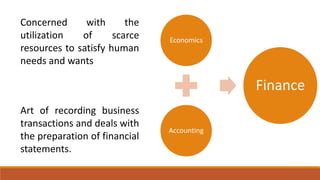

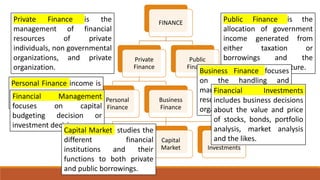

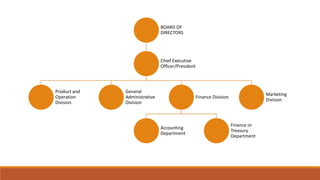

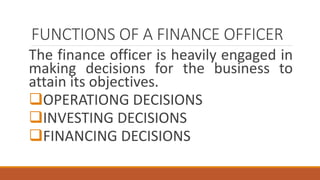

Finance involves the management of money, banking, investments, and credit. It includes private finance like personal and business finance as well as public finance. Business finance has areas like financial management, capital markets, and financial investments. A finance officer's qualifications include knowledge of accounting and economics, understanding of operations and statistics, technical experience, strong communication and relationship skills, and ethical behavior.