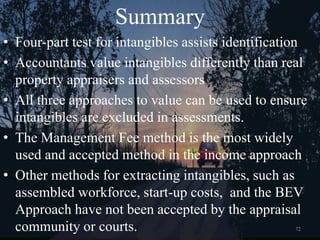

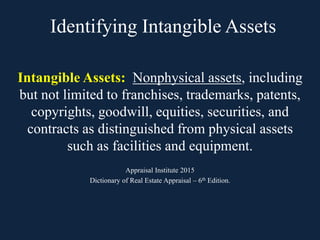

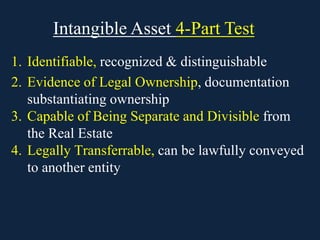

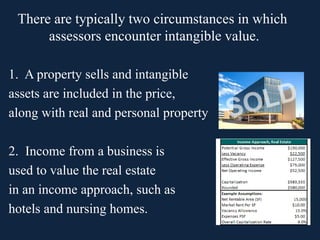

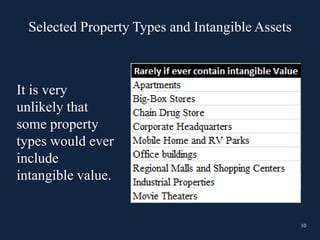

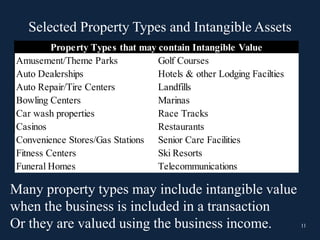

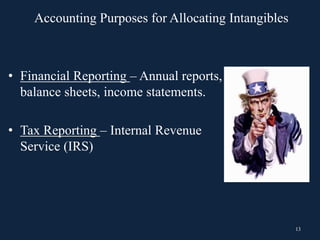

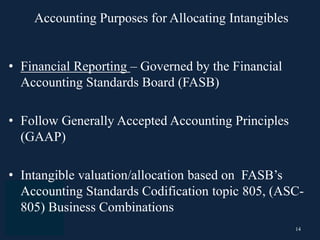

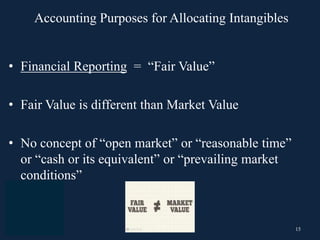

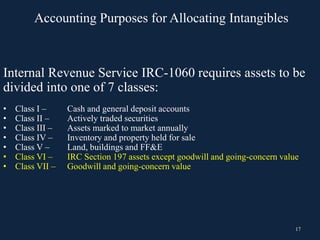

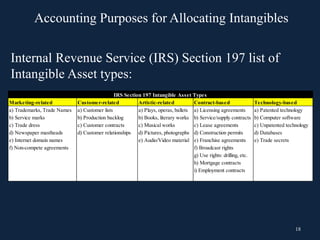

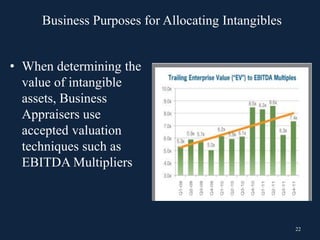

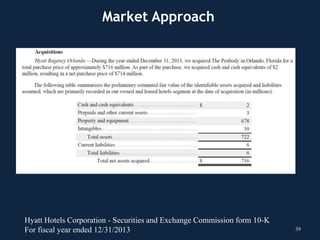

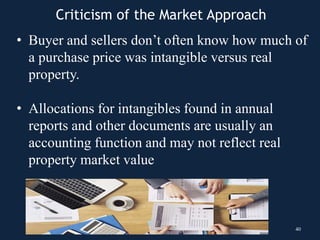

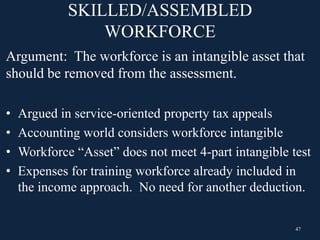

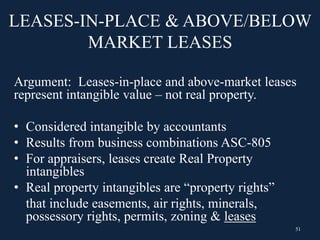

This document provides an overview of intangible assets and how they relate to real estate valuation. It discusses how intangible assets are identified and the legal tests used. There are typically two circumstances where assessors encounter intangible value: 1) when a property sells and intangible assets are included in the price, along with real and personal property, and 2) when income from a business is used to value real estate in an income approach for property types like hotels and nursing homes. The document then examines the accounting, business, and real estate purposes for allocating intangible assets. Finally, it reviews methods for estimating intangible value, including the cost, market, and income approaches.

![Around the World in 80 days

59

Personal property tax on film

negative of the motion

picture “Around the World In

Eighty Days.”

Was the copyright a non-

assessable intangible?

Michael Todd Co. v. County of Los Angeles, 57 Cal. 2d 684 [21 Cal.Rptr. 604, 371 P.2d 340] (1962)

59](https://image.slidesharecdn.com/understandingintangibleassets-240417133038-666301f6/85/Understanding-Intangible-Assets-and-Real-Estate-59-320.jpg)

![60

"Market value" for assessment

purposes is the value of property

when put to beneficial or productive

use; it is not merely whatever

residual value may remain after the

property is demolished, melted

down, or otherwise reduced to its

constituent elements.”

60

Around the World in 80 days

Michael Todd Co. v. County of Los Angeles, 57 Cal. 2d 684 [21 Cal.Rptr. 604, 371 P.2d 340] (1962)](https://image.slidesharecdn.com/understandingintangibleassets-240417133038-666301f6/85/Understanding-Intangible-Assets-and-Real-Estate-60-320.jpg)