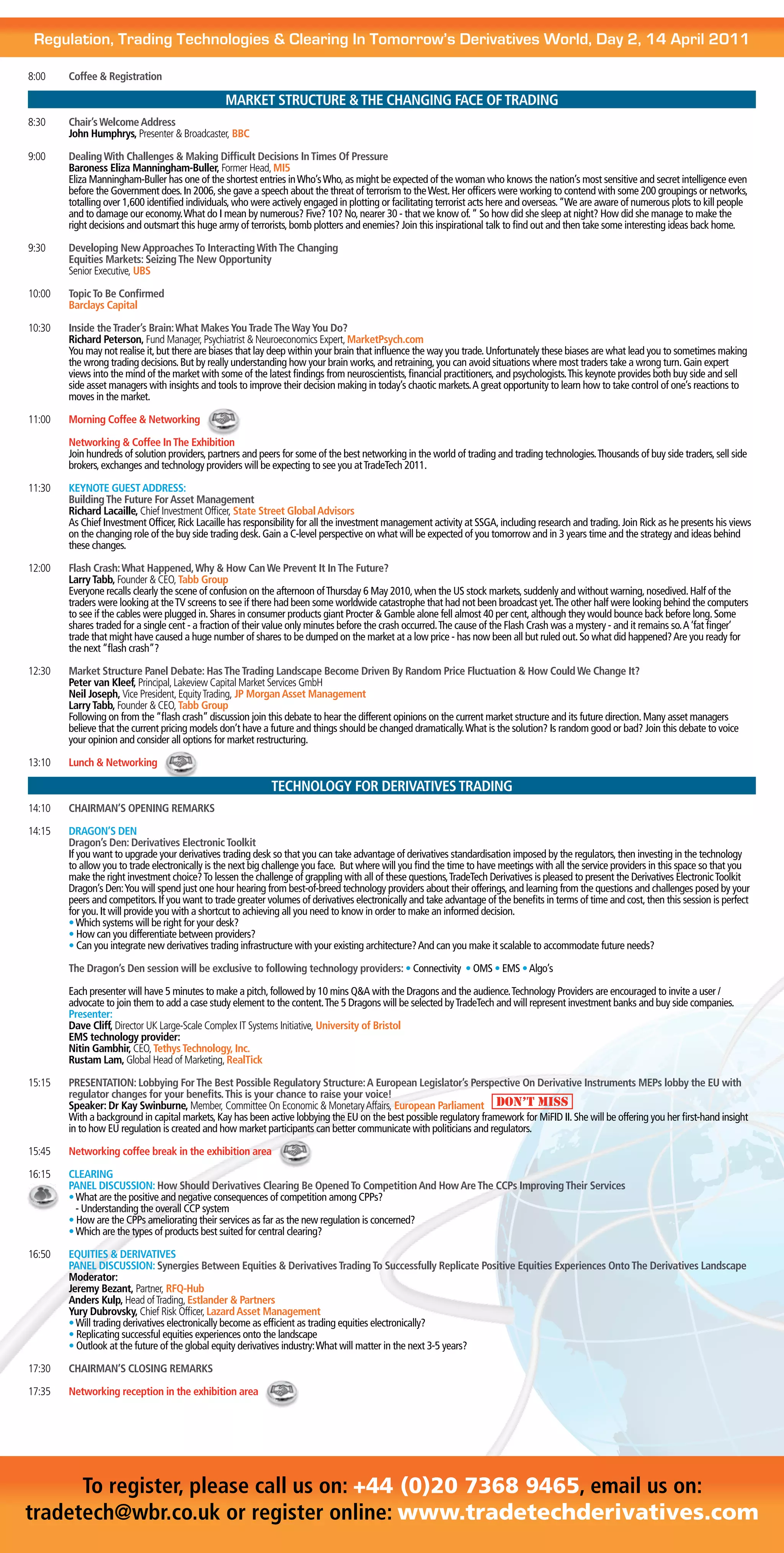

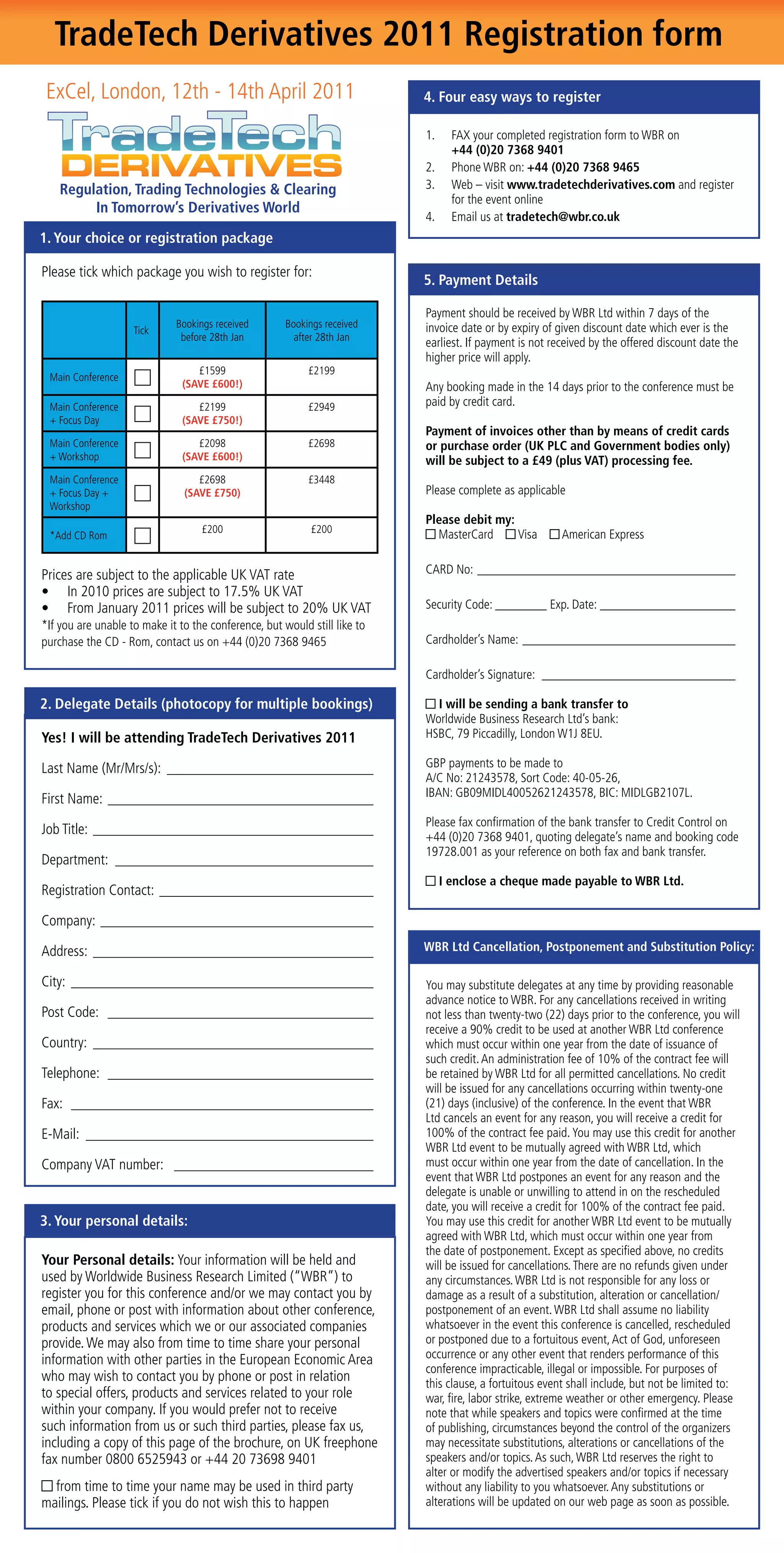

The document outlines the Tradetech Derivatives Conference, offering 35 complimentary passes for qualified buy-side heads of equity derivatives trading, emphasizing networking opportunities with industry experts and regulators. Scheduled for April 13-14, 2011, in London, the event features keynote speeches and panel discussions on future regulations, trading technologies, and the evolving landscape of equity derivatives. The conference aims to equip attendees with insights and strategies to navigate challenges and seize opportunities in the derivatives market.