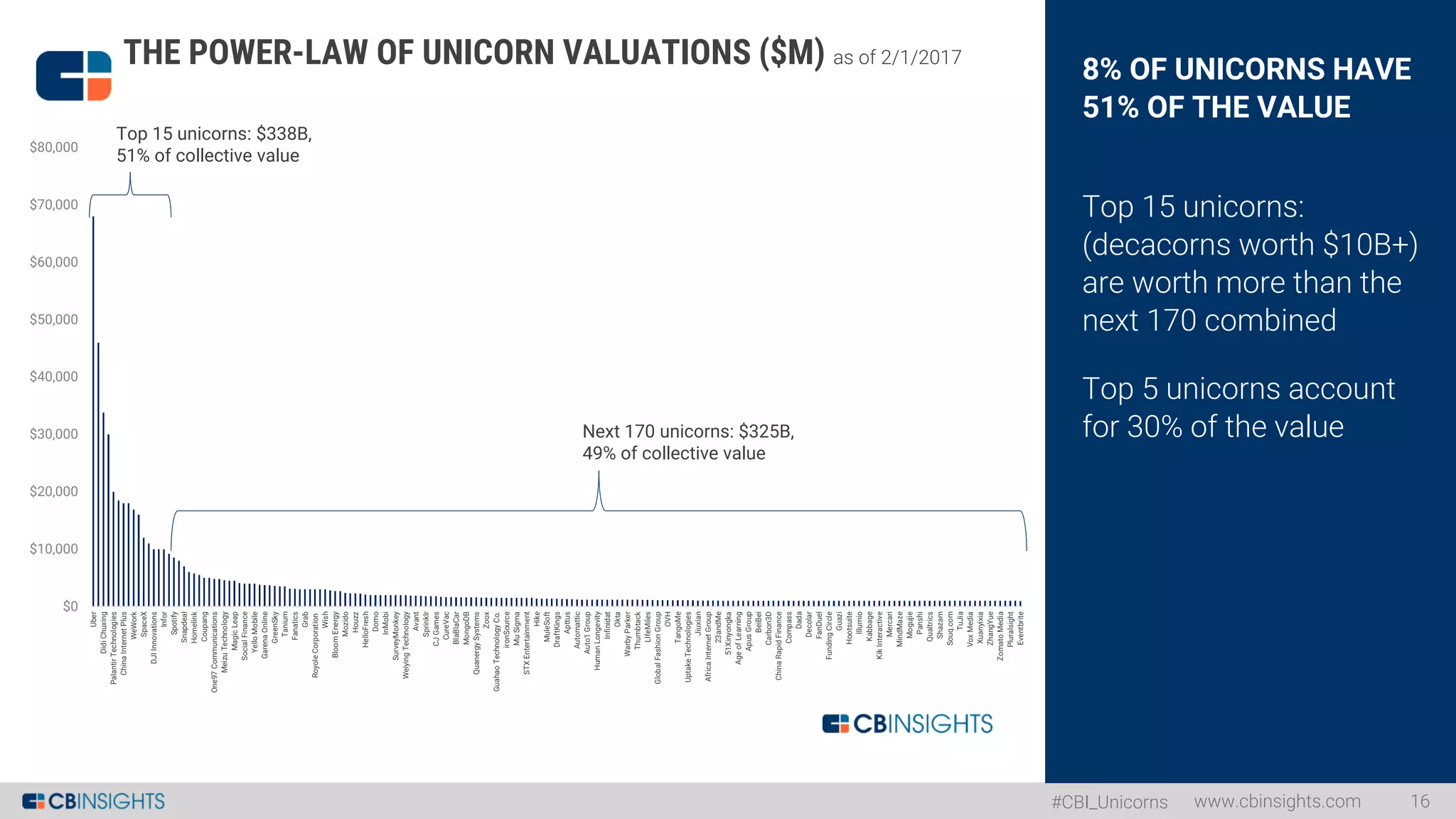

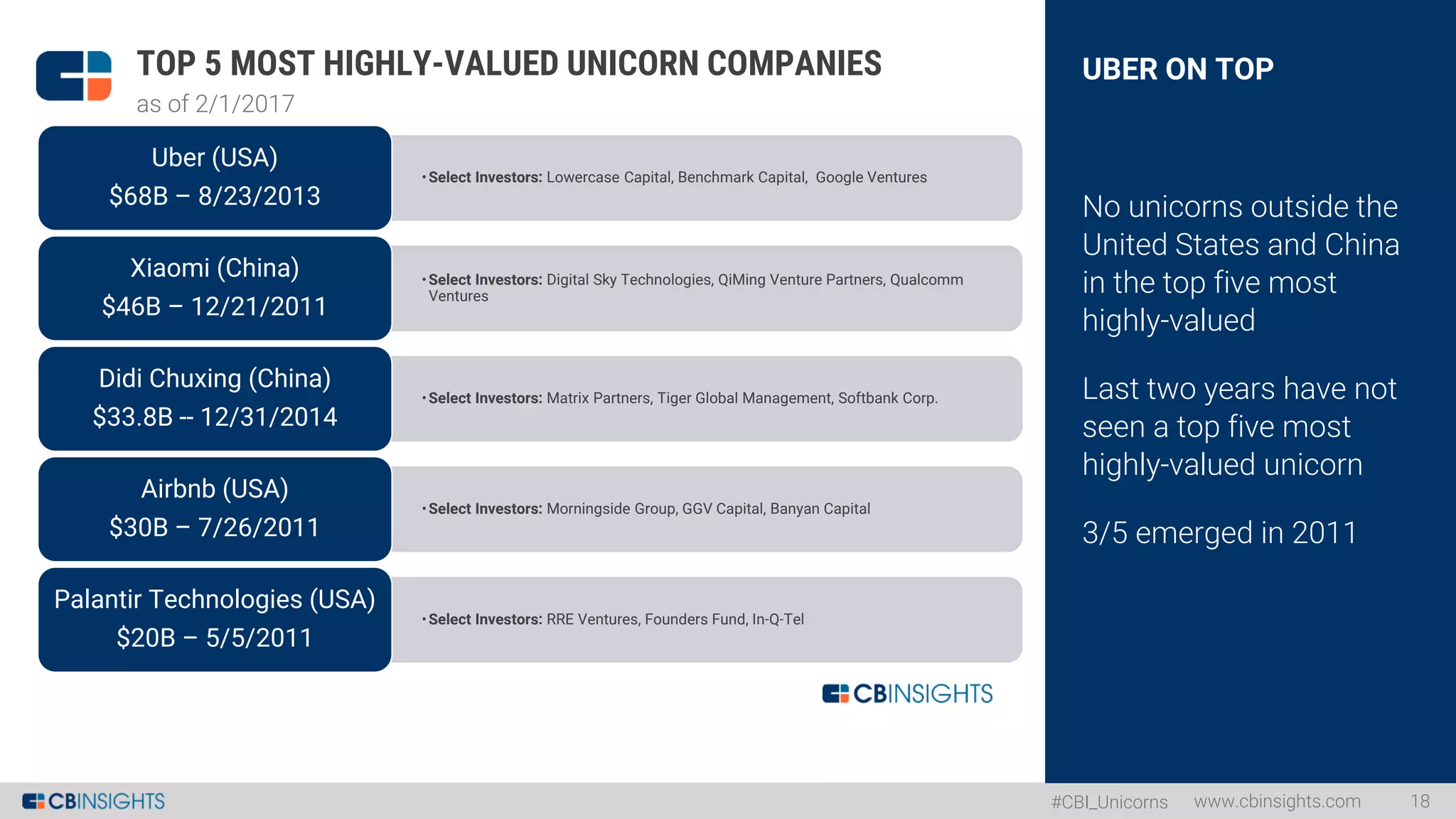

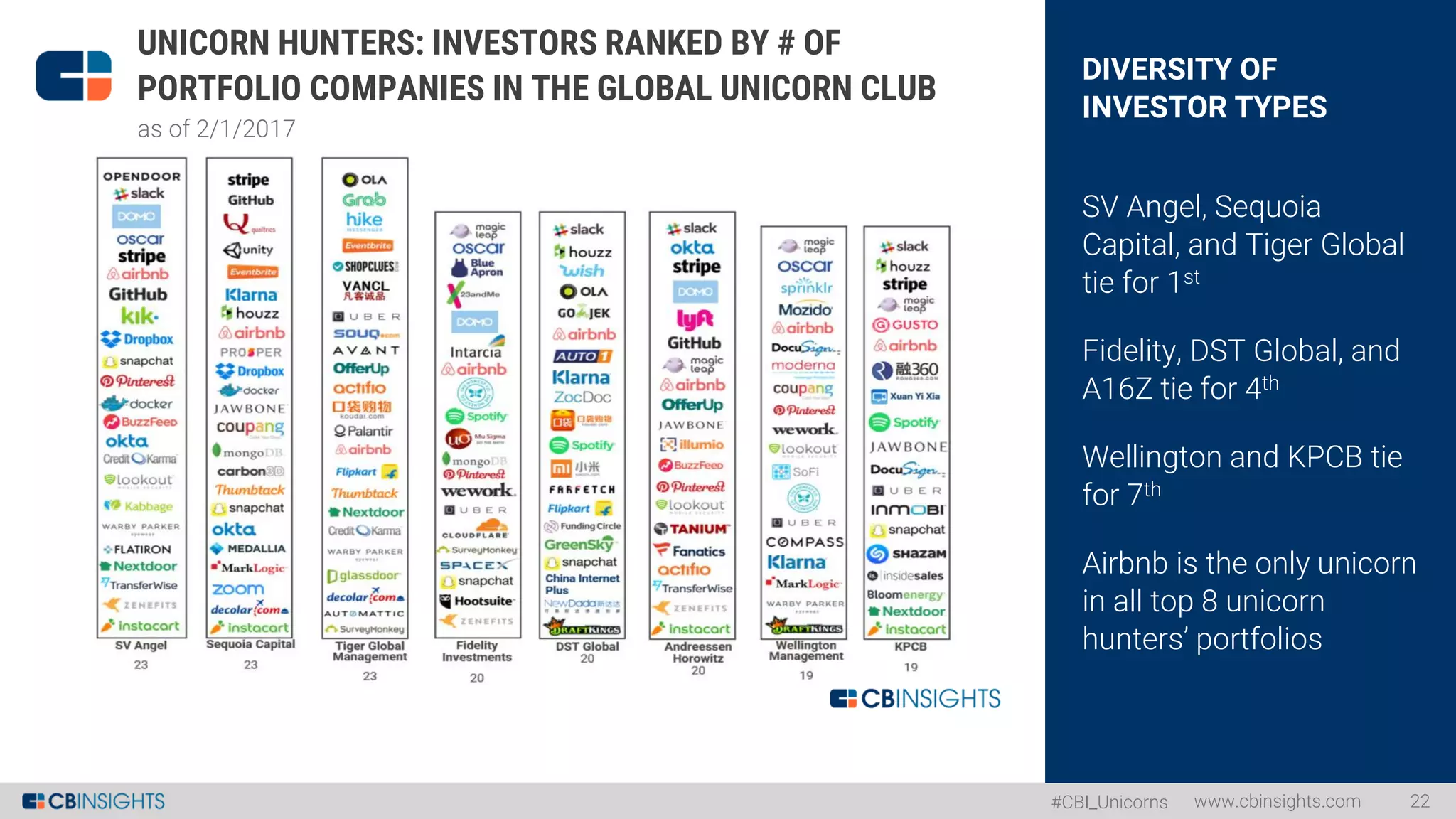

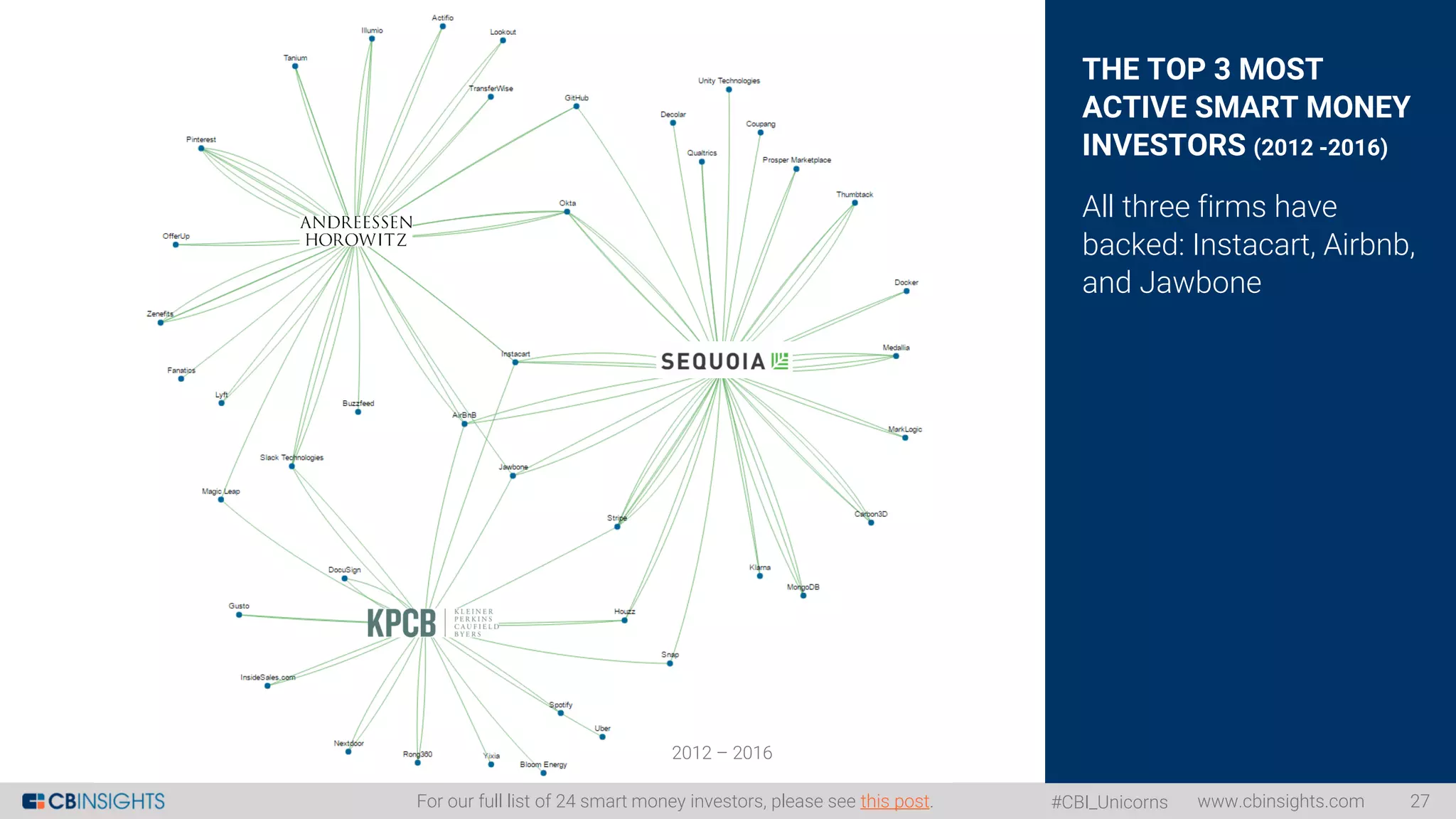

