The document provides information about the Aqaba Special Economic Zone Authority (ASEZA) in Jordan. ASEZA manages and regulates the Aqaba Special Economic Zone (ASEZ), a duty-free area encompassing Jordan's entire Red Sea coastline. The ASEZ aims to transform Aqaba into a world-class business and tourism hub. It offers various investment opportunities across sectors such as tourism, industry and logistics. ASEZA works to attract investment and create a competitive business environment through initiatives like the Aqaba Development Corporation and by providing tax exemptions and customs benefits to companies operating within the ASEZ. Major projects underway include the Ayla resort development and the Saraya Aqaba mixed-use project.

![MIDDLE EAST

UNITED ARAB EMIRATES

DUBAI

After over three years of declining rents and limited sales activity, in 2012,

Dubai’s property marked has bounced back as rents and sales prices in the

emirate’s most sought after areas have increased. Supported by a steady

increase in tourist arrivals, investor confidence is returning to the market.

According to statistics complied by Dubai FDI, the foreign investment

office in the emirate›s Department of Economic Development (DED),

Dubai attracted AED 16.5 billion (USD 4.5 billion) in foreign direct investment

during the first six months of 2012, marking a 7% increase from the same

period last year. According to Dubai FDI, this increase reflects a heightened

confidence globally on the growth prospects across key sectors of the

emirate’s economy, including real estate.

According to the Dubai Land Department (DLD), Dubai property

transactions grew 21% to AED 63 billion (USD 17.15 billion) in the first

half of 2012, compared to Q3 and Q4 2011. Figures published by the

Dubai Government show that foreign investors buying real estate were

responsible for acquisitions of AED 28.3 billion (USD 7.7 billion) in the first

half of 2012, up 36% from the same period last year.

Niall McLoughlin, Senior Vice President of DAMAC Properties, commented:

“The Dubai property market has performed strongly throughout 2012

and we expect this growth to continue well into 2013. There is a mid to

long-term view of investment in Dubai’s property market now which

will see consistent growth in the coming years. This is a natural cycle for

a maturing real estate industry which will create many opportunities for

impressive returns in both rental income and capital gains, outstripping the

money markets.”

Looking at the residential sector, Jones Lang LaSalle (JLL) says that the

first half of 2012 has seen higher levels of residential sales activity and

the overall market is now considered to have bottomed out. According

to the firm, the recovery in prices is most pronounced in the villa sector

where sales prices have increased 21% in the year to May. With regards to

rental prices for quality residential developments, property management

company Asteco reports an average rental increase of 6% and 9% for

apartments and villas respectively (Q2 2012).

However, improvement in prices is largely confined to high-end products

in prime locations, with less established locations still experiencing

declines in both rents and prices.

“Luxury apartments have continued to drive the resurgence in Dubai’s

real estate market through 2012. Recent reports has valuations up nearly

14 I CITYSCAPE I DECEMBER 2012

Population: 8,264,070 (2010 estimate)

Capital City: Abu Dhabi

Largest City: Dubai

Currency: UAE dirham (AED)

GDP: $258.825 billion (2011 estimate)

5% and closing in on 2008 peak prices,” McLoughlin said.

“As liquidity returns to the market investors are looking to ensure they

have a well balanced portfolio and real estate is a key element of that.

As the market has matured and the speculators have moved out, mid to

long-term investors recognise the intrinsic value of real estate in Dubai. We

believe this steady growth will continue well into 2013.”

On the commercial side, although there has been no movement in office

sales and rental prices due to a lack of demand and transaction activity

throughout the most part of 2012 (Asteco), the outlook for investment

in the sector is nevertheless one of cautious optimism. According to real

estate specialist Cluttons, a surprising number of transactions were

recorded during the normally quiet summer months this year, totalling

AED 2 billion (USD 545 million), with major commercial deals taking place in

DIFC, TECOM and Downtown areas.

According to Cluttons, the hospitality sector has been enjoying sustained

occupancy levels and profitable room rates, boosted by Dubai’s ranking

as the world’s eighth most attractive tourist destination by MasterCard’s

Worldwide Index of Global Destination Cities.

McLoughlin agrees, adding that now is a good time to get into the

emirate’s luxury hotel market.

“Investors can see hotels in Dubai more than 80% full across the whole

year and RevPAR [Revenue Per Available Room] rates in excess of USD

100. Dubai’s hotel serviced apartments sector is currently under supplied

and this is the ideal opportunity for buyers to get into the luxury hotel

industry,” he said.

Looking at opportunities in Dubai’s residential real estate market in the

coming year, McLoughlin commented:

“We will see the biggest expansions in serviced apartments as

developers bring this relatively new investment opportunity into the Dubai

property market. Elsewhere, there will be a lot of work completed on Al

Khail Road and other developing areas. Where infrastructure is already in

place such as Sheikh Zayed Road, the Burj Area and Dubai Marina, luxury

properties are commanding a premium price.”

“Location and quality remain the two factors which people use to decide

where to live and these areas are currently attracting huge interest. Where

infrastructure is still under development, such as around the projects on

Al Khail Road, there are many opportunities available to investors. Prices in

Jumeirah Village Circle and IMPZ, for example, will increase dramatically in

the next couple of years and are great investments for the medium term,”

he concluded.

Dubai 2012 Highlights

• Economic recovery well underway due to strong growth

•

•

of key sectors such as tourism, commerce, retail, hospitality and

logistics

Residential property prices up for the first time in 3 years

Strong performance of the hotel sector due to an increase in

tourism, occupancy levels close to 80%](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-18-320.jpg)

![MIDDLE EAST

ABU DHABI

The development of the market in the UAE’s capital has been quite

different to that of its neighbour Dubai. Here, selective new prime

developments offering high quality finishes and amenities have generally

been able to sustain rental levels over the last quarter given strong levels

of demand (Asteco Q3 Abu Dhabi report).

Ahmed Al Fahim, Executive Director of Marketing, Communications, Sales

and Leasing at Tourism Development and Investment Company (TDIC),

a master developer of major tourism destinations and prime residential

projects in Abu Dhabi, commented:

“We are pleased to see that the property market has started to show

healthy signs of recovery during the year, which is evident through the

increased interest in TDIC’s residential offerings.”

TDIC has received high levels of interest for their top-end residential

projects, particularly in areas such as Saadiyat Island, a leisure, residential

and tourism hub expected to become the capital’s cultural centre.

However, the residential market is currently experiencing polarised

performance. Older buildings formerly considered prime have seen

vacancy levels increasing as tenants relocate to new developments,

leading to landlords reducing rents (Asteco).

Matthew Green, Head of Research UAE for CBRE Middle East, commented:

“The residential market in the capital will experience further rental

deflation over the next six months, although performance will be highly

polarised. Premium properties are expected to hold quite firm on rents,

with secondary locations off-island forecast to see a more pronounced dip

in rates as occupiers continue to upscale amidst greater affordability.”

In addition to the increased demand in prime property, recent legislative

changes may also impact on the shape of the emirate’s residential

landscape. The Abu Dhabi government is implementing new regulations

with regards to linking the renewal of residency visas with accommodation

arrangements, which is expected to have an impact on the residential

market with an increase in demand for mid- to low budget apartments in

the centre of the capital (Asteco).

On the whole, the Abu Dhabi market started the year in quite subdued

fashion and this trend has continued throughout the rest of the year with

weak occupier demand prevailing, Green commented.

