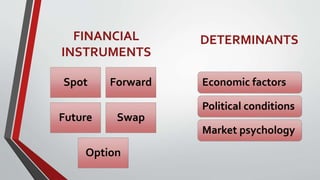

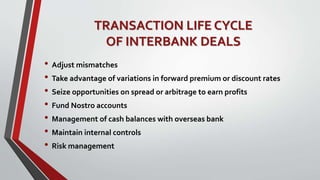

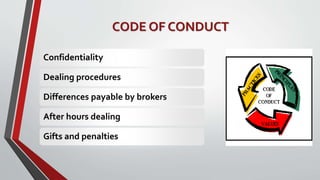

This document summarizes international banking operations and foreign exchange trading. It discusses what an international bank is and how it benefits both individuals and companies. It then explains the foreign exchange market, including the various financial instruments, market participants, practices, and transaction lifecycle. It also describes how banks engage in forex trading and manage the associated risks. Finally, it discusses relevant codes of conduct and ethical issues for international banking operations.