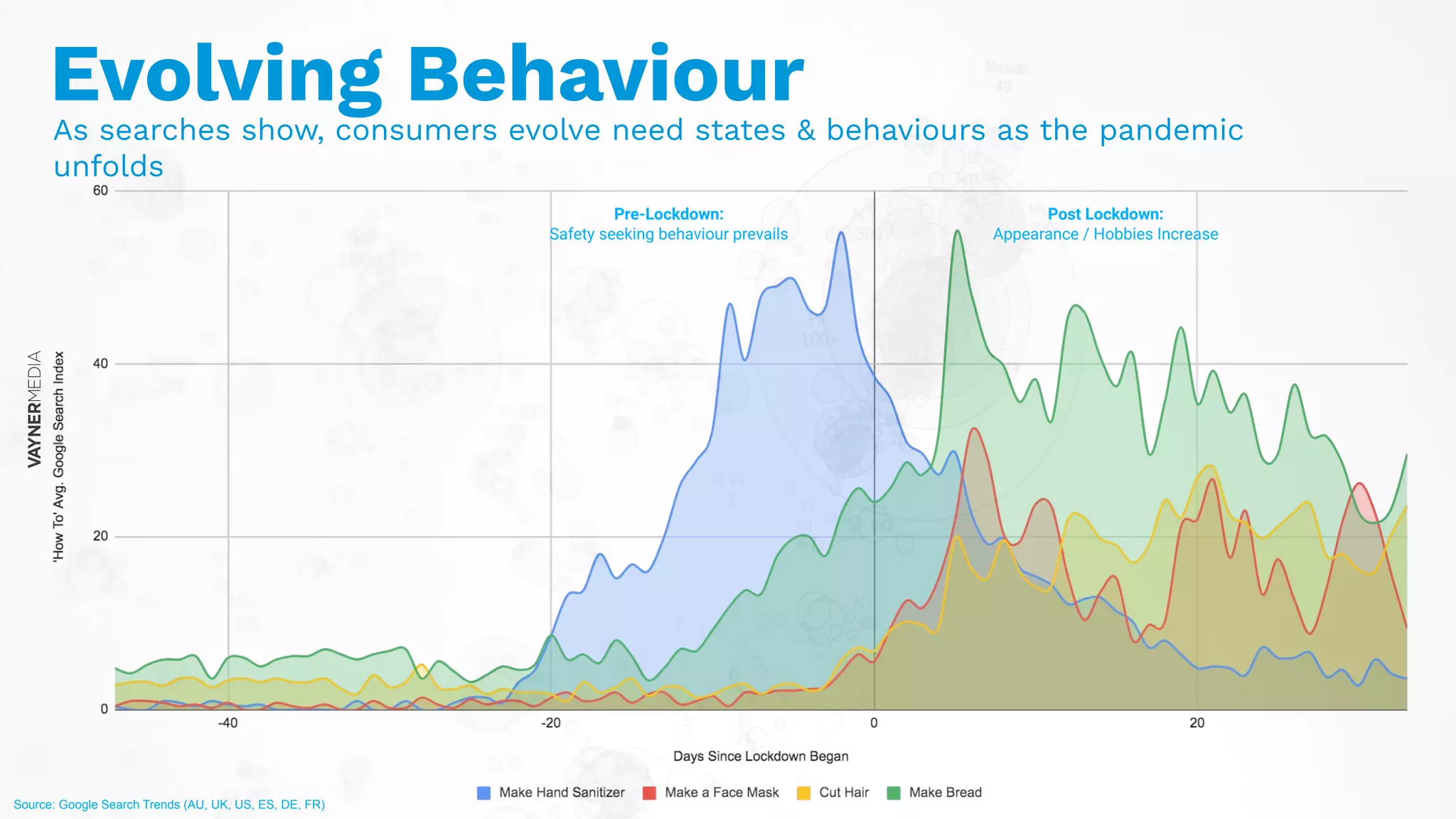

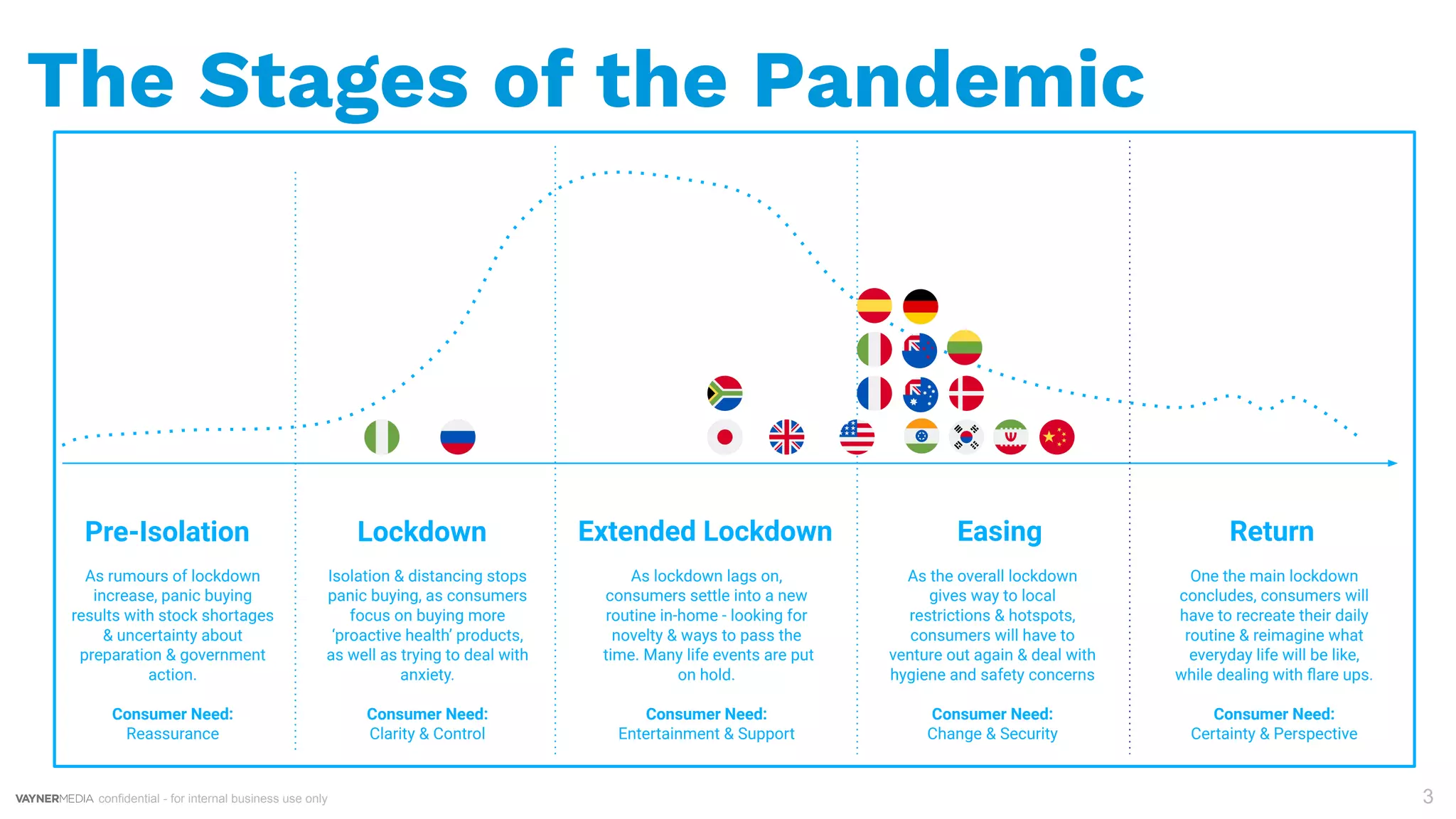

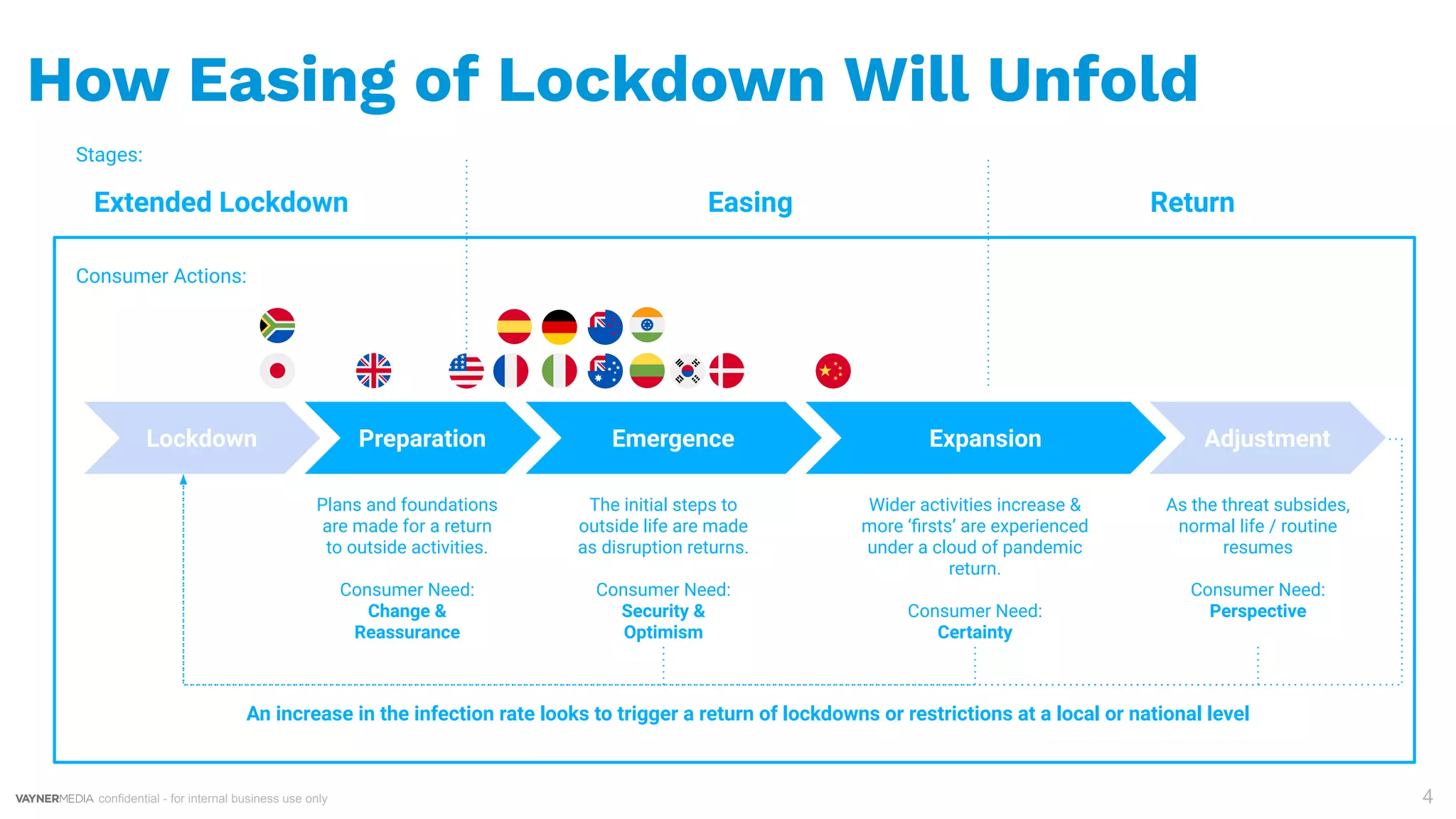

