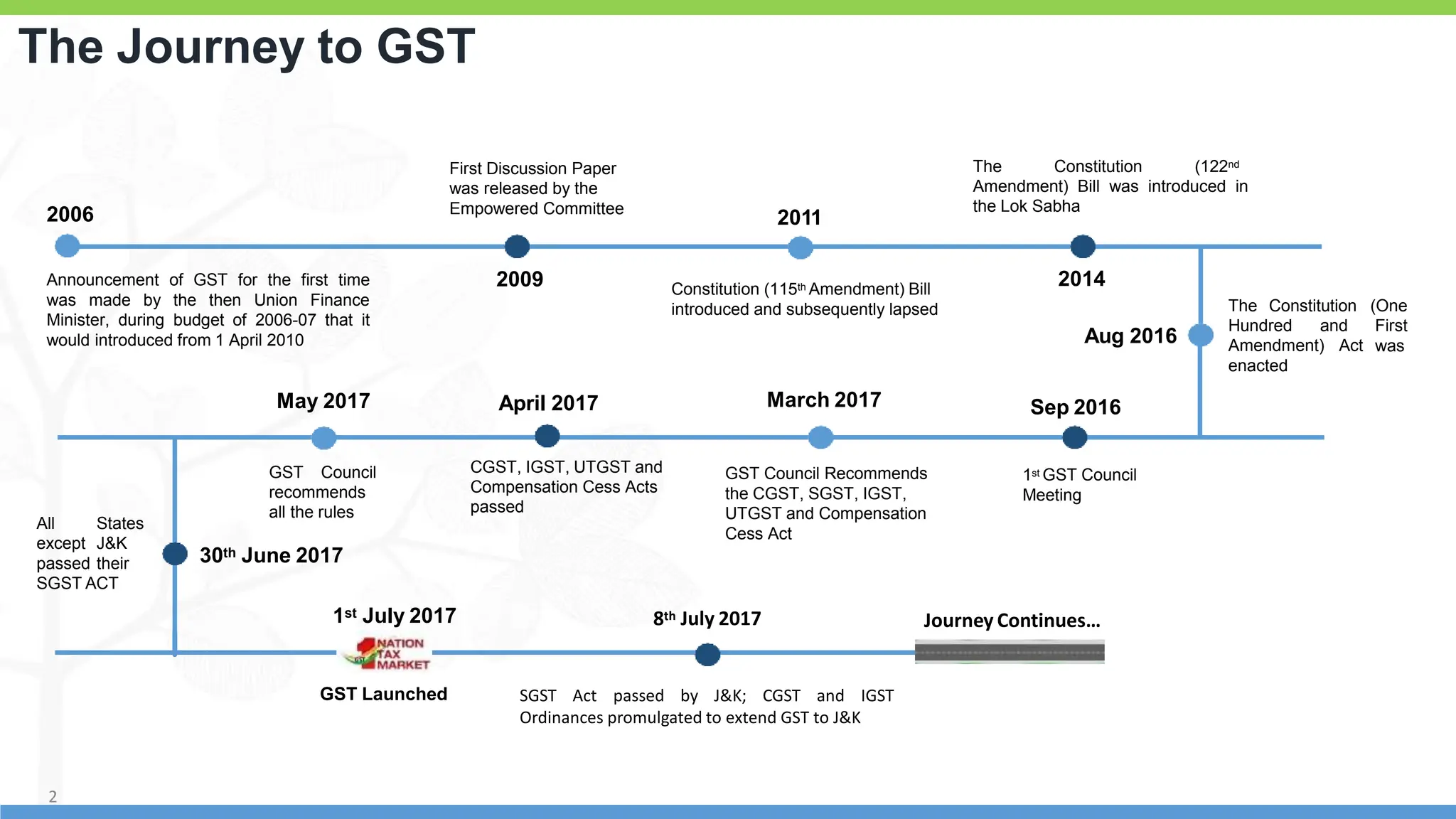

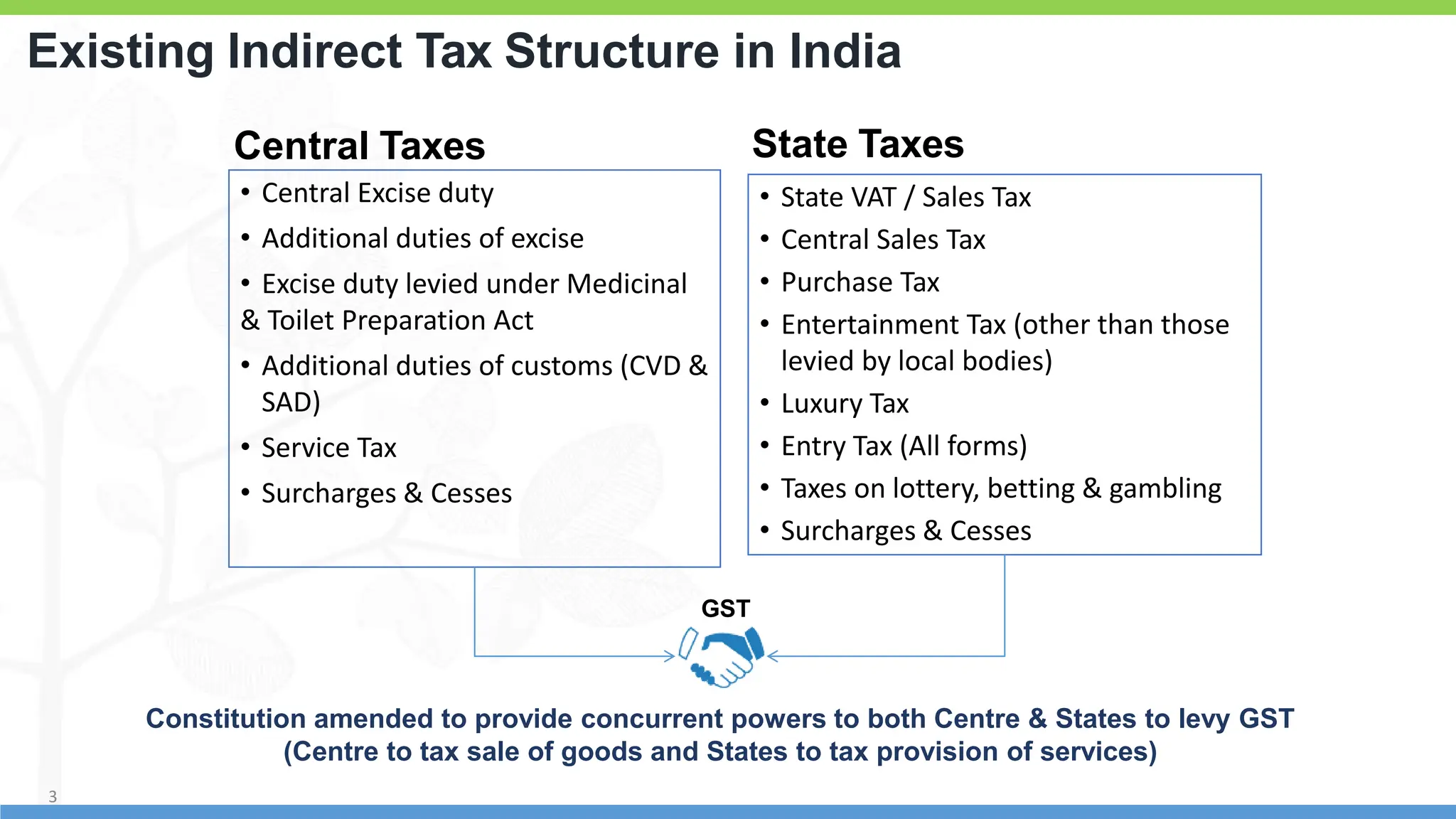

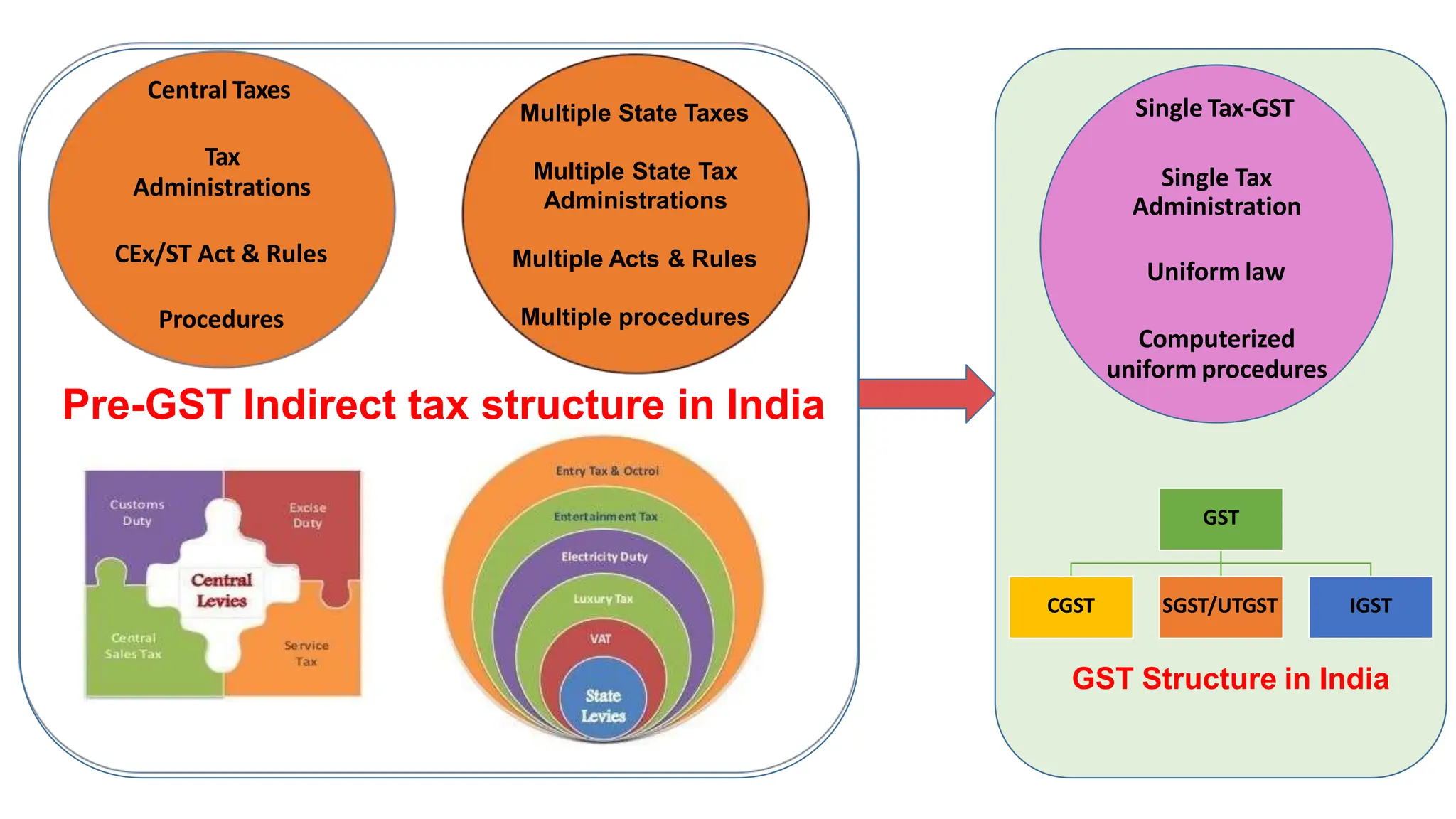

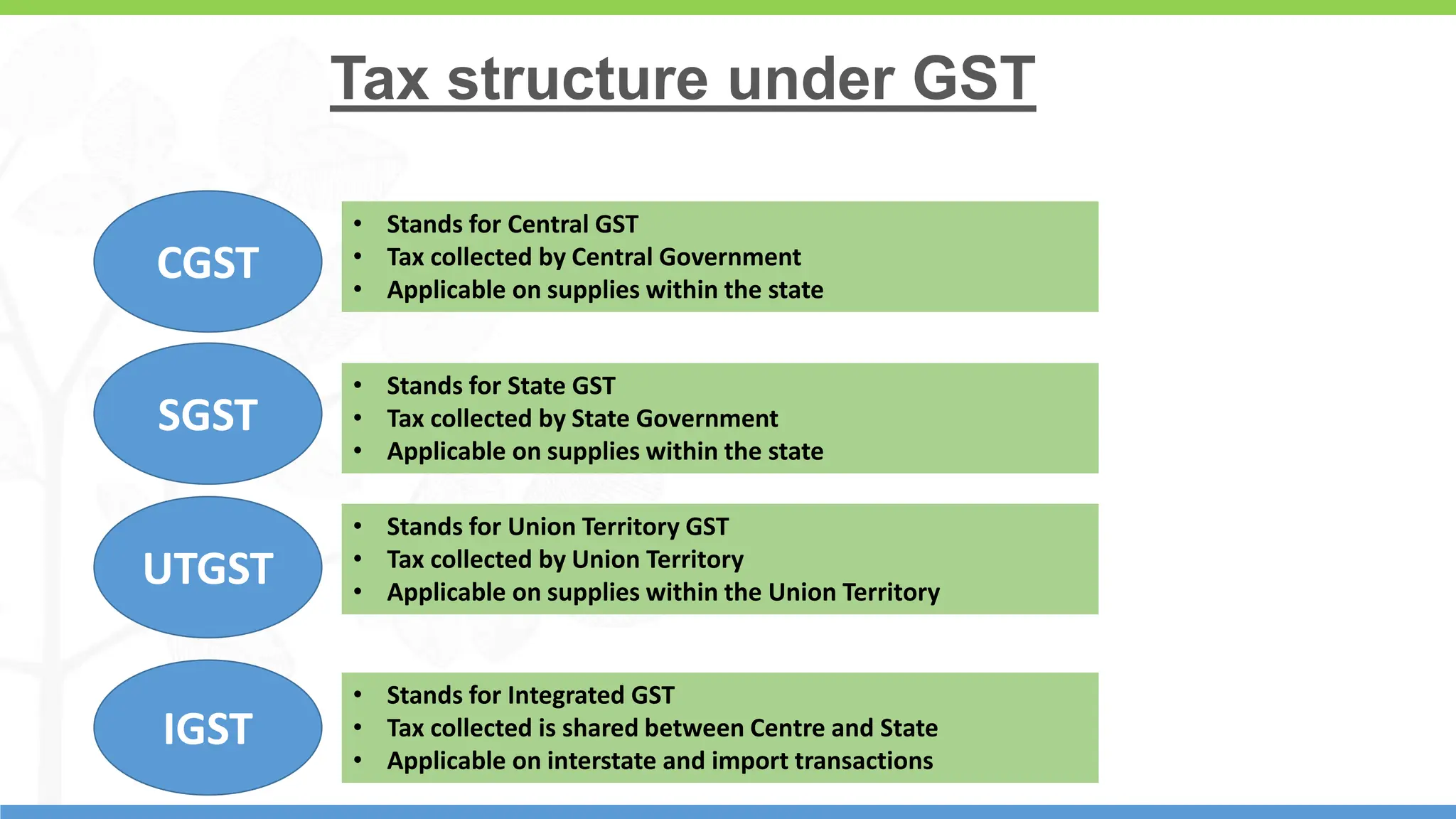

