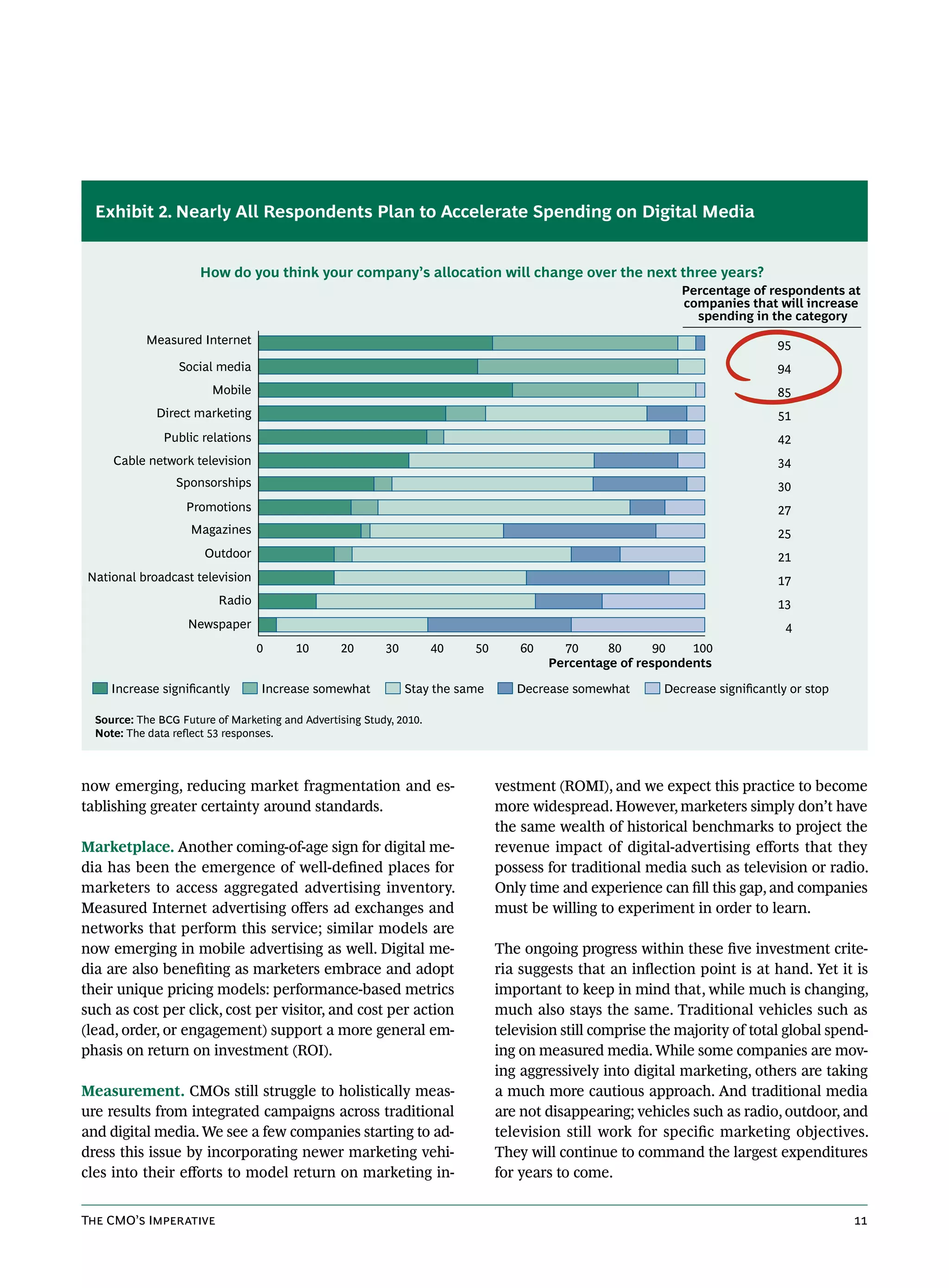

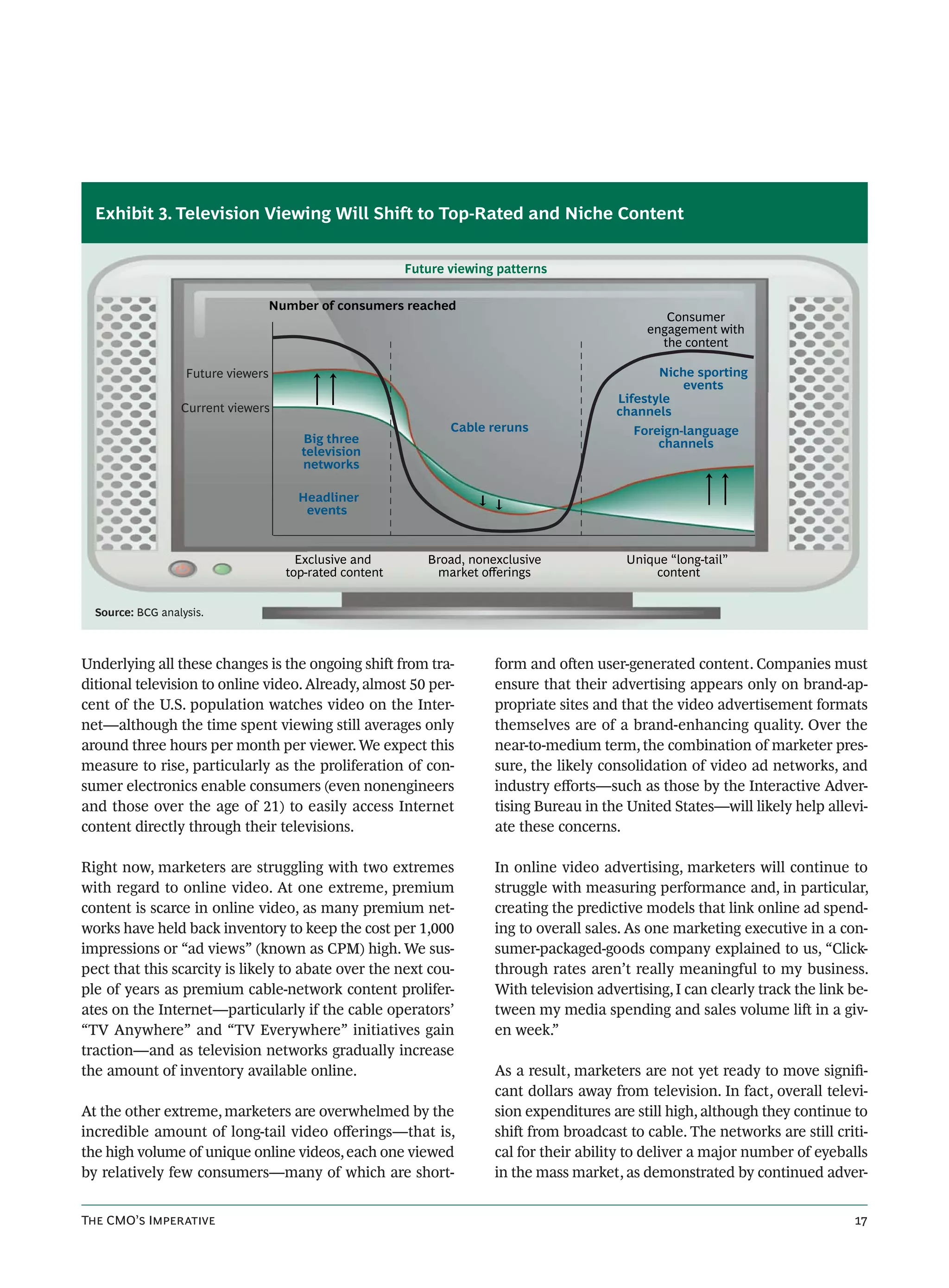

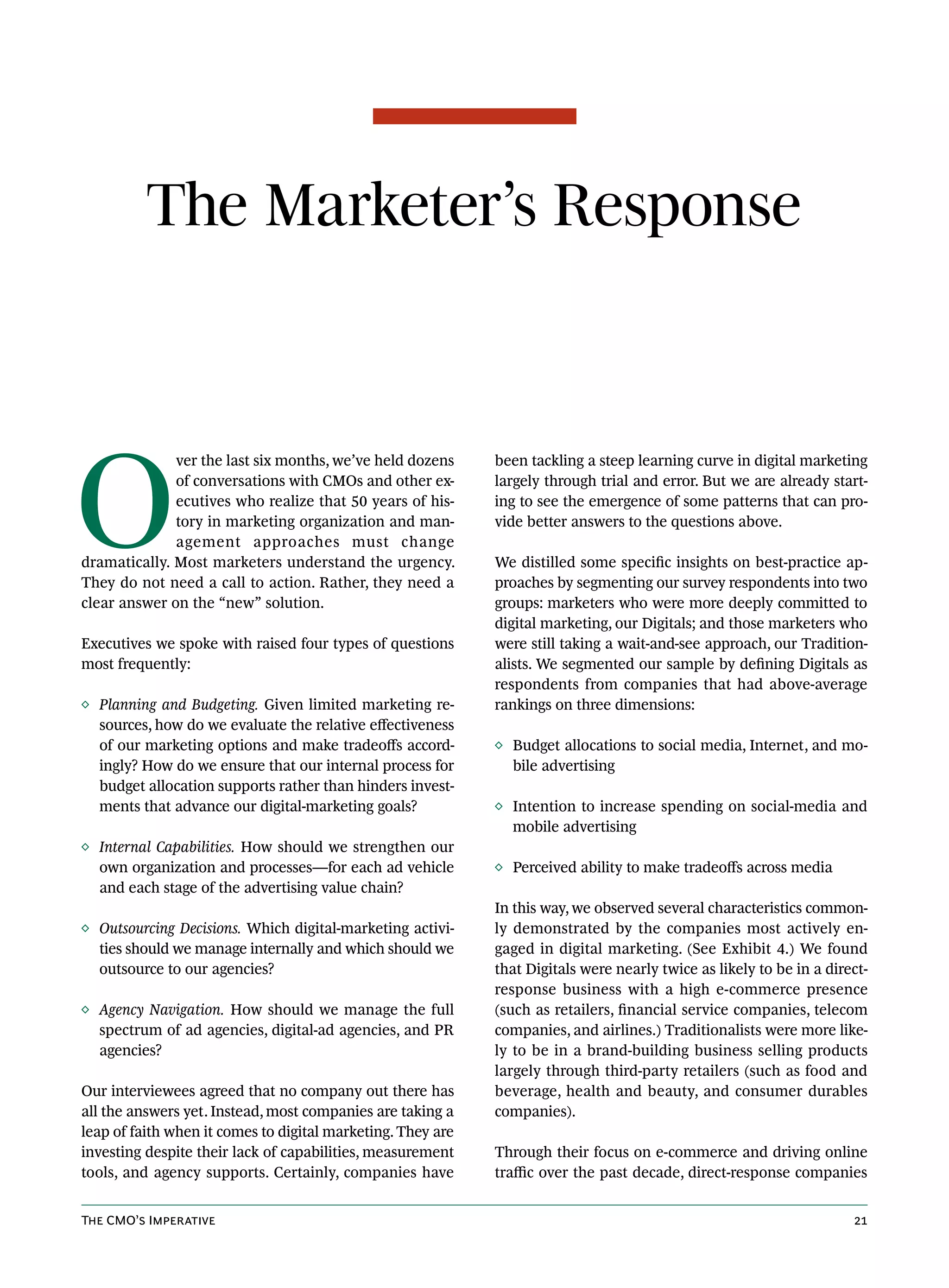

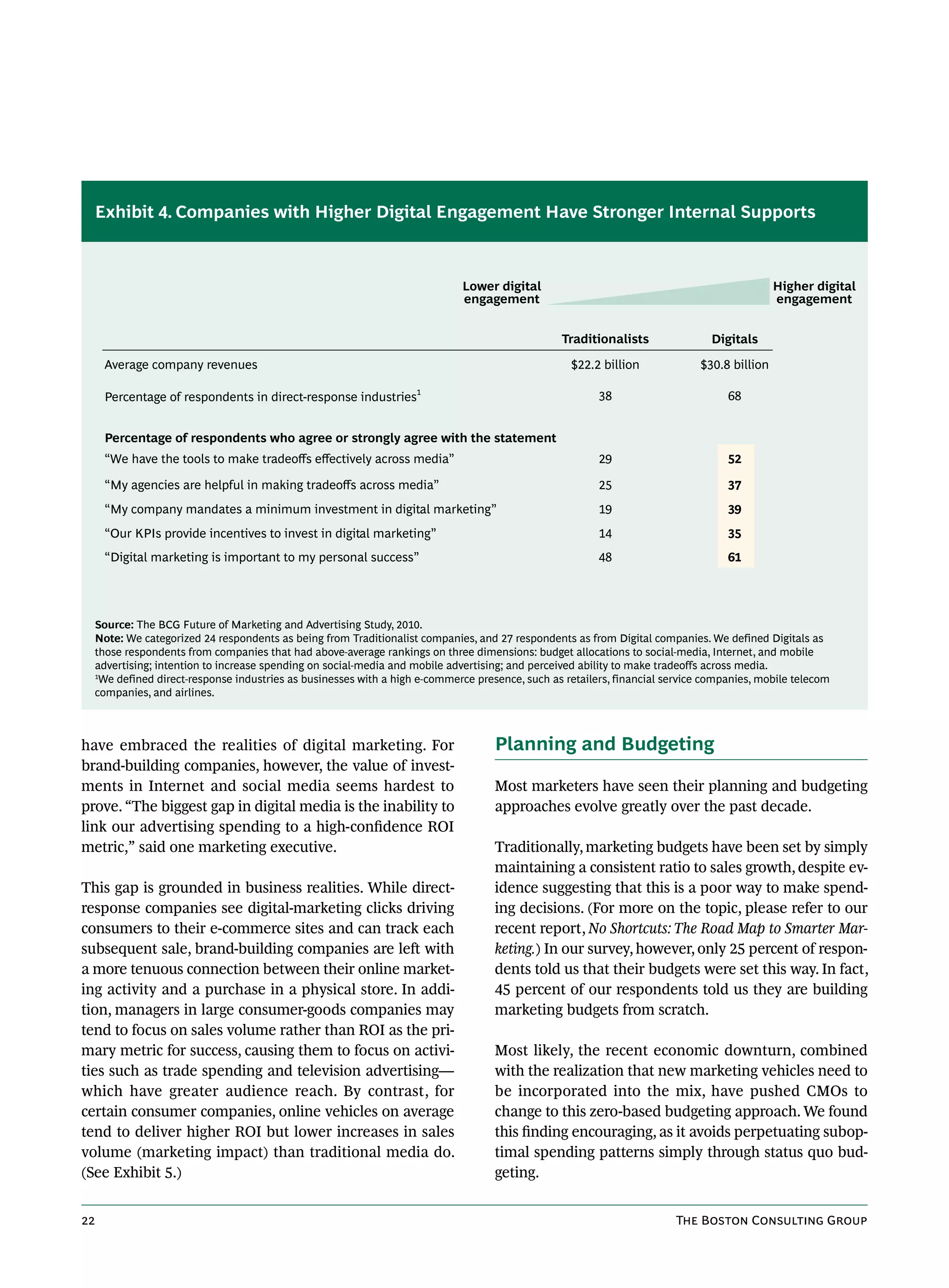

