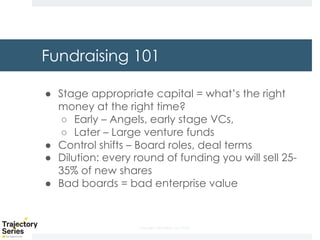

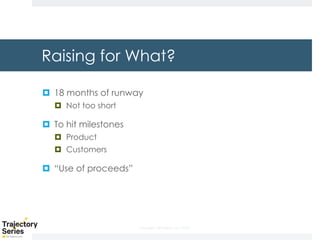

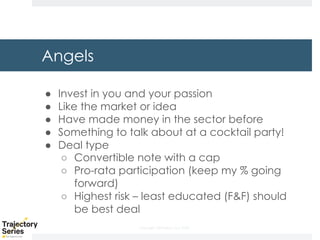

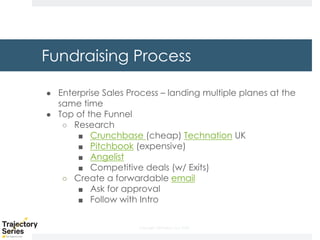

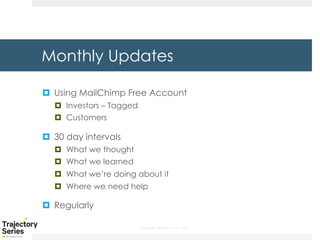

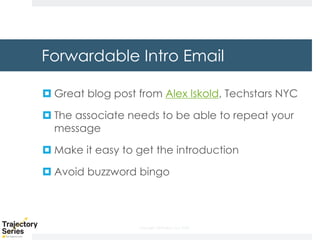

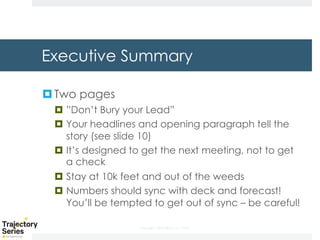

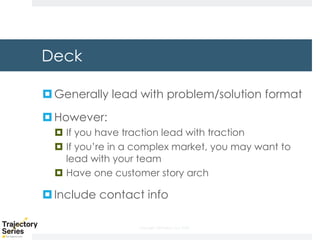

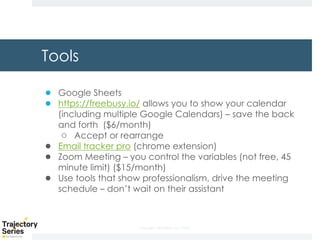

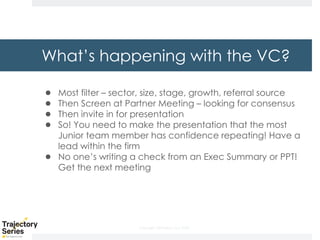

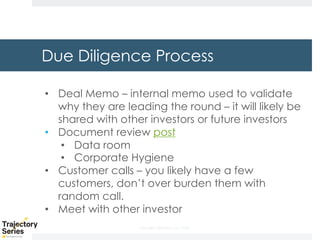

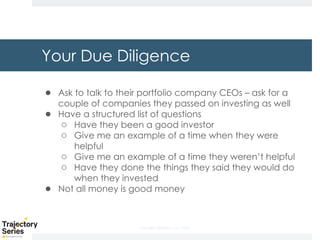

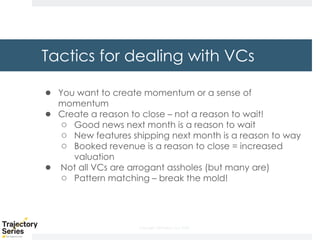

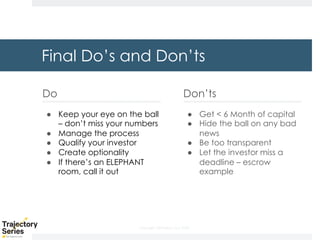

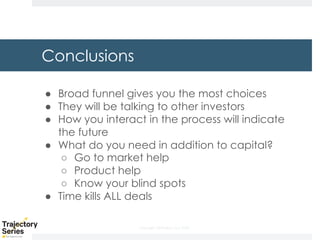

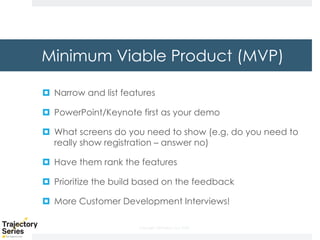

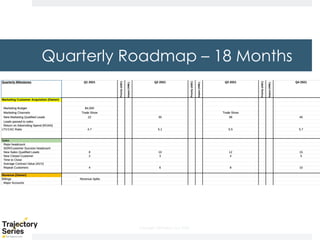

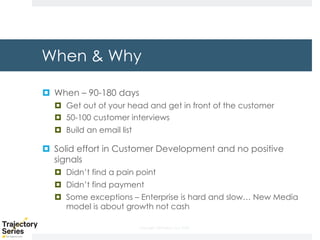

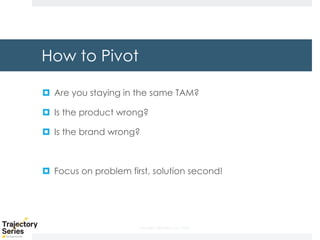

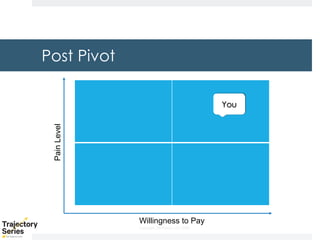

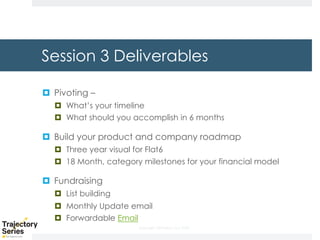

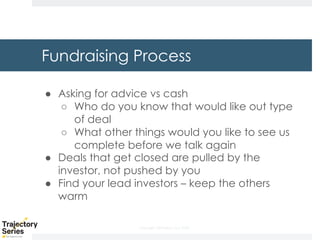

The document outlines key fundraising fundamentals for startups, including stages of investment, due diligence processes, and effective pitching strategies. It emphasizes the importance of understanding the right capital for each stage, maintaining clear communication with investors, and the significance of product vision and roadmaps. Additionally, it discusses tactics for dealing with VCs and the necessity of pivoting when necessary to meet market demands.