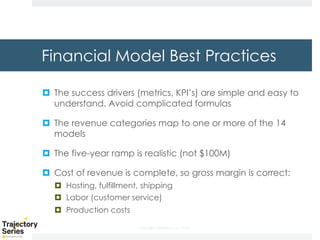

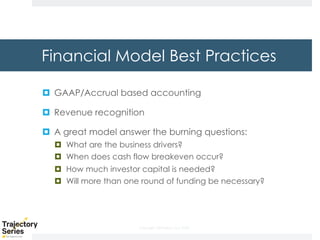

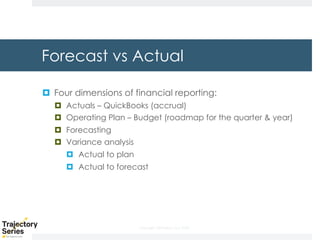

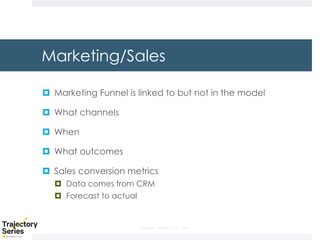

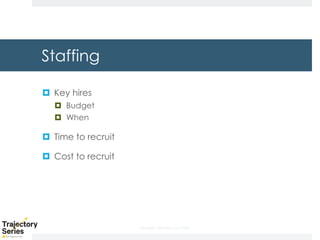

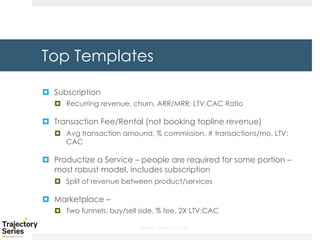

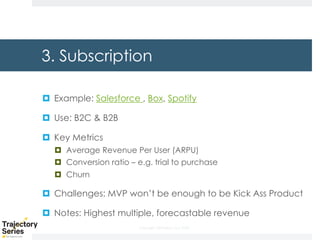

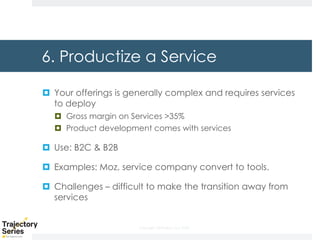

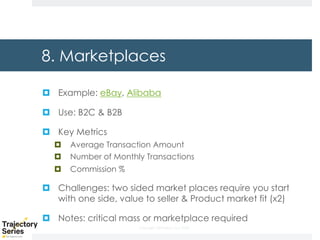

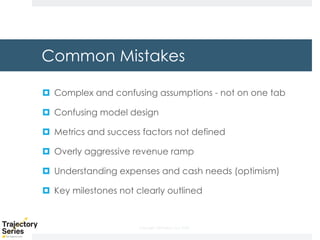

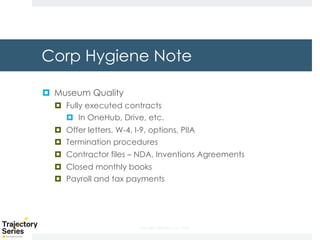

The document outlines best practices for financial modeling essential for startups, including storytelling through finance, accurate metrics, and the significance of cash flow forecasting. It provides templates for various revenue models and emphasizes avoiding common mistakes such as complex assumptions and aggressive revenue ramps. Additionally, it highlights key inputs and drivers for successful financial reporting and forecasting.