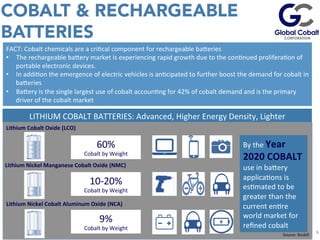

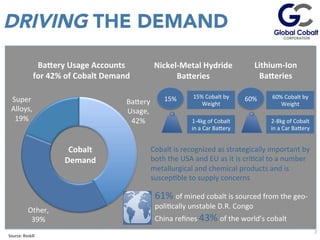

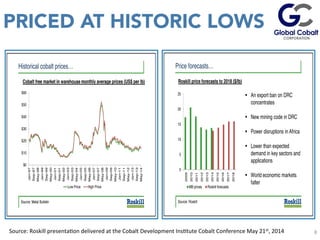

Global Cobalt Corp. presents forward-looking statements regarding its projects in cobalt exploration and development, focusing on past production and expectations for future performance. The document emphasizes the risks and uncertainties involved in mining and mineral exploration, including financing, geological interpretation, and government regulations. It highlights the significance of cobalt in rechargeable batteries, noting a growing demand driven by technological advancements and sustainability efforts.

![Regarding

Forward-‐Looking

Statements

This

presentaJon

includes

certain

“forward-‐looking

statements”

and

“forward-‐looking

informaJon”

within

the

meaning

of

applicable

securiJes

laws,

concerning

the

business,

operaJons

and

financial

performance

and

condiJon

of

the

Company.

All

statements,

other

than

statements

of

historical

fact,

are

forward-‐looking

statements.

Forward-‐looking

statements

are

frequently,

but

not

always,

idenJfied

by

words

such

as

“plans”,

“expects”,

“anJcipates”,

“believes”,

“intends”,

“esJmates”,

“potenJal”,

“possible”

and

similar

expressions,

or

statements

that

events,

condiJons

or

results

“will”,

“may”,

“could”,

or

“should”

occur

or

be

achieved.

Forward-‐looking

statements

contained

in

this

presentaJon

include

statements

with

respect

to:

expectaJons

regarding

the

potenJal

mineralizaJon

and

geological

merits

of

the

Company’s

projects,

including

the

Karakul

Project

and

the

Werner

Lake

Project;

the

Company’s

goals

regarding

development

of

the

Karakul

Project

and

regarding

raising

capital

and

conducJng

further

exploraJon

and

development

of

its

projects;

the

Company’s

proposed

plans

for

advancing

its

projects,

including

drilling

and

other

exploraJon

work;

expectaJons

regarding

the

conJnuity

of

mineral

deposits,

including

in

relaJon

to

adjacent

or

other

properJes

(including

producing

or

past-‐producing

properJes)

that

are

in

the

vicinity

or

same

region

as

the

Company’s

projects;

expectaJons

regarding

any

environmental

issues

that

may

affect

planned

or

future

exploitaJon

and

exploraJon

programs;

mineral

exploitaJon

and

exploraJon

program

cost

esJmates;

statements

with

respect

to

the

future

price

of

cobalt

and

other

metals;

Jming

and

compleJon

of

geological

studies

and

reports;

receipt

and

Jming

of

the

necessary

exploitaJon

permits

and

other

third

party

approvals;

and

government

regulaJon

of

mineral

exploraJon

and

development

operaJons

in

Russia.

EsJmates

of

mineral

resources

and

mineral

reserves

may

also

consJtute

forward-‐looking

statements

and

informaJon

in

that

they

represent

esJmates

of

mineralizaJon

that

may

be

encountered

if

mining

is

commenced,

and/or

economic

viability

of

such

mineralizaJon.

Forward-‐looking

statements

involve

various

risks

and

uncertainJes.