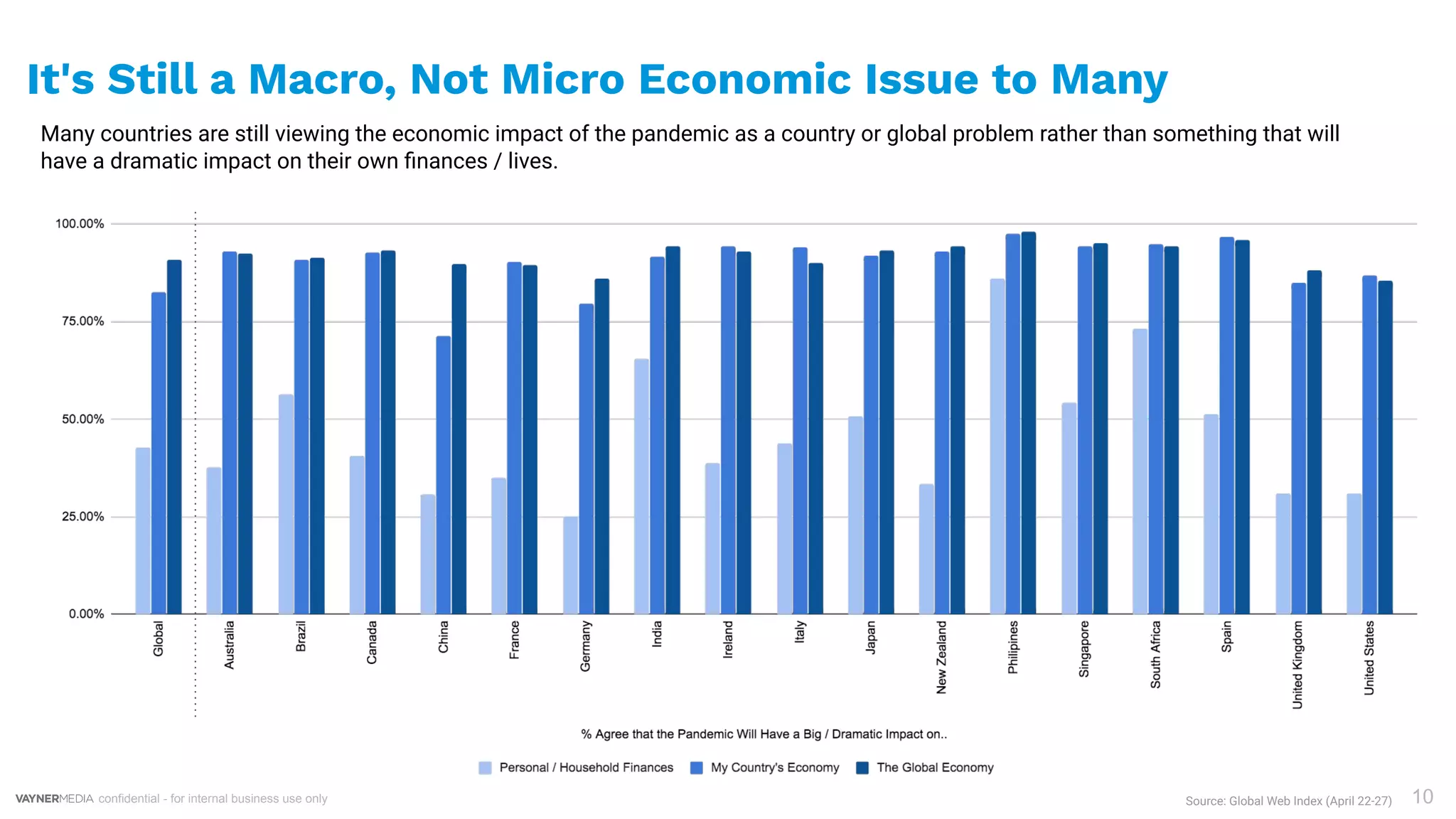

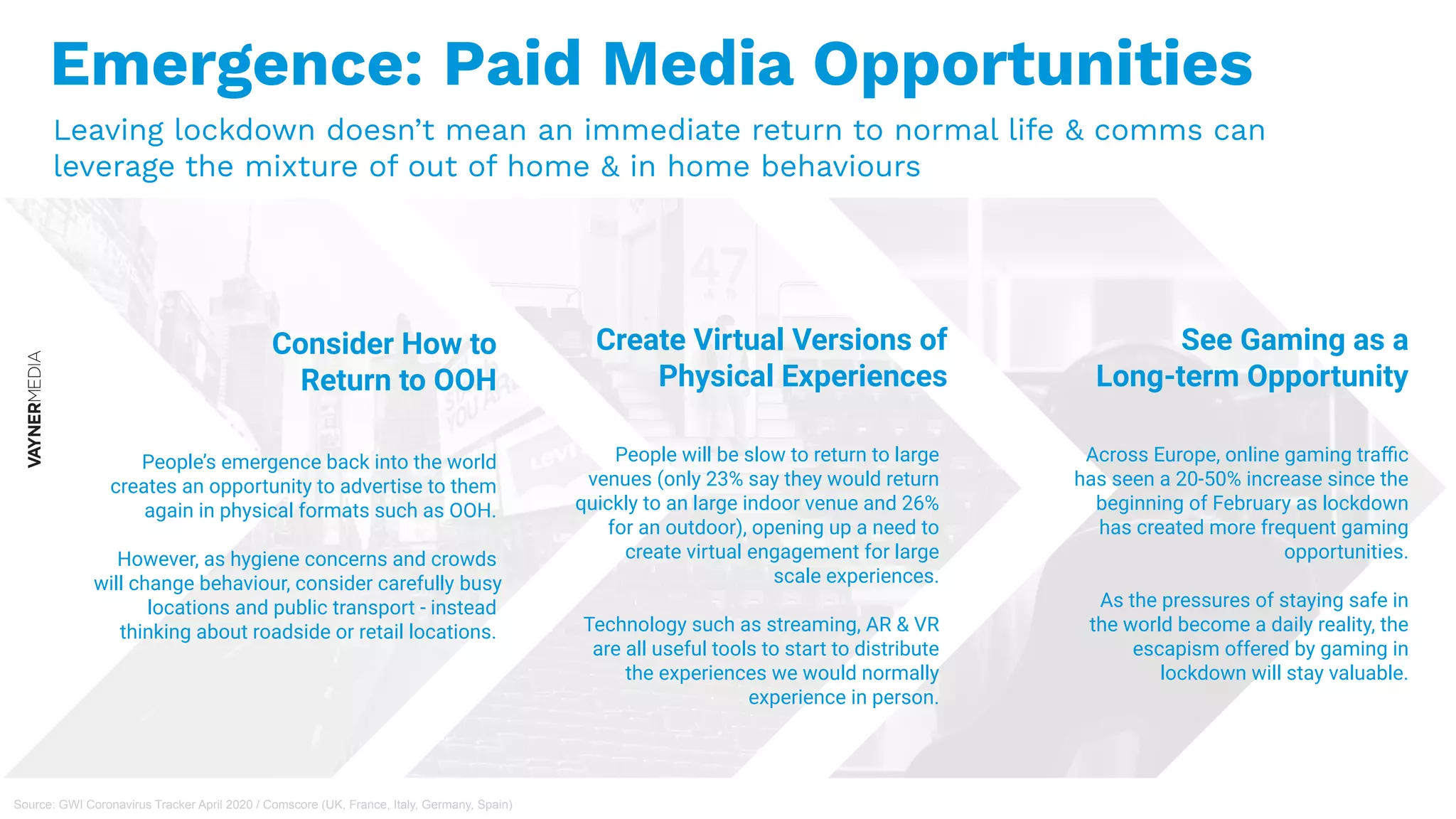

