Recommended

PPTX

Public financial administration and budgeting (1).pptx

PPTX

Chapter three Budgeting Budgeting in the Public Sector (IPSAS 24)

PDF

Public Administration: Public Fiscal Administration

PDF

Public Budgeting Systems 9th Robert D Lee Jr Ronald W Johnson

PPT

Chapter 9- public finance for BBA

DOCX

Public funding, Budgeting –Policy at National Level

DOCX

Public funding, Budgeting –Policy at National Level

PPTX

PUBLIC SECTOR BUDGETINGpublic sector accounting under bachelors of commerce

PDF

Topic 6-Budgeting and budgetary control in the public sector.pdf

PDF

Public Sector Accounting- Lecture.-1.pdf

PDF

Public Finance PPT.pdf the best one for public economics

PPT

Module 1.3 - The Budget and Budget Preparation.ppt

PPTX

PDF

10 Principles of Budgetary Governance

PPTX

public finance for undergraduate students.pptx

PDF

Public Budgeting: Policy, Process and Politics (Aspa Classics) – Ebook PDF Ve...

PDF

(eBook PDF) Budget Tools: Financial Methods in the Public Sector 2nd Edition

PPTX

76910d966c8542986191b005071943232328ce.pptx

PPTX

PPSX

Performance based budgeting by sumayya naseem optometrist, mmsph student abas...

PPTX

Citizens Budget Guide & results - Shield

PPTX

PPT

Public Budgeting Presentation

PPS

Chapter 13: The Lack of a Budgetary Theory (PA-510)

PPTX

PPT

Chapter 13: The Lack of a Budgetary Theory

PDF

Public Participation - Lorena RIVERO DEL PASO, Mexico

PDF

Download full ebook of e instant download pdf

PPT

This ppt is about portfolio management analysis

PPTX

This presentation is about macro economics issues

More Related Content

PPTX

Public financial administration and budgeting (1).pptx

PPTX

Chapter three Budgeting Budgeting in the Public Sector (IPSAS 24)

PDF

Public Administration: Public Fiscal Administration

PDF

Public Budgeting Systems 9th Robert D Lee Jr Ronald W Johnson

PPT

Chapter 9- public finance for BBA

DOCX

Public funding, Budgeting –Policy at National Level

DOCX

Public funding, Budgeting –Policy at National Level

PPTX

PUBLIC SECTOR BUDGETINGpublic sector accounting under bachelors of commerce

Similar to This presentation is about public sector

PDF

Topic 6-Budgeting and budgetary control in the public sector.pdf

PDF

Public Sector Accounting- Lecture.-1.pdf

PDF

Public Finance PPT.pdf the best one for public economics

PPT

Module 1.3 - The Budget and Budget Preparation.ppt

PPTX

PDF

10 Principles of Budgetary Governance

PPTX

public finance for undergraduate students.pptx

PDF

Public Budgeting: Policy, Process and Politics (Aspa Classics) – Ebook PDF Ve...

PDF

(eBook PDF) Budget Tools: Financial Methods in the Public Sector 2nd Edition

PPTX

76910d966c8542986191b005071943232328ce.pptx

PPTX

PPSX

Performance based budgeting by sumayya naseem optometrist, mmsph student abas...

PPTX

Citizens Budget Guide & results - Shield

PPTX

PPT

Public Budgeting Presentation

PPS

Chapter 13: The Lack of a Budgetary Theory (PA-510)