“The emirate is experiencing a sustained period of downward rental

pressures as supply and demand imbalances persist within segments of

the residential and office sectors.

Significant new supply has been delivered over the course of the year

across virtually every asset class. This has heightened already competitive

leasing conditions, emphasising the tenant led market scenario,” Green

said.

While leasing in the commercial sector has continued to improve with

tenants taking advantage of the availability of higher quality office space

and attractive lease terms (Asteco Q3 report), secondary and inferior

office products continue to suffer from widespread rental deflation which

has averaged 8% since the start of 2012, the CBRE Q2 2012 Abu Dhabi

Marketview said.

According to Green, the retail sector currently seems to be showing the

most stability despite the fact that a considerable amount of new supply

will be delivered to the market over the next four years. Depending on the

pace of ongoing construction works, total retail supply could potentially be

doubling by 2015, he said.

TDIC also commented that during 2012, the residential and retail sectors

have been very appealing to various types of investors, prospective

tenants and homeowners. “There’s a strong appetite for residential

developments across Abu Dhabi especially for those who are looking for

unparalleled quality of homes and prominent locations,” Al Fahim said.

The company says it has already leased out 98 percent of its apartments

at The Residences at The St. Regis Saadiyat, sold out 80 percent of its

high-end luxury Saadiyat Beach Villas and leased out 75 percent of its

first phase of luxury Eastern Mangroves Residences within a month of its

launch.

Looking ahead, TDIC is optimistic about the emirate’s residential market

performance:

“The property market has started to show healthy signs of recovery

during the year and we anticipate that the residential market keeps

the same momentum hopefully next year. We believe that [distinctive

properties] will remain attractive to a wide range of prospective

homeowners and tenants in 2013, whilst offering unparalleled high quality

homes and flexible financing options,” Al Fahim said.

As for the future performance of Abu Dhabi’s real estate market on the

whole, Green commented:

“The market is likely to remain constrained amidst ongoing demand and

supply imbalances brought about by the influx of new inventory. Greater

stability may start to be felt towards the end of 2013, as the impact of

recent Government legislation changes start to take effect.”

Abu Dhabi 2012 Highlights

• Market tenant favorable across all asset classes

• Residential market continued to see sale price and rent declines

• New hotel supply in Q4 expected to put downward pressure on

Average Daily Rates

DECEMBER 2012 I CITYSCAPE I 15](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-19-320.jpg)

![MIDDLE EAST

QATAR

OATAR

Qatar has prospered in the last few years with continued high real GDP

growth, making it the world’s fastest growing economy in 2010. This year,

the Gulf State was named the world’s richest country by Forbes magazine,

with an average annual per capita income exceeding USD 88,000.

Although the country felt the delayed impact of the global financial crisis,

Qatar has weathered the global downturn better than many economies

around the world.

Dr. Bassim Halaby, CEO Benchmark International, Al Wa’ab City Executive

Management commented:

“The delayed impact was relatively mild when compared with other GCC

countries such as the UAE, with several factors contributing to Qatar’s

resilience; from the announcement of the Qatar National Vision (QNV)

2030 in the same year, to the surplus liquidity from rising oil prices in 2009,

to the successful bid to host the World Cup 2022 in 2010, and finally to the

announcement of the National Development Strategy (NDS) in 2011. Real

estate recovery was not only inevitable but a more sustainable route to a

diversified economy has been paved.”

According to Jed Wolfe, Managing Director of Asteco Qatar, the elated

market sentiment of 2011 has calmed slightly this year.

“There was a great deal of euphoria and consequential market

expectation in 2011, following FIFA’s announcement that Qatar was to hold

the 2022 World Cup. 2012 started with a more realistic market outlook

with the understanding that the World Cup alone would not mitigate any

negative global economic factors. There was also a wider understanding

that the benefits of such an event would be realised over time and that

there was much work to do to meet the country’s development schedule,”

Wolfe explained.

“I think 2012 has been a year of reassessing one’s holdings and real

estate strategies in order to maximise returns in the lead up to the World

Cup,” he further said.

Commenting on the dynamics of the Qatari real estate market this year,

Halaby said:

“Leading up to 2012, preliminary application of [the 2030] vision is

evidenced through the renovation of Doha Airport, the installation of

Lusail City infrastructure, the launch of Musheireb project as a major

urban renewal project, and the upgrade of the city road network. Although

executed over a delayed timeline, moderate growth in the real estate sector

16 I CITYSCAPE I DECEMBER 2012

Population: 1,757,540 (October 2012)

Capital City: Doha

Largest City: Doha

Currency: Riyal (QAR)

GDP: $182.004 billion (2011 estimate)

is still witnessed in 2012 through improved volume and value of sales

transactions, higher land valuation, and increased demand for residential

and commercial spaces.”

In the residential sector, marginal residential rental increases were

witnessed across most of the locations during Q2 2012, according to the

latest Asteco report. Rental rates increased by up to 8% for one- and twobedroom apartments in certain locations while villa rental rates increased

by 4% on average. This was mainly due to limited supply and waiting lists are

now being seen at the very best quality villa compounds (Asteco).

“The growth in this market has been stimulated by a steady increase

in population and undersupply of certain types of product. I believe the

population growth will continue but supply will increase. Indeed, our

research for quarter 3 indicates rents have stabilised again, [which is due]

to the delivery of more residential product,” Wolfe said.

According to Halaby, a distinctive feature of the Qatari market is not only

that it has grown rapidly in the past 10 years, but that there has been a

growing trend to decentralised ‘lifestyle centres’, breaking away from the

centre of Doha. One of such sub-centres is Al Wa’ab City, a large-scale

mixed-use development covering an area of 1.25 million square metres.

“Coupled with local ownership restrictions, this growing trend of

decentralised ‘lifestyle centres’ has led to stronger family-based

transactions and more inherent, less speculative land purchases. Needless

to say, this has shielded the real estate sector from any bubble threats in

the forthcoming future,” he said.

Other sub-centres include the historic downtown of Musheireb, the

festival city of Doha, Lusail City and the Pearl.

Looking at 2013, Wolfe sees a healthy year ahead.

“In my opinion 2013 will be more positive than 2012. The Government

seems to be very close to announcing finalised plans for a number of

infrastructure projects. If this happens and contractors and developers

mobilise to begin these works, 2013 could be a healthy year for real estate.

Real estate markets the world over have found recent years a tough

challenge. I believe developers who focus on providing quality assets at

the right price points will realise the greatest returns,” he said.

According to Halaby, the outlook for 2013 is one of continued growth.

“The government continues with its diversification mission to endorse

real estate developments in the sports, cultural, and educational

sectors sustained by public transit systems, medical facilities, residential

communities and commercial corridors. This strategy will transform Qatar

into an advanced country that provides a high standard of living for all its

inhabitants – for generations to come,” he concluded.

Qatar 2012 Highlights

• The government’s economic diversification program boosts

quality community real estate developments

• Rental rates up to 8% for apartments and 4% for villas

• Waiting lists are now being seen at the very best quality villa

compounds](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-20-320.jpg)

![MIDDLE EAST

EGYPT

EGYPT

Following the Revolution of February 2011 which ousted former President

Hosni Mubarak, Egypt was struggling to regain political and economic

stability which had an immediate impact on the country’s once thriving real

estate market. Now, things are finally looking up.

After one and a half years of civil unrest and political turmoil, the past

three months have seen a welcome return to more settled and stable

conditions following the election of President Mohamed Morsi and the

appointment of a new government, the latest Jones Lang LaSalle Cairo Real

Estate Market Overview said.

