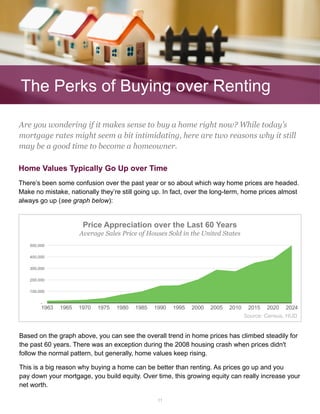

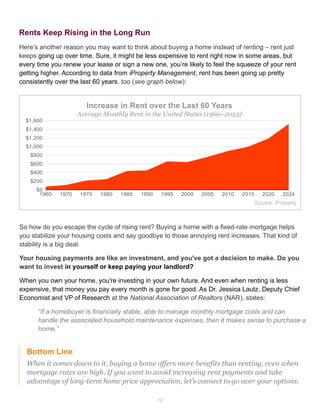

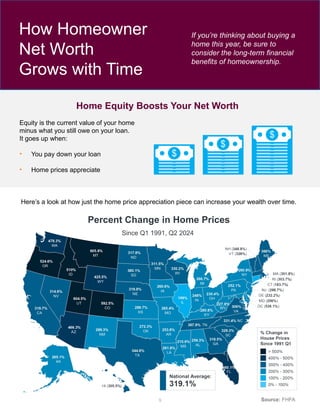

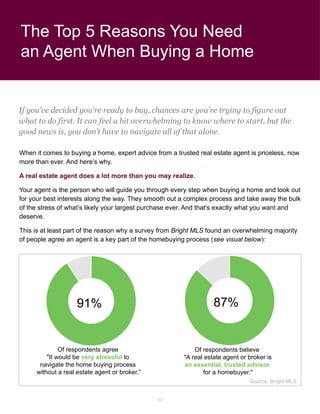

The document outlines key considerations for homebuyers in 2024, emphasizing the importance of focusing on owning a home rather than renting, and highlights current opportunities in the housing market. It discusses increased inventory, new home construction, and moderating home prices, while also cautioning against the common mistake of trying to time the market. Additionally, it stresses the benefits of working with a real estate agent to navigate the buying process effectively.