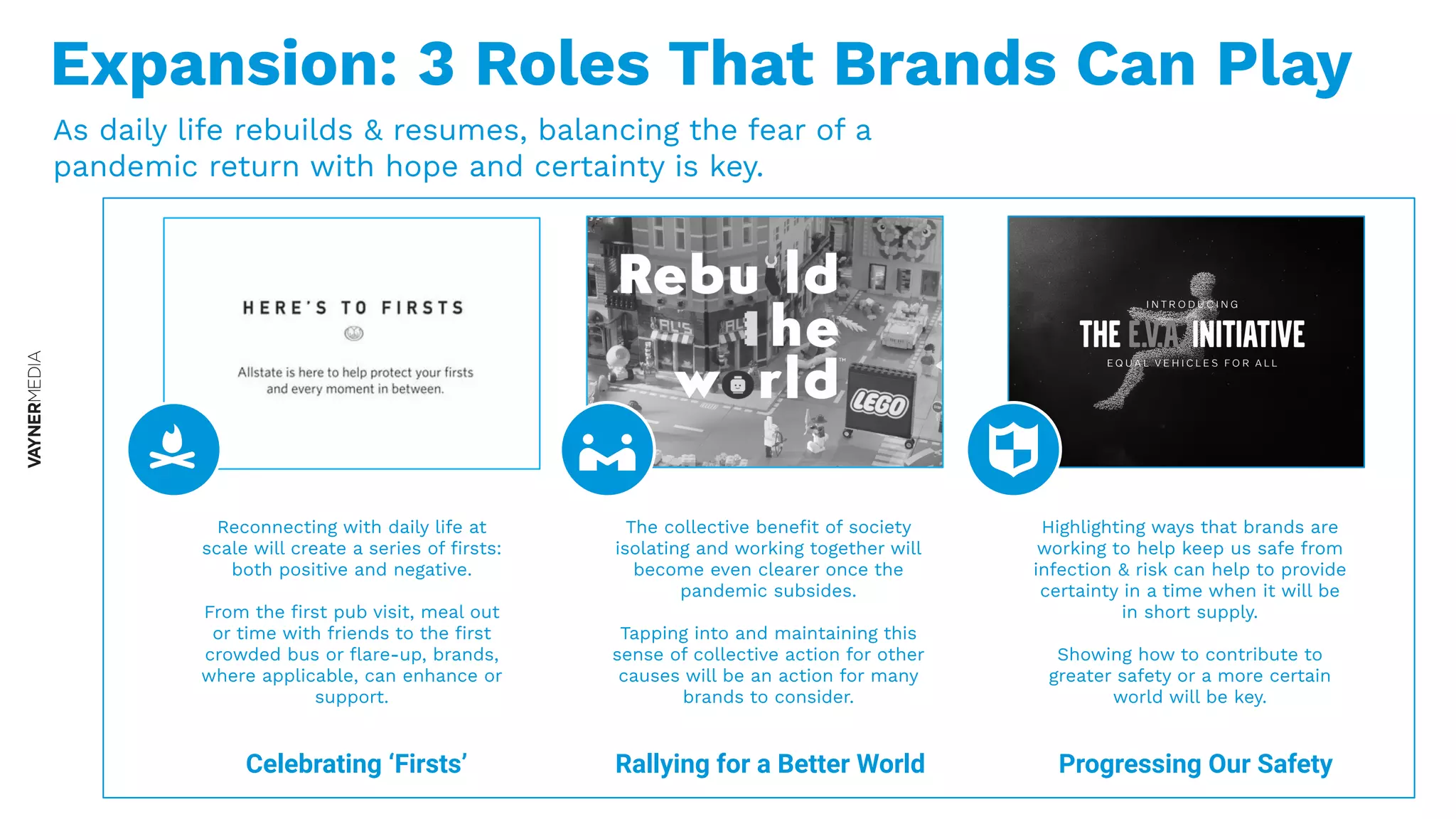

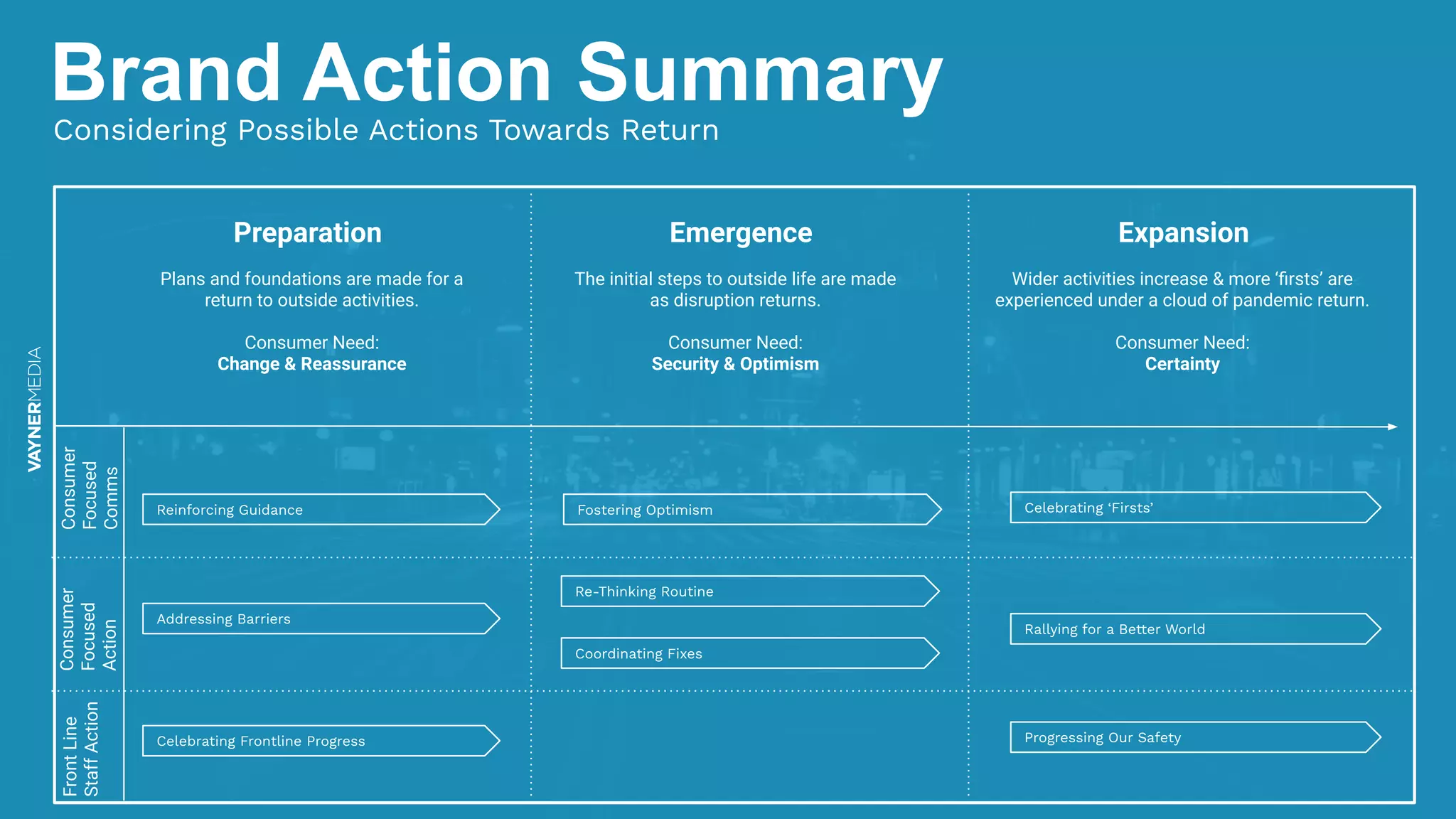

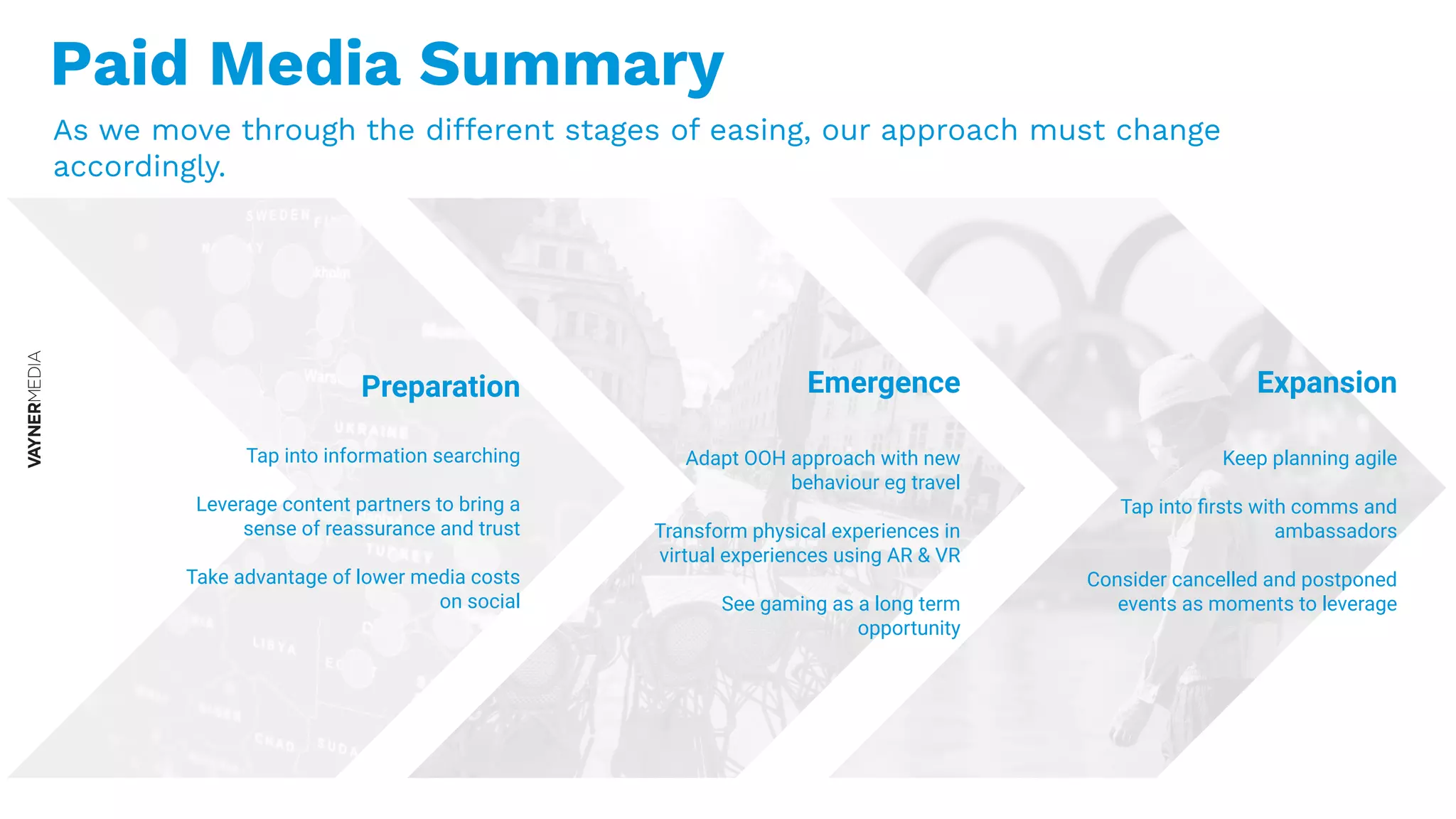

The document discusses the evolving consumer behaviors and needs during and after pandemic lockdowns, categorized by different stages: pre-lockdown, lockdown, and post-lockdown. It highlights consumer desires for safety, reassurance, entertainment, and clarity, as well as the anticipated changes in shopping habits and brand roles during the transition back to normalcy. The analysis emphasizes the importance of effective communication and brand strategies to address consumer concerns and foster optimism as society adjusts to life after lockdown.