While Egypt’s economy was hit hard by the Revolution, with real GDP

of just 1.8% recorded last year, the new government is aiming to achieve

nominal growth of 4% to 5% this year (JLL).

According to JLL, an indication of returning economic confidence is

that 703 new companies have started operations across Egypt. The

government is also undertaking major efforts to boost tourism as this

sector contributes to 12% of GDP and employs 4 million workers (12.6% of

the labour force).

With a large, young and growing population, Egypt presents numerous

opportunities to real estate investors.

18 I CITYSCAPE I DECEMBER 2012

Population: 82,000,000 (2012 census)

Capital City: Cairo

Largest City: Cairo

Currency: Egyptian pound (EGP)

GDP: $533.739 billion (2012 estimate)

“[Egypt’s] most distinctive characteristic when compared with other

parts of the MENA region is the inherent demand for residential properties

due to the continuous annual population growth, plus the backlog of

demand which hasn’t been fulfilled to date. [There are] 500,000 new

marriages [and a] 1.8 million net population growth per annum. No other

market in the region has that kind of demand,” commented Ibrahim

El Missiri, Development Director at Madinet Nasr for Housing and

Development (MNHD).

Residential

In 2012, the residential middle-income sector has witnessed the

most activity and currently experiences the strongest demand, with a

huge spike in activity and demand since September 2012, El Missiri said.

Coldwell Banker New Homes, one of Egypt’s premier real estate agents,

confirmed this while adding that the strongest demand is directed towards

apartments within gated compounds.

This is supported by JLL, who have reported a major shift from high end

luxury villas to apartments aimed at middle income earners within gated

compounds over the past two years, as this sector was previously under

supplied.](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-22-320.jpg)

![MIDDLE EAST

“The bulk of the supply pre-revolution was for the high-end, this has now

shifted to the under supplied middle-income [sector] which is the where

the bulk of the demand is. It’s now about providing high-end lifestyles to

the middle-income market,” El Missiri explained.

As a result of the high demand for apartments, sales prices for

apartments have increased in both New Cairo and 6th of October City;

Cairo’s satellite cites which hold the majority of the capital’s gated

compound developments.

According to JLL, in New Cairo, the average price for apartments has

increased 1.5% per square metre from Q2, currently sitting at USD 1,198.

The firm says similar trends have been experienced in 6th of October City,

with apartment prices up 8% to USD 990 per square metre.

The provision of affordable homes has also been a major topic in the

Egyptian residential market, with the country currently facing an immense

shortfall of 1,500,000 affordable homes. As a measure to combat this

shortage, last year the Ministry of Housing announced plans to construct

one million residential units throughout Egypt over the next five years.

In addition to this, in 2012 the government has been going forward with

providing low income housing under the Youth housing program launched

in 2007 (JLL).

However, in order to be able to reach the high demand for affordable

homes, experts believe government action alone is not sufficient.

“In order to overcome and reduce this gap between supply and demand, a

major strategic collaboration between the government and private sector

should take place, as well as input of the mortgage finance system in order

to spread awareness [about the availability of home financing services]

among the low-income population,” Coldwell Banker New Homes

commented.

Retail

For the retail market, 2012 is proving to be a much more positive year than

2011, with sales figures starting to pick up and purchasing habits returning

to a more normal pattern, JLL said.

According to the firm, despite further expected delays in many projects,

the supply of retail malls is expected to increase significantly in 2013 and

2014. The major new addition in 2013 will be Cairo Festival City, which will

include IKEA (34,000 square metres) and Kidzania, along with 15 other

major anchors.

“Egypt has a significant shortage of supply for retail space, hence the

significant number of shopping centres in the pipeline,” El Missiri said.

“Expressing their confidence in the future of the Cairo real estate

market, Al-Futtaim Group and Emaar Properties (two of the UAE’s largest

developers) have announced plans to join forces to develop Cairo Gate, a

USD 830 million retail and entertainment complex on a 16 acre site on the

Cairo Alexandria desert highway,” JLL further commented.

Majid Al-Futtaim (MAF) is also continuing its expansion plans in Greater

Cairo, with the announcement of a major new centre ‘Mall of Egypt’ located

in 6th of October City. Construction of this 163,000 square metre centre

(with around 380 shops) is due to commence by the end of 2012 for

completion in mid 2015 (JLL).

Commercial

In the office sector, Cairo has not witnessed any significant completions

in Q3 and the current stock of office space in Cairo therefore remains

unchanged at around 744,000 square metres. Vacancies in Grade A

buildings have dropped to 31% (from 38% in Q2) due to increased take-up,

mainly on the east side of Cairo (New Cairo & Maadi) (JLL).

“Given Cairo’s over crowded downtown and old districts, most of the

new office supply to be delivered over the next few years will be in New

Cairo and 6th of October. Demand is increasing in these locations as

more residential projects are completed in the new urban settlements,”

JLL said.

Outlook

Looking at the year ahead for the Cairo market, El Missiri predicts positive

performance for the residential sector.

“The middle-income residential sector will remain strong, within gated

compounds. The high-end residential demand will start to increase as the

country becomes more stable. We’ve seen a spike that has been sustained

since the election of the President,” he said.

Coldwell Banker New Homes shares an optimistic outlook for the

residential market in 2013, given the increase in sales volume during both

Q3 and the first month of Q4 2012.

In the office sector, the picture is slightly different. “The administrative

units’ market segment will continue to struggle along with the economy

as businesses are not investing in new office space until there is clarity and

the economy starts to move. Most of the work in 2012 was the completion

of pre-revolution projects that had stalled,” El Missiri commented.

Despite current economic challenges, the Egyptian real estate market

offers attractive real estate investment opportunities.

“People are investing [in Egypt] due to the fact that it is a resilient market

that has inherent strong local demand. It is not an opportunistic market

that is driven by external demand or speculation. This is apparent in the

fact that the prices have held throughout the past two years,” El Missiri

said.

“Opportunities lie in the better developed middle-income housing

compounds where the demand is high and rental yields are high,” he

concluded.

Egypt 2012 Highlights

• With a stabilising political situation, investor confidence is

returning to the market

• Significant amount of quality retail stock soon to enter

•

the market with major shopping centres currently under

development

Residential sales volumes have increased with a preference for

apartments in New Cairo and 6th of October City

DECEMBER 2012 I CITYSCAPE I 19](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-23-320.jpg)

![MIDDLE EAST

SAUDI ARABIA

RIYADH

Saudi Arabia has one of the world’s largest oil reserves and oil revenues

continue to boost the Kingdom’s budgetary position. In 2012, real GDP is

expected to grow by 5.1% (Jones Lang LaSalle Riyadh Real Estate Overview

Q2 2012).

With high oil revenues enabling the government to post large budget

surpluses, Riyadh has been able to substantially boost spending on job

training and education, infrastructure development, and government

salaries. 2012 has also been a good year for the capital’s real estate market.

Kristian Syson, Director of Professional Services at Cluttons Bahrain

commented:

“Year-on-year the real estate market in Saudi tends to perform well, as

real estate has been seen by Saudis as a safe investment, to be handed

down to future generations.”

This year’s biggest news in the Saudi real estate market came with the

announcement of the approval of the Kingdom’s long awaited Mortgage

Law. According to JLL, the law is a very important step in broadening home

ownership across the Kingdom and will help tackle one of the country›s

most pressing social issues. It is also expected to generate significant

benefits for the economy and should, encourage greater professionalism

in the home building industry.