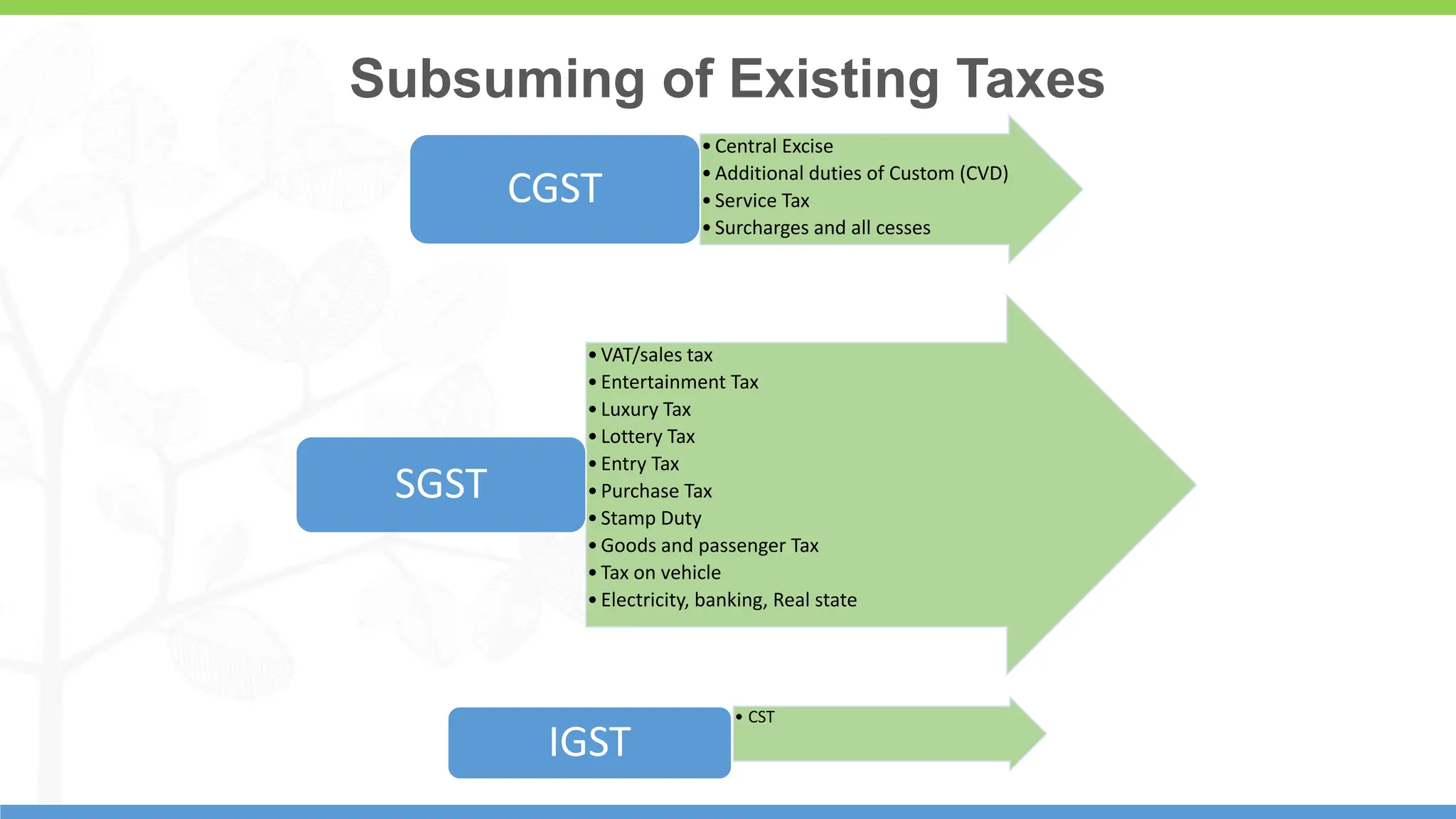

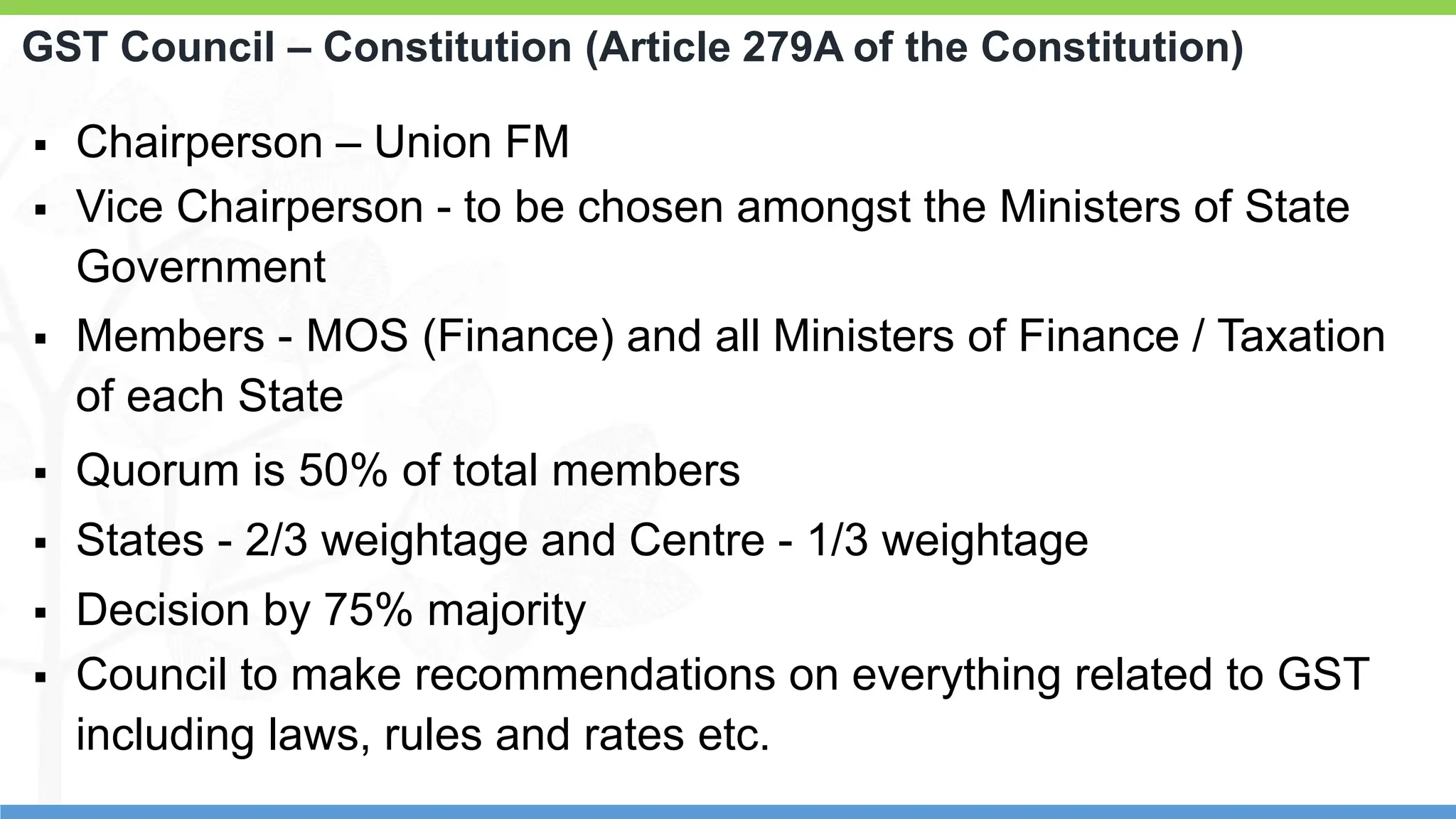

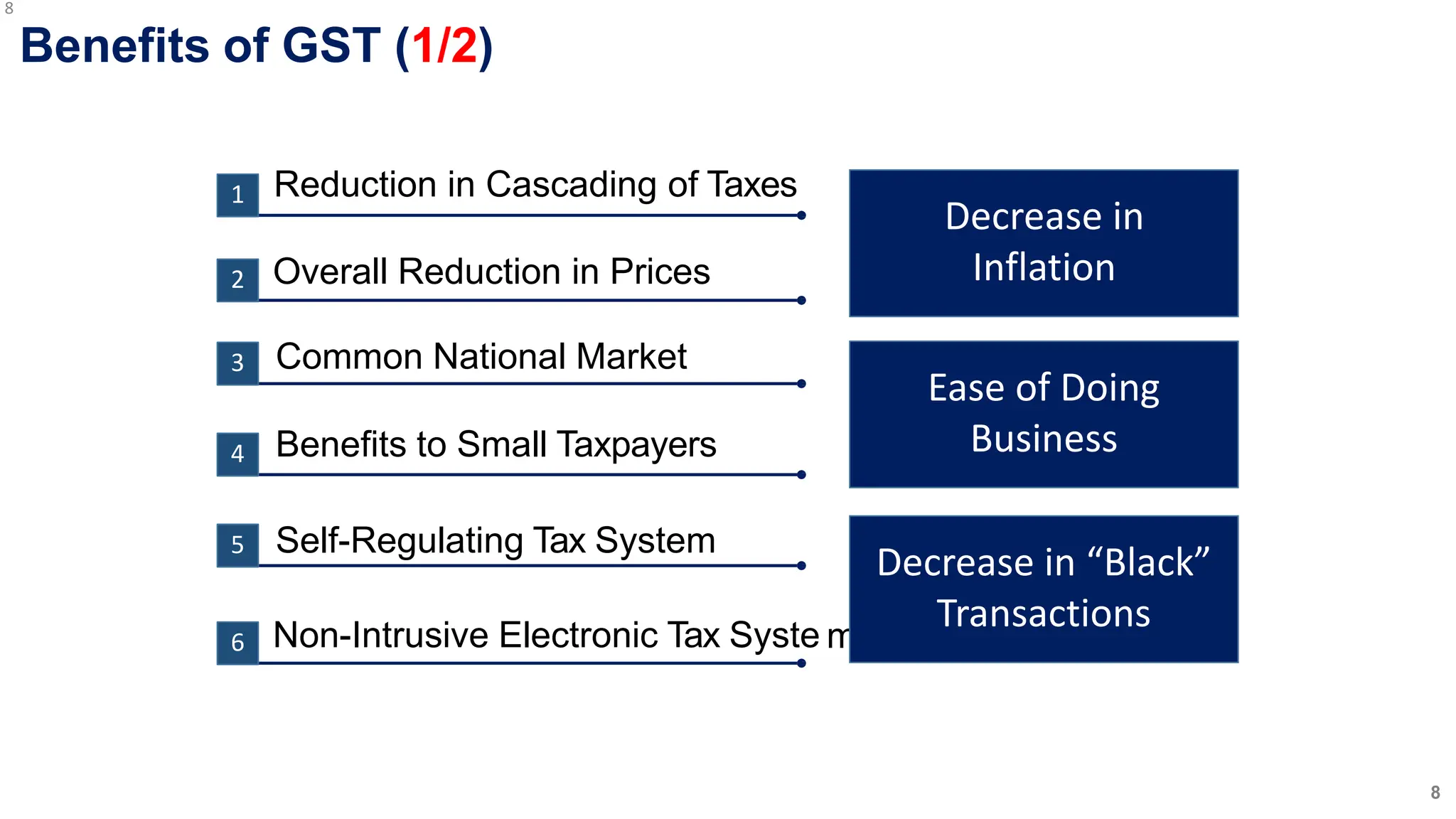

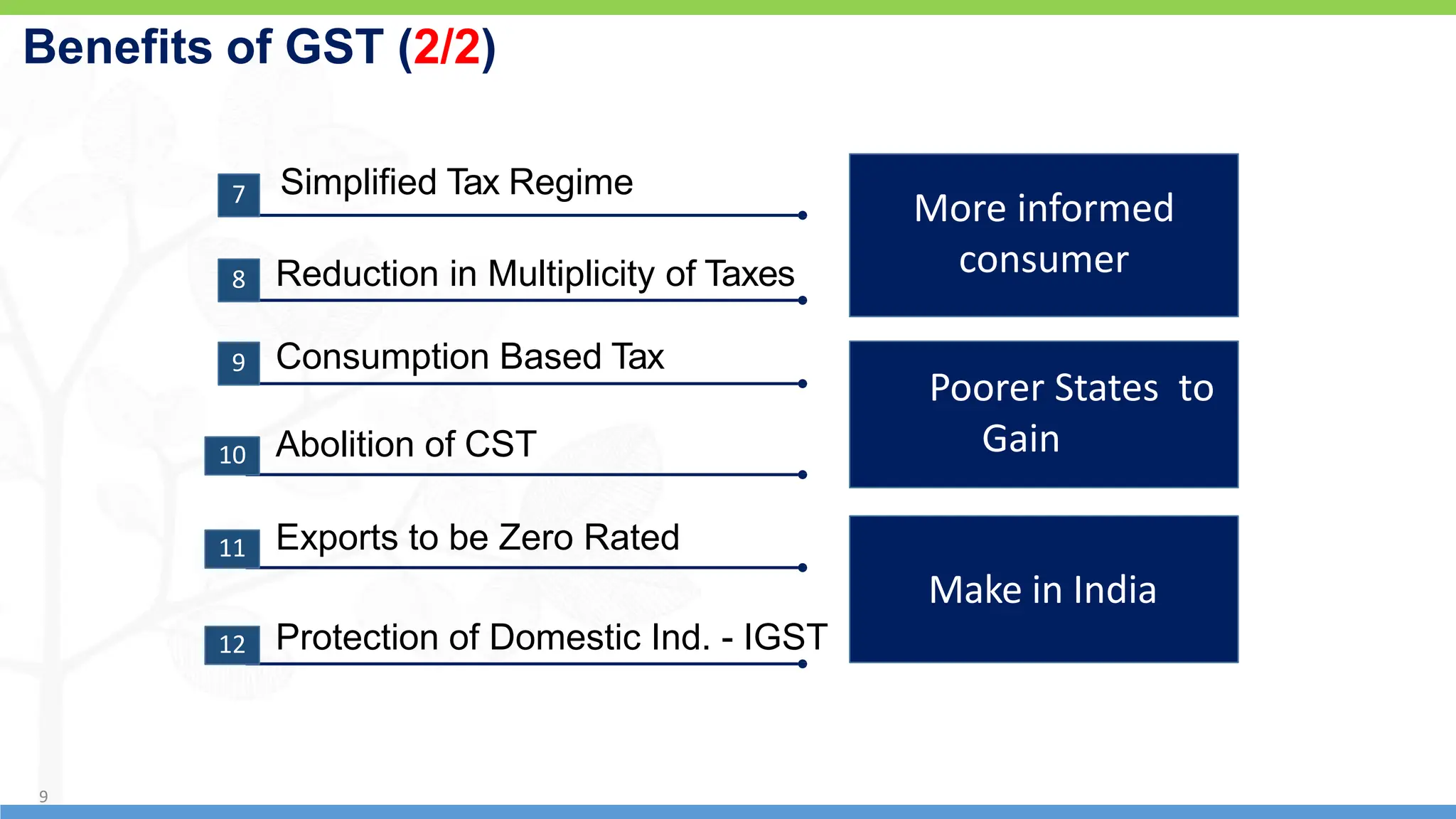