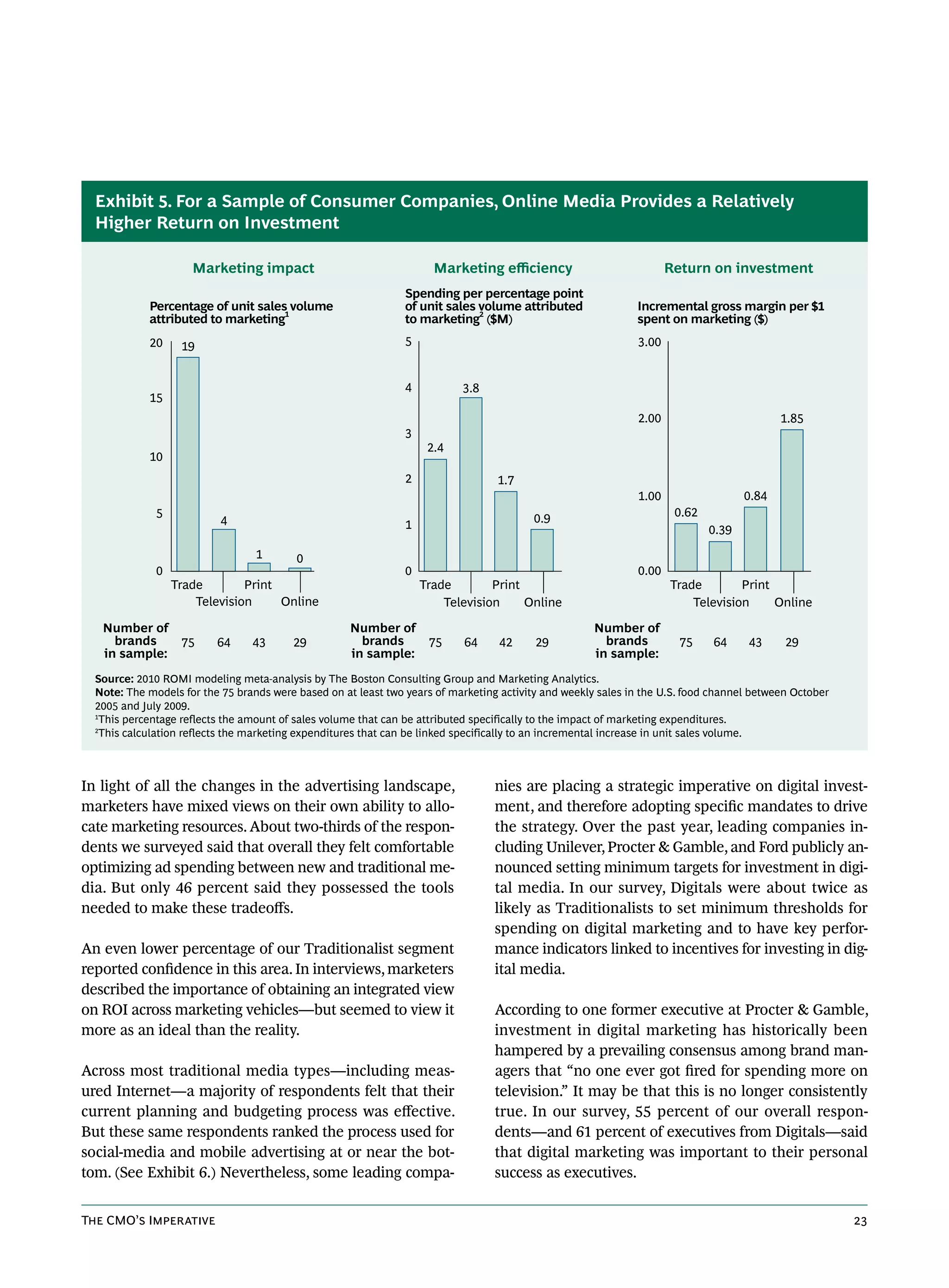

The marketing landscape is undergoing significant changes due to new digital media such as social media, mobile advertising, and online video. This has increased the complexity marketers face in planning campaigns and allocating budgets across various channels. Most marketing executives expect to increase spending on digital media in the coming years but television will still receive a majority of spending. Successful companies will build strong internal digital capabilities while maintaining flexibility to adapt to ongoing changes in the industry.