However, it will take some time before the full benefits of the mortgage

law are realised and its initial impact will be limited, experts believe.

“In order for [the mortgage law] to function effectively, a change is

required to the legal frame work surrounding the law. For example, a

review of the foreclosure system is necessary as under Sharia law, it is

not permitted to take someone’s home. The land registry process will also

need to be reviewed in order to give lenders comfort that the property

which they are taking charge over is actually owned by the borrower,”

Syson explained.

“Whilst it is not doubted that the introduction and implementation of the

mortgage law will open up the possibility of home ownership to a larger

proportion of the market, many commentators have suggested that the

main benefit will be to provide cheaper real estate finance to the affluent

parts of society and will not address the needs of the growing younger

generation of the population,” he further commented.

However, it is understood that a number of large employers in the

20 I CITYSCAPE I DECEMBER 2012

Population: 28,376,355 (2011 census)

Capital City: Riyadh

Largest City: Riyadh

Currency: Saudi riyal (SAR)

GDP: $733.143 billion (2012 estimate)

Kingdom and the Government are looking at ways in which they can

support their employees in obtaining mortgage finance once the law is

implemented, Syson added.

Looking at Riyadh’s performance in the residential sector, average villa

prices have increased across most districts, however average prices in

the centre area have declined in Q2 as most sales have been of older/

refurbished projects due to the lack of new product available for sale (JLL).

During Q2, the average sale price of apartments has increased in Riyadh’s

districts to the east, south and west of Riyadh.

“Increases in rates are a product of a slight imbalance in supply and

demand in favour of the property developer (in the case of sales) and in

favour of the owner (in the case of rentals). In the more popular areas of

the Kingdom this imbalance is driving up prices as people wish to relocate

to newer products. It should also be noted that these increases are not

startling and in most cases are limited to single digit percentage increases,”

Syson commented.

Riyadh’s office market will see a major increase in new supply in 2013

when the first office buildings in both the King Abdullah Financial District

(KAFD) and the Information Technology and Communication Complex

(ITCC) projects will enter the market. Despite the substantial addition

of new supply (over 1 million sqm by 2014), JLL says demand for high

quality space will remain strong, mainly driven by the Government, Saudi

conglomerates and the multinational sector.

Looking at the year ahead, Syson commented:

“The general market outlook for 2013 remains positive, as the

Government continues to invest heavily in infrastructure, education and

healthcare projects within the Kingdom.”

However, potential oversupply in certain sectors will pose a challenge to

the performance of the Riyadh real estate market in the near future.

“The main challenge in 2013 will be the inelastic nature of the real estate

sector which will generate a potential oversupply in certain sectors, such

as office and hospitality in Riyadh, and a potential undersupply in other

areas, such as international grade industrial, warehouse and logistics space

across the Kingdom,” Syson said.

“A real concern in the medium to long term is the generation of demand

for the sectors which are currently oversupplied and whether this

oversupply situation will have, as is expected, a negative impact on the

surrounding market as occupiers will look to relocate to cheaper, better

quality accommodation for less cost,” Syson concluded.

Riyadh 2012 Highlights

•

•

•

Approval of the long awaited Mortgage Law by the Council of

Ministers

Expansion of King Khalid International Airport (KKIA)

commenced in November, tripling its capacity within 3 years

Retail point of sales have grown by 17% YOY in Q2, reflecting

continuous growth in retail spending](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-24-320.jpg)

![MIDDLE EAST

JEDDAH

2012 was a fairly good year for Saudi Arabia’s Red Sea destination.

Martin Cooper, Head of Consulting Middle East, DTZ, commented:

“Jeddah’s real estate market has performed relatively well for the most

part of 2012. There continues to be strong levels of demand, particularly in

the residential (primary accommodation) and hospitality sectors.”

While residential sales prices for both villas and apartments rents have

increased significantly during the first quarter of 2012 (JLL), this was

confined to certain locations.

“Residential sales prices in Jeddah have escalated in certain prime

locations in the city. However, sales prices (and volumes) on the Jeddah

Corniche remain below the peaks reached in 2007 as full confidence has

yet to return to the investment market. Levels of primary residential

demand remain high in the city and this means that well located, designed

and built properties will remain good prospects,” Cooper explained.

On the rental front, villa rents have increased by 3% in the preferred

Northern regions of Jeddah in Q2 2012, says the Jones Lang LaSalle Q2

Jeddah Real Estate Overview. Villas located in residential compounds have

shown the greatest increase in rents, due to the preferences of many

expatriate families to live within gated compounds, the JLL report further

said.

As with many countries in the MENA region, the provision of affordable

housing is a pressing issue in Jeddah.

According to the latest JLL report, government and semi government

entities are working on different projects to develop affordable housing in

Jeddah as the private sector is finding it challenging to provide solutions for

lower income households.

According to the firm, the Ministry of Housing has identified two locations

in Jeddah for affordable housing projects, however no details are available

yet as to what those projects include.

“There are a number of government initiatives in place to address the

shortfall of affordable homes in the Kingdom (which typically target

those in the lowest third of income groups in The Kingdom of Saudi

Arabia [KSA]). These initiatives include increasing the supply of longterm housing loans disbursed through the Real Estate Development

Fund (REDF); a commitment to develop 500,000 new affordable homes

across the Kingdom over the next five years; and residential public

private partnerships (PPPs), such as the Jeddah Development & Urban

Regeneration Company’s Al Ruwais and Qasr Khozam projects,” Cooper of

DTZ commented.

JLL added that in a rare private project aimed at the affordable sector, the

Henaki Group has started a 1,000 unit apartment project in the Kandarah

area, which will be one of the first large scale projects targeting low to

middle income families.

In the office sector, annual performance so far has been affected by

oversupply in the sector.

“Demand for office accommodation in Jeddah continues to be dominated

by relatively small requirements (between 100 and 350 square metres) for

space in multi-tenanted buildings, rather than large single tenant occupiers

looking for sizable floor plates. Some key office schemes in the city have

yet to reach full occupancy,” Cooper said.

According to JLL, a total of around 125,000 square metres of office space

is expected to complete in the second half of 2012, bringing total CBD stock

to around 699,000 square metres. The firm further added that although

the credit situation has eased, actual project deliveries may be lower than

expected in 2012 as developers perceive the over supply situation could

worsen over the coming year.

The hotel market has performed extremely well in 2012. According to

JLL, Jeddah has been one of the best performing markets in the Middle

East during H1 2012, with strong growth recorded in both occupancies and

Average Daily Rates. During the first half of 2012, occupancy rates have

averaged 80%, marking a significant 11% increase compared to the same

period last year. JLL believes the strong performance of the hotel sector

reflects the continued attractiveness of Jeddah as a leisure destination for

Saudi families.

Looking at the city’s future performance, Cooper commented:

“Overall, real estate market prospects within KSA remain strong. The

fundamental drivers of the KSA real estate market (a population of around

28 million and a labour force of around 8 million) are the strongest in the

GCC.”

“However, risks remain around inflationary pressures, as well as potential

oversupply in the office sector in key cities in the Kingdom. Supply

shortages are also likely to remain in the residential sector within KSA, with

an estimated 50% supply gap in Jeddah over the next 2-3 years,” Cooper

concluded.

