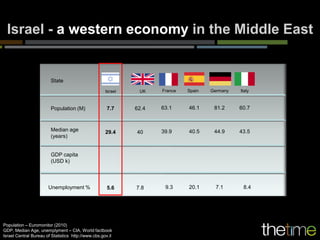

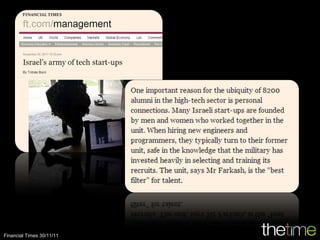

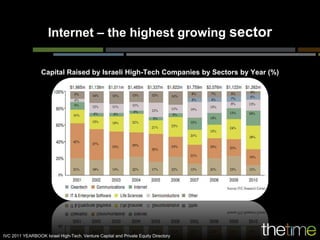

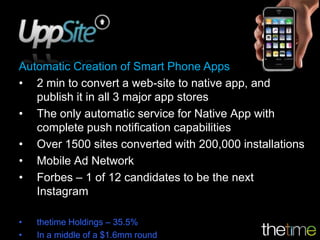

This document provides an overview and summary of an investment strategy and portfolio. The strategy aims to build 5-7 global media companies in 7 years by investing $20-25M from government funds into 8-10 Israeli startups per year focused on telecom, internet, media and entertainment. The portfolio currently includes 27 startups invested in since 2009, including companies in consumer, visual, add-tech, business solutions and video sectors. Several of the portfolio companies are described in 1-2 sentences highlighting their technology, traction and funding status.