PPTX

PPT

Chapter 13: The Lack of a Budgetary Theory

PDF

Public Participation - Lorena RIVERO DEL PASO, Mexico

PDF

Download full ebook of e instant download pdf

More from KhanAghaWardak

PPT

This ppt is about portfolio management analysis

PPTX

This presentation is about macro economics issues

PPT

This presentation is about cost-benefit analysis

PPTX

This presentation is about capital budgeting

PPT

This presentation is about financial statement

PPTX

This presentation is about cost-benefit analysis

PPT

This ppt is about portfolio management analysis

PPT

This ppt is about portfolio management analysis

PPT

This presentation is about cost-benefit analysis

PPTX

Reading-13-Introduction-to-Geo-Politics-2023-Syllabus.pptx

PPTX

This presentation is about macro economics issues

PPT

This presentation is about macro economics issues

PPTX

This presentation is about macro economics issues

PPT

This presentation is about capital aseet pricing model

PPTX

This presentation is about capital budgeting

PPT

This presentation is about financial statement

PPT

This presentation is about cost-benefit analysis

PPT

This presentation is about capital aseet pricing model

PPT

This ppt is about portfolio management analysis

PPTX

This presentation is about capital budgeting

Recently uploaded

PDF

WRN_Investor_Presentation_January 2026.pdf

PDF

Js jony - How to Get a Verified Gmail Account Quickly and Safely.pdf

PDF

1767784681592.pdf Richard Smith's five statements of his pension

PDF

Buy Old Gmail Accounts for All Countries Supported.pdf

PDF

Sukhi Jolly Framework for Infrastructure-Driven Growth

PDF

The 17 Sites Guide to Buy Twitter Accounts in 2025.pdf

PDF

Where to Buying Old Gmail Accounts with Real Age and Trusted Understanding (1...

PDF

Ghana Card now compulsory for every bank transaction - Here are the new stric...

PDF

Your Guide to Buying Verified Chime Bank Accounts Effectively.pdf

PDF

TriStar Gold - Corporate Presentation: January 2026

PDF

How to Buy Verified Payoneer Accounts for Seamless International ...

PDF

Buy Old Gmail accounts 2025 — Guide & Risks to know.pdf

PDF

VA 570 - Thermal Mass Flow Meter For Consumption Measurement

PDF

Elevate Your Trading Game with Verified Binance Accounts.

PDF

Your Guide to Buying Old Gmail Accounts in the US.pdf

PDF

Fruit Production Farming and Exporting Business Plan in Bahir Dar Town, Amhar...

PDF

Adam and Daniel Kaplan - A Head For Entrepreneurship

PPTX

SECURITY IN THE CONTEMPORARY WORLD PPT.pptx

DOCX

Buy Gmail Accounts_ Step-by-Step Guide for 2025

PDF

David Link Accenture - A Key Strategist At Accenture

This presentation is about public sector 1. 2. Introduction

Government process of planning,

authorizing, and controlling resources

Focus on service delivery, equity, and

public welfare.

Different from private sector (profit-

oriented)

3. Objectives of Public Sector Budgeting

• Resource Allocation – funding national priorities

• Economic Stabilization – manage inflation,

unemployment, growth

• Income Redistribution – progressive taxation and

welfare

• Accountability & Transparency – efficient use of

public money

• Fiscal Discipline – sustainable debt management

4. Types of Budgets

• Line-Item Budget – detailed expenditures, easy

control

• Performance Budget – links resources to results

• Program Budget – resources to specific programs

• Zero-Based Budgeting – all expenditures justified

yearly

• Capital vs. Recurrent Budget – investment vs. daily

expenses

5. The Budget Cycle

• Formulation – ministries propose, cabinet

approves

• Legislation – parliament debates and approves

• Execution – ministries spend approved funds

• Evaluation & Audit – audit, reporting,

feedback

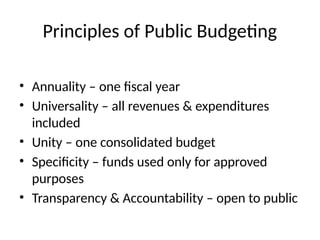

6. Principles of Public Budgeting

• Annuality – one fiscal year

• Universality – all revenues & expenditures

included

• Unity – one consolidated budget

• Specificity – funds used only for approved

purposes

• Transparency & Accountability – open to public

7. Challenges in Public Budgeting

• Political influence and populism

• Revenue shortages in developing economies

• Corruption and weak controls

• Unrealistic projections and fiscal deficits

• Balancing short-term vs. long-term

development

8. Emerging Trends

• Participatory Budgeting – citizen involvement

• Gender-Responsive Budgeting – equitable

resource allocation

• Green Budgeting – climate and environmental

goals

• Digital Public Financial Management – e-

budgeting and transparency

9. Summary

• Public budgeting balances resources, policies,

and priorities

• Not just technical, but political and social

process

• Ensures development, equity, and

accountability