Jeddah 2012 Highlights

• Strong levels of demand in primary residential sector

• The hotel sector recorded strong growth in both occupancies

and Average Daily Rates

• Government and private sector are increasingly looking at

providing solutions for the provision of affordable housing

DECEMBER 2012 I CITYSCAPE I 21](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-25-320.jpg)

![JAPAN

I

n the wake of recovery from the global financial crisis, Asia Pacific

markets will continue to drive global growth for the remainder of

the year, according to the Jones Lang LaSalle (JLL) Q3 Global Market

Perspective.

According to JLL , in Q2 2012, Asia Pacific was the only global region to

show a year-on-year (YOY) increase in investor activity, up 30 per cent

compared to last year, while Japan led the rebound in investment volumes

(+290% YOY) on the back of recovery from the earthquake in March 2011.

According to a 2011 research report by Nomura Research Institute, despite

the weak economic growth of last year, Japan is expected to remain ahead

of high-growth countries including India, Brazil and Russia up to at least

2020. Tokyo will remain the world’s top metropolis in terms of population

and GDP.

The Japanese market, of which Tokyo represents 70%, is the third

largest in the world after the US and China. Compared to the US and China,

however, Japan, which has investable properties worth more than USD 2

trillion, has a much smaller land area. Therefore, most of the properties are

concentrated in a few cities. In fact, the Tokyo region alone accounts for

70% of the total value of investable properties in Japan (Source: Nomura

Research Institute).

Real estate post March 2011

The tragic earthquake of 2011 evidently had an immediate effect on the

country’s real estate market, however investor confidence soon returned.

Will Johnson, Associate at Savills Japan, commented:

“The market ground to a standstill in the first quarter following

the earthquake. Overseas investors were concerned in the months

immediately following the disaster but this has subsided as reported

damage to property was negligible and the risk of radioactive

contamination in the major cities non-existent. After the initial post-quake

shock, domestic firms resumed investment activity within the quarter and

the debt markets reopened in earnest.”

The earthquake has also brought several pre-existing concerns to the

foreground.

“Seismic resistance has always been a factor in building selection, but

it has become a higher priority. The market was in a beginning phase of

a recovery when the earthquake struck and soon after the Euro crisis

[started]. This had a dampening effect on the recovery [of the market],”

commented James Fink, Senior Managing Director at Colliers International

Japan.

Will Johnson further added:

“From a leasing perspective, tenants are showing a strong preference

for modern properties built to up-to-date seismic codes. Newly built

properties equipped with latest seismic technology are achieving a demand

premium, especially those with independent power generation facilities.”

“The Tokyo residential market is

a stable investment environment

most suited for investors seeking

core/core-plus returns. Rents in

the mid-market are not prone to

volatile fluctuation and occupancy

rates have remained consistently

high since the global financial crisis.”

Residential

Generally more stable than retail and office, the residential sector is

currently said to offer the most attractive investment opportunities in

the country. According to the Q1 2012 Japan Investment Update Report

by Colliers International, middle income and compact rental units have

performed much more steadily than the high-end subsector in Tokyo, with

relatively strong rental demand and have continued to be relatively stable

investments in terms of rents and occupancy.

According to the Q2 2012 Savills Residential Research Report, “residential

demand for mid-market assets in Tokyo’s central wards in recent quarters

has been supported not only by the capital’s dominant concentration of

economic infrastructure and sheer weight of people, but also by continued

in-migration from regional towns and cities.” The firm expects the midmarket segment to remain robust over the short to mid term, supported

by the influx of new residents from regional towns.

Will Johnson, Associate, Research & Consultancy at Savills Japan,

commented:

“The Tokyo residential market is a stable investment environment

most suited for investors seeking core/core-plus returns. Rents in the

mid-market are not prone to volatile fluctuation and occupancy rates

have remained consistently high since the global financial crisis. Given its

stability, Tokyo mid-market residential assets benefit from strong and

steady demand from domestic institutional investors, including Japanese

corporates and the J-REITs. This mitigates exit strategy risk for foreign

funds and institutional investors active in this sector.”

Johnson adds that since 2008/2009, liquidity has dramatically improved,

with domestic lenders favouring Tokyo residential above any other sector

and in some cases willing to offer LTVs of up to 70-75% on well-positioned

assets, which has increased competition for Tokyo mid-market residential.

DECEMBER 2012 I CITYSCAPE I 27](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-31-320.jpg)

![JAPAN

Office

Since 2008, vacancy rates sit at a relatively high level of about 8%

(Colliers), however experts predict the office sector will be one of the key

asset classes for investment opportunities in the coming year while the

Tokyo Government is working on re-invigorating external demand.

“The Tokyo Metropolitan Government has adopted policy measures to

provide assistance to multi-national entities that specifically locate within

so-called Comprehensive Special Zones for International Competitiveness

Development, which may act to bolster external demand going forward.

The proposals include a system of tax breaks and incentives to reduce

corporate taxes for new international occupiers from approx. 40% to the

mid-20% range, making Tokyo more competitive as an Asian headquarters

location and a base for R&D,” Johnson said.

“[The Government] aims to see at least 50 companies in five years

establish integrated back-office operations and R&D centres for their Asian

business and to attract at least 500 other global companies. The zones

will target selected growth industries, including ITC , content and creative,

medical and chemical, electronics and precision equipment, and finance and

brokerage. The geographical areas selected for the zones include central

Tokyo and waterfront sites incorporating 1) Tokyo, Shimbashi, Roppongi,

Toyosu and Ariake stations; 2) the area around Shinagawa and Tamachi

stations; 3) the Shinjuku Station area; 4) the Shibuya Station area, and 5)

land by Haneda Airport,” Johnson further explained.

Retail

“Despite its relatively small population, Japan remains the third largest

economy in the world with GDP per capita over 8 times larger than that

of China. (IMF World Economic Outlook, April 2012). Although higher

growth markets get the bulk of the media limelight, the sheer depth of the

Japanese retail market makes it one that can’t be ignored for investors with

diversified portfolios,” Johnson commented.

Looking at the current performance of the sector, the decline in monthly

household income and a drop in monthly household spending over the

last 12 months have caused consumer demand to remain relatively weak

(Colliers). The firm says there has been a noticeable shift away from luxury

goods to reasonably priced casual fashion competing for the most prime

sites.

“While still demonstrating a strong appreciation for high-quality products,

Japanese consumers have become more price conscious since the global

financial crisis. High street brands that provide the right balance between

quality and price are therefore performing strongly. Fast-fashion retailers

are tapping into this demand, with domestic brands such as UNIQLO and

“Although higher growth markets get the bulk of the media limelight, the sheer

depth of the Japanese retail market makes it one that can’t be ignored for

investors with diversified portfolios.”

28 I CITYSCAPE I DECEMBER 2012](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-32-320.jpg)

![PHILIPPINES

the largest contributors of foreign exchange revenues in the country.

Office sector growth

So far, the office sector has benefitted the most from the country’s BPO

boom.

“Strong demand from local and multinational companies and the

continued evolution of the Business Process Outsourcing industry may

propel the Philippine office property market to become one of the major

markets in the Asia Pacific region in the next few years,” commented Jones

Lang LaSalle Leechiu (JLLL).

Colliers further added that currently, strong demand from the Offshore

and Outsourcing sectors has resulted in increased construction activities;

the firm says total office stock is projected to reach 7 million square metres

in 2014, over 20% higher than the previous year.