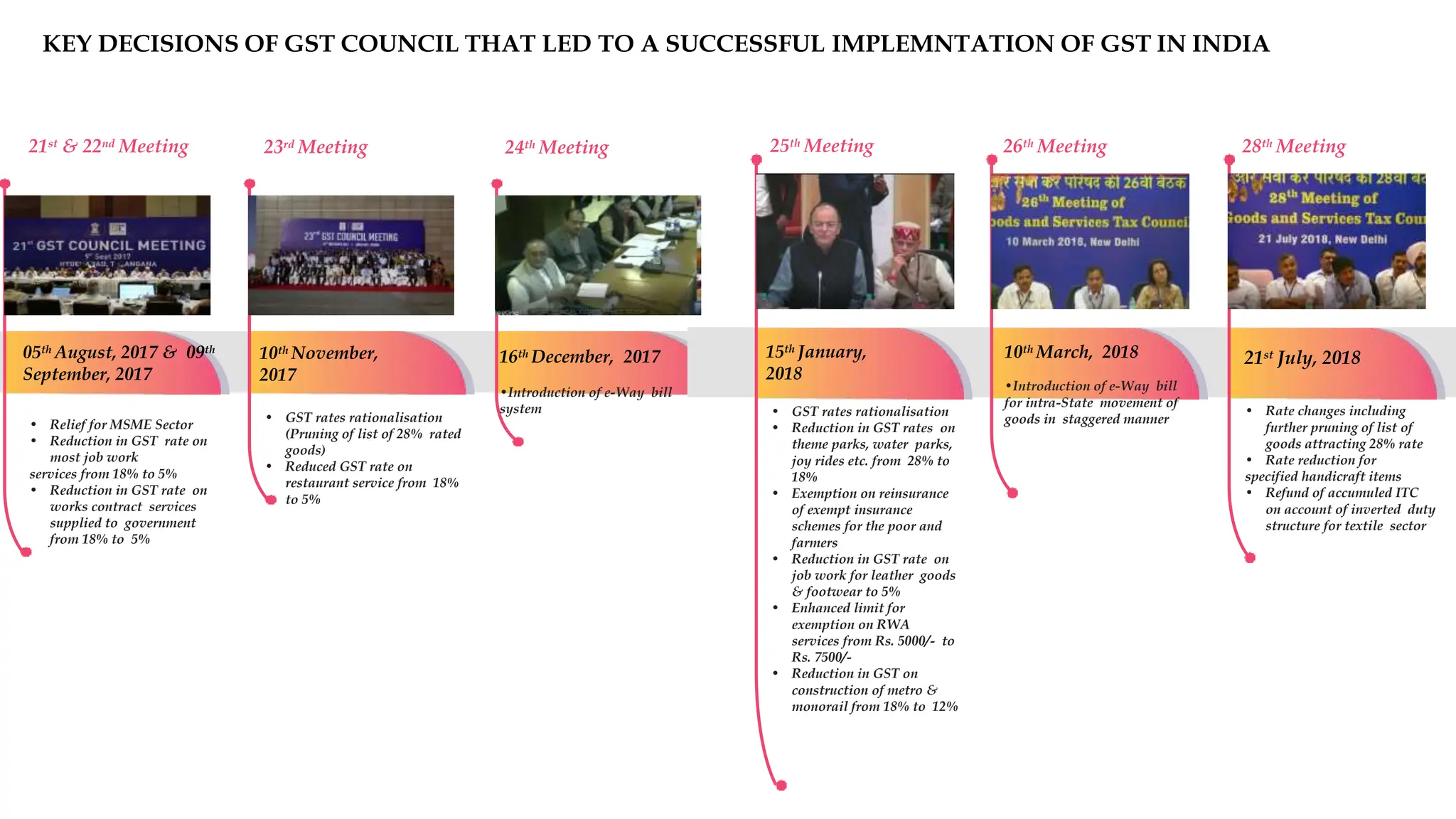

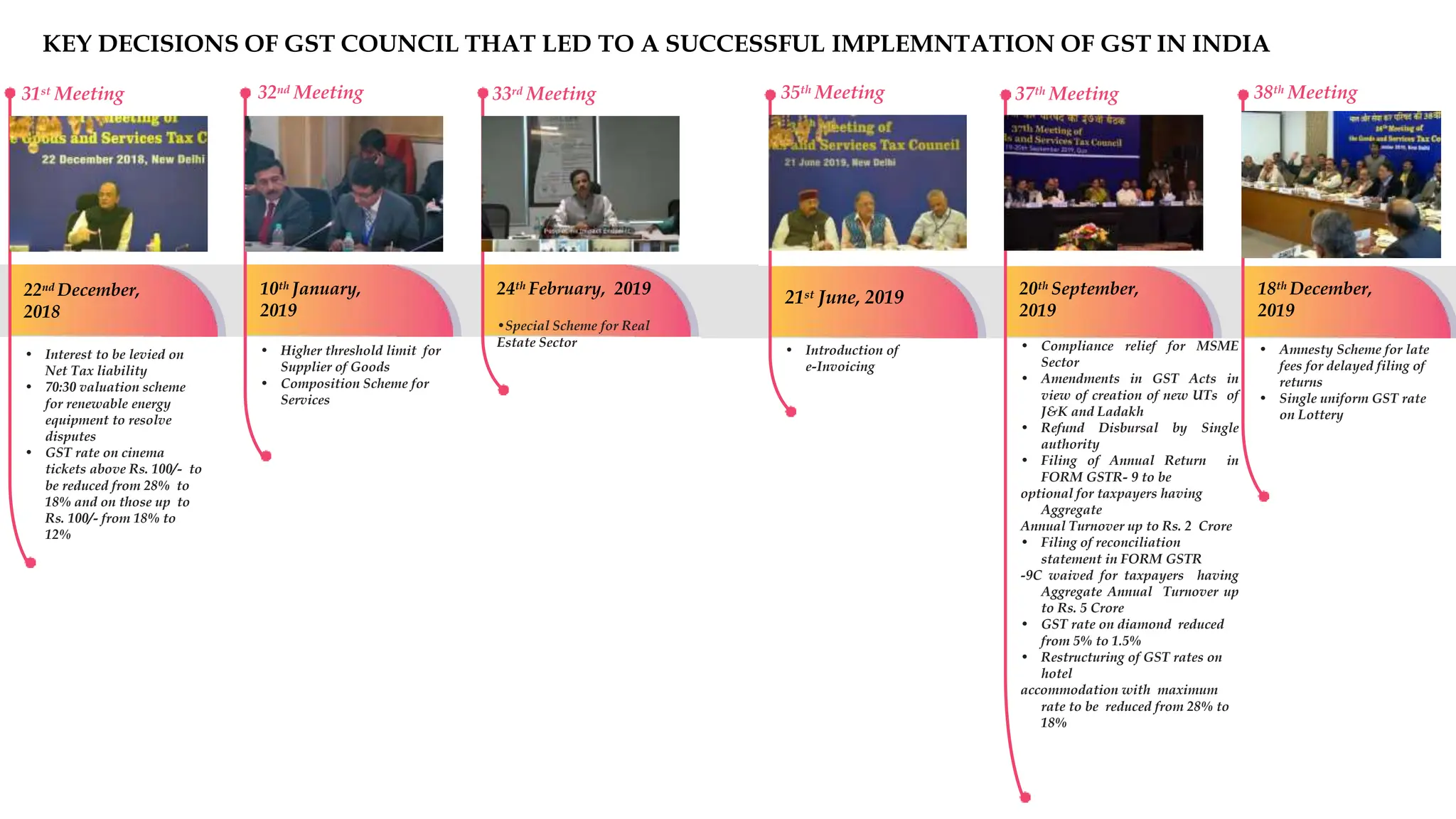

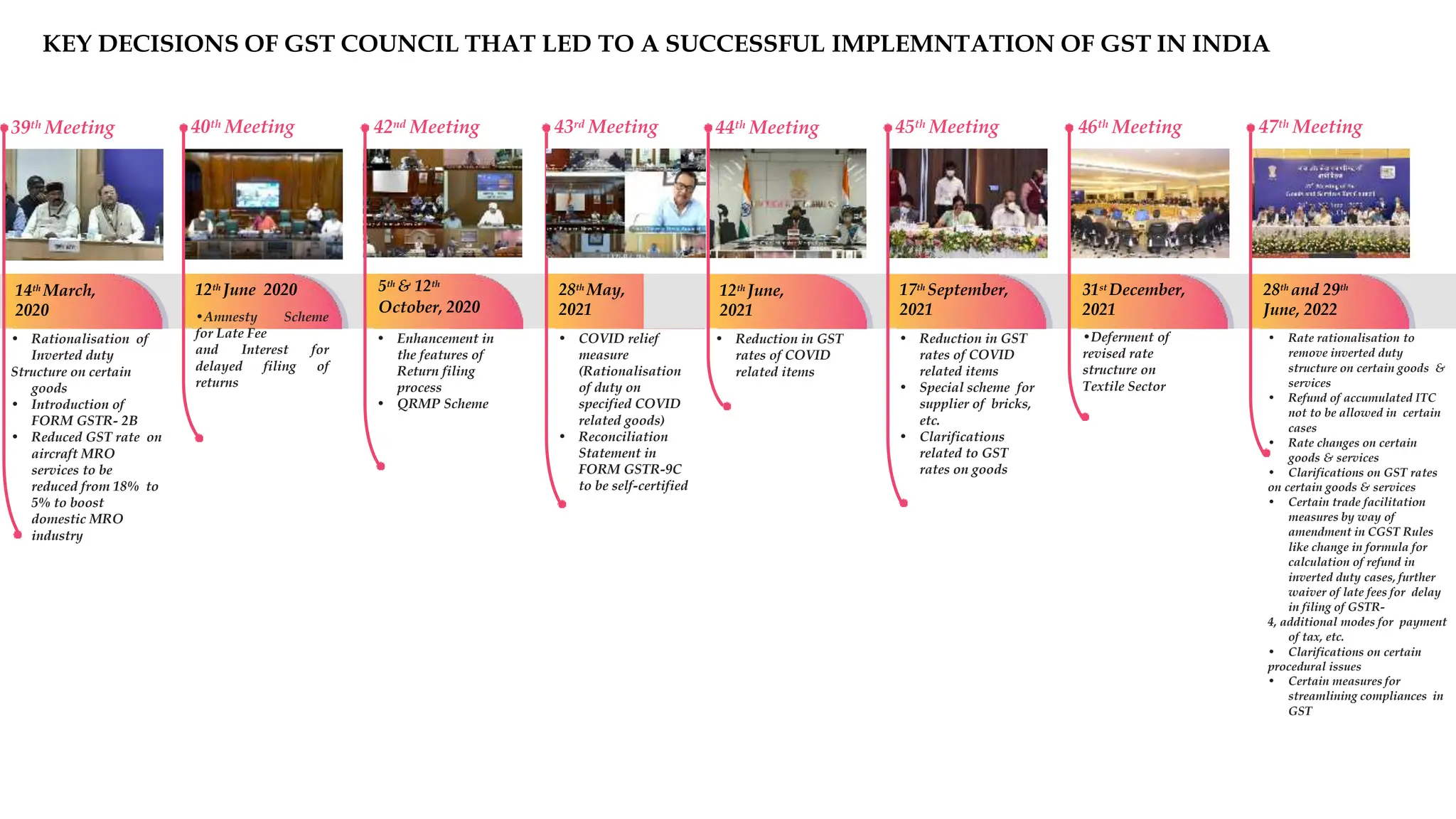

