The document describes several insurance technology solutions from Xuber including:

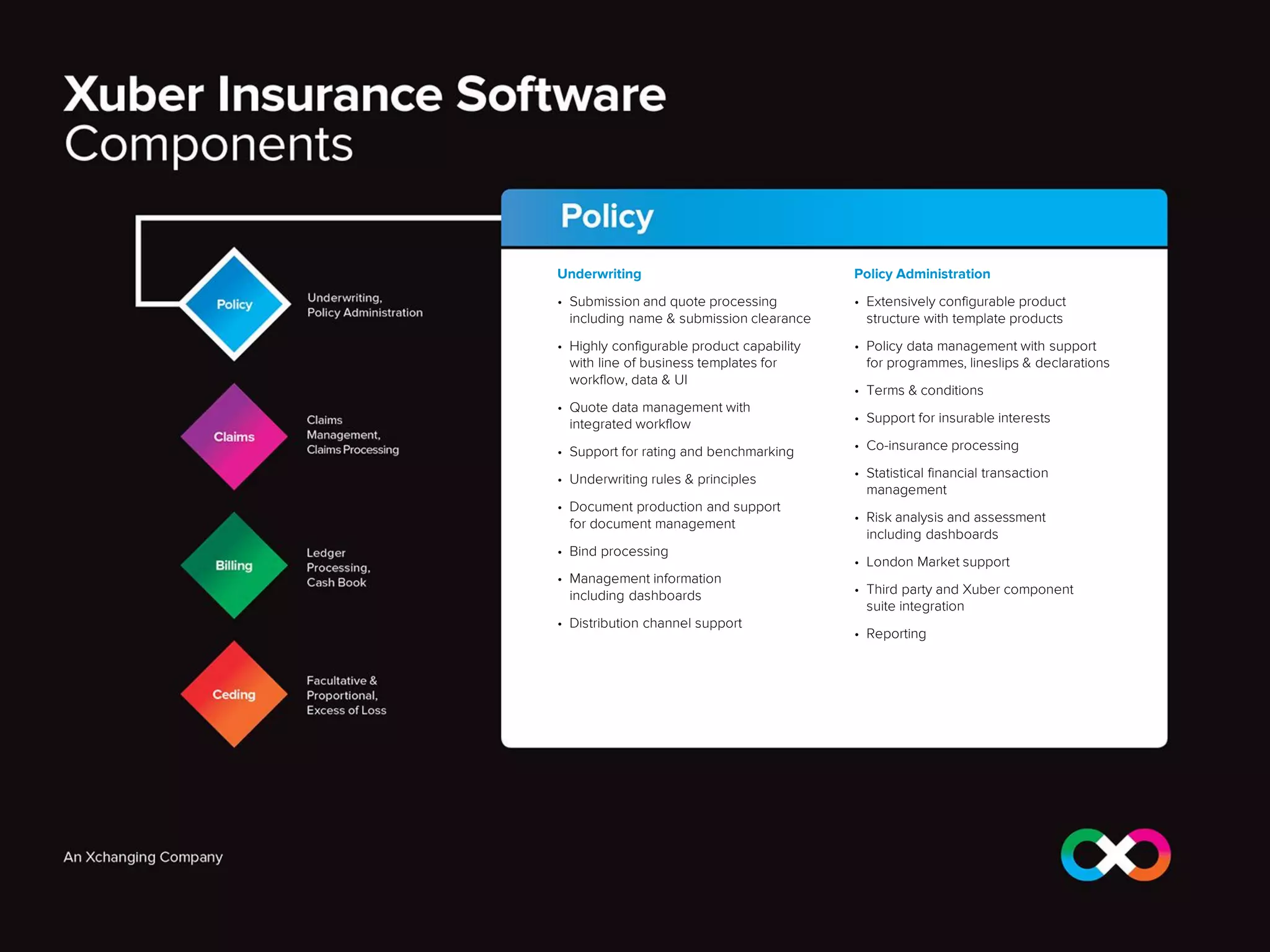

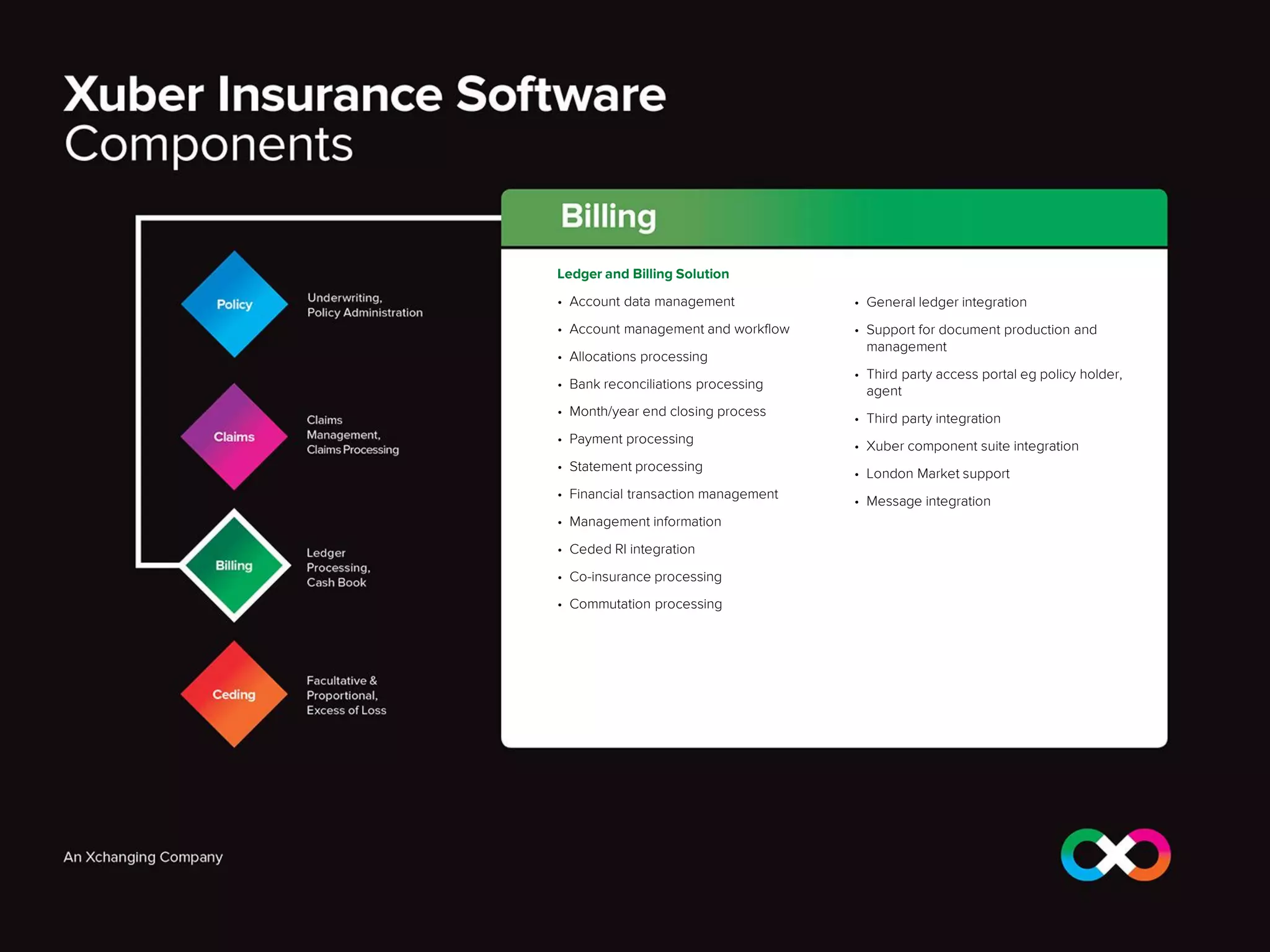

- Xuber for Insurers which provides a full insurance platform for underwriting, policy administration, claims management, billing, and reinsurance.

