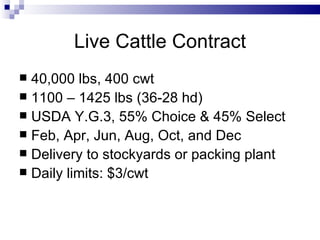

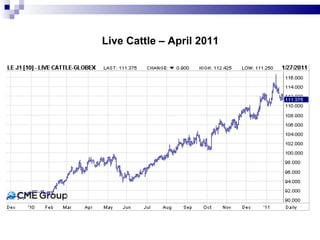

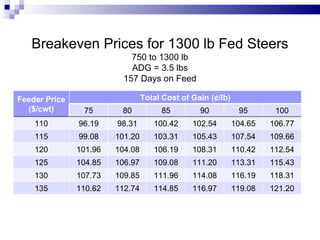

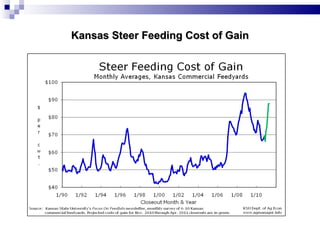

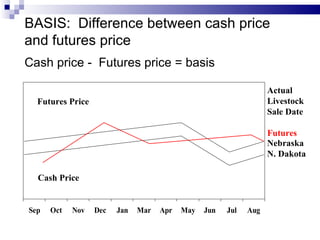

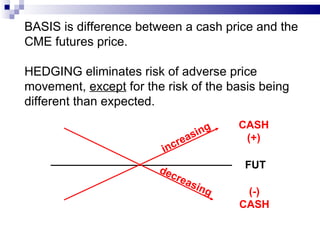

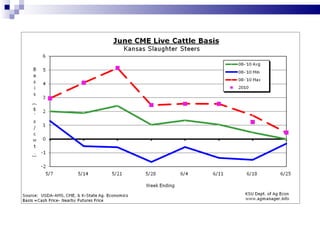

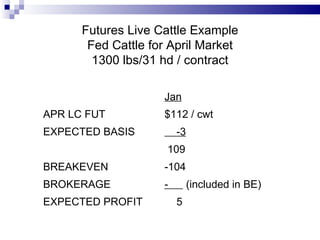

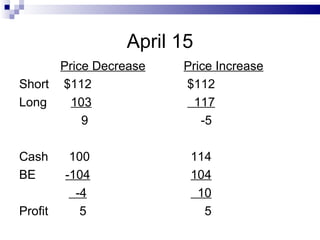

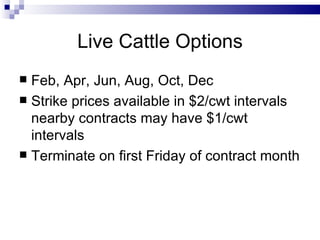

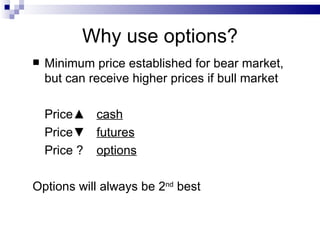

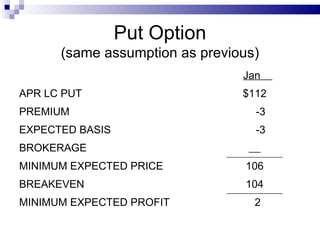

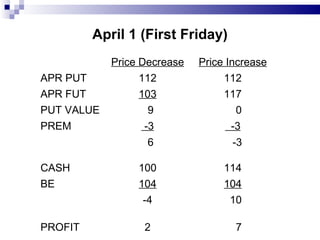

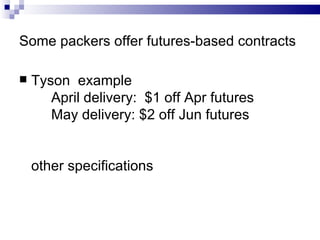

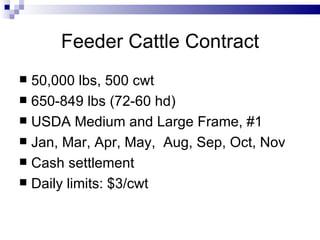

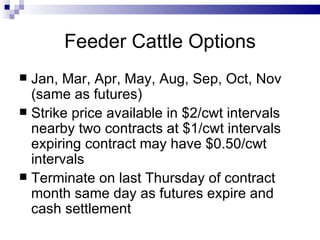

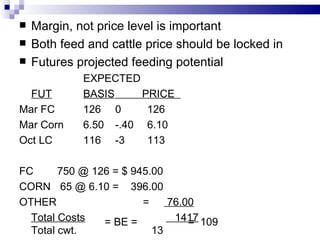

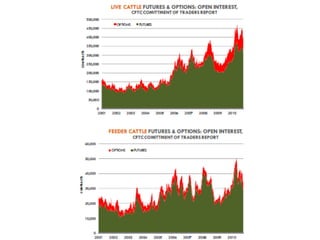

The document provides an overview of futures and options in the cattle market, detailing live and feeder cattle contracts, pricing, and breakeven analysis for feeding operations. It includes information on cost of gain, hedging strategies, and the use of options to manage price risk. Additionally, it emphasizes the importance of understanding margins and pricing dynamics in making trading decisions.