“The Philippines is becoming the lifeboat for many US & European

companies that need to outsource in order for their businesses to survive

and actually preserve jobs back in the US and Europe. We expect the

outsourcing and offshoring industry to expand at a compounded annual

growth rate of 18% within a 5-year horizon,” commented Santos of CBRE.

“By 2016, the target is to reach at least 10% of global revenues.

Also, because of the strong economy, we see that more multinational

companies will be expanding their base in the country. The office sector will

go from strength to strength, with the Philippines being one of the most

cost-effective destinations in Asia. Demand is catching up with supply, and

with strong pre-leasing commitments,” Santos further explained.

According to JLL, over the next three years, five new BPO firms are

expected to enter the country with six existing firms planning to expand,

potentially creating jobs for an estimated 20,0000 Filipinos. Major players

that will be expanding include Sutherland, Accenture, Teleperformance,

SPI, Infosys and IBM.

Strong residential demand

“The Philippines is experiencing democratisation in the housing sector—

from a nation of renters to owners—through low interest rates and flexible

financing schemes. With rising income, a huge housing backlog and a very

liquid market, the strong demand for residential projects is sustained,”

commented Santos of CBRE.

“The increasing inflow of OFW [Overseas Filipino Workers] remittances

is supporting the residential market. While a huge proportion of demand

is coming from OFW families, the improving local labour markets are giving

other buyers like start-up families and young professionals the means to

purchase residential properties,” Santos further commented.

Colliers reports that total residential stock is forecast to grow 30% by

2014. According to the firm, Makati and Fort Bonifacio (Metro Manila)

currently have the strongest residential development activity. In Makati,

total new supply will reach to 1,750 units this year, 5% more than in 2011,

while Fort Bonifacio is projected to deliver 1,600 units in the second half to

reach 4,511 units for the year, Colliers stated. Furthermore to Colliers, takeup in Metro Manila remains consistently strong despite the substantial

number of supply in the pipeline.

While Overseas Filipinos’ remittances power the low-end to mid-range

residential property market, premium residences have continuously been

supported by expatriate demand. As of Q2 2012, the vacancy level for

prime condominiums sat at a low 5% and luxury 3-bedroom rental rates in

the Makati CBD increased by 6% (Colliers).

“The continuous growth in expatriate population spurs the demand for

luxury condominium units. A growing BPO industry translates not only to

more expatriate buyers but also to more investor buyers. Strong leasing

demand from expatriates is keeping the rental market active, making

luxury condominiums more appealing to investors, particularly those

looking for yield-accretive assets,” Santos said.

32 I CITYSCAPE I DECEMBER 2012

“The Philippines is experiencing

democratisation in the housing

sector—from a nation of renters to

owners—through low interest rates

and flexible financing schemes.

With rising income, a huge housing

backlog and a very liquid market,

the strong demand for residential

projects is sustained.”

Increased tourist arrivals boost hotel sector

According to the Department of Tourism, tourist arrivals to the Philippines

have witnessed a 14.6% growth YOY (June 2012).

Colliers reports that in 2011, tourist arrivals in the Philippines breached

the government’s forecast to reach 3.9 million. According to the firm, the

influx of foreign travellers is a good indicator that the government will hit

its target of about 4.6 million visitors in 2012 and eventually its 10-million

target by 2016.

“This growth potential has encouraged developers to venture into

hospitality-related projects all over the country. In Metro Manila alone,

over 11,000 new hotel rooms are expected to be completed in the span of

five years,” Colliers said, adding that new supply this year may reach 2,340

units, 1,500 units more than the new rooms introduced in 2011.

Santos added that the rising inflow of tourists also prompted the surge

in the construction of new resorts, hotels and condominium hotels in

key destinations like Cebu, Davao, Palawan and Boracay. “Likewise, older

hotels are being renovated to be at par with the newer ones. Leisure and

hospitality facilities are becoming attractive investment opportunities and

we are seeing investors actively seeking condominium hotels for long-term

leases or bulk acquisitions to be operated for recurring income,” he said.

Long term opportunities

Looking at long term investment opportunities in the Philippines, Santos

identifies several promising options.

“Considering the long term, [placing capital] in the leisure/gaming/

tourism sector will be a very sound investment. There is optimism in

this area because of the Philippines advantage in having varied tourist

attractions.

Likewise, the office market will remain a major driver of the local real

estate market. The growth in the office market will not be limited to Metro

Manila but will extend to major cities in the provinces.

Massive infrastructure investments planned for the Philippines will be able

to support the expansion of offices outside Metro Manila. The sustained

growth of the BPO industry will continue to generate opportunities in the

office market,” he said.

On a final note, Santos commented on the importance of the Philippines

spreading its positive image.

“The Philippine property market is resilient, and is at its best from the

past 20 years. A crucial role the government, media, and stakeholders have

to perform is to ensure that a positive and enticing image of the country is

promoted not only within the country, but also outside the country,” he

concluded l](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-36-320.jpg)

![POLAND

THE PEARL OF CENTRAL

& EASTERN EUROPE

2012 has seen strong investor interest in Poland so far, especially in the retail sector. Supported by

higher GDP growth than in most European countries, increasing retail sales and a stable political

situation, investment sentiment is expected to remain highly positive.

S

ince the fall of the communist government in 1989, Poland has

steadfastly pursued a policy of liberalising the economy and today

stands out as a successful example of the transition from a centrally

planned economy to a primarily market-based economy. On 1 May 2004,

the post-communist nation became a member of the European Union

(EU) and in 2009, Poland had the highest GDP growth in the Union. As of

February 2012, although the Polish economy’s growth did slow down in the

wake of the global financial crisis, the country avoided full recession thanks

to its very low private debt, robust domestic demand and flexible currency,

a report by global business news provider Bloomberg has claimed.

Brian Burgess, Managing Director of Savills Poland commented:

“The economy continues with positive GDP growth, higher than average

EU growth. Poland’s economy is also positively supported by the effect of

EU funds, which is expected to stay this way for the next 3 years or so.

[…]The political situation is stable and there is a [good] production and

industrial base in the country.”

Looking at investment, Savills Poland has reported that despite the

lower number of transactions, investment activity in H1 2012 confirmed

that Poland is still the major investment market in the Central and Eastern

Europe (CEE) region. In the first half of 2012, the total volume of commercial

property transactions was EUR 856 million (USD 1.1 billion).

According to Dominika Jędrak, Director of Research and Consultancy

Services at Colliers International, Poland, several different factors make the

CEE nation an attractive country for real estate investments:

“Poland continued to be an important country in the CEE region for real

estate investments thanks to its attractiveness in terms of liquidity and

available investment opportunities. It is perceived as a stable country,

resistant to the economic crisis and with a high GDP growth (2.5%, Q2

DECEMBER 2012 I CITYSCAPE I 35](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-39-320.jpg)

![POLAND

“The prognosis for the industrial

market for the next few months

is optimistic. Rising demand for

modern warehouse space results in

the decrease of vacant space level in

certain markets which may increase

rental rates.”

2012), high purchasing power (1.2% higher in Q1 2012 in comparison to

Q1 2011), relatively low level of inflation (4%, July 2012) and pretty high

consumer optimism ratio,” she commented.

“[The] country [has] a large population (over 38.5 million) which is an

important argument for investors from the retail sector. There is also a

well educated labour power. There are low labour costs when compared to

western, ‘old’ Europe. Poland is centrally located in Europe, the real estate

market in general is still not saturated and the consumer market is still

emerging,” Jędrak further said.

Burgess of Savills added that one of the reasons why Poland is one of

the most demanded occupier destinations is the fact that the country has

a favourable investment framework.