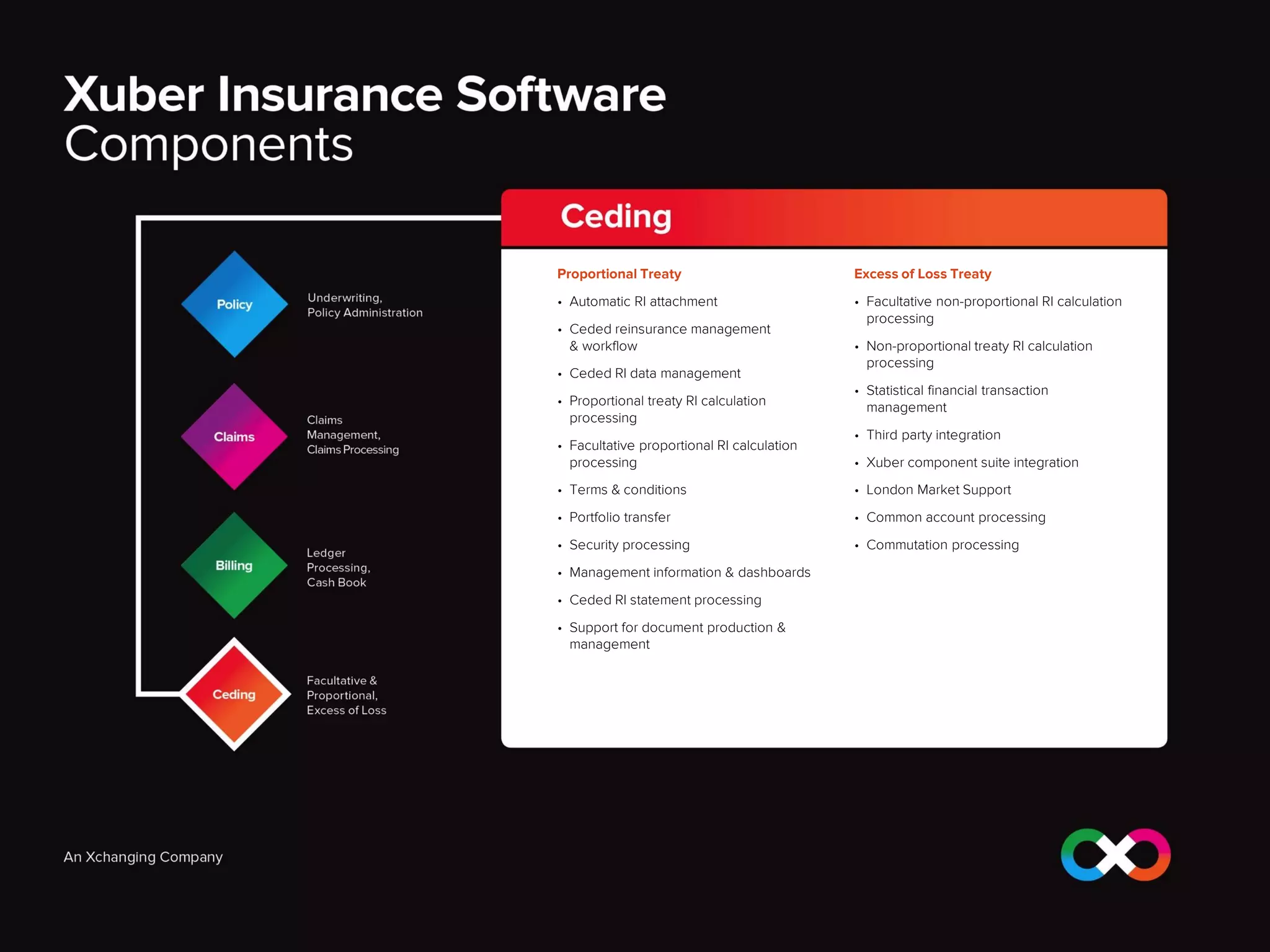

- Xuber for Reinsurers which provides an end-to-end solution for reinsurance processing.

