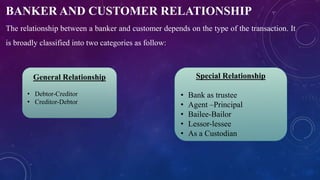

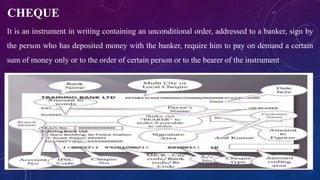

The relationship between a bank and its customers can take several forms depending on the type of transaction. Common relationships include debtor-creditor for deposit and loan accounts, trustee for safe deposit boxes, agent-principal for bill payments, bailee-bailor for security holdings, and lessor-lessee for safe deposit lockers. Asset-liability management (ALM) aims to generate earnings, maintain safety and soundness through adequate capital levels, and manage risks from mismatches between expected and actual cash flows.