“There is a transparent legal and planning structure, modern triple-net

lease format, low transaction costs and understandable tax and company

structures. In a sentence, transacting property investment in Poland is

transparent and inexpensive,” he said.

Retail

The first half of 2012 has seen strong investor interest in the Polish

market, especially in the retail sector. Retail sales have also continued

to grow, with volume increasing by 4.3% year-on-year in May this year

(Cushman & Wakefield Q2 2012 Poland Retail Snapshot).

Jędrak of Colliers commented:

“In H1 2012, Poland’s retail market was relatively stable; over 250,000

square metres of modern retail space were delivered to the Polish market.

This result is comparable with the level recorded in H1 2011. Nearly half of the

new retail supply was delivered in smaller cities. Both small cities (30,000

– 100,000 population) and city agglomerations, especially Warsaw and

Silesia can still offer attractive locations for retail concepts.”

According to Colliers, retail has recently accounted for approximately

45 percent of the total investment volume. Investor interest is spread

nationwide with a focus on Warsaw and major secondary cities, including

Kraków, Wrocław and Katowice. With regards to products, Colliers said the

most sought-after shopping centres are those which are food-anchored

and dominant within their respective catchment areas.

In smaller cities however, the situation is slightly different. Here, the

picture of the local retail market is predominantly determined by the

presence of a modern shopping centre, one that is able to attract bigger,

well known retail chains.

“In general what really determines the success of a planned investment

in a particular location is, among others, local authorities’ attitude and

infrastructure development. These factors may facilitate the investment

process, or, on the contrary make it almost impossible. Identifying a

particular location requires detailed analysis of local conditions, both

in terms of existing and future competition, as well as socio-economic

36 I CITYSCAPE I DECEMBER 2012

situation and planned infrastructure investment etc.,” Jędrak said.

Burgess of Savills further added:

“Much of the focus remains on the development of shopping centres

in the large cities and the re-commercialisation of older centres in good

locations. For specialist investors there are also retail parks and factory

outlets offering cheaper forms of retail sales for those [with limited

purchasing power].”

Industrial

In addition to the retail sector, 2012 has also seen a stable interest from

investors in the industrial market and activity is expected to increase

further (Savills Q1 2012 Poland Investment Market Report).

“Investors are watching the activity in the occupier market (leasing

as well as design & build), which has picked up recently. Also there is the

potential for growth, bearing in mind that rents are [currently] at a low level,

meaning that a modest increase could return a relatively high percentage

growth on the investment,” Burgess explained.

Jędrak shares Burgess’ view on the positive outlook of Poland’s industrial

market:](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-40-320.jpg)

![SPAIN

SPAIN’S COSTAS

MORE ATTRACTIVE

THAN EVER

While Spain has always been among the top destinations for foreign property buyers

with regards to holiday homes, a recent drop in house prices has now sparked a surge in

buyers from Scandinavian countries who are keen to snap up bargain homes along the

country’s sunny coastlines.

T

he Eurozone recession has had an impact on almost all global real

estate markets, but especially on a number of south European

markets. In our October edition, the Cityscape magazine featured Greece

and showed how the drastic drop in house prices has lured herds of

overseas investors to purchase property in one of Europe’s most popular

holiday destinations.

A similar ‘success’ can be attributed to Spain which has remained the

most popular country regarding property purchases in August this year,

thanks to a large number of distressed properties on the market, according

to data from TheMoveChannel.com, a leading independent website for

international property.

Dan Johnson, Director of TheMoveChannel.com commented: “It’s hard to

remember a time when real estate headlines were not overshadowed by

38 I CITYSCAPE I AUGUST 2012

the Eurozone crisis. The recession has meant different things for different

countries. Despite Spain’s poor financial outlook, international buyers have

seized the chance to snap up bargain holiday homes along the Costas.”

In October, specialist property sales portal Kyero released its Q3 2012

House Price Index, stating that over the last 12 months, the average

asking price of Spanish property has decreased from EUR 267,000 to

EUR 244,000, indicating an 8.5% reduction. House prices are highest

in Barcelona with an average asking price of EUR 606,500 (248% above

national average), followed by Mallorca and Girona.

David Vaughan, International Residential at Savills UK, commented:

“In Spain, where unemployment has reached 25%, [property prices]

along all of the Costas have fallen considerably and further in areas such

as Marbella where there has been an enormous amount of construction of](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-42-320.jpg)

![CANADA

per cent compared to August 2011.

“Strong ownership demand relative to the number of homes available

for sale has resulted in strong year-over-year rates of price increase. This

has especially been the case for low-rise home types, including singledetached and semi-detached houses and town homes,” commented

Jason Mercer, Senior Manager, Market Analysis, TREB.

Mercer also added that price growth on the sale side for condominiums

has not been as strong. “With many new projects completing over the past

year, the number of units listed in the resale market has expanded. With

more choice for buyers, the pace of average price growth has slowed for

condos,” he said.

Looking at the rental performance of the GTA condominium apartment

market however, figures are more positive. “Investors looking to rent their

units have benefited from strong demand relative to supply, resulting in

average rent increases above the rate of inflation for one bedroom and two

bedroom units,” Mercer explained, adding that condominium apartments

are sought after by tennants because of their modern finishes and

amenities coupled with locations close to transportation alternatives.

Looking ahead, Mercer sees an overall positive picture in terms of future

price growth for the region. “The average rate of price growth for all home

types will be in the high single digits for 2012 as a whole. The average selling

price will continue to grow in 2013, but at a slower pace - likely in the low to

mid single digits. The slower pace of price growth will result from a better

supplied market, with buyers benefiting from more choice,” he concluded.

Vancouver

Predictions for Vancouver vary. According to IP Global, prospects for

Canada’s coastal city are not as bright as those for Toronto.

“Talk of an overheated property market in Vancouver has continued

despite the city’s strong economic fundamentals, as evidenced by

flat price growth and rental growth only just beating inflation. Stable

transaction volumes suggest that a significant market correct is unlikely;

investors appear to be content to take a wait and see approach until the

long term direction of the market becomes clearer,” the firm commented.

Scott Brown, Senior Vice President, Western Canada at Colliers

International Residential Marketing, believes pessimistic views about

Vancouver’s real estate market result from one-sided research.

“The market has only experienced flat price growth recently yet tends

not to over inflate anyhow. The more expensive areas of Vancouver are

being driven up by offshore demand and influx of wealthy [individuals]

from around the world. This is expected to be a long term trend and should

see values in Vancouver downtown for instance increase from USD 700

per square foot on average to USD 1,000 per square foot ,” he commented.

Brown added that recent commentaries about Vancouver’s housing

market have been focused primarily on USD 1,500,000+ single family

dwellings in prestigious Westside neighbourhoods, although this market

only represents a small portion of the overall market, thus creating a

distorted view.

“Outside downtown, the market is driven by end users and remains

stable. We do expect a number of successful launches in the next 3 - 6

months that will show the resilience of the market once again. All of

these projects will attract the local and foreign investor because they are

integrated into our evolving rapid transit system and therefore prime for

rental. Rental rate growth here has been stable but is expected to increase

in these key areas over the next 5 - 10 years,” he explained.

According to the analyst, the future of Vancouver’s real estate market is

certainly a bright one.

“The long term outlook sees average prices in key areas rising by 10 to 20%.