- Xuber plans to release solutions for MGAs and Brokers in 2013 that will utilize the same technology platform.

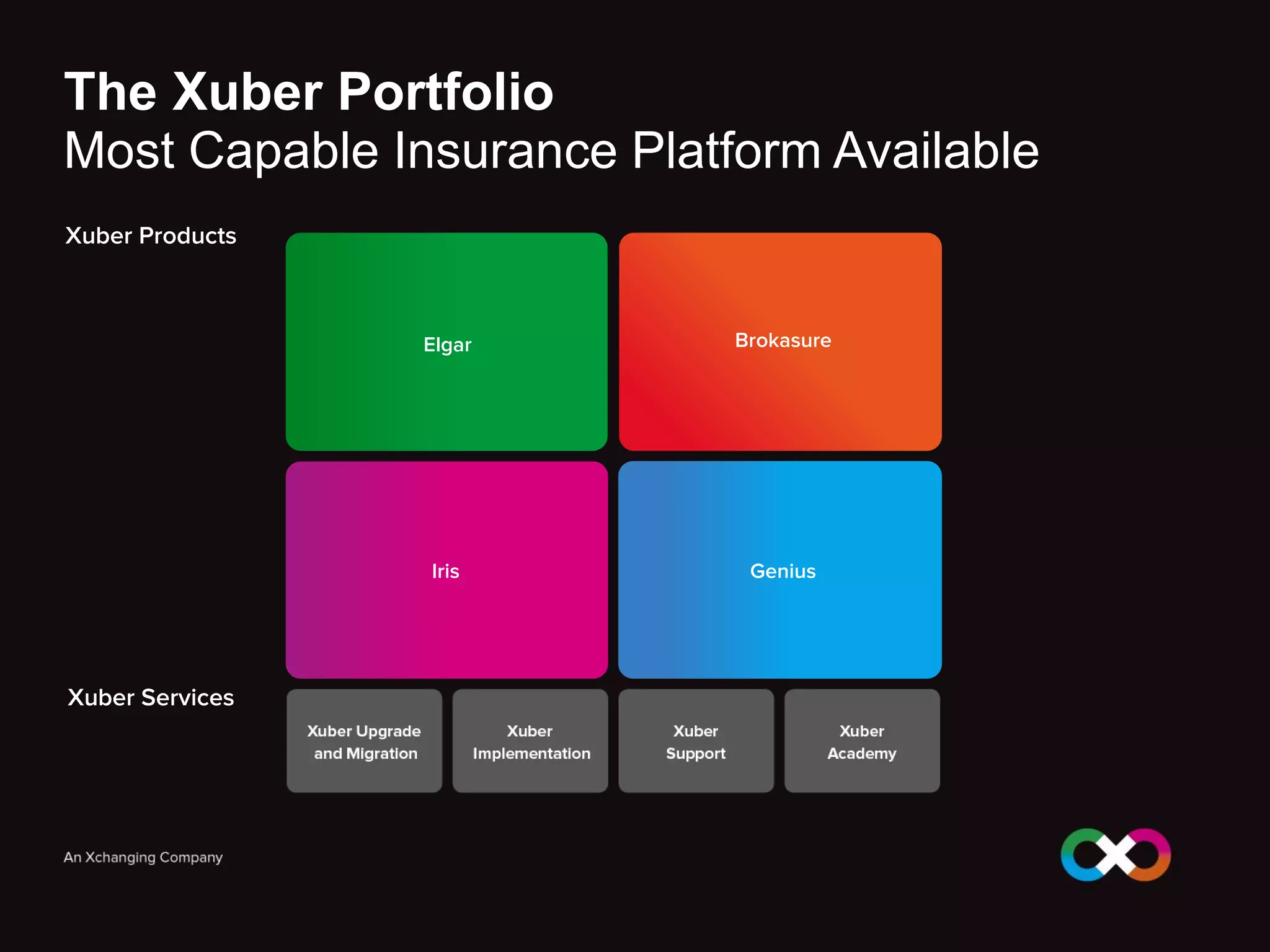

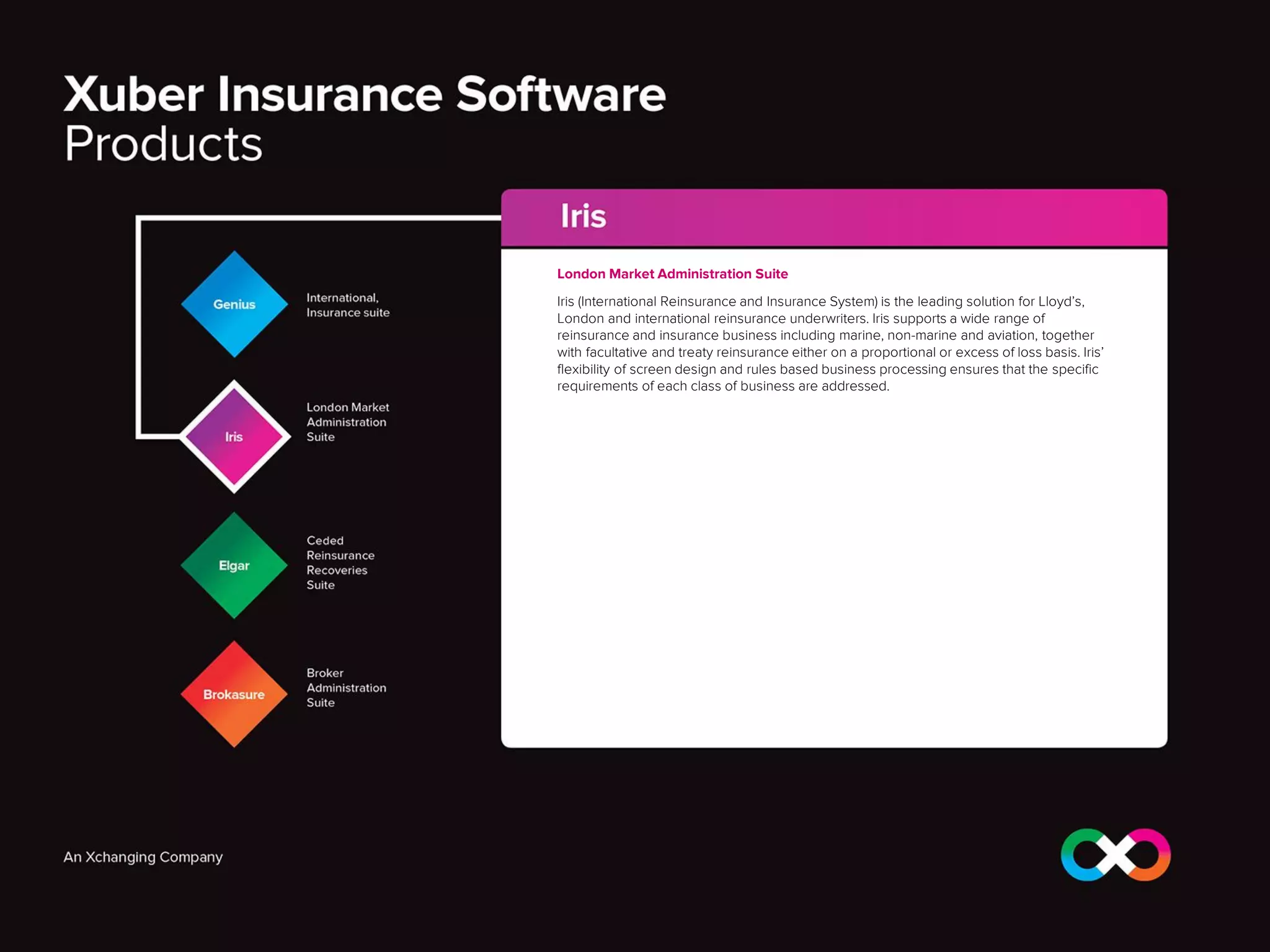

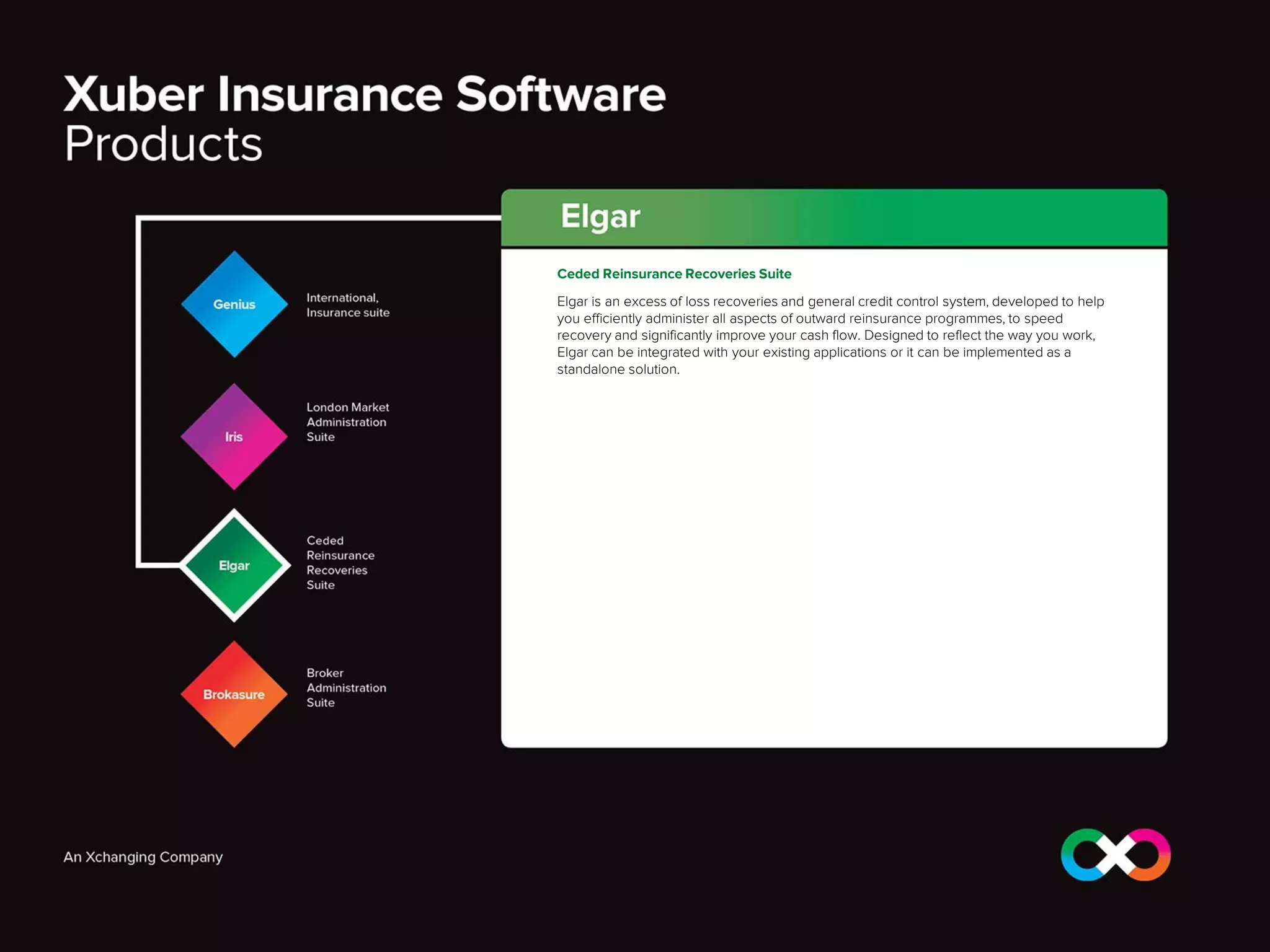