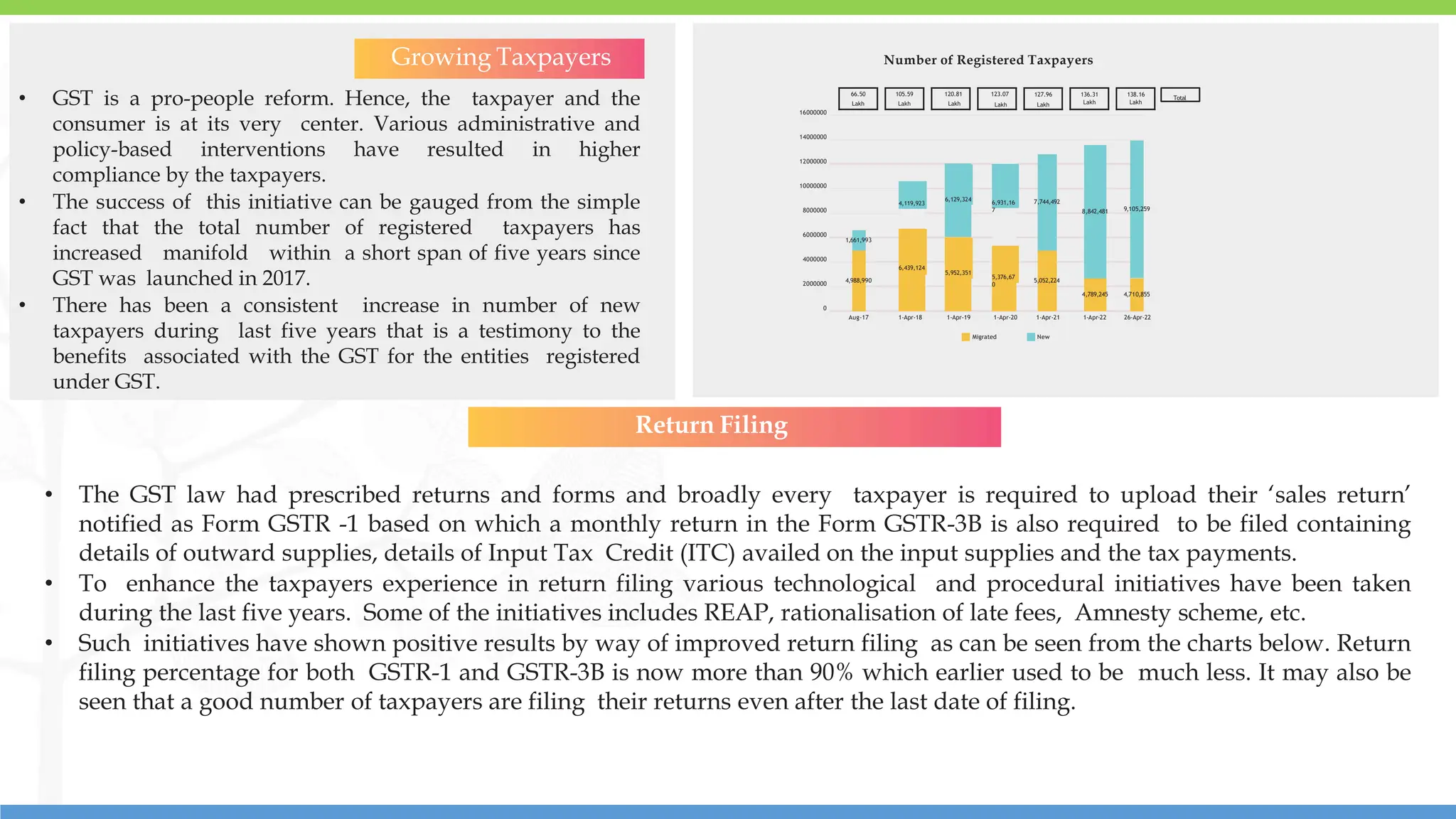

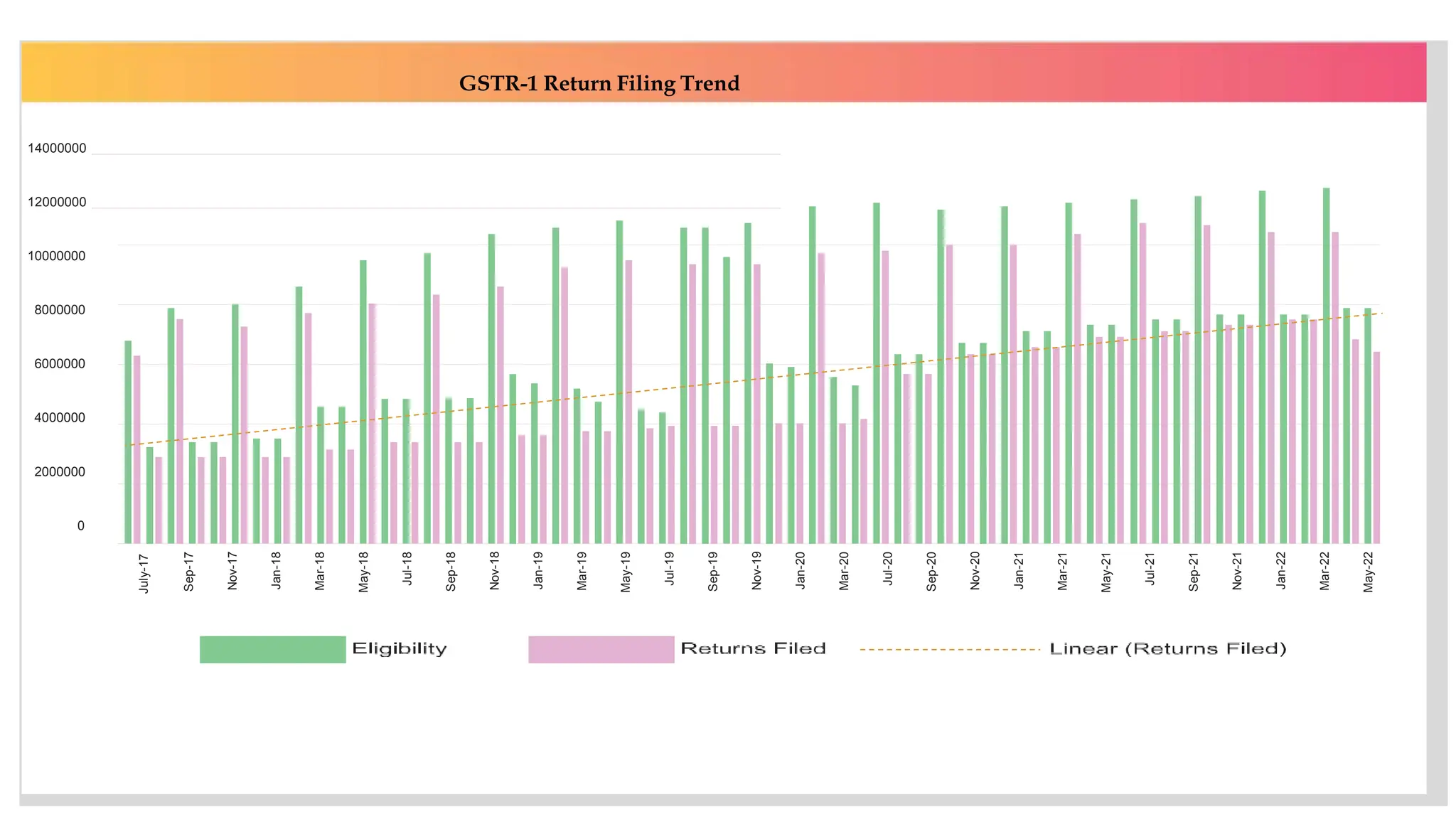

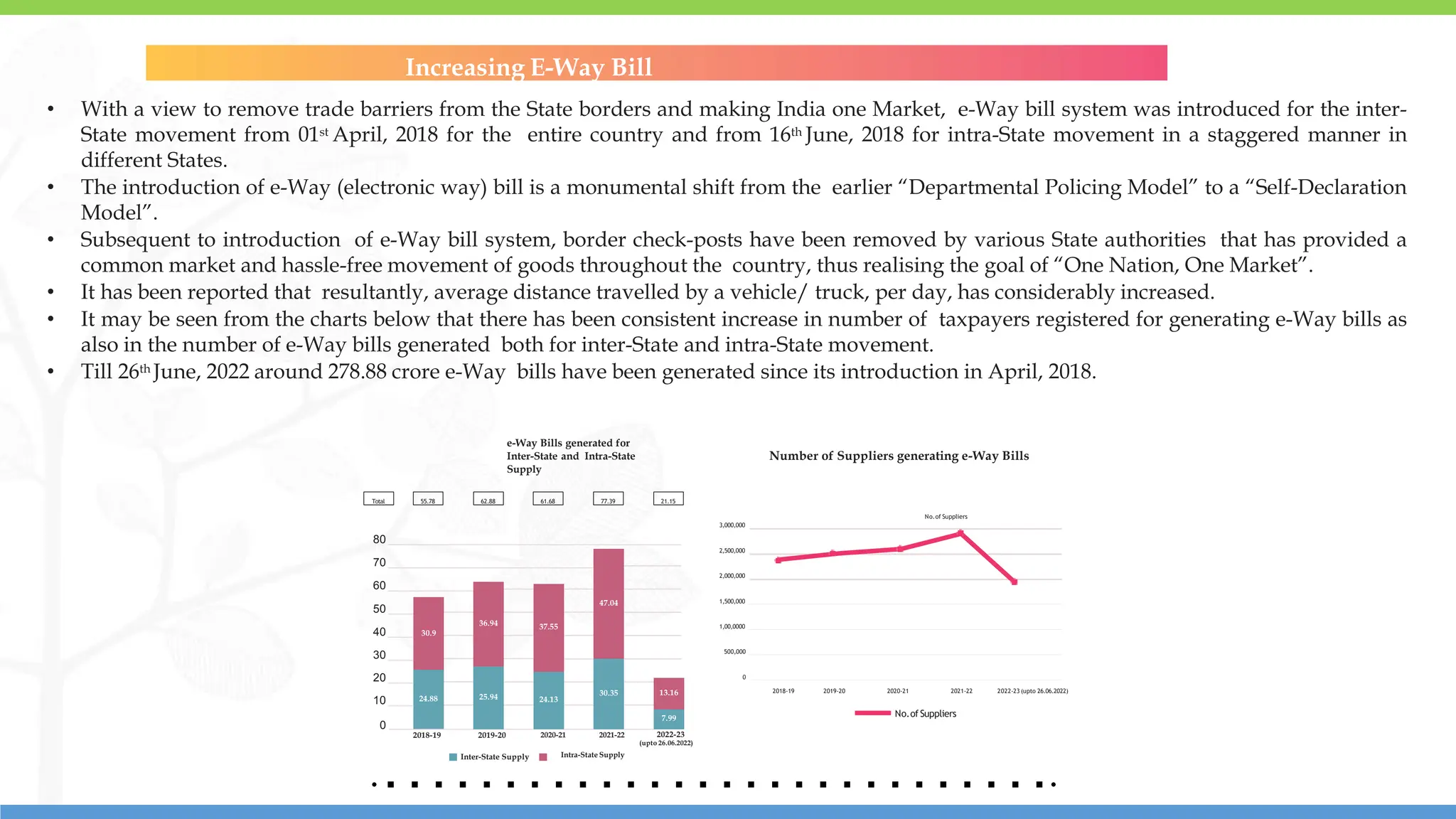

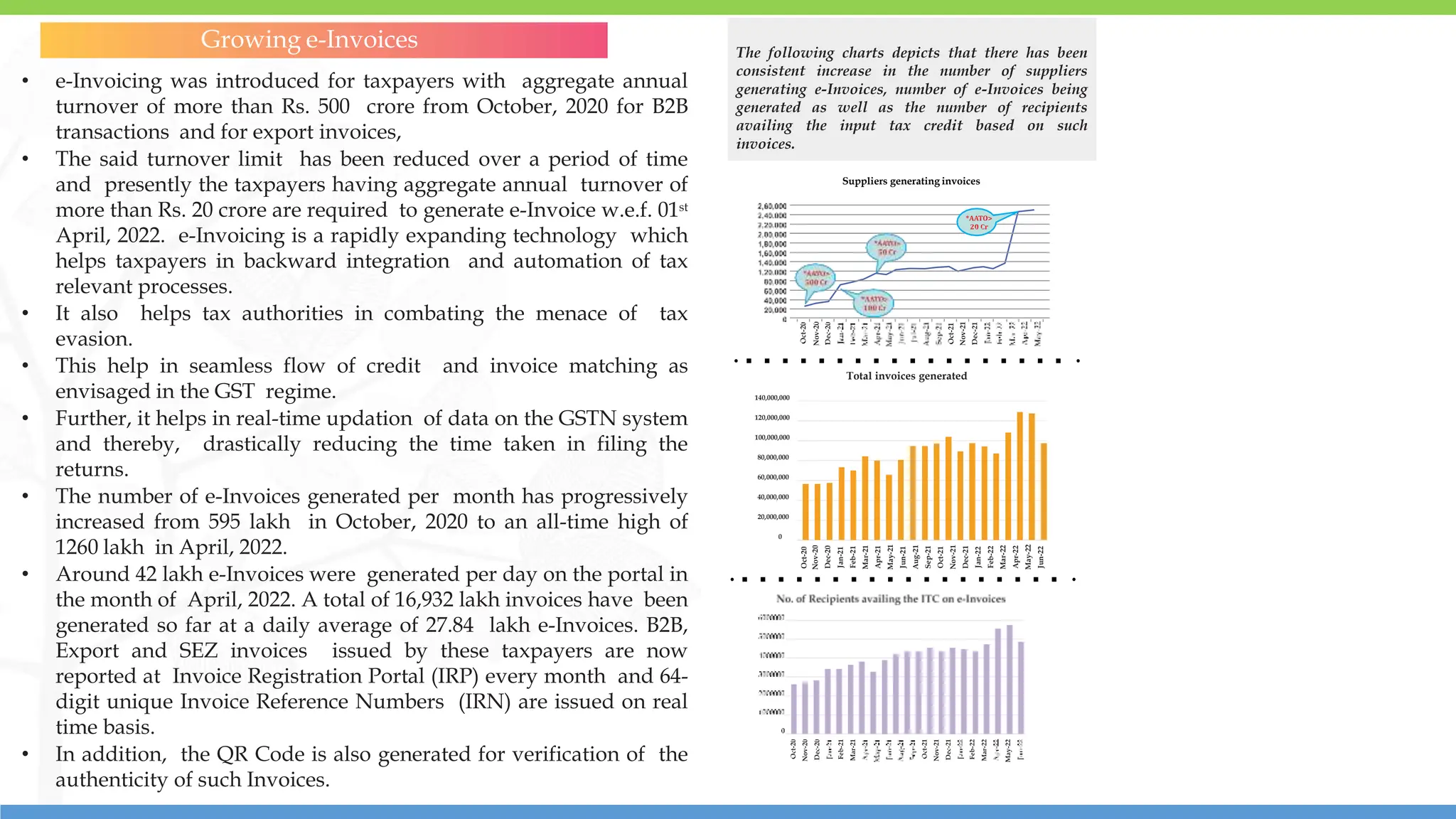