There

can

be

no

assurance

that

such

statements

will

prove

to

be

accurate,

and

actual

results

and

future

events

could

differ

materially

from

those

anJcipated

in

such

statements.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

our

expectaJons

include

the

uncertainJes

involving

the

need

for

addiJonal

financing

to

explore

and

develop

properJes

and

availability

of

financing

in

the

debt

and

capital

markets;

uncertainJes

involved

in

the

interpretaJon

of

drilling

results

and

geological

tests

and

the

esJmaJon

of

reserves

and

resources;

the

need

for

cooperaJon

of

government

agencies

and

naJve

groups

in

the

development

and

operaJon

of

properJes;

the

need

to

obtain

permits

and

governmental

approvals;

risks

of

construcJon

and

mining

projects

such

as

accidents,

equipment

breakdowns,

bad

weather,

non-‐compliance

with

environmental

and

permit

requirements,

unanJcipated

variaJon

in

geological

structures,

ore

grades

or

recovery

rates;

unexpected

cost

increases;

fluctuaJons

in

metal

prices

and

currency

exchange

rates;

the

impact

of

economic

sancJons

on

companies

conducJng

business

in

Russia;

and

other

risk

and

uncertainJes

disclosed

in

reports

and

documents

filed

by

the

Company

with

applicable

securiJes

regulatory

authoriJes

from

Jme

to

Jme.

The

forward-‐looking

statements

made

herein

reflect

the

Company’s

beliefs,

opinions

and

projecJons

on

the

date

the

statements

are

made.

Except

as

required

by

law,

the

Company

assumes

no

obligaJon

to

update

the

forward-‐looking

statements

of

beliefs,

opinions,

projecJons,

or

other

factors,

should

they

change.

Regarding

Historical

Resources

Note

that

the

C1

and

C2

resource

esJmates

shown

are

historical

in

nature

and

do

not

use

categories

defined

in

Canadian

NaJonal

Instrument

43-‐101

Standards

of

Disclosure

for

Mineral

Projects

(“NI

43-‐101”)

and

accordingly

are

not

compliant

with

NI

43-‐101

or

Canadian

InsJtute

of

Mining,

Metallurgy

and

Petroleum

(“CIM”)

standards.

[The

exact

date

of

these

es=mates

is

unknown].

Historical

resource

esJmates

are

based

on

the

Russian

reserve

system

and

based

primarily

on

trench

and

prospecJng

samples

only.

These

resources

are

considered

historical

in

nature

under

NI

43-‐101

and

a

qualified

person

under

NI

43-‐101

has

not

done

sufficient

work

to

classify

the

historical

esJmate

as

current

mineral

resources.

The

Company

is

not

treaJng

the

historical

esJmate

as

current

mineral

resources.

Regarding

Mineral

Reserve

and

Resource

Es=mates

Unless

otherwise

indicated,

all

reserve

and

resource

esJmates

included

in

this

presentaJon

have

been

prepared

in

accordance

with

NI

43-‐101

and

CIM

standards.

Canadian

standards,

including

NI

43-‐101,

differ

significantly

from

the

requirements

of

the

United

States

SecuriJes

and

Exchange

Commissions

,

and

reserve

and

resource

informaJon

in

this

presentaJon

may

not

be

comparable

to

similar

informaJon

disclosed

by

U.S.

companies.

In

parJcular,

and

without

limiJng

the

generality

of

the

foregoing,

the

term

“resource”

does

not

equate

to

the

term

“‘reserves”.

Under

U.S.

standards,

mineralizaJon

may

not

be

classified

as

a

“reserve”

unless

the

determinaJon

has

been

made

that

the

mineralizaJon

could

be

economically

and

legally

produced

or

extracted

at

the

Jme

the

reserve

determinaJon

is

made.

Qualified

Person

Mr.

Paul

Sarjeant,

P.

Geo.,

is

a

Qualified

Person

as

defined

by

NI

43-‐101.

Mr.

Sarjeant

is

the

Company’s

Vice

President

ExploraJon,

and,

unless

otherwise

indicated,

has

prepared

or

supervised

the

preparaJon

of

the

technical

informaJon

contained

in

this

presentaJon

and/or

reviewed

and

approved

such

disclosure.

For

more

informaJon,

see

the

individual

technical

reports

and

news

releases

available

under

the

Company’s

profile

at

www.sedar.com

All

monetary

amounts

in

this

presentaJon

are

in

Canadian

dollars

unless

otherwise

indicated.

CAUTIONARY STATEMENTS

2](https://image.slidesharecdn.com/gcopresentation-march2015-150310163625-conversion-gate01/85/TSXV-GCO-Corporate-Presentation-March-2015-2-320.jpg)