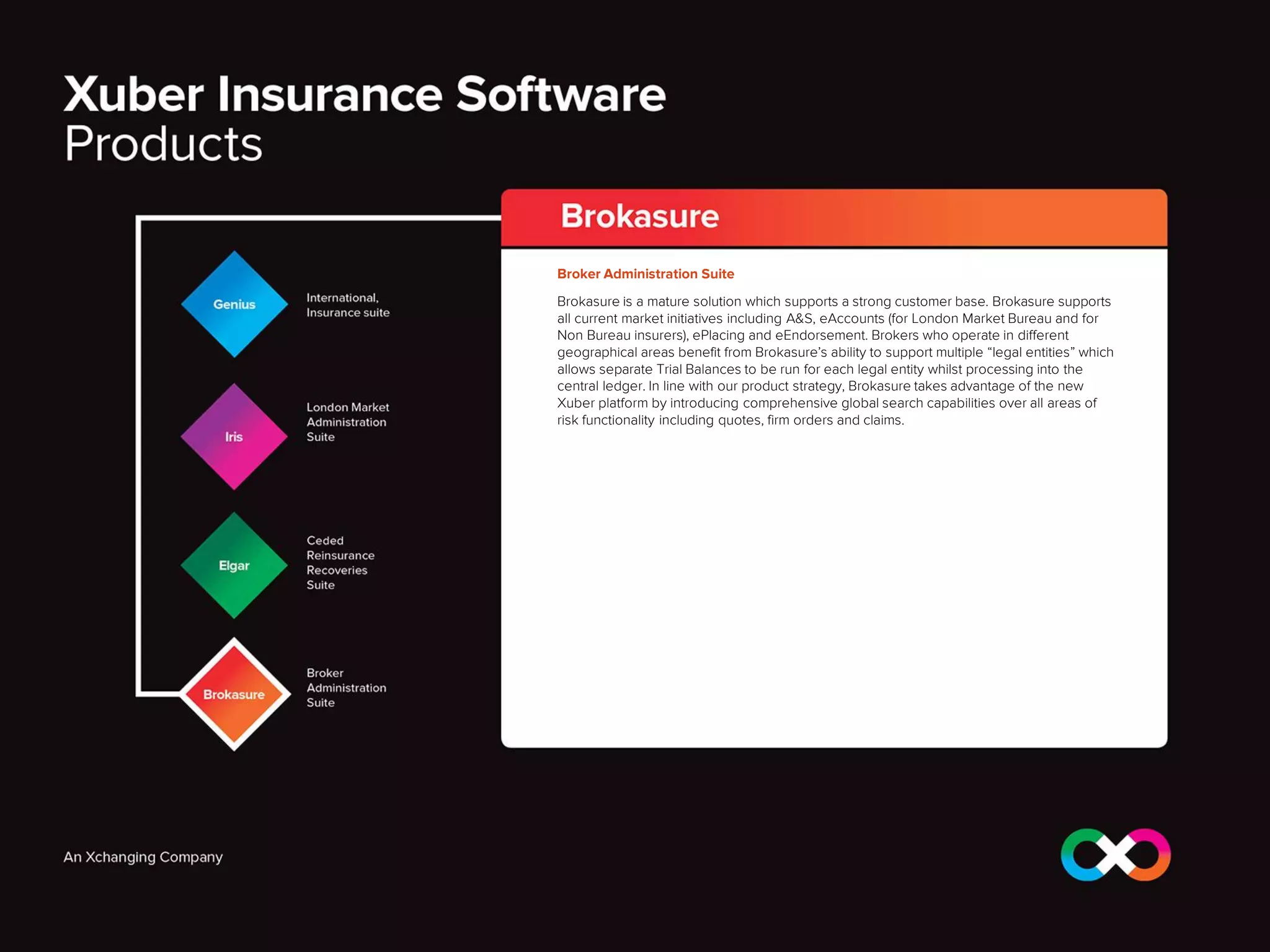

- The document also describes several additional Xuber solutions: Genius for international insurance, Iris for London Market administration, Elgar for ceded reinsurance recoveries, and Brokasure for broker administration.