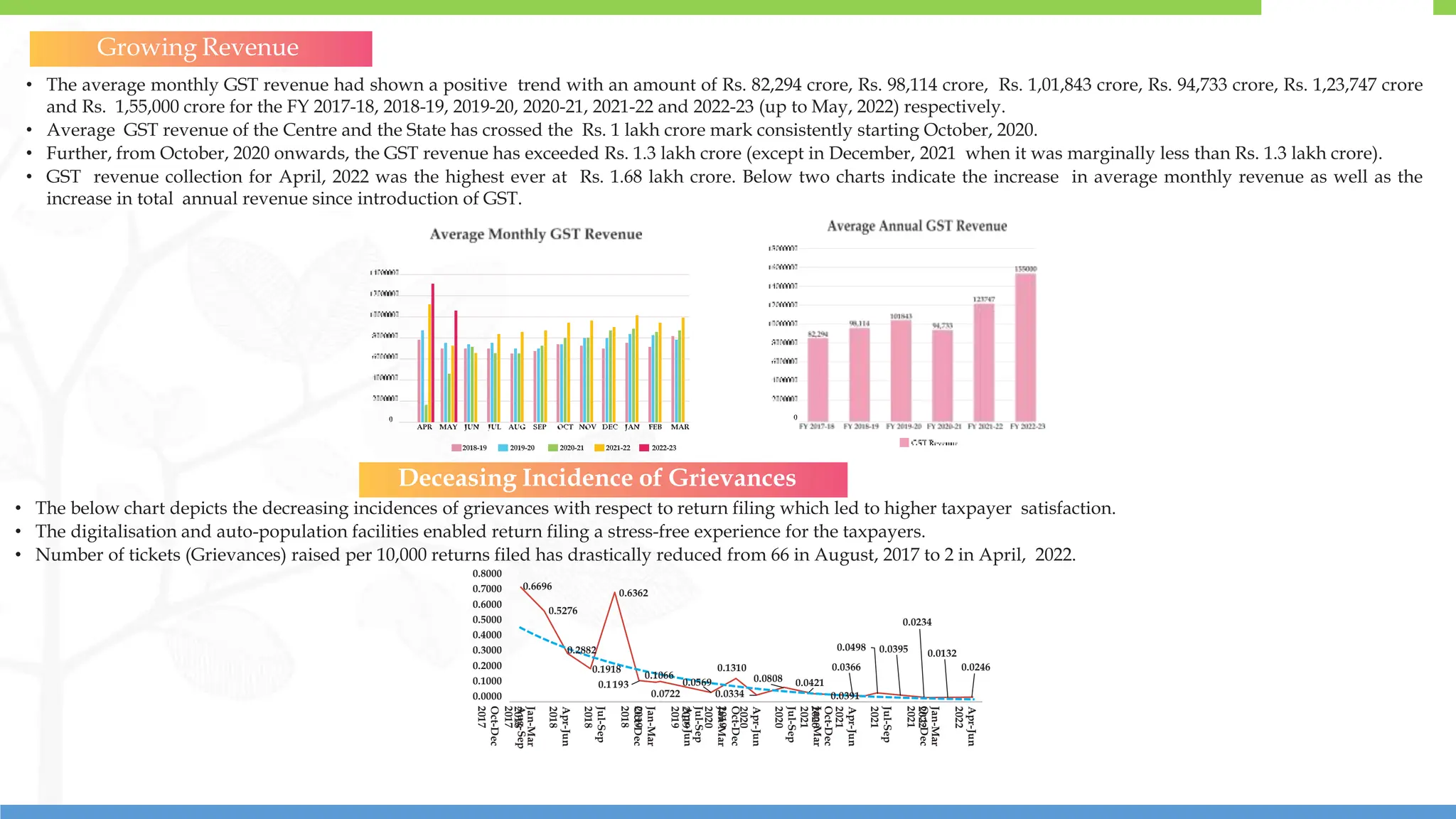

The document outlines the history and structure of the Goods and Services Tax (GST) in India, highlighting its introduction, phases of implementation, and various tax components including CGST, SGST, and IGST. It further discusses the significant impact of GST on tax compliance, ease of doing business, increased tax revenue, and the benefits to consumers and businesses, alongside the operational adjustments made post-launch. Additionally, it reviews the continuous improvements and adaptations made by the GST Council in response to economic changes and stakeholder feedback since its implementation in 2017.