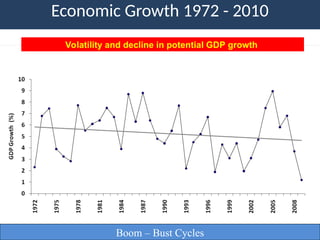

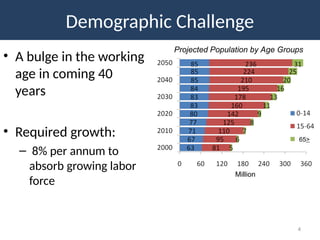

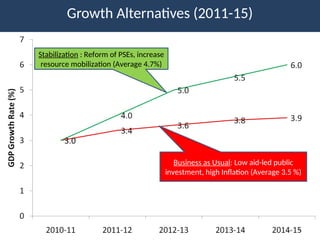

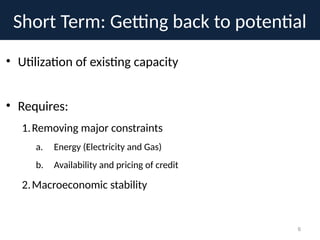

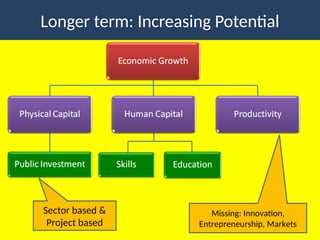

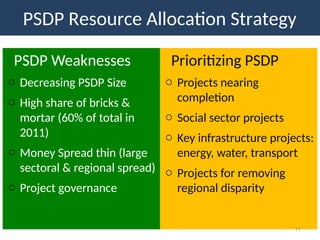

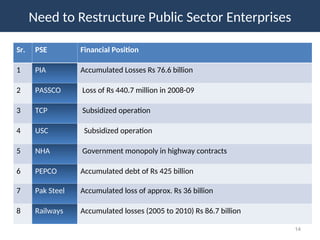

The document outlines a growth and development strategy for Pakistan, emphasizing the need for structural reforms to enhance potential GDP growth, manage public resources effectively, and focus on productivity. It identifies issues such as inadequate infrastructure, governance challenges, and the necessity of deregulating markets to stimulate innovation and entrepreneurship. Aiming for an annual growth rate of 8% is crucial to absorb the anticipated increase in the working-age population over the next 40 years.