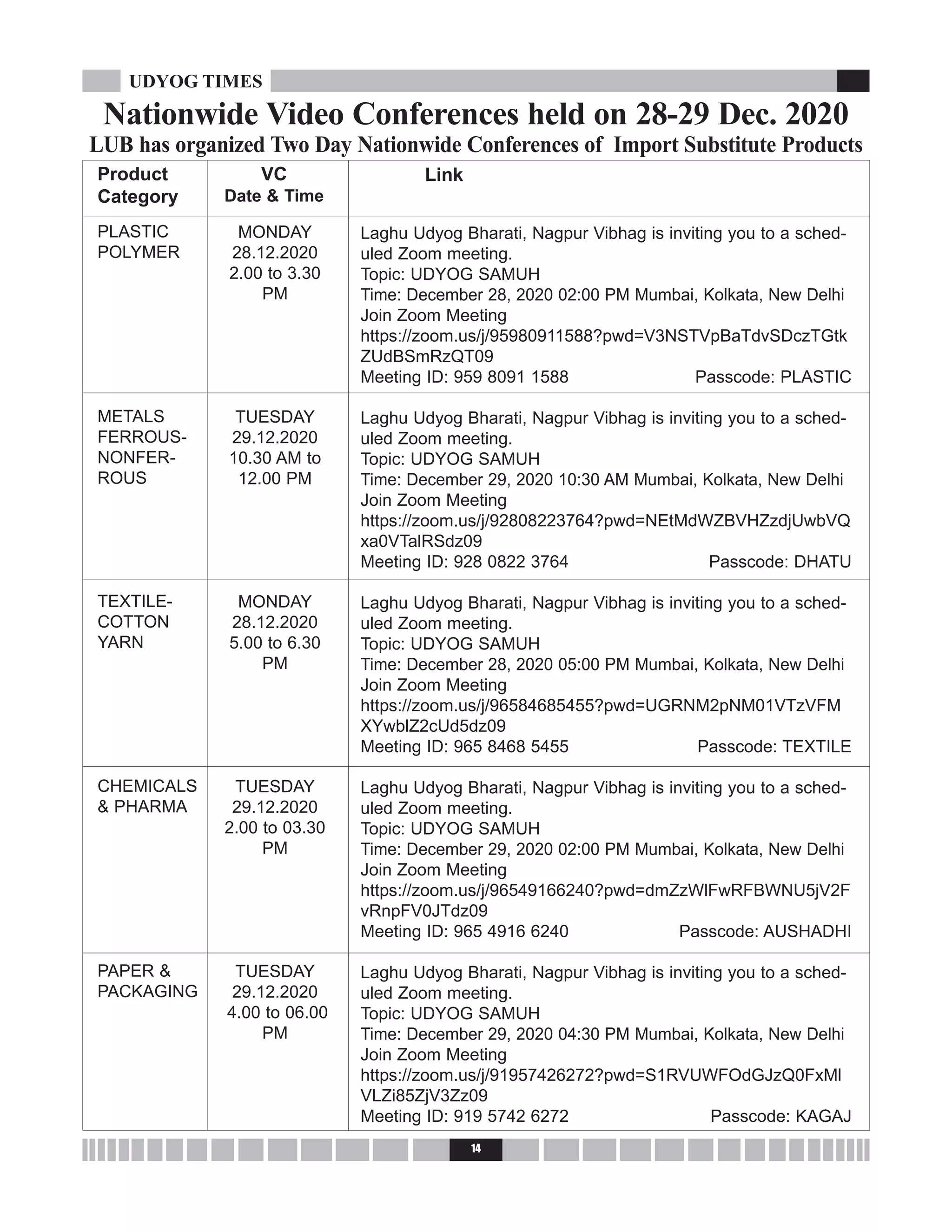

The document is the January 2021 issue of 'Udyog Times,' focusing on the upcoming union budget and high expectations from the MSME sector amid the ongoing pandemic. It discusses the need for enhanced collateral-free loan limits and easing of foreign exchange regulations to support MSMEs and boost foreign investments. There is a call for professional financial institutions to support the sector's growth and alleviate the economic pressures faced by small and medium-sized businesses.