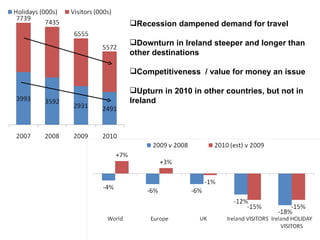

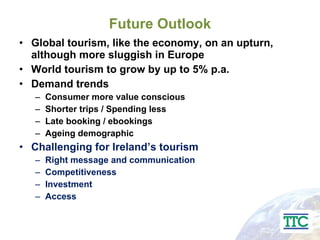

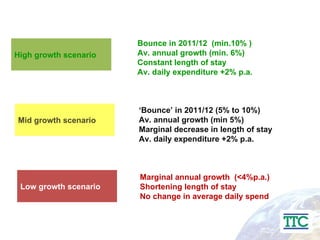

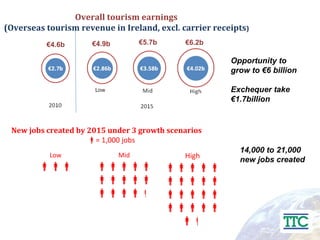

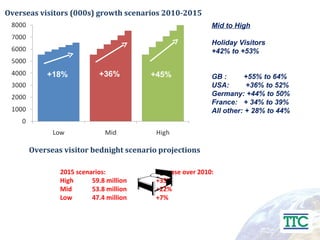

The document discusses the significant downturn in Ireland's tourism sector, highlighting a 2 million decline in overseas visitors and a €1.7 billion drop in foreign earnings. It outlines potential growth scenarios for the tourism industry from 2010 to 2015, including the possibility of new jobs and increased overall tourism earnings. A proposed 10-point plan aims to improve Ireland's image, enhance marketing strategies, and focus on key markets to facilitate recovery.

![[email_address]](https://image.slidesharecdn.com/itictourismopportunitylaunch27jan2011-12964818777188-phpapp02/85/Tourism-Opportunity-Launch-27-Jan-2011-11-320.jpg)