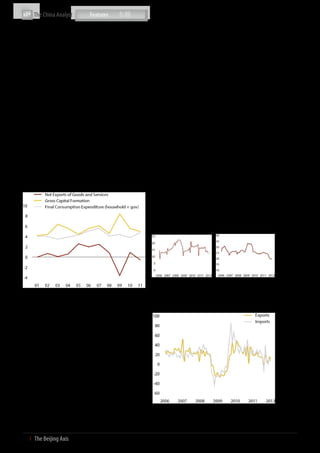

China's economy is experiencing a significant slowdown from its peak growth rates of over 10% in recent years. While some see this as indicating an impending "hard landing," a more moderate "firm landing" is likely as China transitions to a more sustainable growth model focused on consumption and higher-value industries. Local governments are implementing stimulus measures to support growth, but a major central government stimulus is not expected. Overall China is expected to grow around 7.7% in 2012, which will still outpace other major economies.