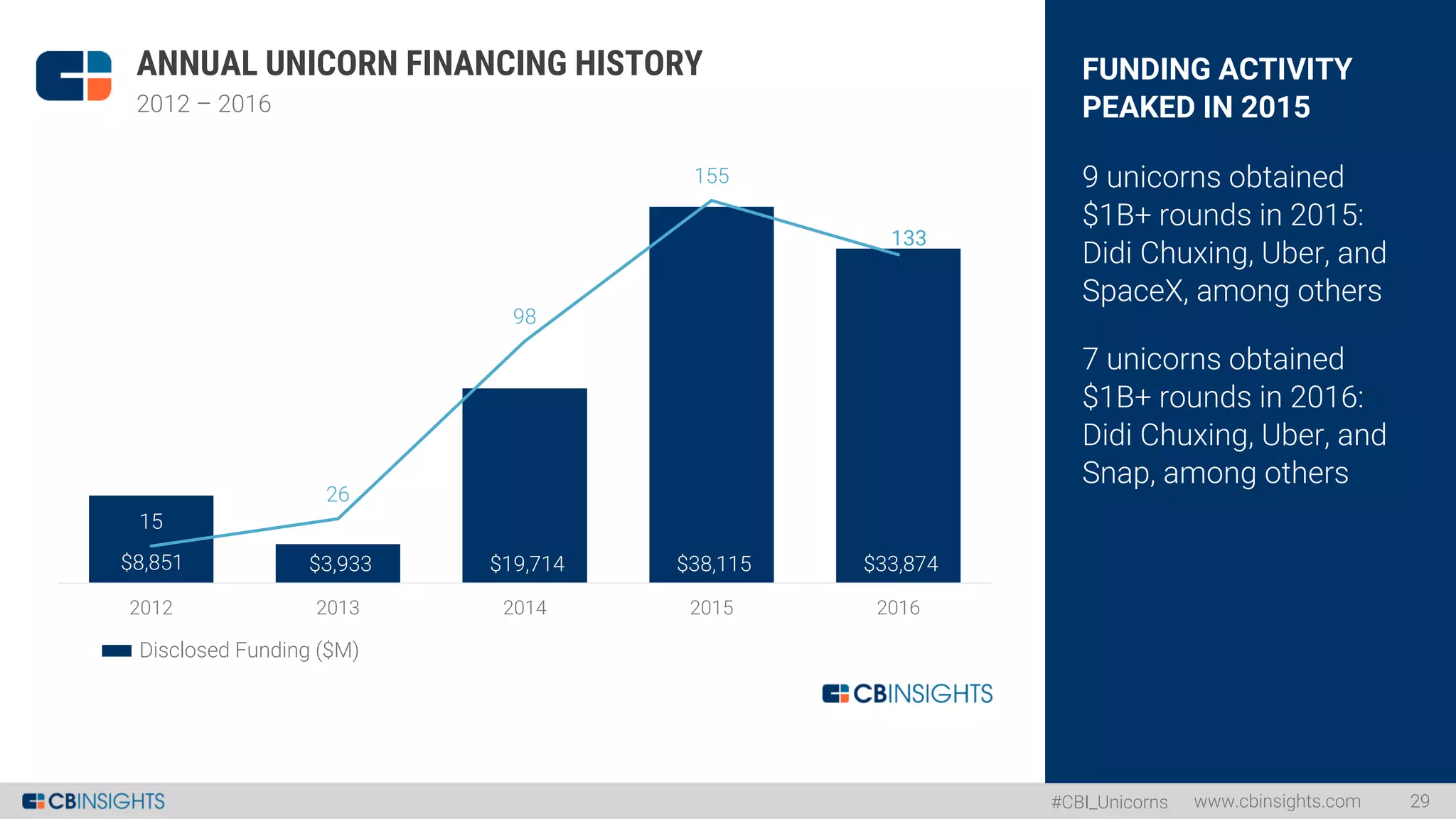

As of February 1, 2017, there are 185 global unicorns valued at over $1 billion, primarily concentrated in e-commerce, internet software, and fintech sectors, with the U.S. housing 52% of them. The top five unicorns by valuation include Uber, Xiaomi, Didi Chuxing, Airbnb, and Palantir, which collectively represent a significant share of the total value of the unicorn club. The venture capital landscape shows that 40% of unicorn investors are VCs, with Sequoia Capital being one of the most active investors in early-stage unicorn deals.