We also expect to see international and local investors very active in select areas

with the former being driven to Vancouver in part by restrictive investment

measures being implemented in the UK and Australia,” Brown concluded l

DECEMBER 2012 I CITYSCAPE I 43](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-47-320.jpg)

![MEXICO

growing, signaling a good outlook for the sector. However, it is important

to keep in mind that the growth of the industrial sector in Mexico is highly

correlated to the health of the US economy, since Mexico is mainly a

durable-goods manufacturing platform for the US market. As long as

consumer confidence in the US continues to recover, sustained growth can

be expected in Mexico’s industrial sector,” Ramirez concluded.

Hotel investment on the rise

According to JLL, Mexico experienced a high level of activity in the first six

months of the year, totalling USD 266.5 million. Part of the reason for the

increased volume during H1 2012 were several large transactions such as

the sale of the Nikko Hotel in Mexico City to Hyatt and the Rosewood Hotel

in San Miguel de Allende to a group of private investors, JLL said.

“The main driver, however, is the realisation by opportunistic investors

that the market has passed the bottom of the cycle and both the tourism

industry and the real estate market have started a sustained recovery. This

recovery is reflected in hotel occupancy statistics which are recovering to

pre-crisis levels,” the firm said.

Gilberto Riojas, Tourism Sector Director at Jones Lang LaSalle Mexico

further elaborated:

“Distressed hotel sales are finally getting scarce, visitor numbers are

back to 2007 levels and although ADRs (Average Daily Rates) [have not

yet increased], occupancy and the industry in general is again growing...

investors are looking at an imminent growth cycle. The future of the

hospitality and second home industry will grow solidly as the basic

motivators for US visitors/investors (although losing some ground to

their European and South American peers, still by far the largest in Mexico)

remain unchanged.”

According to Riojas, these motivators include proximity and ease of travel

from and to the US, familiarity in hotel brands in both seaside and inner city

destinations, excellent CCC offer (Culture, Climate, Cuisine) and the region’s

best hospitality grade.

Looking at investment in other sectors, experts believe both the retail as

well as the industrial sector currently provide prime opportunities.

“In the retail sector, large funds such as MRP and Planigrupo are

aggressively looking for acquisitions which should translate into an

increased level of transaction activity,” commented Jorge Velasco,

Research Analyst at Jones Lang LaSalle Mexico.

46 I CITYSCAPE I DECEMBER 2012

As mentioned earlier, Mexico’s performance in the industrial sector is

largely dependent on the performance of the US economy.

“In the industrial sector, the key driver is the speed of recovery of the

US economy, which is reflected in the level of activity in the Mexican

manufacturing sector and then in the industrial real estate market. Since

no significant change in the US economy is expected in the short term,

things will remain stable for the remainder of this year in the Mexican

industrial market,” Velasco concluded.

In general, the outlook for Mexico’s real estate market is positive, JLL

believes.

“The implications for the future of the real estate market are that the

transaction volume is likely to increase, as both owners and investors arrive

at the conclusion that property prices will start to increase. As a result,

more owners will seek to sell some properties, as prices reach acceptable

levels, and more buyers will jump into the market in search of the remaining

bargains,” the firm said.

New governance, old challenges

Although President Nieto is seeking to promote structural changes in

the Mexican oil industry, quick, dramatic change is unlikely, Diaz explained,

saying that in order to promote the development of the real estate market,

a few major challenges need to be overcome which cannot be addressed by

government action only.

The analyst identifies two main obstacles:

“The income flat tax (IETU) is the major obstacle in closing real estate

transactions, since it burdens the sale of property developed or acquired

before 2008 with a 17.5% tax against which no deductions can be made.

For property acquired after 1.1.2008, there is no problem since the

acquisition cost can be deducted from the sale price. It is uncertain if the

new administration is willing to make the necessary changes to the tax

code to solve this problem.

Secondly, in the office sector, the main challenge is the mismatch in cap

rate expectations between buyers and sellers, mostly due to unrealistically

high price expectations by sellers. As a result there is an acute scarcity of

product available for sale. The new financing alternatives described above

are narrowing the gap, and some potential sellers are becoming interested

in considering offers at current (historically low) market cap rates,” Diaz

concluded l](https://image.slidesharecdn.com/pages3-140218082216-phpapp02/85/The-Magazine-Cityscape-December-2012-50-320.jpg)

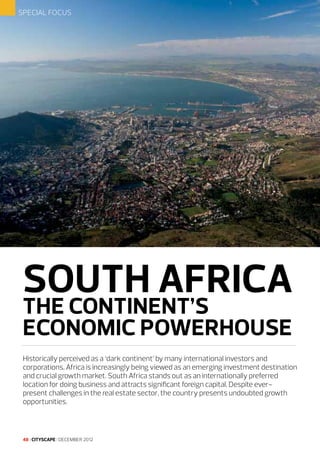

![SPECIAL FOCUS

“As mature

economies continue

to face economic

challenges and

stagnating

growth, ever more

international

corporations

and investors

are considering

expanding into

Africa to benefit

from its high growth

potential.”

“The high ranking is a result of several factors, including rigid listed vehicle

governance, strong auditing and reporting standards, a highly-developed

legal system, the fairness and efficiency of the regulatory framework

relating to real estate taxation, planning and building codes, enforceability

of contracts and title and a strong tradition of property rights,” the Jones

Lang LaSalle Global Real Estate Transparency Index 2012 report on subSaharan Africa said.

Sanett Uys, Group Research Manager at Broll South Africa, a CBRE

affiliate, added:

“From an institutional and legal framework South Africa is very

transparent. There is good governance in place and the property industry

is part of the legal framework. However, we are not that transparent when

it comes to the sharing of property information and statistics.”

The increasing entry of international real estate providers into South

Africa however is likely to positively impact on the availability of property

related information in the country.

“The quality of data is improving with a number of real estate service

providers and data companies making inroads across different real

estate sectors and encouraging an improvement in the quality of market

analysis. The entrance of international real estate service providers is

likely to further influence the level and depth of information on market

fundamentals (JLL).”

According to Uys, over the last 6 to 12 months, the South African real

estate market remained fairly stable with no major movements.

“The prime areas have continued to perform well and the secondary

areas continue to have vacancies and rental adjustments. South Africa

has annual rental escalations so rentals continue to grow at a rate of

approximately 8 - 10%. However, we are seeing that rentals which have

escalated above market related rentals are being adjusted back to current

market rental levels,” she said.

The analyst further commented that prime properties in all sectors

continue to post solid performance. In addition to this, there continues to

50 I CITYSCAPE I DECEMBER 2012

be a shortage of prime industrial units in some regions, she said.

South Africa is home to the continent’s most mature office market.

Johannesburg, the country’s largest city, continues to be the focus of

occupier demand. According to data from JLL, office stock in Johannesburg

increased by 41,000 square metres in Q2 2012, while most completions

were seen in the preferred nodes of Rosebank and Illovo. Commitments for

developments slowed in Q2, reflecting a cautionary response in the market

due to the subdued economic outlook. The development pipeline has also

declined since 2009 (JLL).

On a national level, Broll is expecting the office market to remain stable

throughout 2013 with no major movements. New businesses expanding

their footprint as well as new businesses and retailers entering the

market are the current main drivers of demand for office space, Uys

commented.

In Johannesburg, the Central Business District is regaining favour with

occupiers and property investors as improving security and building decay

are addressed by the authorities and developers, JLL reports. According

to the firm, this confidence is further boosted by the recent building

development for the international insurer Zurich.